Email

AI Skills Help Pay Bills

| From | AEI DataPoints <[email protected]> |

| Subject | AI Skills Help Pay Bills |

| Date | August 21, 2025 11:01 AM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

Expert analysis made easy. Breaking down the news with data, charts, and maps.

Edited by: Brady Africk and Carter Hutchinson

Happy Thursday! In today’s newsletter, we examine the growth of AI jobs outside of the tech sector, potential changes to the IRS income tax calculation, and the declining productivity of the American construction sector.

Don’t forget––subscribe <[link removed]> and send DataPoints to a friend!

For inquiries, please email [email protected] <[link removed]>.

1. More Jobs Want AI Skills

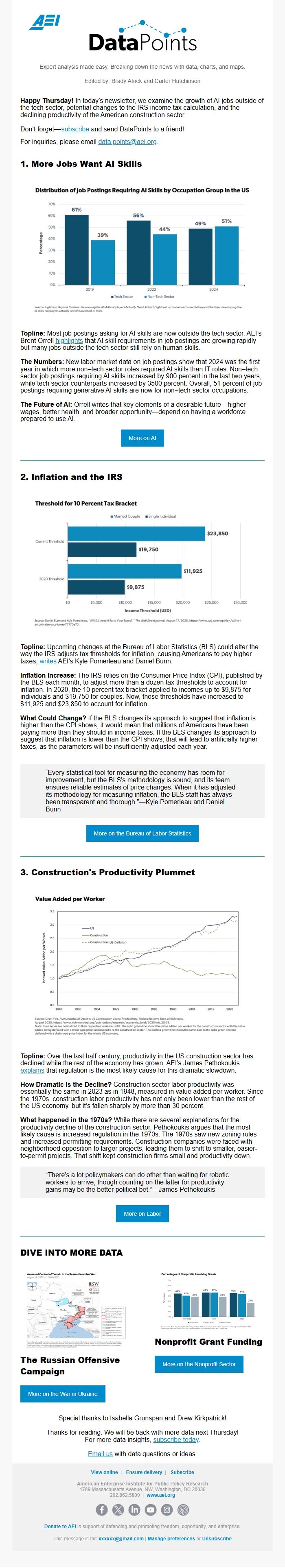

Topline: Most job postings asking for AI skills are now outside the tech sector. AEI’s Brent Orrell highlights <[link removed]> that AI skill requirements in job postings are growing rapidly but many jobs outside the tech sector still rely on human skills.

The Numbers: New labor market data on job postings show that 2024 was the first year in which more non–tech sector roles required AI skills than IT roles. Non–tech sector job postings requiring AI skills increased by 900 percent in the last two years, while tech sector counterparts increased by 3500 percent. Overall, 51 percent of job postings requiring generative AI skills are now for non–tech sector occupations.

The Future of AI: Orrell writes that key elements of a desirable future—higher wages, better health, and broader opportunity—depend on having a workforce prepared to use AI.

2. Inflation and the IRS

Topline: Upcoming changes at the Bureau of Labor Statistics (BLS) could alter the way the IRS adjusts tax thresholds for inflation, causing Americans to pay higher taxes, writes <[link removed]> AEI’s Kyle Pomerleau and Daniel Bunn.

Inflation Increase: The IRS relies on the Consumer Price Index (CPI), published by the BLS each month, to adjust more than a dozen tax thresholds to account for inflation. In 2020, the 10 percent tax bracket applied to incomes up to $9,875 for individuals and $19,750 for couples. Now, those thresholds have increased to $11,925 and $23,850 to account for inflation.

What Could Change? If the BLS changes its approach to suggest that inflation is higher than the CPI shows, it would mean that millions of Americans have been paying more than they should in income taxes. If the BLS changes its approach to suggest that inflation is lower than the CPI shows, that will lead to artificially higher taxes, as the parameters will be insufficiently adjusted each year.

“Every statistical tool for measuring the economy has room for improvement, but the BLS’s methodology is sound, and its team ensures reliable estimates of price changes. When it has adjusted its methodology for measuring inflation, the BLS staff has always been transparent and thorough.”—Kyle Pomerleau and Daniel Bunn

3. Construction's Productivity Plummet

Topline: Over the last half-century, productivity in the US construction sector has declined while the rest of the economy has grown. AEI’s James Pethokoukis explains <[link removed]> that regulation is the most likely cause for this dramatic slowdown.

How Dramatic is the Decline? Construction sector labor productivity was essentially the same in 2023 as in 1948, measured in value added per worker. Since the 1970s, construction labor productivity has not only been lower than the rest of the US economy, but it’s fallen sharply by more than 30 percent.

What happened in the 1970s? While there are several explanations for the productivity decline of the construction sector, Pethokoukis argues that the most likely cause is increased regulation in the 1970s. The 1970s saw new zoning rules and increased permitting requirements. Construction companies were faced with neighborhood opposition to larger projects, leading them to shift to smaller, easier-to-permit projects. That shift kept construction firms small and productivity down.

“There’s a lot policymakers can do other than waiting for robotic workers to arrive, though counting on the

latter for productivity gains may be the better political bet.”—James Pethokoukis

DIVE INTO MORE DATA

The Russian Offensive Campaign <[link removed]>

Nonprofit Grant Funding <[link removed]>

Special thanks to Isabella Grunspan and Drew Kirkpatrick!

Thanks for reading. We will be back with more data next Thursday!

For more data insights, subscribe today <[link removed]>.

Email us <[link removed]> with data questions or ideas.

View online <[[[link removed]]]> | Ensure delivery <[link removed]> | Subscribe <[link removed]>

American Enterprise Institute for Public Policy Research

1789 Massachusetts Avenue, NW, Washington, DC 20036

202.862.5800 | www.aei.org <[link removed]>

<[link removed]> <[link removed]> <[link removed]> <[link removed]> <[link removed]>

<[link removed]> Donate to AEI <[link removed]> in support of defending and promoting freedom, opportunity, and enterprise.

This message is for: [email protected] <[email protected]> | Manage preferences <[link removed]> or Unsubscribe <[link removed]>

<!-- This is a comment -->

Edited by: Brady Africk and Carter Hutchinson

Happy Thursday! In today’s newsletter, we examine the growth of AI jobs outside of the tech sector, potential changes to the IRS income tax calculation, and the declining productivity of the American construction sector.

Don’t forget––subscribe <[link removed]> and send DataPoints to a friend!

For inquiries, please email [email protected] <[link removed]>.

1. More Jobs Want AI Skills

Topline: Most job postings asking for AI skills are now outside the tech sector. AEI’s Brent Orrell highlights <[link removed]> that AI skill requirements in job postings are growing rapidly but many jobs outside the tech sector still rely on human skills.

The Numbers: New labor market data on job postings show that 2024 was the first year in which more non–tech sector roles required AI skills than IT roles. Non–tech sector job postings requiring AI skills increased by 900 percent in the last two years, while tech sector counterparts increased by 3500 percent. Overall, 51 percent of job postings requiring generative AI skills are now for non–tech sector occupations.

The Future of AI: Orrell writes that key elements of a desirable future—higher wages, better health, and broader opportunity—depend on having a workforce prepared to use AI.

2. Inflation and the IRS

Topline: Upcoming changes at the Bureau of Labor Statistics (BLS) could alter the way the IRS adjusts tax thresholds for inflation, causing Americans to pay higher taxes, writes <[link removed]> AEI’s Kyle Pomerleau and Daniel Bunn.

Inflation Increase: The IRS relies on the Consumer Price Index (CPI), published by the BLS each month, to adjust more than a dozen tax thresholds to account for inflation. In 2020, the 10 percent tax bracket applied to incomes up to $9,875 for individuals and $19,750 for couples. Now, those thresholds have increased to $11,925 and $23,850 to account for inflation.

What Could Change? If the BLS changes its approach to suggest that inflation is higher than the CPI shows, it would mean that millions of Americans have been paying more than they should in income taxes. If the BLS changes its approach to suggest that inflation is lower than the CPI shows, that will lead to artificially higher taxes, as the parameters will be insufficiently adjusted each year.

“Every statistical tool for measuring the economy has room for improvement, but the BLS’s methodology is sound, and its team ensures reliable estimates of price changes. When it has adjusted its methodology for measuring inflation, the BLS staff has always been transparent and thorough.”—Kyle Pomerleau and Daniel Bunn

3. Construction's Productivity Plummet

Topline: Over the last half-century, productivity in the US construction sector has declined while the rest of the economy has grown. AEI’s James Pethokoukis explains <[link removed]> that regulation is the most likely cause for this dramatic slowdown.

How Dramatic is the Decline? Construction sector labor productivity was essentially the same in 2023 as in 1948, measured in value added per worker. Since the 1970s, construction labor productivity has not only been lower than the rest of the US economy, but it’s fallen sharply by more than 30 percent.

What happened in the 1970s? While there are several explanations for the productivity decline of the construction sector, Pethokoukis argues that the most likely cause is increased regulation in the 1970s. The 1970s saw new zoning rules and increased permitting requirements. Construction companies were faced with neighborhood opposition to larger projects, leading them to shift to smaller, easier-to-permit projects. That shift kept construction firms small and productivity down.

“There’s a lot policymakers can do other than waiting for robotic workers to arrive, though counting on the

latter for productivity gains may be the better political bet.”—James Pethokoukis

DIVE INTO MORE DATA

The Russian Offensive Campaign <[link removed]>

Nonprofit Grant Funding <[link removed]>

Special thanks to Isabella Grunspan and Drew Kirkpatrick!

Thanks for reading. We will be back with more data next Thursday!

For more data insights, subscribe today <[link removed]>.

Email us <[link removed]> with data questions or ideas.

View online <[[[link removed]]]> | Ensure delivery <[link removed]> | Subscribe <[link removed]>

American Enterprise Institute for Public Policy Research

1789 Massachusetts Avenue, NW, Washington, DC 20036

202.862.5800 | www.aei.org <[link removed]>

<[link removed]> <[link removed]> <[link removed]> <[link removed]> <[link removed]>

<[link removed]> Donate to AEI <[link removed]> in support of defending and promoting freedom, opportunity, and enterprise.

This message is for: [email protected] <[email protected]> | Manage preferences <[link removed]> or Unsubscribe <[link removed]>

<!-- This is a comment -->

Message Analysis

- Sender: n/a

- Political Party: n/a

- Country: n/a

- State/Locality: n/a

- Office: n/a

-

Email Providers:

- Marketo