Email

[Treasurer of the State of Iowa] State Treasurer of Iowa News 2019 Third Quarter Newsletter

| From | Treasurer of the State of Iowa <[email protected]> |

| Subject | [Treasurer of the State of Iowa] State Treasurer of Iowa News 2019 Third Quarter Newsletter |

| Date | August 23, 2019 1:32 AM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

State Treasurer of Iowa News 2019 Third Quarter Newsletter

August is “ABLE to Save” Month

Earlier this month, I announced August is Able to Save Month. Iowa partnered with the ABLE National Resource Center along with other states and organizations around the country in an effort to increase awareness about ABLE accounts and to encourage those with disabilities and their families to start building their financial futures.

IAble has over 500 accounts with more than $3.3 million invested. Nationally, there are over 46,000 open ABLE accounts with over $260 million in total assets. Accounts can be opened online with as little as $25.

Prior to federal passage of the Stephen Beck, Jr. Achieving a Better Life Experience (ABLE) Act in 2014, millions of individuals with disabilities were unable to save more than $2,000 in assets without jeopardizing their eligibility for critical federal benefits. Following in the federal government’s footsteps, the Iowa legislature passed legislation that paved the way for Iowa’s ABLE program, IAble.

IAble offers individuals with disabilities the opportunity to save up to $100,000 for disability-related expenses without losing their eligibility for certain assistance programs, like SSI (Supplemental Security Income) and Medicaid. Funds can be used for short-term saving or long-term investing, and include both federal and state income tax benefits. You can visit IAble.gov to learn more about the tax benefits.

For more information about IAble, please visit IAble.gov. You may also call the program at 1-888-609-8910, or email us at [email protected].

September is College Savings Month! Celebrate with College Savings Iowa

This September, my office and College Savings Iowa are celebrating College Savings Month, the month-long celebration of 529 savings plans. Be sure to take the time during this College Savings Month to learn more about College Savings Iowa and how a 529 plan can help you and your family save more to reach higher education goals. Everyone can get involved, so if you already have a College Savings Iowa account open, don’t forget to get your friends and family involved. With this 529 program, you can save for any kind of future for your children, grandchildren and even for yourself. If you want to learn more about College Savings Iowa, you can visit our website at CollegeSavingsIowa.com or call our education specialists at 888-672-9116.

Another great reason to celebrate 529 plans and College Savings Iowa is the tax benefits savers and students can receive. Iowa taxpayers can receive the benefit of a state tax deduction every year when they save with College Savings Iowa, while withdrawals are federally and state tax-free when used for qualified education expenses. For 2019, Iowa tax payers can deduct up to $3,387 in contributions per beneficiary account from their 2019 Iowa state taxes.* A married couple with two children will be able to deduct up to $13,548 in College Savings Iowa contributions on their 2019 state taxes as an example.

Keep an eye on my office’s social media platforms for more ways to celebrate College Savings Month with us. You can connect with the plan on Facebook and Twitter to stay up to date on current giveaways, news and events.

*Adjusted annually for inflation. If withdrawals are not qualified, the deductions must be added back to Iowa taxable income. The availability of tax or other benefits may be contingent on meeting other requirements.

Millions Earned in State of Iowa’s Investments

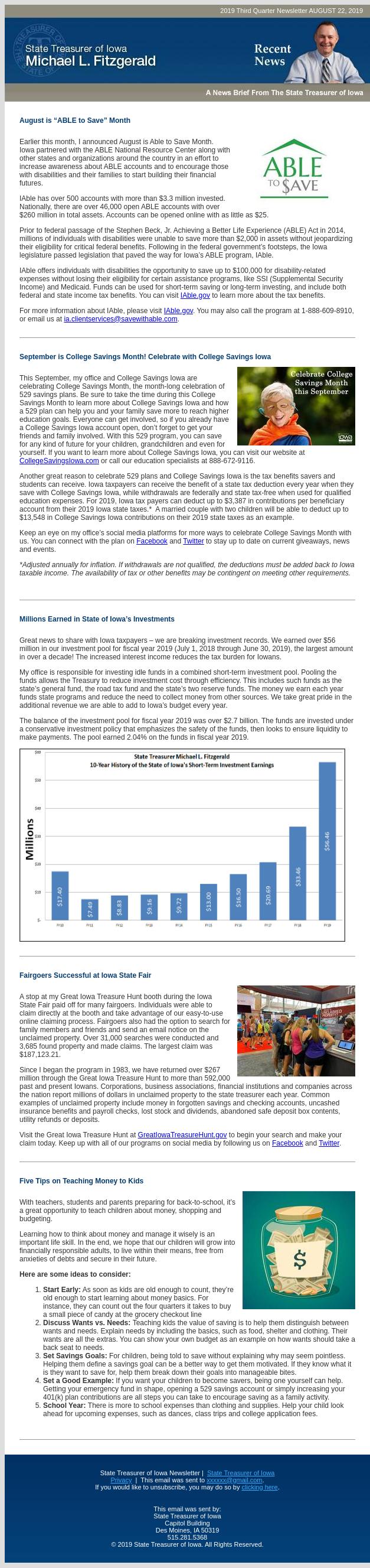

Great news to share with Iowa taxpayers – we are breaking investment records. We earned over $56 million in our investment pool for fiscal year 2019 (July 1, 2018 through June 30, 2019), the largest amount in over a decade! The increased interest income reduces the tax burden for Iowans.

My office is responsible for investing idle funds in a combined short-term investment pool. Pooling the funds allows the Treasury to reduce investment cost through efficiency. This includes such funds as the state’s general fund, the road tax fund and the state’s two reserve funds. The money we earn each year funds state programs and reduce the need to collect money from other sources. We take great pride in the additional revenue we are able to add to Iowa’s budget every year.

The balance of the investment pool for fiscal year 2019 was over $2.7 billion. The funds are invested under a conservative investment policy that emphasizes the safety of the funds, then looks to ensure liquidity to make payments. The pool earned 2.04% on the funds in fiscal year 2019.

Fairgoers Successful at Iowa State Fair

A stop at my Great Iowa Treasure Hunt booth during the Iowa State Fair paid off for many fairgoers. Individuals were able to claim directly at the booth and take advantage of our easy-to-use online claiming process. Fairgoers also had the option to search for family members and friends and send an email notice on the unclaimed property. Over 31,000 searches were conducted and 3,685 found property and made claims. The largest claim was $187,123.21.

Since I began the program in 1983, we have returned over $267 million through the Great Iowa Treasure Hunt to more than 592,000 past and present Iowans. Corporations, business associations, financial institutions and companies across the nation report millions of dollars in unclaimed property to the state treasurer each year. Common examples of unclaimed property include money in forgotten savings and checking accounts, uncashed insurance benefits and payroll checks, lost stock and dividends, abandoned safe deposit box contents, utility refunds or deposits.

Visit the Great Iowa Treasure Hunt at GreatIowaTreasureHunt.gov to begin your search and make your claim today. Keep up with all of our programs on social media by following us on Facebook and Twitter.

Five Tips on Teaching Money to Kids

With teachers, students and parents preparing for back-to-school, it’s a great opportunity to teach children about money, shopping and budgeting.

Learning how to think about money and manage it wisely is an important life skill. In the end, we hope that our children will grow into financially responsible adults, to live within their means, free from anxieties of debts and secure in their future.

Here are some ideas to consider:

Start Early: As soon as kids are old enough to count, they’re old enough to start learning about money basics. For instance, they can count out the four quarters it takes to buy a small piece of candy at the grocery checkout line

Discuss Wants vs. Needs: Teaching kids the value of saving is to help them distinguish between wants and needs. Explain needs by including the basics, such as food, shelter and clothing. Their wants are all the extras. You can show your own budget as an example on how wants should take a back seat to needs.

Set Savings Goals: For children, being told to save without explaining why may seem pointless. Helping them define a savings goal can be a better way to get them motivated. If they know what it is they want to save for, help them break down their goals into manageable bites.

Set a Good Example: If you want your children to become savers, being one yourself can help. Getting your emergency fund in shape, opening a 529 savings account or simply increasing your 401(k) plan contributions are all steps you can take to encourage saving as a family activity.

School Year: There is more to school expenses than clothing and supplies. Help your child look ahead for upcoming expenses, such as dances, class trips and college application fees.

You are receiving this email because [email protected] is signed up to receive Treasurer of the State of Iowa communications.

If you wish to unsubscribe from future Treasurer of the State of Iowa emails, you can always unsubscribe at

[link removed].

Please don't reply to this email.

Copyright 2019 Treasurer of the State of Iowa. All rights reserved.

August is “ABLE to Save” Month

Earlier this month, I announced August is Able to Save Month. Iowa partnered with the ABLE National Resource Center along with other states and organizations around the country in an effort to increase awareness about ABLE accounts and to encourage those with disabilities and their families to start building their financial futures.

IAble has over 500 accounts with more than $3.3 million invested. Nationally, there are over 46,000 open ABLE accounts with over $260 million in total assets. Accounts can be opened online with as little as $25.

Prior to federal passage of the Stephen Beck, Jr. Achieving a Better Life Experience (ABLE) Act in 2014, millions of individuals with disabilities were unable to save more than $2,000 in assets without jeopardizing their eligibility for critical federal benefits. Following in the federal government’s footsteps, the Iowa legislature passed legislation that paved the way for Iowa’s ABLE program, IAble.

IAble offers individuals with disabilities the opportunity to save up to $100,000 for disability-related expenses without losing their eligibility for certain assistance programs, like SSI (Supplemental Security Income) and Medicaid. Funds can be used for short-term saving or long-term investing, and include both federal and state income tax benefits. You can visit IAble.gov to learn more about the tax benefits.

For more information about IAble, please visit IAble.gov. You may also call the program at 1-888-609-8910, or email us at [email protected].

September is College Savings Month! Celebrate with College Savings Iowa

This September, my office and College Savings Iowa are celebrating College Savings Month, the month-long celebration of 529 savings plans. Be sure to take the time during this College Savings Month to learn more about College Savings Iowa and how a 529 plan can help you and your family save more to reach higher education goals. Everyone can get involved, so if you already have a College Savings Iowa account open, don’t forget to get your friends and family involved. With this 529 program, you can save for any kind of future for your children, grandchildren and even for yourself. If you want to learn more about College Savings Iowa, you can visit our website at CollegeSavingsIowa.com or call our education specialists at 888-672-9116.

Another great reason to celebrate 529 plans and College Savings Iowa is the tax benefits savers and students can receive. Iowa taxpayers can receive the benefit of a state tax deduction every year when they save with College Savings Iowa, while withdrawals are federally and state tax-free when used for qualified education expenses. For 2019, Iowa tax payers can deduct up to $3,387 in contributions per beneficiary account from their 2019 Iowa state taxes.* A married couple with two children will be able to deduct up to $13,548 in College Savings Iowa contributions on their 2019 state taxes as an example.

Keep an eye on my office’s social media platforms for more ways to celebrate College Savings Month with us. You can connect with the plan on Facebook and Twitter to stay up to date on current giveaways, news and events.

*Adjusted annually for inflation. If withdrawals are not qualified, the deductions must be added back to Iowa taxable income. The availability of tax or other benefits may be contingent on meeting other requirements.

Millions Earned in State of Iowa’s Investments

Great news to share with Iowa taxpayers – we are breaking investment records. We earned over $56 million in our investment pool for fiscal year 2019 (July 1, 2018 through June 30, 2019), the largest amount in over a decade! The increased interest income reduces the tax burden for Iowans.

My office is responsible for investing idle funds in a combined short-term investment pool. Pooling the funds allows the Treasury to reduce investment cost through efficiency. This includes such funds as the state’s general fund, the road tax fund and the state’s two reserve funds. The money we earn each year funds state programs and reduce the need to collect money from other sources. We take great pride in the additional revenue we are able to add to Iowa’s budget every year.

The balance of the investment pool for fiscal year 2019 was over $2.7 billion. The funds are invested under a conservative investment policy that emphasizes the safety of the funds, then looks to ensure liquidity to make payments. The pool earned 2.04% on the funds in fiscal year 2019.

Fairgoers Successful at Iowa State Fair

A stop at my Great Iowa Treasure Hunt booth during the Iowa State Fair paid off for many fairgoers. Individuals were able to claim directly at the booth and take advantage of our easy-to-use online claiming process. Fairgoers also had the option to search for family members and friends and send an email notice on the unclaimed property. Over 31,000 searches were conducted and 3,685 found property and made claims. The largest claim was $187,123.21.

Since I began the program in 1983, we have returned over $267 million through the Great Iowa Treasure Hunt to more than 592,000 past and present Iowans. Corporations, business associations, financial institutions and companies across the nation report millions of dollars in unclaimed property to the state treasurer each year. Common examples of unclaimed property include money in forgotten savings and checking accounts, uncashed insurance benefits and payroll checks, lost stock and dividends, abandoned safe deposit box contents, utility refunds or deposits.

Visit the Great Iowa Treasure Hunt at GreatIowaTreasureHunt.gov to begin your search and make your claim today. Keep up with all of our programs on social media by following us on Facebook and Twitter.

Five Tips on Teaching Money to Kids

With teachers, students and parents preparing for back-to-school, it’s a great opportunity to teach children about money, shopping and budgeting.

Learning how to think about money and manage it wisely is an important life skill. In the end, we hope that our children will grow into financially responsible adults, to live within their means, free from anxieties of debts and secure in their future.

Here are some ideas to consider:

Start Early: As soon as kids are old enough to count, they’re old enough to start learning about money basics. For instance, they can count out the four quarters it takes to buy a small piece of candy at the grocery checkout line

Discuss Wants vs. Needs: Teaching kids the value of saving is to help them distinguish between wants and needs. Explain needs by including the basics, such as food, shelter and clothing. Their wants are all the extras. You can show your own budget as an example on how wants should take a back seat to needs.

Set Savings Goals: For children, being told to save without explaining why may seem pointless. Helping them define a savings goal can be a better way to get them motivated. If they know what it is they want to save for, help them break down their goals into manageable bites.

Set a Good Example: If you want your children to become savers, being one yourself can help. Getting your emergency fund in shape, opening a 529 savings account or simply increasing your 401(k) plan contributions are all steps you can take to encourage saving as a family activity.

School Year: There is more to school expenses than clothing and supplies. Help your child look ahead for upcoming expenses, such as dances, class trips and college application fees.

You are receiving this email because [email protected] is signed up to receive Treasurer of the State of Iowa communications.

If you wish to unsubscribe from future Treasurer of the State of Iowa emails, you can always unsubscribe at

[link removed].

Please don't reply to this email.

Copyright 2019 Treasurer of the State of Iowa. All rights reserved.

Message Analysis

- Sender: Office of the Iowa Treasurer

- Political Party: n/a

- Country: United States

- State/Locality: Iowa

- Office: n/a