Email

Silver to Crash Like the Past OR Will It Zoom Higher?

| From | Money Metals Exchange <[email protected]> |

| Subject | Silver to Crash Like the Past OR Will It Zoom Higher? |

| Date | October 6, 2025 3:43 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

Breaking News from America's #1 Precious Metals Dealer

[link removed] style="" Unsubscribe | [link removed] style="" Report Spam | [link removed] style="" View In Browser

[link removed]

[link removed]

Gold [link removed] Silver [link removed] IRAs [link removed] Monthly [link removed] News [link removed] Storage [link removed] Specials [link removed]

Money Metals News Alert

October 6, 2025 Gold is pushing higher for the 8th consecutive week. The yellow metal is up $50 this morning, trading at all-time high and nearing the $4,000 level.

Silver has surged 60 cents so far today, after adding $2 last week.

The silver move is being fueled by what may be a physical shortage, as indicated by a condition called "backwardation." Normally, the price of the metal in the future is a bit more expensive to account for the cost of funds. This is known as "contango."

But right now, the price of silver on the December contract, for instance, is currently sitting below the spot market price.

1 Kilo Silver Bar

(Money Metals) [link removed] [link removed]

Shop Now >> [link removed]

Backwardation is unusual and it implies very strong demand in the spot market for physical metal.

Premiums for physical coins, bars, and rounds at MoneyMetals.com [link removed] remain low, although we've seen excess inventory dissipate at the wholesale level. Premiums may begin to creep up soon.

Friday's Close

(Weekly Gain/Loss)

Monday Morning

(Gain/Loss from Friday's Close)

Gold [link removed]

$3,900 (+1.5%) [link removed]

$3,956 (+1.4%) [link removed]

Silver [link removed]

$48.18 (+2.2%) [link removed]

$48.80 (+1.3%) [link removed]

Platinum [link removed]

$1,618 (+1.5%) [link removed]

$1,652 (+2.1%) [link removed]

Palladium [link removed]

$1,283 (+0.1%) [link removed]

$1,323 (+3.0%) [link removed]

Gold : Silver Ratio (as of Friday's closing prices) 80.9 to 1

Is Silver About to Crash Like in 1980 & 2011?

Share this Article: [link removed] [link removed] [link removed]

With silver rallying strongly and rising more than 50% since the start of the year, a growing number of investors are starting to worry that a crash may be coming, similar to what happened after the major spikes in 1980 and 2011, instead of focusing on the incredible long-term opportunity that remains in front of us.

But as one of the few analysts who correctly identified the bull market in both silver and gold [link removed] from the very beginning, I have consistently urged investors to stop dwelling on negative scenarios and instead recognize the tremendous upside that still lies ahead.

This is silver???s moment to shine, and it is also a moment of vindication for those of us who believed in it all along, even when it was ignored by the mainstream financial world and left for dead as recently as just a few months ago.

I believe silver will not repeat the sharp collapses that followed its short-lived surges in 1980 and 2011. This time is different.

1 Oz Silver Britannias (Queen Elizabeth) [link removed] [link removed]

Shop Now >> [link removed]

This is a legitimate, sustainable bull market with real staying power and the potential for lasting gains.

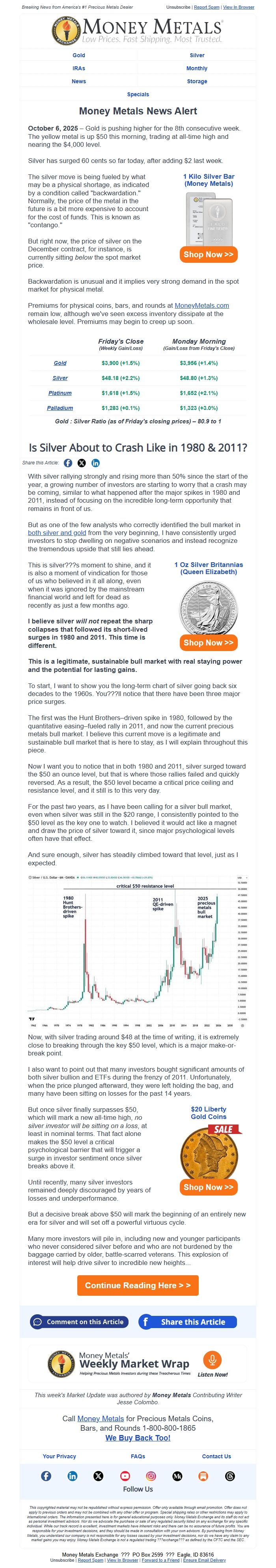

To start, I want to show you the long-term chart of silver going back six decades to the 1960s. You???ll notice that there have been three major price surges.

The first was the Hunt Brothersdriven spike in 1980, followed by the quantitative easingfueled rally in 2011, and now the current precious metals bull market. I believe this current move is a legitimate and sustainable bull market that is here to stay, as I will explain throughout this piece.

Now I want you to notice that in both 1980 and 2011, silver surged toward the $50 an ounce level, but that is where those rallies failed and quickly reversed. As a result, the $50 level became a critical price ceiling and resistance level, and it still is to this very day.

For the past two years, as I have been calling for a silver bull market, even when silver was still in the $20 range, I consistently pointed to the $50 level as the key one to watch. I believed it would act like a magnet and draw the price of silver toward it, since major psychological levels often have that effect.

And sure enough, silver has steadily climbed toward that level, just as I expected.

Now, with silver trading around $48 at the time of writing, it is extremely close to breaking through the key $50 level, which is a major make-or-break point.

I also want to point out that many investors bought significant amounts of both silver bullion and ETFs during the frenzy of 2011. Unfortunately, when the price plunged afterward, they were left holding the bag, and many have been sitting on losses for the past 14 years.

But once silver finally surpasses $50, which will mark a new all-time high, no silver investor will be sitting on a loss, at least in nominal terms. That fact alone makes the $50 level a critical psychological barrier that will trigger a surge in investor sentiment once silver breaks above it.

Until recently, many silver investors remained deeply discouraged by years of losses and underperformance.

$20 Liberty

Gold Coins [link removed] [link removed]

Shop Now >> [link removed]

But a decisive break above $50 will mark the beginning of an entirely new era for silver and will set off a powerful virtuous cycle.

Many more investors will pile in, including new and younger participants who never considered silver before and who are not burdened by the baggage carried by older, battle-scarred veterans. This explosion of interest will help drive silver to incredible new heights...

Continue Reading Here > > [link removed]

[link removed]

[link removed]

[link removed]

This week's Market Update was authored by Money Metals Contributing Writer Jesse Colombo.

Call Money Metals [link removed] for Precious Metals Coins,

Bars, and Rounds 1-800-800-1865

We Buy Back Too! [link removed]

Your Privacy [link removed] FAQs [link removed] Contact Us [link removed]

[link removed] [link removed] [link removed] [link removed] [link removed] [link removed] [link removed] [link removed]

Follow Us

This copyrighted material may not be republished without express permission. Offer only available through email promotion. Offer does not apply to previous orders and may not be combined with any other offer or program. Special shipping rates or other restrictions may apply to international orders. The information presented here is for general educational purposes only. Money Metals Exchange and its staff do not act as personal investment advisors. Nor do we advocate the purchase or sale of any regulated security listed on any exchange for any specific individual. While our track record is excellent, investment markets have inherent risks and there can be no assurance of future profits. You are responsible for your investment decisions, and they should be made in consultation with your own advisors. By purchasing from Money Metals, you understand our company is not responsible for any losses caused by your investment decisions, nor do we have any claim to any market gains you may enjoy. Money Metals Exchange is not a regulated trading ???exchange??? as defined by the CFTC and the SEC.

Money Metals Exchange

PO Box 2599

Eagle, ID 83616

[link removed] style="" Unsubscribe | [link removed] style="" Report Spam | [link removed] style="" View In Browser | [link removed] style="" Forward to a Friend | Ensure Email Delivery [link removed]

[link removed] style="" Unsubscribe | [link removed] style="" Report Spam | [link removed] style="" View In Browser

[link removed]

[link removed]

Gold [link removed] Silver [link removed] IRAs [link removed] Monthly [link removed] News [link removed] Storage [link removed] Specials [link removed]

Money Metals News Alert

October 6, 2025 Gold is pushing higher for the 8th consecutive week. The yellow metal is up $50 this morning, trading at all-time high and nearing the $4,000 level.

Silver has surged 60 cents so far today, after adding $2 last week.

The silver move is being fueled by what may be a physical shortage, as indicated by a condition called "backwardation." Normally, the price of the metal in the future is a bit more expensive to account for the cost of funds. This is known as "contango."

But right now, the price of silver on the December contract, for instance, is currently sitting below the spot market price.

1 Kilo Silver Bar

(Money Metals) [link removed] [link removed]

Shop Now >> [link removed]

Backwardation is unusual and it implies very strong demand in the spot market for physical metal.

Premiums for physical coins, bars, and rounds at MoneyMetals.com [link removed] remain low, although we've seen excess inventory dissipate at the wholesale level. Premiums may begin to creep up soon.

Friday's Close

(Weekly Gain/Loss)

Monday Morning

(Gain/Loss from Friday's Close)

Gold [link removed]

$3,900 (+1.5%) [link removed]

$3,956 (+1.4%) [link removed]

Silver [link removed]

$48.18 (+2.2%) [link removed]

$48.80 (+1.3%) [link removed]

Platinum [link removed]

$1,618 (+1.5%) [link removed]

$1,652 (+2.1%) [link removed]

Palladium [link removed]

$1,283 (+0.1%) [link removed]

$1,323 (+3.0%) [link removed]

Gold : Silver Ratio (as of Friday's closing prices) 80.9 to 1

Is Silver About to Crash Like in 1980 & 2011?

Share this Article: [link removed] [link removed] [link removed]

With silver rallying strongly and rising more than 50% since the start of the year, a growing number of investors are starting to worry that a crash may be coming, similar to what happened after the major spikes in 1980 and 2011, instead of focusing on the incredible long-term opportunity that remains in front of us.

But as one of the few analysts who correctly identified the bull market in both silver and gold [link removed] from the very beginning, I have consistently urged investors to stop dwelling on negative scenarios and instead recognize the tremendous upside that still lies ahead.

This is silver???s moment to shine, and it is also a moment of vindication for those of us who believed in it all along, even when it was ignored by the mainstream financial world and left for dead as recently as just a few months ago.

I believe silver will not repeat the sharp collapses that followed its short-lived surges in 1980 and 2011. This time is different.

1 Oz Silver Britannias (Queen Elizabeth) [link removed] [link removed]

Shop Now >> [link removed]

This is a legitimate, sustainable bull market with real staying power and the potential for lasting gains.

To start, I want to show you the long-term chart of silver going back six decades to the 1960s. You???ll notice that there have been three major price surges.

The first was the Hunt Brothersdriven spike in 1980, followed by the quantitative easingfueled rally in 2011, and now the current precious metals bull market. I believe this current move is a legitimate and sustainable bull market that is here to stay, as I will explain throughout this piece.

Now I want you to notice that in both 1980 and 2011, silver surged toward the $50 an ounce level, but that is where those rallies failed and quickly reversed. As a result, the $50 level became a critical price ceiling and resistance level, and it still is to this very day.

For the past two years, as I have been calling for a silver bull market, even when silver was still in the $20 range, I consistently pointed to the $50 level as the key one to watch. I believed it would act like a magnet and draw the price of silver toward it, since major psychological levels often have that effect.

And sure enough, silver has steadily climbed toward that level, just as I expected.

Now, with silver trading around $48 at the time of writing, it is extremely close to breaking through the key $50 level, which is a major make-or-break point.

I also want to point out that many investors bought significant amounts of both silver bullion and ETFs during the frenzy of 2011. Unfortunately, when the price plunged afterward, they were left holding the bag, and many have been sitting on losses for the past 14 years.

But once silver finally surpasses $50, which will mark a new all-time high, no silver investor will be sitting on a loss, at least in nominal terms. That fact alone makes the $50 level a critical psychological barrier that will trigger a surge in investor sentiment once silver breaks above it.

Until recently, many silver investors remained deeply discouraged by years of losses and underperformance.

$20 Liberty

Gold Coins [link removed] [link removed]

Shop Now >> [link removed]

But a decisive break above $50 will mark the beginning of an entirely new era for silver and will set off a powerful virtuous cycle.

Many more investors will pile in, including new and younger participants who never considered silver before and who are not burdened by the baggage carried by older, battle-scarred veterans. This explosion of interest will help drive silver to incredible new heights...

Continue Reading Here > > [link removed]

[link removed]

[link removed]

[link removed]

This week's Market Update was authored by Money Metals Contributing Writer Jesse Colombo.

Call Money Metals [link removed] for Precious Metals Coins,

Bars, and Rounds 1-800-800-1865

We Buy Back Too! [link removed]

Your Privacy [link removed] FAQs [link removed] Contact Us [link removed]

[link removed] [link removed] [link removed] [link removed] [link removed] [link removed] [link removed] [link removed]

Follow Us

This copyrighted material may not be republished without express permission. Offer only available through email promotion. Offer does not apply to previous orders and may not be combined with any other offer or program. Special shipping rates or other restrictions may apply to international orders. The information presented here is for general educational purposes only. Money Metals Exchange and its staff do not act as personal investment advisors. Nor do we advocate the purchase or sale of any regulated security listed on any exchange for any specific individual. While our track record is excellent, investment markets have inherent risks and there can be no assurance of future profits. You are responsible for your investment decisions, and they should be made in consultation with your own advisors. By purchasing from Money Metals, you understand our company is not responsible for any losses caused by your investment decisions, nor do we have any claim to any market gains you may enjoy. Money Metals Exchange is not a regulated trading ???exchange??? as defined by the CFTC and the SEC.

Money Metals Exchange

PO Box 2599

Eagle, ID 83616

[link removed] style="" Unsubscribe | [link removed] style="" Report Spam | [link removed] style="" View In Browser | [link removed] style="" Forward to a Friend | Ensure Email Delivery [link removed]

Message Analysis

- Sender: n/a

- Political Party: n/a

- Country: n/a

- State/Locality: n/a

- Office: n/a