Email

Key decisions loom in Florida Power and Light's historic bid to raise rates by $10 billion

| From | Energy and Policy Institute <[email protected]> |

| Subject | Key decisions loom in Florida Power and Light's historic bid to raise rates by $10 billion |

| Date | September 17, 2025 12:00 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

[link removed]

** Key decisions loom in Florida Power and Light’s historic bid to raise rates by $10 billion ([link removed])

------------------------------------------------------------

By Shelby Green on September 15, 2025

Nearly 12 million Floridians face higher electricity bills as state regulators weigh competing proposals in Florida Power and Light’s bid for what is likely the largest rate hike in United States history. One proposal, led by Florida Power and Light (FPL), would lead to a $7 billion rate increase compared to another proposal, led by the state’s consumer advocate, which would limit the rate increase to $5 billion.

FPL filed its historic

$9.819 billion ([link removed]) request to increase rates ([link removed]) in February 2025, including a request to raise the company’s return on equity (ROE) to 11.9 percent ([link removed]) , several points higher than the industry standard of 9.68 percent ([link removed]) . About one third of the proposed first-year rate increase would go strictly to profits, due to an increased ROE, according to the Office of Public Counsel (OPC)

([link removed]) , which represents the public in utility rate cases and other matters.

This is likely ([link removed]) the largest rate hike request in American history, and it will be handled by the Florida Public Service Commission (PSC), a regulatory board of five Governor-appointed officials responsible for setting utility rates and deciding how much customers pay for electricity through a legal proceeding known as a rate case. FPL’s proposed ROE, if approved, would be the highest for any regulated electric utility in Florida ([link removed]) . FPL reported $4.543 billion ([link removed]) in profit last year, and its CEO, Armando

Pimentel, was compensated $11.351 million ([link removed]) , nearly 20% more than the average compensation of the 54 utility CEOs analyzed by the Energy and Policy Institute (EPI) ([link removed]) . An increase to a utility’s ROE allows the company to charge customers more money on their bills for the benefit of shareholders. Approximately half of every dollar FPL collects ([link removed]) could go directly towards profit, according to the OPC.

Customers are still paying for the $150 “storm recovery fee” ([link removed]) the PSC allowed FPL to charge for additional hurricane recovery costs earlier this year ([link removed]) . The proposed 23 percent rate increase ([link removed]) would mark at least the third rate hike since 2021, when the PSC approved a 20 percent increase – $5 billion ([link removed]) – which at the time was the largest in its history. Collectively, Florida residents could soon be paying $600 more annually ([link removed]) for electricity than they were

just five years ago.

AARP scrutinized FPL for its request to increase its profits that will hit “older residents living on fixed incomes […] the hardest.” ([link removed]) In a message ([link removed]) urging the Commission to reject FPL’s proposal, a Bradenton senior detailed how she is forced to take money from her grocery budget in order to keep the lights on. Higher rates could force seniors on fixed incomes to choose between essentials like groceries or gas, says AARP ([link removed]) , a senior-focused organization that hand-delivered nearly 34,000 petitions ([link removed]) urging the Commission to reject FPL’s rate increase.

** Drastic differences in two competing proposals to conclude Florida Power and Light’s rate case

------------------------------------------------------------

Days before the PSC was set to hear arguments on FPL’s rate case, FPL abruptly filed a settlement agreement ([link removed]) attempting to close the original rate case and move forward with hearings and testimony only on its settlement agreement before the PSC. In the settlement agreement, FPL trimmed its rate increase to $6.903 billion ([link removed]) and agreed to a 10.95 percent ROE ([link removed]) , still the highest among its peer utilities and topping the 10.5 percent ([link removed]) the PSC gave to Tampa Electric Company (TECO) last year. TECO’s rate increase

is currently on appeal ([link removed]) before the Florida Supreme Court.

FPL claimed it worked with a “diverse” ([link removed]) group to develop new rates with a “meaningful representation of [all] customer interests.” ([link removed]) However, the OPC condemned FPL’s new proposal as “disproportionately favorable” ([link removed]) to corporate interests and countered with its own settlement, backed by Floridians Against Rate Increases (FAIR) and a coalition of organizations — including Florida Rising, the League of United Latin American Citizens of Florida, and the Environmental Confederation of Southwest Florida (FEL). Under FPL’s proposed settlement agreement, small businesses served by FPL would be forced to pay 10% more than

current rates for their service ([link removed]) . Nearly every group that signed onto FPL’s proposal represents corporate interests, a tiny minority of FPL’s total customer base, according to a joint motion ([link removed]) filed by the OPC, FAIR, and FEL.

The OPC says the groups supporting its proposal represent the interests of a commanding 98% of FPL’s customer base ([link removed]) . The OPC’s proposal would cut the base bill (excluding surcharges, taxes, and fees) by nearly half ([link removed]) for the average residential customer compared to FPL’s initial plan, freeze rates ([link removed]) for two years, and keep the minimum bill at $25

([link removed]) . FPL’s ROE would still be highest in Florida, at 10.6 percent, and permit the monopoly utility to collect $5.241 billion over the next four years ([link removed]) .

FPL opposed the OPC’s alternate settlement, claiming it is invalid because it lacked the utility’s support. The OPC argued that “no Court has ruled that the public interest standard requires the utility to be a party to a non-unanimous rate case settlement agreement. ([link removed]) ” However, the PSC dismissed ([link removed]) the OPC’s settlement agreement, adopting FPL’s position that the petitioning utility is an “indispensable party

([link removed]) ” to any settlement.

The OPC can still submit the terms ([link removed]) of its alternative settlement as a proposed stipulation within its testimony, due September 17, for the PSC’s consideration.

** Florida Power and Light proposes to shift significant costs onto everyday Floridians

------------------------------------------------------------

FPL’s settlement with Walmart, Wawa, and several other large entities* hands nearly $1 billion in subsidies ([link removed]) to industrial giants, according to the OPC, at the expense of Florida’s families and small businesses. Small businesses could face a rate increase of over $75 million ([link removed]) next year, three times what FPL proposed in its original plan, while also bearing additional costs created by data centers.

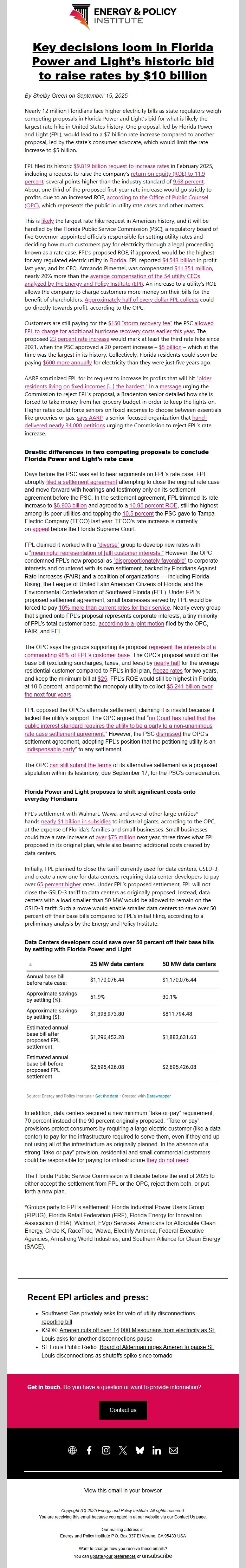

Initially, FPL planned to close the tariff currently used for data centers, GSLD-3, and create a new one for data centers, requiring data center developers to pay over 65 percent higher ([link removed]) rates. Under FPL’s proposed settlement, FPL will not close the GSLD-3 tariff to data centers as originally proposed. Instead, data centers with a load smaller than 50 MW would be allowed to remain on the GSLD-3 tariff. Such a move would enable smaller data centers to save over 50 percent off their base bills compared to FPL’s initial filing, according to a preliminary analysis by the Energy and Policy Institute.

** Data Centers developers could save over 50 percent off their base bills by settling with Florida Power and Light

------------------------------------------------------------

In addition, data centers secured a new minimum “take-or-pay” requirement, 70 percent instead of the 90 percent originally proposed. “Take or pay” provisions protect consumers by requiring a large electric customer (like a data center) to pay for the infrastructure required to serve them, even if they end up not using all of the infrastructure as originally planned. In the absence of a strong “take-or-pay” provision, residential and small commercial customers could be responsible for paying for infrastructure

they do not need ([link removed]) .

The Florida Public Service Commission will decide before the end of 2025 to either accept the settlement from FPL or the OPC, reject them both, or put forth a new plan.

*Groups party to FPL’s settlement: Florida Industrial Power Users Group (FIPUG), Florida Retail Federation (FRF), Florida Energy for Innovation Association (FEIA), Walmart, EVgo Services, Americans for Affordable Clean Energy, Circle K, RaceTrac, Wawa, Electrify America, Federal Executive Agencies, Armstrong World Industries, and Southern Alliance for Clean Energy (SACE).

** Recent EPI articles and press:

------------------------------------------------------------

* Southwest Gas privately asks for veto of utility disconnections reporting bill ([link removed])

* KSDK: Ameren cuts off over 14,000 Missourians from electricity as St. Louis asks for another disconnections pause ([link removed])

* St. Louis Public Radio: Board of Alderman urges Ameren to pause St. Louis disconnections as shutoffs spike since tornado ([link removed])

Get in touch. Do you have a question or want to provide information?

Contact us ([link removed])

[link removed]

[link removed]

[link removed]

[link removed]

[link removed]

[link removed]

mailto:[email protected]

View this email in your browser ([link removed])

Copyright (C) 2025 Energy and Policy Institute. All rights reserved.

You are receiving this email because you opted in at our website via our Contact Us page.

Our mailing address is:

Energy and Policy Institute

P.O. Box 337

El Verano, CA 95433

USA

Want to change how you receive these emails?

You can update your preferences ([link removed]) or unsubscribe ([link removed])

** Key decisions loom in Florida Power and Light’s historic bid to raise rates by $10 billion ([link removed])

------------------------------------------------------------

By Shelby Green on September 15, 2025

Nearly 12 million Floridians face higher electricity bills as state regulators weigh competing proposals in Florida Power and Light’s bid for what is likely the largest rate hike in United States history. One proposal, led by Florida Power and Light (FPL), would lead to a $7 billion rate increase compared to another proposal, led by the state’s consumer advocate, which would limit the rate increase to $5 billion.

FPL filed its historic

$9.819 billion ([link removed]) request to increase rates ([link removed]) in February 2025, including a request to raise the company’s return on equity (ROE) to 11.9 percent ([link removed]) , several points higher than the industry standard of 9.68 percent ([link removed]) . About one third of the proposed first-year rate increase would go strictly to profits, due to an increased ROE, according to the Office of Public Counsel (OPC)

([link removed]) , which represents the public in utility rate cases and other matters.

This is likely ([link removed]) the largest rate hike request in American history, and it will be handled by the Florida Public Service Commission (PSC), a regulatory board of five Governor-appointed officials responsible for setting utility rates and deciding how much customers pay for electricity through a legal proceeding known as a rate case. FPL’s proposed ROE, if approved, would be the highest for any regulated electric utility in Florida ([link removed]) . FPL reported $4.543 billion ([link removed]) in profit last year, and its CEO, Armando

Pimentel, was compensated $11.351 million ([link removed]) , nearly 20% more than the average compensation of the 54 utility CEOs analyzed by the Energy and Policy Institute (EPI) ([link removed]) . An increase to a utility’s ROE allows the company to charge customers more money on their bills for the benefit of shareholders. Approximately half of every dollar FPL collects ([link removed]) could go directly towards profit, according to the OPC.

Customers are still paying for the $150 “storm recovery fee” ([link removed]) the PSC allowed FPL to charge for additional hurricane recovery costs earlier this year ([link removed]) . The proposed 23 percent rate increase ([link removed]) would mark at least the third rate hike since 2021, when the PSC approved a 20 percent increase – $5 billion ([link removed]) – which at the time was the largest in its history. Collectively, Florida residents could soon be paying $600 more annually ([link removed]) for electricity than they were

just five years ago.

AARP scrutinized FPL for its request to increase its profits that will hit “older residents living on fixed incomes […] the hardest.” ([link removed]) In a message ([link removed]) urging the Commission to reject FPL’s proposal, a Bradenton senior detailed how she is forced to take money from her grocery budget in order to keep the lights on. Higher rates could force seniors on fixed incomes to choose between essentials like groceries or gas, says AARP ([link removed]) , a senior-focused organization that hand-delivered nearly 34,000 petitions ([link removed]) urging the Commission to reject FPL’s rate increase.

** Drastic differences in two competing proposals to conclude Florida Power and Light’s rate case

------------------------------------------------------------

Days before the PSC was set to hear arguments on FPL’s rate case, FPL abruptly filed a settlement agreement ([link removed]) attempting to close the original rate case and move forward with hearings and testimony only on its settlement agreement before the PSC. In the settlement agreement, FPL trimmed its rate increase to $6.903 billion ([link removed]) and agreed to a 10.95 percent ROE ([link removed]) , still the highest among its peer utilities and topping the 10.5 percent ([link removed]) the PSC gave to Tampa Electric Company (TECO) last year. TECO’s rate increase

is currently on appeal ([link removed]) before the Florida Supreme Court.

FPL claimed it worked with a “diverse” ([link removed]) group to develop new rates with a “meaningful representation of [all] customer interests.” ([link removed]) However, the OPC condemned FPL’s new proposal as “disproportionately favorable” ([link removed]) to corporate interests and countered with its own settlement, backed by Floridians Against Rate Increases (FAIR) and a coalition of organizations — including Florida Rising, the League of United Latin American Citizens of Florida, and the Environmental Confederation of Southwest Florida (FEL). Under FPL’s proposed settlement agreement, small businesses served by FPL would be forced to pay 10% more than

current rates for their service ([link removed]) . Nearly every group that signed onto FPL’s proposal represents corporate interests, a tiny minority of FPL’s total customer base, according to a joint motion ([link removed]) filed by the OPC, FAIR, and FEL.

The OPC says the groups supporting its proposal represent the interests of a commanding 98% of FPL’s customer base ([link removed]) . The OPC’s proposal would cut the base bill (excluding surcharges, taxes, and fees) by nearly half ([link removed]) for the average residential customer compared to FPL’s initial plan, freeze rates ([link removed]) for two years, and keep the minimum bill at $25

([link removed]) . FPL’s ROE would still be highest in Florida, at 10.6 percent, and permit the monopoly utility to collect $5.241 billion over the next four years ([link removed]) .

FPL opposed the OPC’s alternate settlement, claiming it is invalid because it lacked the utility’s support. The OPC argued that “no Court has ruled that the public interest standard requires the utility to be a party to a non-unanimous rate case settlement agreement. ([link removed]) ” However, the PSC dismissed ([link removed]) the OPC’s settlement agreement, adopting FPL’s position that the petitioning utility is an “indispensable party

([link removed]) ” to any settlement.

The OPC can still submit the terms ([link removed]) of its alternative settlement as a proposed stipulation within its testimony, due September 17, for the PSC’s consideration.

** Florida Power and Light proposes to shift significant costs onto everyday Floridians

------------------------------------------------------------

FPL’s settlement with Walmart, Wawa, and several other large entities* hands nearly $1 billion in subsidies ([link removed]) to industrial giants, according to the OPC, at the expense of Florida’s families and small businesses. Small businesses could face a rate increase of over $75 million ([link removed]) next year, three times what FPL proposed in its original plan, while also bearing additional costs created by data centers.

Initially, FPL planned to close the tariff currently used for data centers, GSLD-3, and create a new one for data centers, requiring data center developers to pay over 65 percent higher ([link removed]) rates. Under FPL’s proposed settlement, FPL will not close the GSLD-3 tariff to data centers as originally proposed. Instead, data centers with a load smaller than 50 MW would be allowed to remain on the GSLD-3 tariff. Such a move would enable smaller data centers to save over 50 percent off their base bills compared to FPL’s initial filing, according to a preliminary analysis by the Energy and Policy Institute.

** Data Centers developers could save over 50 percent off their base bills by settling with Florida Power and Light

------------------------------------------------------------

In addition, data centers secured a new minimum “take-or-pay” requirement, 70 percent instead of the 90 percent originally proposed. “Take or pay” provisions protect consumers by requiring a large electric customer (like a data center) to pay for the infrastructure required to serve them, even if they end up not using all of the infrastructure as originally planned. In the absence of a strong “take-or-pay” provision, residential and small commercial customers could be responsible for paying for infrastructure

they do not need ([link removed]) .

The Florida Public Service Commission will decide before the end of 2025 to either accept the settlement from FPL or the OPC, reject them both, or put forth a new plan.

*Groups party to FPL’s settlement: Florida Industrial Power Users Group (FIPUG), Florida Retail Federation (FRF), Florida Energy for Innovation Association (FEIA), Walmart, EVgo Services, Americans for Affordable Clean Energy, Circle K, RaceTrac, Wawa, Electrify America, Federal Executive Agencies, Armstrong World Industries, and Southern Alliance for Clean Energy (SACE).

** Recent EPI articles and press:

------------------------------------------------------------

* Southwest Gas privately asks for veto of utility disconnections reporting bill ([link removed])

* KSDK: Ameren cuts off over 14,000 Missourians from electricity as St. Louis asks for another disconnections pause ([link removed])

* St. Louis Public Radio: Board of Alderman urges Ameren to pause St. Louis disconnections as shutoffs spike since tornado ([link removed])

Get in touch. Do you have a question or want to provide information?

Contact us ([link removed])

[link removed]

[link removed]

[link removed]

[link removed]

[link removed]

[link removed]

mailto:[email protected]

View this email in your browser ([link removed])

Copyright (C) 2025 Energy and Policy Institute. All rights reserved.

You are receiving this email because you opted in at our website via our Contact Us page.

Our mailing address is:

Energy and Policy Institute

P.O. Box 337

El Verano, CA 95433

USA

Want to change how you receive these emails?

You can update your preferences ([link removed]) or unsubscribe ([link removed])

Message Analysis

- Sender: Energy and Policy Institute

- Political Party: n/a

- Country: United States

- State/Locality: n/a

- Office: n/a

-

Email Providers:

- MailChimp