| From | BearMarket.com <[email protected]> |

| Subject | Why Oil Prices Fell 5.9% Today |

| Date | June 25, 2020 11:11 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

Bear MarketDaily Bear Market News

#

Why Oil Prices Fell 5.9% Today

By Jason Rivera,

Bear Market

Thursday, June 25

Oil prices are falling again on increasing fear due to the recent large spike in new coronavirus cases worldwide.

From June 11th to today coronavirus cases jumped 27% from 7.4 million to 9.4 million as of this writing… And they’re showing no signs of slowing down.

Florida, California, and Texas are all seeing almost daily records of new cases in those states.

27 states nationwide ([link removed]) are now seeing large daily increases in new virus cases.

And new cases of the virus in Brazil, India, Russia, and Mexico are still exploding.

This is leading to renewed fears of potential state and country closures like what we saw from mid-March to early May.

If these happen again it means much lower demand for oil again. The fear of this happening again is why prices of crude oil fell again today.

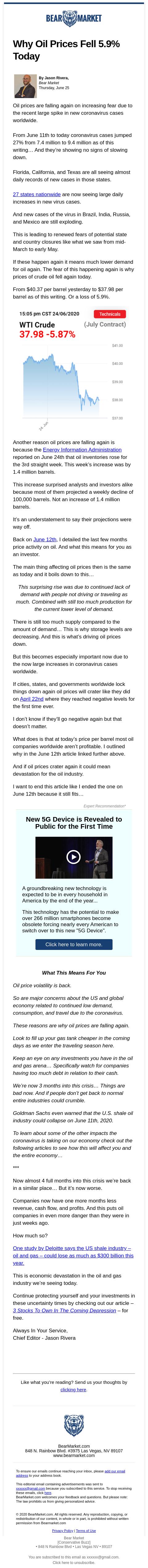

From $40.37 per barrel yesterday to $37.98 per barrel as of this writing. Or a loss of 5.9%.

Another reason oil prices are falling again is because the Energy Information Administration ([link removed]) reported on June 24th that oil inventories rose for the 3rd straight week. This week’s increase was by 1.4 million barrels.

This increase surprised analysts and investors alike because most of them projected a weekly decline of 100,000 barrels. Not an increase of 1.4 million barrels.

It’s an understatement to say their projections were way off.

Back on June 12th ([link removed]), I detailed the last few months price activity on oil. And what this means for you as an investor.

The main thing affecting oil prices then is the same as today and it boils down to this…

This surprising rise was due to continued lack of demand with people not driving or traveling as much. Combined with still too much production for the current lower level of demand.

There is still too much supply compared to the amount of demand… This is why storage levels are decreasing. And this is what’s driving oil prices down.

But this becomes especially important now due to the now large increases in coronavirus cases worldwide.

If cities, states, and governments worldwide lock things down again oil prices will crater like they did on April 22nd ([link removed]) where they reached negative levels for the first time ever.

I don’t know if they’ll go negative again but that doesn’t matter.

What does is that at today’s price per barrel most oil companies worldwide aren’t profitable. I outlined why in the June 12th article linked further above.

And if oil prices crater again it could mean devastation for the oil industry.

I want to end this article like I ended the one on June 12th because it still fits…

Expert Recommendation*

New 5G Device is Revealed to Public for the First Time ([link removed])

[link removed] ([link removed])

A groundbreaking new technology is expected to be in every household in America by the end of the year...

This technology has the potential to make over 266 million smartphones become obsolete forcing nearly every American to switch over to this new "5G Device".

Click here to learn more. ([link removed])

--

What This Means For You

Oil price volatility is back.

So are major concerns about the US and global economy related to continued low demand, consumption, and travel due to the coronavirus.

These reasons are why oil prices are falling again.

Look to fill up your gas tank cheaper in the coming days as we enter the traveling season here.

Keep an eye on any investments you have in the oil and gas arena… Specifically watch for companies having too much debt in relation to their cash.

We’re now 3 months into this crisis… Things are bad now. And if people don’t get back to normal entire industries could crumble.

Goldman Sachs even warned that the U.S. shale oil industry could collapse on June 11th, 2020.

To learn about some of the other impacts the coronavirus is taking on our economy check out the following articles to see how this will affect you and the entire economy…

***

Now almost 4 full months into this crisis we’re back in a similar place… But it’s now worse.

Companies now have one more months less revenue, cash flow, and profits. And this puts oil companies in even more danger than they were in just weeks ago.

How much so?

One study by Deloitte says the US shale industry – oil and gas – could lose as much as $300 billion this year. ([link removed])

This is economic devastation in the oil and gas industry we’re seeing today.

Continue protecting yourself and your investments in these uncertainty times by checking out our article – 3 Stocks To Own In The Coming Depression ([link removed]) – for free.

Always In Your Service,

Chief Editor - Jason Rivera

Like what you’re reading? Send us your thoughts by clicking here (mailto:[email protected]).

#

BearMarket.com

848 N. Rainbow Blvd. #3975 Las Vegas, NV 89107

www.bearmarket.com

To ensure our emails continue reaching your inbox, please add our email address (mailto:[email protected]) to your address book.

This editorial email containing advertisements was sent to [email protected] because you subscribed to this service. To stop receiving these emails, click here ([link removed]).

BearMarket.com welcomes your feedback and questions. But please note: The law prohibits us from giving personalized advice.

© 2020 BearMarket.com. All rights reserved. Any reproduction, copying, or redistribution of our content, in whole or in part, is prohibited without written permission from Bearmarket.com

Privacy Policy ([link removed]) | Terms of Use ([link removed])

Bear Market

[Conservative Buzz]

• 848 N Rainbow Blvd • Las Vegas NV • 89107

You are subscribed to this email as [email protected]. Click here to unsubscribe [link removed].

#

Why Oil Prices Fell 5.9% Today

By Jason Rivera,

Bear Market

Thursday, June 25

Oil prices are falling again on increasing fear due to the recent large spike in new coronavirus cases worldwide.

From June 11th to today coronavirus cases jumped 27% from 7.4 million to 9.4 million as of this writing… And they’re showing no signs of slowing down.

Florida, California, and Texas are all seeing almost daily records of new cases in those states.

27 states nationwide ([link removed]) are now seeing large daily increases in new virus cases.

And new cases of the virus in Brazil, India, Russia, and Mexico are still exploding.

This is leading to renewed fears of potential state and country closures like what we saw from mid-March to early May.

If these happen again it means much lower demand for oil again. The fear of this happening again is why prices of crude oil fell again today.

From $40.37 per barrel yesterday to $37.98 per barrel as of this writing. Or a loss of 5.9%.

Another reason oil prices are falling again is because the Energy Information Administration ([link removed]) reported on June 24th that oil inventories rose for the 3rd straight week. This week’s increase was by 1.4 million barrels.

This increase surprised analysts and investors alike because most of them projected a weekly decline of 100,000 barrels. Not an increase of 1.4 million barrels.

It’s an understatement to say their projections were way off.

Back on June 12th ([link removed]), I detailed the last few months price activity on oil. And what this means for you as an investor.

The main thing affecting oil prices then is the same as today and it boils down to this…

This surprising rise was due to continued lack of demand with people not driving or traveling as much. Combined with still too much production for the current lower level of demand.

There is still too much supply compared to the amount of demand… This is why storage levels are decreasing. And this is what’s driving oil prices down.

But this becomes especially important now due to the now large increases in coronavirus cases worldwide.

If cities, states, and governments worldwide lock things down again oil prices will crater like they did on April 22nd ([link removed]) where they reached negative levels for the first time ever.

I don’t know if they’ll go negative again but that doesn’t matter.

What does is that at today’s price per barrel most oil companies worldwide aren’t profitable. I outlined why in the June 12th article linked further above.

And if oil prices crater again it could mean devastation for the oil industry.

I want to end this article like I ended the one on June 12th because it still fits…

Expert Recommendation*

New 5G Device is Revealed to Public for the First Time ([link removed])

[link removed] ([link removed])

A groundbreaking new technology is expected to be in every household in America by the end of the year...

This technology has the potential to make over 266 million smartphones become obsolete forcing nearly every American to switch over to this new "5G Device".

Click here to learn more. ([link removed])

--

What This Means For You

Oil price volatility is back.

So are major concerns about the US and global economy related to continued low demand, consumption, and travel due to the coronavirus.

These reasons are why oil prices are falling again.

Look to fill up your gas tank cheaper in the coming days as we enter the traveling season here.

Keep an eye on any investments you have in the oil and gas arena… Specifically watch for companies having too much debt in relation to their cash.

We’re now 3 months into this crisis… Things are bad now. And if people don’t get back to normal entire industries could crumble.

Goldman Sachs even warned that the U.S. shale oil industry could collapse on June 11th, 2020.

To learn about some of the other impacts the coronavirus is taking on our economy check out the following articles to see how this will affect you and the entire economy…

***

Now almost 4 full months into this crisis we’re back in a similar place… But it’s now worse.

Companies now have one more months less revenue, cash flow, and profits. And this puts oil companies in even more danger than they were in just weeks ago.

How much so?

One study by Deloitte says the US shale industry – oil and gas – could lose as much as $300 billion this year. ([link removed])

This is economic devastation in the oil and gas industry we’re seeing today.

Continue protecting yourself and your investments in these uncertainty times by checking out our article – 3 Stocks To Own In The Coming Depression ([link removed]) – for free.

Always In Your Service,

Chief Editor - Jason Rivera

Like what you’re reading? Send us your thoughts by clicking here (mailto:[email protected]).

#

BearMarket.com

848 N. Rainbow Blvd. #3975 Las Vegas, NV 89107

www.bearmarket.com

To ensure our emails continue reaching your inbox, please add our email address (mailto:[email protected]) to your address book.

This editorial email containing advertisements was sent to [email protected] because you subscribed to this service. To stop receiving these emails, click here ([link removed]).

BearMarket.com welcomes your feedback and questions. But please note: The law prohibits us from giving personalized advice.

© 2020 BearMarket.com. All rights reserved. Any reproduction, copying, or redistribution of our content, in whole or in part, is prohibited without written permission from Bearmarket.com

Privacy Policy ([link removed]) | Terms of Use ([link removed])

Bear Market

[Conservative Buzz]

• 848 N Rainbow Blvd • Las Vegas NV • 89107

You are subscribed to this email as [email protected]. Click here to unsubscribe [link removed].

Message Analysis

- Sender: Conservative Buzz

- Political Party: n/a

- Country: United States

- State/Locality: n/a

- Office: n/a

-

Email Providers:

- Campaigner

- MessageGears