Email

More Questions from Gold & Silver Stackers...

| From | Money Metals Exchange <[email protected]> |

| Subject | More Questions from Gold & Silver Stackers... |

| Date | July 28, 2025 2:47 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

Breaking News from America's #1 Precious Metals Dealer

[link removed] style="" Unsubscribe | [link removed] style="" Report Spam | [link removed] style="" View In Browser

[link removed]

[link removed]

Gold [link removed] Silver [link removed] IRAs [link removed] Monthly [link removed] News [link removed] Storage [link removed] Specials [link removed]

Money Metals News Alert

July 28, 2025 Gold has pulled back over the past few days, mostly on optimism surrounding trade deals between the U.S. and other nations namely Japan and the EU.

Meanwhile, silver is $1 lower than last week's high as it consolidates its recent gains after having busted over the key $37 price level early this month.

The platinum group metals are also consolidating their recent gains.

The Federal Reserve's Open Market Committee meets this week to discuss rates and the economic outlook.

90% Junk Silver

(Dimes / Quarters) [link removed] [link removed]

Shop Now >> [link removed]

Support for rate cuts is building, but most observers do not expect cuts until the September 17th meeting.

Money Metals continues to offer extremely low premiums for those wishing to add to their gold and silver holdings. And we also offer very strong bids for those wishing to sell.

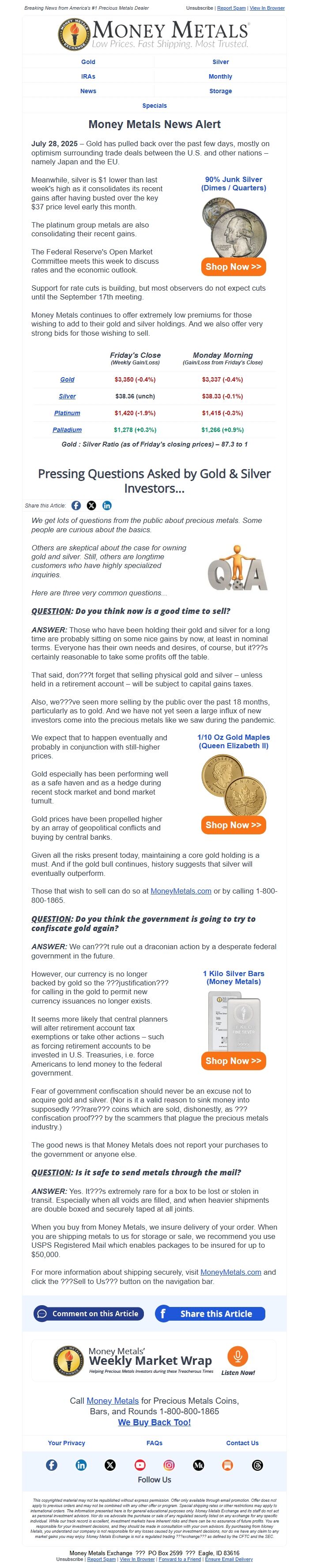

Friday's Close

(Weekly Gain/Loss)

Monday Morning

(Gain/Loss from Friday's Close)

Gold [link removed]

$3,350 (-0.4%) [link removed]

$3,337 (-0.4%) [link removed]

Silver [link removed]

$38.36 (unch) [link removed]

$38.33 (-0.1%) [link removed]

Platinum [link removed]

$1,420 (-1.9%) [link removed]

$1,415 (-0.3%) [link removed]

Palladium [link removed]

$1,278 (+0.3%) [link removed]

$1,266 (+0.9%) [link removed]

Gold : Silver Ratio (as of Friday's closing prices) 87.3 to 1

Pressing Questions Asked by Gold & Silver Investors...

Share this Article: [link removed] [link removed] [link removed]

We get lots of questions from the public about precious metals. Some people are curious about the basics.

Others are skeptical about the case for owning gold and silver. Still, others are longtime customers who have highly specialized inquiries.

Here are three very common questions...

QUESTION: Do you think now is a good time to sell?

ANSWER: Those who have been holding their gold and silver for a long time are probably sitting on some nice gains by now, at least in nominal terms. Everyone has their own needs and desires, of course, but it???s certainly reasonable to take some profits off the table.

That said, don???t forget that selling physical gold and silver unless held in a retirement account will be subject to capital gains taxes.

Also, we???ve seen more selling by the public over the past 18 months, particularly as to gold. And we have not yet seen a large influx of new investors come into the precious metals like we saw during the pandemic.

We expect that to happen eventually and probably in conjunction with still-higher prices.

Gold especially has been performing well as a safe haven and as a hedge during recent stock market and bond market tumult.

Gold prices have been propelled higher by an array of geopolitical conflicts and buying by central banks.

1/10 Oz Gold Maples (Queen Elizabeth II) [link removed] [link removed]

Shop Now >> [link removed]

Given all the risks present today, maintaining a core gold holding is a must. And if the gold bull continues, history suggests that silver will eventually outperform.

Those that wish to sell can do so at MoneyMetals.com [link removed] or by calling 1-800-800-1865.

QUESTION: Do you think the government is going to try to confiscate gold again?

ANSWER: We can???t rule out a draconian action by a desperate federal government in the future.

However, our currency is no longer backed by gold so the ???justification??? for calling in the gold to permit new currency issuances no longer exists.

It seems more likely that central planners will alter retirement account tax exemptions or take other actions such as forcing retirement accounts to be invested in U.S. Treasuries, i.e. force Americans to lend money to the federal government.

1 Kilo Silver Bars (Money Metals) [link removed] [link removed]

Shop Now >> [link removed]

Fear of government confiscation should never be an excuse not to acquire gold and silver. (Nor is it a valid reason to sink money into supposedly ???rare??? coins which are sold, dishonestly, as ???confiscation proof??? by the scammers that plague the precious metals industry.)

The good news is that Money Metals does not report your purchases to the government or anyone else.

QUESTION: Is it safe to send metals through the mail?

ANSWER: Yes. It???s extremely rare for a box to be lost or stolen in transit. Especially when all voids are filled, and when heavier shipments are double boxed and securely taped at all joints.

When you buy from Money Metals, we insure delivery of your order. When you are shipping metals to us for storage or sale, we recommend you use USPS Registered Mail which enables packages to be insured for up to $50,000.

For more information about shipping securely, visit MoneyMetals.com [link removed] and click the ???Sell to Us??? button on the navigation bar.

[link removed]

[link removed]

[link removed]

Call Money Metals [link removed] for Precious Metals Coins,

Bars, and Rounds 1-800-800-1865

We Buy Back Too! [link removed]

Your Privacy [link removed] FAQs [link removed] Contact Us [link removed]

[link removed] [link removed] [link removed] [link removed] [link removed] [link removed] [link removed] [link removed]

Follow Us

This copyrighted material may not be republished without express permission. Offer only available through email promotion. Offer does not apply to previous orders and may not be combined with any other offer or program. Special shipping rates or other restrictions may apply to international orders. The information presented here is for general educational purposes only. Money Metals Exchange and its staff do not act as personal investment advisors. Nor do we advocate the purchase or sale of any regulated security listed on any exchange for any specific individual. While our track record is excellent, investment markets have inherent risks and there can be no assurance of future profits. You are responsible for your investment decisions, and they should be made in consultation with your own advisors. By purchasing from Money Metals, you understand our company is not responsible for any losses caused by your investment decisions, nor do we have any claim to any market gains you may enjoy. Money Metals Exchange is not a regulated trading ???exchange??? as defined by the CFTC and the SEC.

Money Metals Exchange

PO Box 2599

Eagle, ID 83616

[link removed] style="" Unsubscribe | [link removed] style="" Report Spam | [link removed] style="" View In Browser | [link removed] style="" Forward to a Friend | Ensure Email Delivery [link removed]

[link removed] style="" Unsubscribe | [link removed] style="" Report Spam | [link removed] style="" View In Browser

[link removed]

[link removed]

Gold [link removed] Silver [link removed] IRAs [link removed] Monthly [link removed] News [link removed] Storage [link removed] Specials [link removed]

Money Metals News Alert

July 28, 2025 Gold has pulled back over the past few days, mostly on optimism surrounding trade deals between the U.S. and other nations namely Japan and the EU.

Meanwhile, silver is $1 lower than last week's high as it consolidates its recent gains after having busted over the key $37 price level early this month.

The platinum group metals are also consolidating their recent gains.

The Federal Reserve's Open Market Committee meets this week to discuss rates and the economic outlook.

90% Junk Silver

(Dimes / Quarters) [link removed] [link removed]

Shop Now >> [link removed]

Support for rate cuts is building, but most observers do not expect cuts until the September 17th meeting.

Money Metals continues to offer extremely low premiums for those wishing to add to their gold and silver holdings. And we also offer very strong bids for those wishing to sell.

Friday's Close

(Weekly Gain/Loss)

Monday Morning

(Gain/Loss from Friday's Close)

Gold [link removed]

$3,350 (-0.4%) [link removed]

$3,337 (-0.4%) [link removed]

Silver [link removed]

$38.36 (unch) [link removed]

$38.33 (-0.1%) [link removed]

Platinum [link removed]

$1,420 (-1.9%) [link removed]

$1,415 (-0.3%) [link removed]

Palladium [link removed]

$1,278 (+0.3%) [link removed]

$1,266 (+0.9%) [link removed]

Gold : Silver Ratio (as of Friday's closing prices) 87.3 to 1

Pressing Questions Asked by Gold & Silver Investors...

Share this Article: [link removed] [link removed] [link removed]

We get lots of questions from the public about precious metals. Some people are curious about the basics.

Others are skeptical about the case for owning gold and silver. Still, others are longtime customers who have highly specialized inquiries.

Here are three very common questions...

QUESTION: Do you think now is a good time to sell?

ANSWER: Those who have been holding their gold and silver for a long time are probably sitting on some nice gains by now, at least in nominal terms. Everyone has their own needs and desires, of course, but it???s certainly reasonable to take some profits off the table.

That said, don???t forget that selling physical gold and silver unless held in a retirement account will be subject to capital gains taxes.

Also, we???ve seen more selling by the public over the past 18 months, particularly as to gold. And we have not yet seen a large influx of new investors come into the precious metals like we saw during the pandemic.

We expect that to happen eventually and probably in conjunction with still-higher prices.

Gold especially has been performing well as a safe haven and as a hedge during recent stock market and bond market tumult.

Gold prices have been propelled higher by an array of geopolitical conflicts and buying by central banks.

1/10 Oz Gold Maples (Queen Elizabeth II) [link removed] [link removed]

Shop Now >> [link removed]

Given all the risks present today, maintaining a core gold holding is a must. And if the gold bull continues, history suggests that silver will eventually outperform.

Those that wish to sell can do so at MoneyMetals.com [link removed] or by calling 1-800-800-1865.

QUESTION: Do you think the government is going to try to confiscate gold again?

ANSWER: We can???t rule out a draconian action by a desperate federal government in the future.

However, our currency is no longer backed by gold so the ???justification??? for calling in the gold to permit new currency issuances no longer exists.

It seems more likely that central planners will alter retirement account tax exemptions or take other actions such as forcing retirement accounts to be invested in U.S. Treasuries, i.e. force Americans to lend money to the federal government.

1 Kilo Silver Bars (Money Metals) [link removed] [link removed]

Shop Now >> [link removed]

Fear of government confiscation should never be an excuse not to acquire gold and silver. (Nor is it a valid reason to sink money into supposedly ???rare??? coins which are sold, dishonestly, as ???confiscation proof??? by the scammers that plague the precious metals industry.)

The good news is that Money Metals does not report your purchases to the government or anyone else.

QUESTION: Is it safe to send metals through the mail?

ANSWER: Yes. It???s extremely rare for a box to be lost or stolen in transit. Especially when all voids are filled, and when heavier shipments are double boxed and securely taped at all joints.

When you buy from Money Metals, we insure delivery of your order. When you are shipping metals to us for storage or sale, we recommend you use USPS Registered Mail which enables packages to be insured for up to $50,000.

For more information about shipping securely, visit MoneyMetals.com [link removed] and click the ???Sell to Us??? button on the navigation bar.

[link removed]

[link removed]

[link removed]

Call Money Metals [link removed] for Precious Metals Coins,

Bars, and Rounds 1-800-800-1865

We Buy Back Too! [link removed]

Your Privacy [link removed] FAQs [link removed] Contact Us [link removed]

[link removed] [link removed] [link removed] [link removed] [link removed] [link removed] [link removed] [link removed]

Follow Us

This copyrighted material may not be republished without express permission. Offer only available through email promotion. Offer does not apply to previous orders and may not be combined with any other offer or program. Special shipping rates or other restrictions may apply to international orders. The information presented here is for general educational purposes only. Money Metals Exchange and its staff do not act as personal investment advisors. Nor do we advocate the purchase or sale of any regulated security listed on any exchange for any specific individual. While our track record is excellent, investment markets have inherent risks and there can be no assurance of future profits. You are responsible for your investment decisions, and they should be made in consultation with your own advisors. By purchasing from Money Metals, you understand our company is not responsible for any losses caused by your investment decisions, nor do we have any claim to any market gains you may enjoy. Money Metals Exchange is not a regulated trading ???exchange??? as defined by the CFTC and the SEC.

Money Metals Exchange

PO Box 2599

Eagle, ID 83616

[link removed] style="" Unsubscribe | [link removed] style="" Report Spam | [link removed] style="" View In Browser | [link removed] style="" Forward to a Friend | Ensure Email Delivery [link removed]

Message Analysis

- Sender: n/a

- Political Party: n/a

- Country: n/a

- State/Locality: n/a

- Office: n/a