Email

Take Advantage of Federal Energy Tax Credits Before They Are Gone

| From | Michigan Executive Office of the Governor <[email protected]> |

| Subject | Take Advantage of Federal Energy Tax Credits Before They Are Gone |

| Date | September 4, 2025 5:54 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

With the recent passage of the ‘Big Betrayal Bill,’ Republicans in Washington enacted destructive cuts to key programs that lower costs for

*September 4, 2025*

View as a webpage [ [link removed] ]

Governor Whitmer Header

energy tax credits

Dear Friend,

With the recent passage of the ‘Big Betrayal Bill,’ Republicans in Washington enacted destructive cuts to key programs that lower costs for Americans, including the elimination of several key energy tax credits that put money back in your pocket.

These cuts will impact how we power our homes, businesses, and vehicles here in Michigan. The federal energy tax credits have played a critical role in making clean energy more affordable, covering 30% or more of costs connected to solar panels, energy-efficient appliances, electric vehicles, and home improvements that help families lower their monthly utility bills. These incentives not only saved working families and small businesses thousands, but they also supported jobs and ensured reliable energy as demand for electricity continues to grow.

*Although these credits will soon be gone, there is still time for families and businesses to take advantage of them. That means if you’ve been considering upgrading your furnace or water heater, purchasing an EV, or making your home more energy efficient, now is the time to act. Deadlines are as soon as September 30, 2025, for electric vehicles, and every dollar in credits that you can claim before these cuts fully take effect is money back in your pocket.*

Rolling back these energy tax credits doesn’t just mean higher costs for families—it threatens local jobs and slows our progress toward clean energy in Michigan. My administration remains committed to building a clean and affordable energy future for Michigan, and we will continue to find ways to support families and grow Michigan’s clean energy economy.

Together, we will keep moving forward to build a stronger, cleaner Michigan for everyone.

Sincerely,

signature

Gretchen Whitmer

Governor

Take Advantage of Federal Energy Tax Credits Before They Are Gone

There remains a short window of opportunity to take advantage of the many federal tax credits that will soon be eliminated. I strongly encourage Michigan families, homeowners, and business owners to explore and use these cost saving programs before they expire! Deadlines are as soon as September 30, 2025, for electric vehicles, as shown below in red.

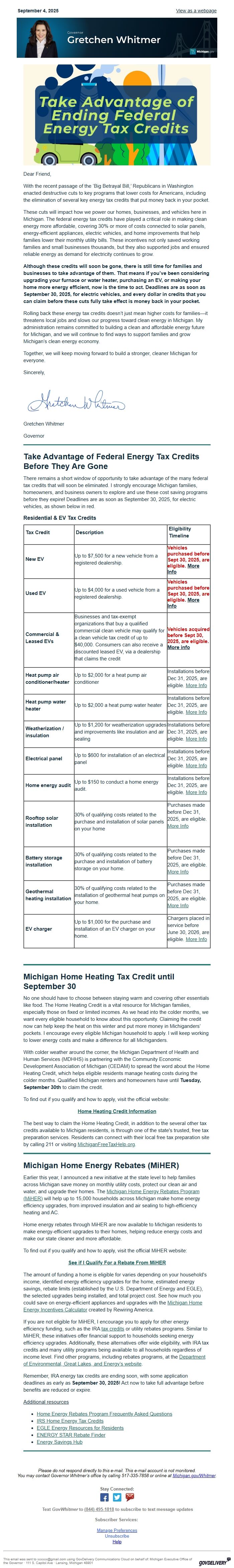

Residential & EV Tax Credits

* Tax Credit*

* Description*

* Eligibility Timeline*

* New EV *

Up to $7,500 for a new vehicle from a registered dealership.

Vehicles purchased before Sept 30, 2025, are eligible. More Info [ [link removed] ]

* Used EV *

Up to $4,000 for a used vehicle from a registered dealership.

Vehicles purchased before Sept 30, 2025, are eligible. More Info [ [link removed] ]

* Commercial & Leased EVs *

Businesses and tax-exempt organizations that buy a qualified commercial clean vehicle may qualify for a clean vehicle tax credit of up to $40,000. Consumers can also receive a discounted leased EV, via a dealership that claims the credit

Vehicles acquired before Sept 30, 2025, are eligible. More info [ [link removed] ]

* Heat pump air conditioner/heater *

Up to $2,000 for a heat pump air conditioner

Installations before Dec 31, 2025, are eligible. More Info [ [link removed] ]

* Heat pump water heater *

Up to $2,000 a heat pump water heater

Installations before Dec 31, 2025, are eligible. More Info [ [link removed] ]

* Weatherization / insulation *

Up to $1,200 for weatherization upgrades and improvements like insulation and air sealing

Installations before Dec 31, 2025, are eligible. More Info [ [link removed] ]

* Electrical panel *

Up to $600 for installation of an electrical panel

Installations before Dec 31, 2025, are eligible. More Info [ [link removed] ]

* Home energy audit *

Up to $150 to conduct a home energy audit.

Installations before Dec 31, 2025, are eligible. More Info [ [link removed] ]

* Rooftop solar installation *

30% of qualifying costs related to the purchase and installation of solar panels on your home

Purchases made before Dec 31, 2025, are eligible. More Info [ [link removed] ]

* Battery storage installation *

30% of qualifying costs related to the purchase and installation of battery storage on your home.

Purchases made before Dec 31, 2025, are eligible. More Info [ [link removed] ]

* Geothermal heating installation *

30% of qualifying costs related to the installation of geothermal heat pumps on your home.

Purchases made before Dec 31, 2025, are eligible. More Info [ [link removed] ]

* EV charger *

Up to $1,000 for the purchase and installation of an EV charger on your home.

Chargers placed in service before June 30, 2026, are eligible. More Info [ [link removed] ]

blank

Michigan Home Heating Tax Credit until September 30

No one should have to choose between staying warm and covering other essentials like food. The Home Heating Credit is a vital resource for Michigan families, especially those on fixed or limited incomes. As we head into the colder months, we want every eligible household to know about this opportunity. Claiming the credit now can help keep the heat on this winter and put more money in Michiganders’ pockets. I encourage every eligible Michigan household to apply. I will keep working to lower energy costs and make a difference for all Michiganders.

With colder weather around the corner, the Michigan Department of Health and Human Services (MDHHS) is partnering with the Community Economic Development Association of Michigan (CEDAM) to spread the word about the Home Heating Credit, which helps eligible residents manage heating costs during the colder months. Qualified Michigan renters and homeowners have until *Tuesday, September 30th* to claim the credit.

To find out if you qualify and how to apply, visit the official website:

*Home Heating Credit Information [ [link removed] ]*

The best way to claim the Home Heating Credit, in addition to the several other tax credits available to Michigan residents, is through one of the state's trusted, free tax preparation services. Residents can connect with their local free tax preparation site by calling 211 or visiting MichiganFreeTaxHelp.org [ [link removed] ].

Michigan Home Energy Rebates (MiHER)

Earlier this year, I announced a new initiative at the state level to help families across Michigan save money on monthly utility costs, protect our clean air and water, and upgrade their homes. The Michigan Home Energy Rebates Program (MiHER) [ [link removed] ] will help up to 15,000 households across Michigan make home energy efficiency upgrades, from improved insulation and air sealing to high-efficiency heating and AC.

Home energy rebates through MiHER are now available to Michigan residents to make energy-efficient upgrades to their homes, helping reduce energy costs and make our state cleaner and more affordable.

To find out if you qualify and how to apply, visit the official MiHER website:

*See if I Qualify For a Rebate From MiHER [ [link removed] ]*

The amount of funding a home is eligible for varies depending on your household's income, identified energy efficiency upgrades for the home, estimated energy savings, rebate limits (established by the U.S. Department of Energy and EGLE), the selected upgrades being installed, and total project cost. See how much you could save on energy-efficient appliances and upgrades with the Michigan Home Energy Incentives Calculator [ [link removed] ] created by Rewiring America.

If you are not eligible for MiHER, I encourage you to apply for other energy efficiency funding, such as the IRA tax credits [ [link removed] ] or utility rebates programs. Similar to MiHER, these initiatives offer financial support to households seeking energy efficiency upgrades. Additionally, these alternatives offer wide eligibility, with IRA tax credits and many utility programs being available to all households regardless of income level. Find other programs, including rebates programs, at the Department of Environmental, Great Lakes, and Energy’s website [ [link removed] ].

Remember, IRA energy tax credits are ending soon, with some application deadlines as early as *September 30, 2025*! Act now to take full advantage before benefits are reduced or expire.

_Additional resources_

* Home Energy Rebates Program Frequently Asked Questions [ [link removed] ]

* IRS Home Energy Tax Credits [ [link removed] ]

* EGLE Energy Resources for Residents [ [link removed] ]__

* ENERGY STAR Rebate Finder [ [link removed] ]

* Energy Savings Hub [ [link removed] ]

"Please do not respond directly to this e-mail. This e-mail account is not monitored.

You may contact Governor Whitmer’s office by calling 517-335-7858 or online at Michigan.gov/Whitmer [ [link removed] ]."

*Stay Connected:* Visit us on Facebook [ [link removed] ] Visit us on Twitter [ [link removed] ] Sign up for email updates [ [link removed] ]

* Text " GovWhitmer "to _(844) 495-1818_ to subscribe to text message updates*

* Subscriber Services:*

Manage [ [link removed] ] Preferences [ [link removed] ] Unsubscribe [ [link removed] ] Help [ [link removed] ]

div.qs_banner {display: none !important;}

________________________________________________________________________

This email was sent to [email protected] using GovDelivery Communications Cloud on behalf of: Michigan Executive Office of the Governor · 111 S. Capitol Ave · Lansing, Michigan 48901 GovDelivery logo [ [link removed] ]

body .abe-column-block { min-height: 5px; } table.gd_combo_table img {margin-left:10px; margin-right:10px;} table.gd_combo_table div.govd_image_display img, table.gd_combo_table td.gd_combo_image_cell img {margin-left:0px; margin-right:0px;} table.govd_hr {min-width: 100%;}

*September 4, 2025*

View as a webpage [ [link removed] ]

Governor Whitmer Header

energy tax credits

Dear Friend,

With the recent passage of the ‘Big Betrayal Bill,’ Republicans in Washington enacted destructive cuts to key programs that lower costs for Americans, including the elimination of several key energy tax credits that put money back in your pocket.

These cuts will impact how we power our homes, businesses, and vehicles here in Michigan. The federal energy tax credits have played a critical role in making clean energy more affordable, covering 30% or more of costs connected to solar panels, energy-efficient appliances, electric vehicles, and home improvements that help families lower their monthly utility bills. These incentives not only saved working families and small businesses thousands, but they also supported jobs and ensured reliable energy as demand for electricity continues to grow.

*Although these credits will soon be gone, there is still time for families and businesses to take advantage of them. That means if you’ve been considering upgrading your furnace or water heater, purchasing an EV, or making your home more energy efficient, now is the time to act. Deadlines are as soon as September 30, 2025, for electric vehicles, and every dollar in credits that you can claim before these cuts fully take effect is money back in your pocket.*

Rolling back these energy tax credits doesn’t just mean higher costs for families—it threatens local jobs and slows our progress toward clean energy in Michigan. My administration remains committed to building a clean and affordable energy future for Michigan, and we will continue to find ways to support families and grow Michigan’s clean energy economy.

Together, we will keep moving forward to build a stronger, cleaner Michigan for everyone.

Sincerely,

signature

Gretchen Whitmer

Governor

Take Advantage of Federal Energy Tax Credits Before They Are Gone

There remains a short window of opportunity to take advantage of the many federal tax credits that will soon be eliminated. I strongly encourage Michigan families, homeowners, and business owners to explore and use these cost saving programs before they expire! Deadlines are as soon as September 30, 2025, for electric vehicles, as shown below in red.

Residential & EV Tax Credits

* Tax Credit*

* Description*

* Eligibility Timeline*

* New EV *

Up to $7,500 for a new vehicle from a registered dealership.

Vehicles purchased before Sept 30, 2025, are eligible. More Info [ [link removed] ]

* Used EV *

Up to $4,000 for a used vehicle from a registered dealership.

Vehicles purchased before Sept 30, 2025, are eligible. More Info [ [link removed] ]

* Commercial & Leased EVs *

Businesses and tax-exempt organizations that buy a qualified commercial clean vehicle may qualify for a clean vehicle tax credit of up to $40,000. Consumers can also receive a discounted leased EV, via a dealership that claims the credit

Vehicles acquired before Sept 30, 2025, are eligible. More info [ [link removed] ]

* Heat pump air conditioner/heater *

Up to $2,000 for a heat pump air conditioner

Installations before Dec 31, 2025, are eligible. More Info [ [link removed] ]

* Heat pump water heater *

Up to $2,000 a heat pump water heater

Installations before Dec 31, 2025, are eligible. More Info [ [link removed] ]

* Weatherization / insulation *

Up to $1,200 for weatherization upgrades and improvements like insulation and air sealing

Installations before Dec 31, 2025, are eligible. More Info [ [link removed] ]

* Electrical panel *

Up to $600 for installation of an electrical panel

Installations before Dec 31, 2025, are eligible. More Info [ [link removed] ]

* Home energy audit *

Up to $150 to conduct a home energy audit.

Installations before Dec 31, 2025, are eligible. More Info [ [link removed] ]

* Rooftop solar installation *

30% of qualifying costs related to the purchase and installation of solar panels on your home

Purchases made before Dec 31, 2025, are eligible. More Info [ [link removed] ]

* Battery storage installation *

30% of qualifying costs related to the purchase and installation of battery storage on your home.

Purchases made before Dec 31, 2025, are eligible. More Info [ [link removed] ]

* Geothermal heating installation *

30% of qualifying costs related to the installation of geothermal heat pumps on your home.

Purchases made before Dec 31, 2025, are eligible. More Info [ [link removed] ]

* EV charger *

Up to $1,000 for the purchase and installation of an EV charger on your home.

Chargers placed in service before June 30, 2026, are eligible. More Info [ [link removed] ]

blank

Michigan Home Heating Tax Credit until September 30

No one should have to choose between staying warm and covering other essentials like food. The Home Heating Credit is a vital resource for Michigan families, especially those on fixed or limited incomes. As we head into the colder months, we want every eligible household to know about this opportunity. Claiming the credit now can help keep the heat on this winter and put more money in Michiganders’ pockets. I encourage every eligible Michigan household to apply. I will keep working to lower energy costs and make a difference for all Michiganders.

With colder weather around the corner, the Michigan Department of Health and Human Services (MDHHS) is partnering with the Community Economic Development Association of Michigan (CEDAM) to spread the word about the Home Heating Credit, which helps eligible residents manage heating costs during the colder months. Qualified Michigan renters and homeowners have until *Tuesday, September 30th* to claim the credit.

To find out if you qualify and how to apply, visit the official website:

*Home Heating Credit Information [ [link removed] ]*

The best way to claim the Home Heating Credit, in addition to the several other tax credits available to Michigan residents, is through one of the state's trusted, free tax preparation services. Residents can connect with their local free tax preparation site by calling 211 or visiting MichiganFreeTaxHelp.org [ [link removed] ].

Michigan Home Energy Rebates (MiHER)

Earlier this year, I announced a new initiative at the state level to help families across Michigan save money on monthly utility costs, protect our clean air and water, and upgrade their homes. The Michigan Home Energy Rebates Program (MiHER) [ [link removed] ] will help up to 15,000 households across Michigan make home energy efficiency upgrades, from improved insulation and air sealing to high-efficiency heating and AC.

Home energy rebates through MiHER are now available to Michigan residents to make energy-efficient upgrades to their homes, helping reduce energy costs and make our state cleaner and more affordable.

To find out if you qualify and how to apply, visit the official MiHER website:

*See if I Qualify For a Rebate From MiHER [ [link removed] ]*

The amount of funding a home is eligible for varies depending on your household's income, identified energy efficiency upgrades for the home, estimated energy savings, rebate limits (established by the U.S. Department of Energy and EGLE), the selected upgrades being installed, and total project cost. See how much you could save on energy-efficient appliances and upgrades with the Michigan Home Energy Incentives Calculator [ [link removed] ] created by Rewiring America.

If you are not eligible for MiHER, I encourage you to apply for other energy efficiency funding, such as the IRA tax credits [ [link removed] ] or utility rebates programs. Similar to MiHER, these initiatives offer financial support to households seeking energy efficiency upgrades. Additionally, these alternatives offer wide eligibility, with IRA tax credits and many utility programs being available to all households regardless of income level. Find other programs, including rebates programs, at the Department of Environmental, Great Lakes, and Energy’s website [ [link removed] ].

Remember, IRA energy tax credits are ending soon, with some application deadlines as early as *September 30, 2025*! Act now to take full advantage before benefits are reduced or expire.

_Additional resources_

* Home Energy Rebates Program Frequently Asked Questions [ [link removed] ]

* IRS Home Energy Tax Credits [ [link removed] ]

* EGLE Energy Resources for Residents [ [link removed] ]__

* ENERGY STAR Rebate Finder [ [link removed] ]

* Energy Savings Hub [ [link removed] ]

"Please do not respond directly to this e-mail. This e-mail account is not monitored.

You may contact Governor Whitmer’s office by calling 517-335-7858 or online at Michigan.gov/Whitmer [ [link removed] ]."

*Stay Connected:* Visit us on Facebook [ [link removed] ] Visit us on Twitter [ [link removed] ] Sign up for email updates [ [link removed] ]

* Text " GovWhitmer "to _(844) 495-1818_ to subscribe to text message updates*

* Subscriber Services:*

Manage [ [link removed] ] Preferences [ [link removed] ] Unsubscribe [ [link removed] ] Help [ [link removed] ]

div.qs_banner {display: none !important;}

________________________________________________________________________

This email was sent to [email protected] using GovDelivery Communications Cloud on behalf of: Michigan Executive Office of the Governor · 111 S. Capitol Ave · Lansing, Michigan 48901 GovDelivery logo [ [link removed] ]

body .abe-column-block { min-height: 5px; } table.gd_combo_table img {margin-left:10px; margin-right:10px;} table.gd_combo_table div.govd_image_display img, table.gd_combo_table td.gd_combo_image_cell img {margin-left:0px; margin-right:0px;} table.govd_hr {min-width: 100%;}

Message Analysis

- Sender: Office of the Governor of Michigan

- Political Party: n/a

- Country: United States

- State/Locality: MIchigan

- Office: n/a

-

Email Providers:

- govDelivery