Email

FS-2025-05: FAQs for modification of sections 25C, 25D, 25E, 30C, 30D, 45L, 45W, AND 179D under Public Law 119-21, 139 Stat. 72 (July 4, 2025), commonly known as the One, Big, Beautiful Bill Act (OBBB).

| From | IRS Newswire <[email protected]> |

| Subject | FS-2025-05: FAQs for modification of sections 25C, 25D, 25E, 30C, 30D, 45L, 45W, AND 179D under Public Law 119-21, 139 Stat. 72 (July 4, 2025), commonly known as the One, Big, Beautiful Bill Act (OBBB). |

| Date | August 21, 2025 8:11 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

Bookmark and Share [ [link removed] ]

a { color:#0073AF !important;} a:hover { color:#004673 !important;} &amp;amp;amp;amp;amp;lt;!-- body { font-family: arial; } p { font-size: 12px; } li { font-size: 12px; } h2 { font-size: 24px; font-style: italic;} --&amp;amp;amp;amp;amp;gt;

IRS.gov Banner

IRS Newswire August 21, 2025

News Essentials

What's Hot [ [link removed] ]

News Releases [ [link removed] ]

IRS - The Basics [ [link removed] ]

IRS Guidance [ [link removed] ]

Media Contacts [ [link removed] ]

Facts & Figures [ [link removed] ]

Around The Nation [ [link removed] ]

e-News Subscriptions [ [link removed] ]

________________________________________________________________________

The Newsroom Topics

Multimedia Center [ [link removed] ]

Noticias en Español [ [link removed] ]

Radio PSAs [ [link removed] ]

Tax Scams [ [link removed] ]

The Tax Gap [ [link removed] ]

Fact Sheets [ [link removed] ]

IRS Tax Tips [ [link removed] ]

Armed Forces [ [link removed] ]

Latest News Home [ [link removed] ]

________________________________________________________________________

IRS Resources

Contact My Local Office [ [link removed] ]

Filing Options [ [link removed] ]

Forms & Instructions [ [link removed] ]

Frequently Asked Questions [ [link removed] ]

News [ [link removed] ]

Taxpayer Advocate [ [link removed] ]

Where to File [ [link removed] ]

IRS Social Media [ [link removed] ]

________________________________________________________________________

Issue Number: FS-2025-05

Inside This Issue

________________________________________________________________________

*FAQs for modification of sections 25C, 25D, 25E, 30C, 30D, 45L, 45W, AND 179D under Public Law 119-21, 139 Stat. 72 (July 4, 2025), commonly known as the One, Big, Beautiful Bill Act (OBBB).*

FS-2025-05, Aug. 21, 2025

This fact sheet provides answers to frequently asked questions (FAQs) related to § 45Z of the Internal Revenue Code.

These FAQs are being issued to provide general information to taxpayers and tax professionals as expeditiously as possible. Accordingly, these FAQs may not address any particular taxpayer’s specific facts and circumstances, and they may be updated or modified upon further review. Because these FAQs have not been published in the Internal Revenue Bulletin, they will not be relied on or used by the IRS to resolve a case. Similarly, if an FAQ turns out to be an inaccurate statement of the law as applied to a particular taxpayer’s case, the law will control the taxpayer’s tax liability. Nonetheless, a taxpayer who reasonably and in good faith relies on these FAQs will not be subject to a penalty that provides a reasonable cause standard for relief, including a negligence penalty or other accuracy-related penalty, to the extent that reliance results in an underpayment of tax. Any later updates or modifications to these FAQs will be dated to enable taxpayers to confirm the date on which any changes to the FAQs were made. Additionally, prior versions of these FAQs will be maintained on IRS.gov to ensure that taxpayers, who may have relied on a prior version, can locate that version if they later need to do so.

More information about reliance is available [ [link removed] ]. These FAQs were announced in IR-2025-86. [ [link removed] ]

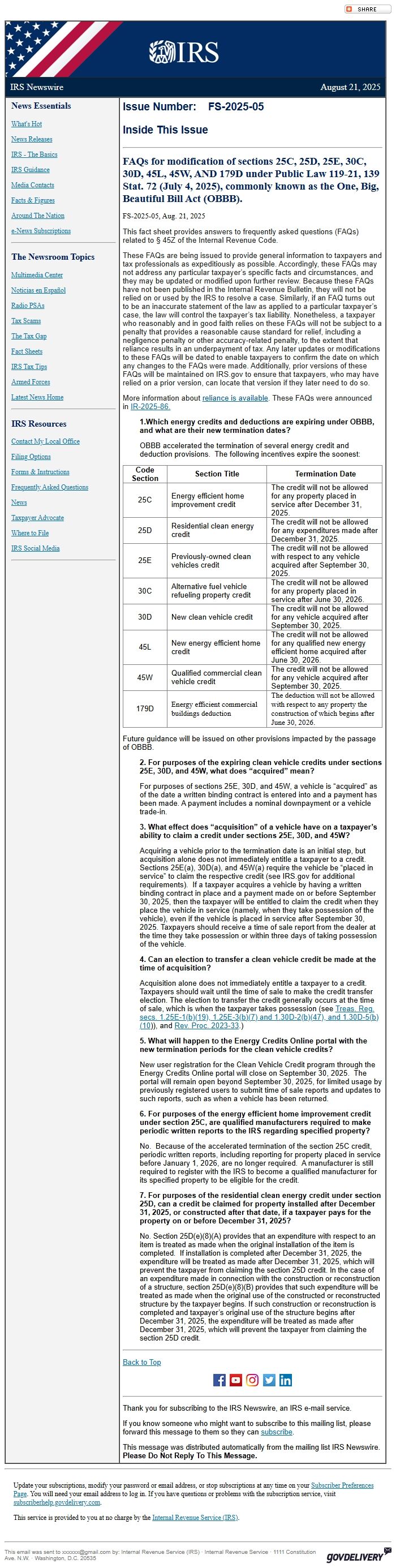

*1.Which energy credits and deductions are expiring under OBBB, and what are their new termination dates?*

OBBB accelerated the termination of several energy credit and deduction provisions. The following incentives expire the soonest:

*Code Section*

*Section Title*

* Termination Date*

25C

Energy efficient home improvement credit

The credit will not be allowed for any property placed in service after December 31, 2025.

25D

Residential clean energy credit

The credit will not be allowed for any expenditures made after December 31, 2025.

25E

Previously-owned clean vehicles credit

The credit will not be allowed with respect to any vehicle acquired after September 30, 2025.

30C

Alternative fuel vehicle refueling property credit

The credit will not be allowed for any property placed in service after June 30, 2026.

30D

New clean vehicle credit

The credit will not be allowed for any vehicle acquired after September 30, 2025.

45L

New energy efficient home credit

The credit will not be allowed for any qualified new energy efficient home acquired after June 30, 2026.

45W

Qualified commercial clean vehicle credit

The credit will not be allowed for any vehicle acquired after September 30, 2025.

179D

Energy efficient commercial buildings deduction

The deduction will not be allowed with respect to any property the construction of which begins after June 30, 2026.

Future guidance will be issued on other provisions impacted by the passage of OBBB.

*2. For purposes of the expiring clean vehicle credits under sections 25E, 30D, and 45W, what does “acquired” mean?*

For purposes of sections 25E, 30D, and 45W, a vehicle is “acquired” as of the date a written binding contract is entered into and a payment has been made. A payment includes a nominal downpayment or a vehicle trade-in.

*3. What effect does “acquisition” of a vehicle have on a taxpayer’s ability to claim a credit under sections 25E, 30D, and 45W? *

Acquiring a vehicle prior to the termination date is an initial step, but acquisition alone does not immediately entitle a taxpayer to a credit. Sections 25E(a), 30D(a), and 45W(a) require the vehicle be “placed in service” to claim the respective credit (see IRS.gov for additional requirements). If a taxpayer acquires a vehicle by having a written binding contract in place and a payment made on or before September 30, 2025, then the taxpayer will be entitled to claim the credit when they place the vehicle in service (namely, when they take possession of the vehicle), even if the vehicle is placed in service after September 30, 2025. Taxpayers should receive a time of sale report from the dealer at the time they take possession or within three days of taking possession of the vehicle.

*4. Can an election to transfer a clean vehicle credit be made at the time of acquisition? *

Acquisition alone does not immediately entitle a taxpayer to a credit. Taxpayers should wait until the time of sale to make the credit transfer election. The election to transfer the credit generally occurs at the time of sale, which is when the taxpayer takes possession (see Treas. Reg. secs. 1.25E-1(b)(19), 1.25E-3(b)(7) and 1.30D-2(b)(47), and 1.30D-5(b)(10 [ [link removed] ])), and Rev. Proc. 2023-33 [ [link removed] ].)

*5. What will happen to the Energy Credits Online portal with the new termination periods for the clean vehicle credits? *

New user registration for the Clean Vehicle Credit program through the Energy Credits Online portal will close on September 30, 2025. The portal will remain open beyond September 30, 2025, for limited usage by previously registered users to submit time of sale reports and updates to such reports, such as when a vehicle has been returned.

*6. For purposes of the energy efficient home improvement credit under section 25C, are qualified manufacturers required to make periodic written reports to the IRS regarding specified property?*

No. Because of the accelerated termination of the section 25C credit, periodic written reports, including reporting for property placed in service before January 1, 2026, are no longer required. A manufacturer is still required to register with the IRS to become a qualified manufacturer for its specified property to be eligible for the credit.

*7. For purposes of the residential clean energy credit under section 25D, can a credit be claimed for property installed after December 31, 2025, or constructed after that date, if a taxpayer pays for the property on or before December 31, 2025?*

No. Section 25D(e)(8)(A) provides that an expenditure with respect to an item is treated as made when the original installation of the item is completed. If installation is completed after December 31, 2025, the expenditure will be treated as made after December 31, 2025, which will prevent the taxpayer from claiming the section 25D credit. In the case of an expenditure made in connection with the construction or reconstruction of a structure, section 25D(e)(8)(B) provides that such expenditure will be treated as made when the original use of the constructed or reconstructed structure by the taxpayer begins. If such construction or reconstruction is completed and taxpayer’s original use of the structure begins after December 31, 2025, the expenditure will be treated as made after December 31, 2025, which will prevent the taxpayer from claiming the section 25D credit.

________________________________________________________________________

Back to Top [ #Fifteenth ]

FaceBook Logo [ [link removed] ] YouTube Logo [ [link removed] ] Instagram Logo [ [link removed] ] Twitter Logo [ [link removed] ] LinkedIn Logo [ [link removed] ]

________________________________________________________________________

Thank you for subscribing to the IRS Newswire, an IRS e-mail service.

If you know someone who might want to subscribe to this mailing list, please forward this message to them so they can subscribe [ [link removed] ].

This message was distributed automatically from the mailing list IRS Newswire. *Please Do Not Reply To This Message.*

________________________________________________________________________

Update your subscriptions, modify your password or email address, or stop subscriptions at any time on your Subscriber Preferences Page [ [link removed] ]. You will need your email address to log in. If you have questions or problems with the subscription service, visit subscriberhelp.govdelivery.com [ [link removed] ].

This service is provided to you at no charge by the Internal Revenue Service (IRS) [ [link removed] ].

body .abe-column-block {min-height: 5px;} ________________________________________________________________________

This email was sent to [email protected] by: Internal Revenue Service (IRS) · Internal Revenue Service · 1111 Constitution Ave. N.W. · Washington, D.C. 20535 GovDelivery logo [ [link removed] ]

body .abe-column-block { min-height: 5px; } table.gd_combo_table img {margin-left:10px; margin-right:10px;} table.gd_combo_table div.govd_image_display img, table.gd_combo_table td.gd_combo_image_cell img {margin-left:0px; margin-right:0px;}

a { color:#0073AF !important;} a:hover { color:#004673 !important;} &amp;amp;amp;amp;amp;lt;!-- body { font-family: arial; } p { font-size: 12px; } li { font-size: 12px; } h2 { font-size: 24px; font-style: italic;} --&amp;amp;amp;amp;amp;gt;

IRS.gov Banner

IRS Newswire August 21, 2025

News Essentials

What's Hot [ [link removed] ]

News Releases [ [link removed] ]

IRS - The Basics [ [link removed] ]

IRS Guidance [ [link removed] ]

Media Contacts [ [link removed] ]

Facts & Figures [ [link removed] ]

Around The Nation [ [link removed] ]

e-News Subscriptions [ [link removed] ]

________________________________________________________________________

The Newsroom Topics

Multimedia Center [ [link removed] ]

Noticias en Español [ [link removed] ]

Radio PSAs [ [link removed] ]

Tax Scams [ [link removed] ]

The Tax Gap [ [link removed] ]

Fact Sheets [ [link removed] ]

IRS Tax Tips [ [link removed] ]

Armed Forces [ [link removed] ]

Latest News Home [ [link removed] ]

________________________________________________________________________

IRS Resources

Contact My Local Office [ [link removed] ]

Filing Options [ [link removed] ]

Forms & Instructions [ [link removed] ]

Frequently Asked Questions [ [link removed] ]

News [ [link removed] ]

Taxpayer Advocate [ [link removed] ]

Where to File [ [link removed] ]

IRS Social Media [ [link removed] ]

________________________________________________________________________

Issue Number: FS-2025-05

Inside This Issue

________________________________________________________________________

*FAQs for modification of sections 25C, 25D, 25E, 30C, 30D, 45L, 45W, AND 179D under Public Law 119-21, 139 Stat. 72 (July 4, 2025), commonly known as the One, Big, Beautiful Bill Act (OBBB).*

FS-2025-05, Aug. 21, 2025

This fact sheet provides answers to frequently asked questions (FAQs) related to § 45Z of the Internal Revenue Code.

These FAQs are being issued to provide general information to taxpayers and tax professionals as expeditiously as possible. Accordingly, these FAQs may not address any particular taxpayer’s specific facts and circumstances, and they may be updated or modified upon further review. Because these FAQs have not been published in the Internal Revenue Bulletin, they will not be relied on or used by the IRS to resolve a case. Similarly, if an FAQ turns out to be an inaccurate statement of the law as applied to a particular taxpayer’s case, the law will control the taxpayer’s tax liability. Nonetheless, a taxpayer who reasonably and in good faith relies on these FAQs will not be subject to a penalty that provides a reasonable cause standard for relief, including a negligence penalty or other accuracy-related penalty, to the extent that reliance results in an underpayment of tax. Any later updates or modifications to these FAQs will be dated to enable taxpayers to confirm the date on which any changes to the FAQs were made. Additionally, prior versions of these FAQs will be maintained on IRS.gov to ensure that taxpayers, who may have relied on a prior version, can locate that version if they later need to do so.

More information about reliance is available [ [link removed] ]. These FAQs were announced in IR-2025-86. [ [link removed] ]

*1.Which energy credits and deductions are expiring under OBBB, and what are their new termination dates?*

OBBB accelerated the termination of several energy credit and deduction provisions. The following incentives expire the soonest:

*Code Section*

*Section Title*

* Termination Date*

25C

Energy efficient home improvement credit

The credit will not be allowed for any property placed in service after December 31, 2025.

25D

Residential clean energy credit

The credit will not be allowed for any expenditures made after December 31, 2025.

25E

Previously-owned clean vehicles credit

The credit will not be allowed with respect to any vehicle acquired after September 30, 2025.

30C

Alternative fuel vehicle refueling property credit

The credit will not be allowed for any property placed in service after June 30, 2026.

30D

New clean vehicle credit

The credit will not be allowed for any vehicle acquired after September 30, 2025.

45L

New energy efficient home credit

The credit will not be allowed for any qualified new energy efficient home acquired after June 30, 2026.

45W

Qualified commercial clean vehicle credit

The credit will not be allowed for any vehicle acquired after September 30, 2025.

179D

Energy efficient commercial buildings deduction

The deduction will not be allowed with respect to any property the construction of which begins after June 30, 2026.

Future guidance will be issued on other provisions impacted by the passage of OBBB.

*2. For purposes of the expiring clean vehicle credits under sections 25E, 30D, and 45W, what does “acquired” mean?*

For purposes of sections 25E, 30D, and 45W, a vehicle is “acquired” as of the date a written binding contract is entered into and a payment has been made. A payment includes a nominal downpayment or a vehicle trade-in.

*3. What effect does “acquisition” of a vehicle have on a taxpayer’s ability to claim a credit under sections 25E, 30D, and 45W? *

Acquiring a vehicle prior to the termination date is an initial step, but acquisition alone does not immediately entitle a taxpayer to a credit. Sections 25E(a), 30D(a), and 45W(a) require the vehicle be “placed in service” to claim the respective credit (see IRS.gov for additional requirements). If a taxpayer acquires a vehicle by having a written binding contract in place and a payment made on or before September 30, 2025, then the taxpayer will be entitled to claim the credit when they place the vehicle in service (namely, when they take possession of the vehicle), even if the vehicle is placed in service after September 30, 2025. Taxpayers should receive a time of sale report from the dealer at the time they take possession or within three days of taking possession of the vehicle.

*4. Can an election to transfer a clean vehicle credit be made at the time of acquisition? *

Acquisition alone does not immediately entitle a taxpayer to a credit. Taxpayers should wait until the time of sale to make the credit transfer election. The election to transfer the credit generally occurs at the time of sale, which is when the taxpayer takes possession (see Treas. Reg. secs. 1.25E-1(b)(19), 1.25E-3(b)(7) and 1.30D-2(b)(47), and 1.30D-5(b)(10 [ [link removed] ])), and Rev. Proc. 2023-33 [ [link removed] ].)

*5. What will happen to the Energy Credits Online portal with the new termination periods for the clean vehicle credits? *

New user registration for the Clean Vehicle Credit program through the Energy Credits Online portal will close on September 30, 2025. The portal will remain open beyond September 30, 2025, for limited usage by previously registered users to submit time of sale reports and updates to such reports, such as when a vehicle has been returned.

*6. For purposes of the energy efficient home improvement credit under section 25C, are qualified manufacturers required to make periodic written reports to the IRS regarding specified property?*

No. Because of the accelerated termination of the section 25C credit, periodic written reports, including reporting for property placed in service before January 1, 2026, are no longer required. A manufacturer is still required to register with the IRS to become a qualified manufacturer for its specified property to be eligible for the credit.

*7. For purposes of the residential clean energy credit under section 25D, can a credit be claimed for property installed after December 31, 2025, or constructed after that date, if a taxpayer pays for the property on or before December 31, 2025?*

No. Section 25D(e)(8)(A) provides that an expenditure with respect to an item is treated as made when the original installation of the item is completed. If installation is completed after December 31, 2025, the expenditure will be treated as made after December 31, 2025, which will prevent the taxpayer from claiming the section 25D credit. In the case of an expenditure made in connection with the construction or reconstruction of a structure, section 25D(e)(8)(B) provides that such expenditure will be treated as made when the original use of the constructed or reconstructed structure by the taxpayer begins. If such construction or reconstruction is completed and taxpayer’s original use of the structure begins after December 31, 2025, the expenditure will be treated as made after December 31, 2025, which will prevent the taxpayer from claiming the section 25D credit.

________________________________________________________________________

Back to Top [ #Fifteenth ]

FaceBook Logo [ [link removed] ] YouTube Logo [ [link removed] ] Instagram Logo [ [link removed] ] Twitter Logo [ [link removed] ] LinkedIn Logo [ [link removed] ]

________________________________________________________________________

Thank you for subscribing to the IRS Newswire, an IRS e-mail service.

If you know someone who might want to subscribe to this mailing list, please forward this message to them so they can subscribe [ [link removed] ].

This message was distributed automatically from the mailing list IRS Newswire. *Please Do Not Reply To This Message.*

________________________________________________________________________

Update your subscriptions, modify your password or email address, or stop subscriptions at any time on your Subscriber Preferences Page [ [link removed] ]. You will need your email address to log in. If you have questions or problems with the subscription service, visit subscriberhelp.govdelivery.com [ [link removed] ].

This service is provided to you at no charge by the Internal Revenue Service (IRS) [ [link removed] ].

body .abe-column-block {min-height: 5px;} ________________________________________________________________________

This email was sent to [email protected] by: Internal Revenue Service (IRS) · Internal Revenue Service · 1111 Constitution Ave. N.W. · Washington, D.C. 20535 GovDelivery logo [ [link removed] ]

body .abe-column-block { min-height: 5px; } table.gd_combo_table img {margin-left:10px; margin-right:10px;} table.gd_combo_table div.govd_image_display img, table.gd_combo_table td.gd_combo_image_cell img {margin-left:0px; margin-right:0px;}

Message Analysis

- Sender: Internal Revenue Service

- Political Party: n/a

- Country: United States

- State/Locality: n/a

- Office: n/a

-

Email Providers:

- govDelivery