| From | Fraser Institute <[email protected]> |

| Subject | Ontario's finances, and Alberta's per-person spending |

| Date | August 9, 2025 5:00 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

Having trouble viewing? Try the web version [link removed] of this email. Latest Research Despite renewed promises of budget balance, Queens Park has a track record of missing fiscal targets resulting in mounting debt [[link removed]]

Hold the Celebration on Ontario’s Finances (Again!) is a new study that shows while the Ontario government now forecasts it will finally balance the province’s operating budget by 2027, given the current government’s history of missing its own fiscal targets, it is questionable whether this one will be achieved. In fact, the government has presented three different planned dates for eliminating its deficit in the last three budgets.

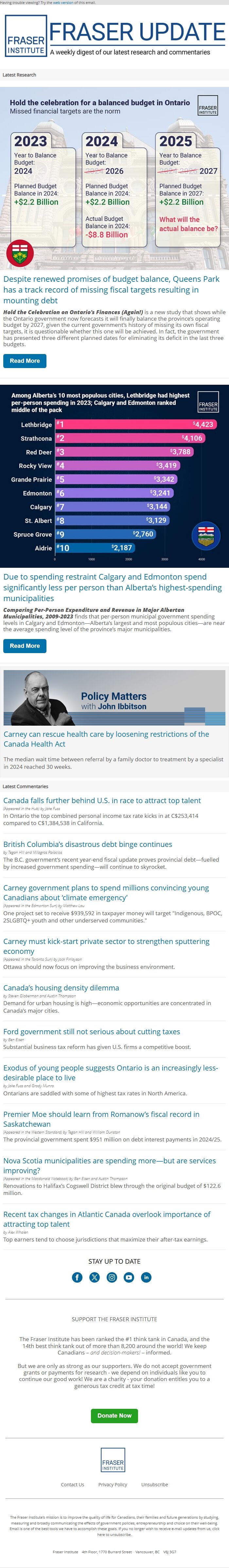

Read More [[link removed]] Due to spending restraint Calgary and Edmonton spend significantly less per person than Alberta’s highest-spending municipalities [[link removed]]

Comparing Per-Person Expenditure and Revenue in Major Albertan Municipalities, 2009-2023 finds that per-person municipal government spending levels in Calgary and Edmonton—Alberta’s largest and most populous cities—are near the average spending level of the province’s major municipalities.

Read More [[link removed]] Carney can rescue health care by loosening restrictions of the Canada Health Act [[link removed]]

The median wait time between referral by a family doctor to treatment by a specialist in 2024 reached 30 weeks.

Latest Commentaries Canada falls further behind U.S. in race to attract top talent [[link removed]] (Appeared in the Hub) by Jake Fuss

In Ontario the top combined personal income tax rate kicks in at C$253,414 compared to C$1,384,538 in California.

British Columbia’s disastrous debt binge continues [[link removed]] by Tegan Hill and Milagros Palacios

The B.C. government’s recent year-end fiscal update proves provincial debt—fuelled by increased government spending—will continue to skyrocket.

Carney government plans to spend millions convincing young Canadians about ‘climate emergency’ [[link removed]] (Appeared in the Edmonton Sun) by Matthew Lau

One project set to receive $939,592 in taxpayer money will target "Indigenous, BPOC, 2SLGBTQ+ youth and other underserved communities."

Carney must kick-start private sector to strengthen sputtering economy [[link removed]] (Appeared in the Toronto Sun) by Jock Finlayson

Ottawa should now focus on improving the business environment.

Canada’s housing density dilemma [[link removed]] by Steven Globerman and Austin Thompson

Demand for urban housing is high—economic opportunities are concentrated in Canada’s major cities.

Ford government still not serious about cutting taxes [[link removed]] by Ben Eisen

Substantial business tax reform has given U.S. firms a competitive boost.

Exodus of young people suggests Ontario is an increasingly less-desirable place to live [[link removed]] by Jake Fuss and Grady Munro

Ontarians are saddled with some of highest tax rates in North America.

Premier Moe should learn from Romanow’s fiscal record in Saskatchewan [[link removed]] (Appeared in the Western Standard) by Tegan Hill and William Dunstan

The provincial government spent $951 million on debt interest payments in 2024/25.

Nova Scotia municipalities are spending more—but are services improving? [[link removed]] (Appeared in the Macdonald Notebook) by Ben Eisen and Austin Thompson

Renovations to Halifax’s Cogswell District blew through the original budget of $122.6 million.

Recent tax changes in Atlantic Canada overlook importance of attracting top talent [[link removed]] by Alex Whalen

Top earners tend to choose jurisdictions that maximize their after-tax earnings.

STAY UP TO DATE

SUPPORT THE FRASER INSTITUTE

The Fraser Institute has been ranked the #1 think tank in Canada, and the 14th best think tank out of more than 8,200 around the world! We keep Canadians – and decision-makers! – informed.

But we are only as strong as our supporters. We do not accept government grants or payments for research - we depend on individuals like you to continue our good work! We are a charity - your donation entitles you to a generous tax credit at tax time!

Donate Now [[link removed][campaignid]]

Contact Us [[link removed]] Privacy Policy [[link removed]] Unsubscribe [link removed] The Fraser Institute's mission is to improve the quality of life for Canadians, their families and future generations by studying, measuring and broadly communicating the effects of government policies, entrepreneurship and choice on their well-being. Email is one of the best tools we have to accomplish these goals. If you no longer wish to receive e-mail updates from us, click here to unsubscribe [link removed].

Fraser Institute 4th Floor, 1770 Burrard Street Vancouver, BC V6J 3G7

Hold the Celebration on Ontario’s Finances (Again!) is a new study that shows while the Ontario government now forecasts it will finally balance the province’s operating budget by 2027, given the current government’s history of missing its own fiscal targets, it is questionable whether this one will be achieved. In fact, the government has presented three different planned dates for eliminating its deficit in the last three budgets.

Read More [[link removed]] Due to spending restraint Calgary and Edmonton spend significantly less per person than Alberta’s highest-spending municipalities [[link removed]]

Comparing Per-Person Expenditure and Revenue in Major Albertan Municipalities, 2009-2023 finds that per-person municipal government spending levels in Calgary and Edmonton—Alberta’s largest and most populous cities—are near the average spending level of the province’s major municipalities.

Read More [[link removed]] Carney can rescue health care by loosening restrictions of the Canada Health Act [[link removed]]

The median wait time between referral by a family doctor to treatment by a specialist in 2024 reached 30 weeks.

Latest Commentaries Canada falls further behind U.S. in race to attract top talent [[link removed]] (Appeared in the Hub) by Jake Fuss

In Ontario the top combined personal income tax rate kicks in at C$253,414 compared to C$1,384,538 in California.

British Columbia’s disastrous debt binge continues [[link removed]] by Tegan Hill and Milagros Palacios

The B.C. government’s recent year-end fiscal update proves provincial debt—fuelled by increased government spending—will continue to skyrocket.

Carney government plans to spend millions convincing young Canadians about ‘climate emergency’ [[link removed]] (Appeared in the Edmonton Sun) by Matthew Lau

One project set to receive $939,592 in taxpayer money will target "Indigenous, BPOC, 2SLGBTQ+ youth and other underserved communities."

Carney must kick-start private sector to strengthen sputtering economy [[link removed]] (Appeared in the Toronto Sun) by Jock Finlayson

Ottawa should now focus on improving the business environment.

Canada’s housing density dilemma [[link removed]] by Steven Globerman and Austin Thompson

Demand for urban housing is high—economic opportunities are concentrated in Canada’s major cities.

Ford government still not serious about cutting taxes [[link removed]] by Ben Eisen

Substantial business tax reform has given U.S. firms a competitive boost.

Exodus of young people suggests Ontario is an increasingly less-desirable place to live [[link removed]] by Jake Fuss and Grady Munro

Ontarians are saddled with some of highest tax rates in North America.

Premier Moe should learn from Romanow’s fiscal record in Saskatchewan [[link removed]] (Appeared in the Western Standard) by Tegan Hill and William Dunstan

The provincial government spent $951 million on debt interest payments in 2024/25.

Nova Scotia municipalities are spending more—but are services improving? [[link removed]] (Appeared in the Macdonald Notebook) by Ben Eisen and Austin Thompson

Renovations to Halifax’s Cogswell District blew through the original budget of $122.6 million.

Recent tax changes in Atlantic Canada overlook importance of attracting top talent [[link removed]] by Alex Whalen

Top earners tend to choose jurisdictions that maximize their after-tax earnings.

STAY UP TO DATE

SUPPORT THE FRASER INSTITUTE

The Fraser Institute has been ranked the #1 think tank in Canada, and the 14th best think tank out of more than 8,200 around the world! We keep Canadians – and decision-makers! – informed.

But we are only as strong as our supporters. We do not accept government grants or payments for research - we depend on individuals like you to continue our good work! We are a charity - your donation entitles you to a generous tax credit at tax time!

Donate Now [[link removed][campaignid]]

Contact Us [[link removed]] Privacy Policy [[link removed]] Unsubscribe [link removed] The Fraser Institute's mission is to improve the quality of life for Canadians, their families and future generations by studying, measuring and broadly communicating the effects of government policies, entrepreneurship and choice on their well-being. Email is one of the best tools we have to accomplish these goals. If you no longer wish to receive e-mail updates from us, click here to unsubscribe [link removed].

Fraser Institute 4th Floor, 1770 Burrard Street Vancouver, BC V6J 3G7

Message Analysis

- Sender: Fraser Institute

- Political Party: n/a

- Country: Canada

- State/Locality: n/a

- Office: n/a

-

Email Providers:

- Campaign Monitor