Email

The Weekly Roundup from the Office of Rick Barnes

| From | Tarrant County Tax Office <[email protected]> |

| Subject | The Weekly Roundup from the Office of Rick Barnes |

| Date | October 2, 2025 1:10 AM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

News and Updates from the Office of Rick Barnes ([link removed]) .

[link removed]

[link removed]

2025 Taxes Now Live!

Stay Ahead - View Your Property Taxes Today

The 2025 property tax information is now available. View your tax amount, print a statement or receipt of past payment, sign up for paperless billing, and more from your online account ([link removed]) .

Property Tax Bills Will Begin Mailing the Last Week of October…Now What?

Here are a few things you need to know right now.

Stay tuned—in future correspondence, we will share more details, tips, and step-by-step guidance to make the property tax payment process easier and safer.

[link removed]

Review Your Bill Carefully

If you believe there is an error in your name, address, assessed value, or exemptions, please contact the Appraisal District ([link removed]) where the property is located to request an update.

Note the Payment Deadlines

While property tax bills are due upon receipt, they do not become delinquent until February 1, 2026. Payments made after January 31, 2026 will incur penalties and interest ([link removed]) .

Your Payment Method

Use our worry-free, convenient, and secure online payment portal ([link removed]) . Or pay by phone, by mail, or in person. If you have a mortgage escrow account, confirm with your mortgage company that they are making the payment for you.

Ready to Pay Now?

Help us serve you efficiently — use online ([link removed]) , phone, or in-person payment options for the fastest processing. These options are quick, secure, and eliminate the risk of a delayed, missing, or stolen payment through the mail ([link removed]) . To pay by phone, call 817-884-1110.

Learn More: Mail Theft is On the Rise ([link removed])

Search for Your Account or Make a Payment ([link removed])

Sub-Courthouse Locations to Pay in Person ([link removed])

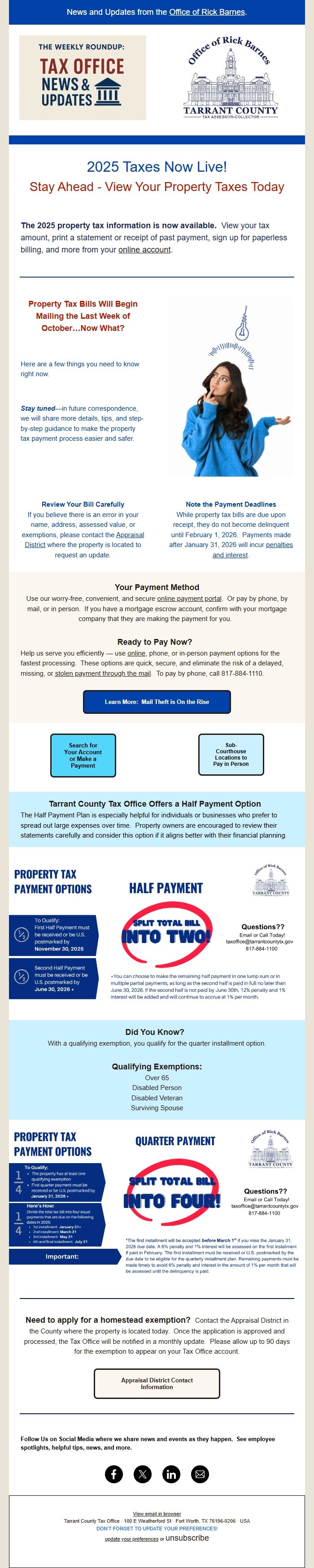

Tarrant County Tax Office Offers a Half Payment Option

The Half Payment Plan is especially helpful for individuals or businesses who prefer to spread out large expenses over time. Property owners are encouraged to review their statements carefully and consider this option if it aligns better with their financial planning.

[link removed]

Did You Know?

With a qualifying exemption, you qualify for the quarter installment option.

Qualifying Exemptions:

Over 65

Disabled Person

Disabled Veteran

Surviving Spouse

[link removed]

Need to apply for a homestead exemption? Contact the Appraisal District in the County where the property is located today. Once the application is approved and processed, the Tax Office will be notified in a monthly update. Please allow up to 90 days for the exemption to appear on your Tax Office account.

Appraisal District Contact Information ([link removed])

Follow Us on Social Media where we share news and events as they happen. See employee spotlights, helpful tips, news, and more.

[link removed]

[link removed]

[link removed]

mailto:[email protected]

View email in browser ([link removed])

Tarrant County Tax Office . 100 E Weatherford St . Fort Worth, TX 76196-0206 . USA

DON’T FORGET TO UPDATE YOUR PREFERENCES!

update your preferences ([link removed]) or unsubscribe ([link removed])

[link removed]

[link removed]

2025 Taxes Now Live!

Stay Ahead - View Your Property Taxes Today

The 2025 property tax information is now available. View your tax amount, print a statement or receipt of past payment, sign up for paperless billing, and more from your online account ([link removed]) .

Property Tax Bills Will Begin Mailing the Last Week of October…Now What?

Here are a few things you need to know right now.

Stay tuned—in future correspondence, we will share more details, tips, and step-by-step guidance to make the property tax payment process easier and safer.

[link removed]

Review Your Bill Carefully

If you believe there is an error in your name, address, assessed value, or exemptions, please contact the Appraisal District ([link removed]) where the property is located to request an update.

Note the Payment Deadlines

While property tax bills are due upon receipt, they do not become delinquent until February 1, 2026. Payments made after January 31, 2026 will incur penalties and interest ([link removed]) .

Your Payment Method

Use our worry-free, convenient, and secure online payment portal ([link removed]) . Or pay by phone, by mail, or in person. If you have a mortgage escrow account, confirm with your mortgage company that they are making the payment for you.

Ready to Pay Now?

Help us serve you efficiently — use online ([link removed]) , phone, or in-person payment options for the fastest processing. These options are quick, secure, and eliminate the risk of a delayed, missing, or stolen payment through the mail ([link removed]) . To pay by phone, call 817-884-1110.

Learn More: Mail Theft is On the Rise ([link removed])

Search for Your Account or Make a Payment ([link removed])

Sub-Courthouse Locations to Pay in Person ([link removed])

Tarrant County Tax Office Offers a Half Payment Option

The Half Payment Plan is especially helpful for individuals or businesses who prefer to spread out large expenses over time. Property owners are encouraged to review their statements carefully and consider this option if it aligns better with their financial planning.

[link removed]

Did You Know?

With a qualifying exemption, you qualify for the quarter installment option.

Qualifying Exemptions:

Over 65

Disabled Person

Disabled Veteran

Surviving Spouse

[link removed]

Need to apply for a homestead exemption? Contact the Appraisal District in the County where the property is located today. Once the application is approved and processed, the Tax Office will be notified in a monthly update. Please allow up to 90 days for the exemption to appear on your Tax Office account.

Appraisal District Contact Information ([link removed])

Follow Us on Social Media where we share news and events as they happen. See employee spotlights, helpful tips, news, and more.

[link removed]

[link removed]

[link removed]

mailto:[email protected]

View email in browser ([link removed])

Tarrant County Tax Office . 100 E Weatherford St . Fort Worth, TX 76196-0206 . USA

DON’T FORGET TO UPDATE YOUR PREFERENCES!

update your preferences ([link removed]) or unsubscribe ([link removed])

Message Analysis

- Sender: n/a

- Political Party: n/a

- Country: n/a

- State/Locality: n/a

- Office: n/a

-

Email Providers:

- MailChimp