|

|

|

|

|

|

|

Money Metals News Alert

|

September 29, 2025

– Silver prices surged higher again last week and this morning, gaining

nearly 9% over the past 10 days. The gold price has risen by 4%, making yet

another all-time high.

|

|

|

Metal prices have risen

despite some strength in the U.S. dollar versus other unbacked fiat currencies.

The greenback finished the

week back above 98 in the DXY index.

U.S. stocks lost a bit of

ground, with the S&P 500 ending about 13 points lower. Yields on the 10-year

Treasury rose slightly.

|

|

|

|

Activity in the retail bullion markets

continues to be brisk. There has been a significant jump in both buying and

selling throughout September relative to July and August.

|

|

|

Gold : Silver Ratio (as of

Friday's closing prices) – 81.5 to

1

|

|

|

|

Government Shutdown Theatre Fuels More Gold

Gains

|

|

|

|

|

|

Rumors of a federal government

shutdown are once again swirling. Absent a deal, non-essential agencies will have

to suspend operations until legislators put together a spending deal.

Americans have another front row seat

to the public relations battle between Republicans and Democrats to see which

party is most to blame for the impasse.

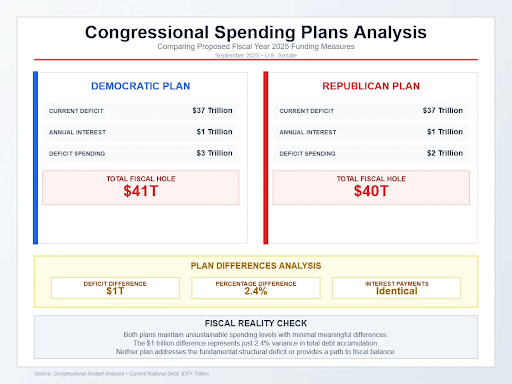

Legislators on both sides of the aisle

want citizens to know a shutdown is bad and the other party is responsible.

They don???t want people paying attention to just how little the difference is

between the Republican and Democratic spending proposals.

This difference is summed up in the

chart below:

|

|

|

|

|

The Democrats would be happy to spend

$3 trillion more than the government collects in taxes. Republicans are pushing

for a $2 trillion budget deficit.

Just a few years back, Americans were

witness to budget drama which included deficits a mere quarter of these amounts.

Republican legislators are proudly

standing behind an offer which would extend the current Biden-era funding levels

for 7 weeks. They aren???t embarrassed at all to be supporting spending levels they

pretended to oppose just a couple years ago.

Democrats insist that certain

healthcare spending increases which were tamped down via the ???One Big Beautiful

Bill??? must be restored.

Despite the looming October 1

deadline, there is no budget resolution or appropriations package currently up for

debate or vote.

|

|

|

The Trump administration

is threatening to permanently layoff some non-essential employees if there is a

shutdown.

Democrats are howling

about those threats and promising to stand firm.

Voters on both sides are

expected to be proud of the principled stand their respective party leaders are

making.

|

|

|

|

For fans of limited government and

sound money, here???s a spoiler alert: Republicans in Congress aren???t planning a

meaningful change in spending or deficits, and, of course, neither are Democrats.

In the end, and despite the drama,

citizens are going to get stuck with a deal in which government spending rises and

the national debt ratchets trillions higher.

The Federal Reserve Bank will enable

the whole thing with artificially lower interest rates. It might even have to step

in again as the buyer of last resort for the oceans of new debt the Treasury will

be issuing.

|

|

|

|

|

|

|

|

This week's Market Update was

authored by Money Metals Director Clint Siegner.

|

|

|

|

|

|

|

|

|

|

This copyrighted material may not

be republished without express permission. Offer only available through email

promotion. Offer does not apply to previous orders and may not be combined with

any other offer or program. Special shipping rates or other restrictions may apply

to international orders. The information presented here is for general educational

purposes only. Money Metals Exchange and its staff do not act as personal

investment advisors. Nor do we advocate the purchase or sale of any regulated

security listed on any exchange for any specific individual. While our track

record is excellent, investment markets have inherent risks and there can be no

assurance of future profits. You are responsible for your investment decisions,

and they should be made in consultation with your own advisors. By purchasing from

Money Metals, you understand our company is not responsible for any losses caused

by your investment decisions, nor do we have any claim to any market gains you may

enjoy. Money Metals Exchange is not a regulated trading ???exchange??? as defined by

the CFTC and the SEC.

|

|

|