John,

The GOP just proposed slashing the IRS budget by nearly a quarter, on top of the $20 billion they already clawed back earlier this year. This is a deliberate attempt to let the ultra-rich evade taxes with impunity.[1][2]

They’re gutting an agency that actually brings in more money than it costs. Every $1 invested in the IRS generates $7 in return, largely by finally auditing corporations and millionaires who’ve skirted tax law for decades.[3]

But the GOP’s billionaire backers don’t want a functioning IRS. They want a shield.

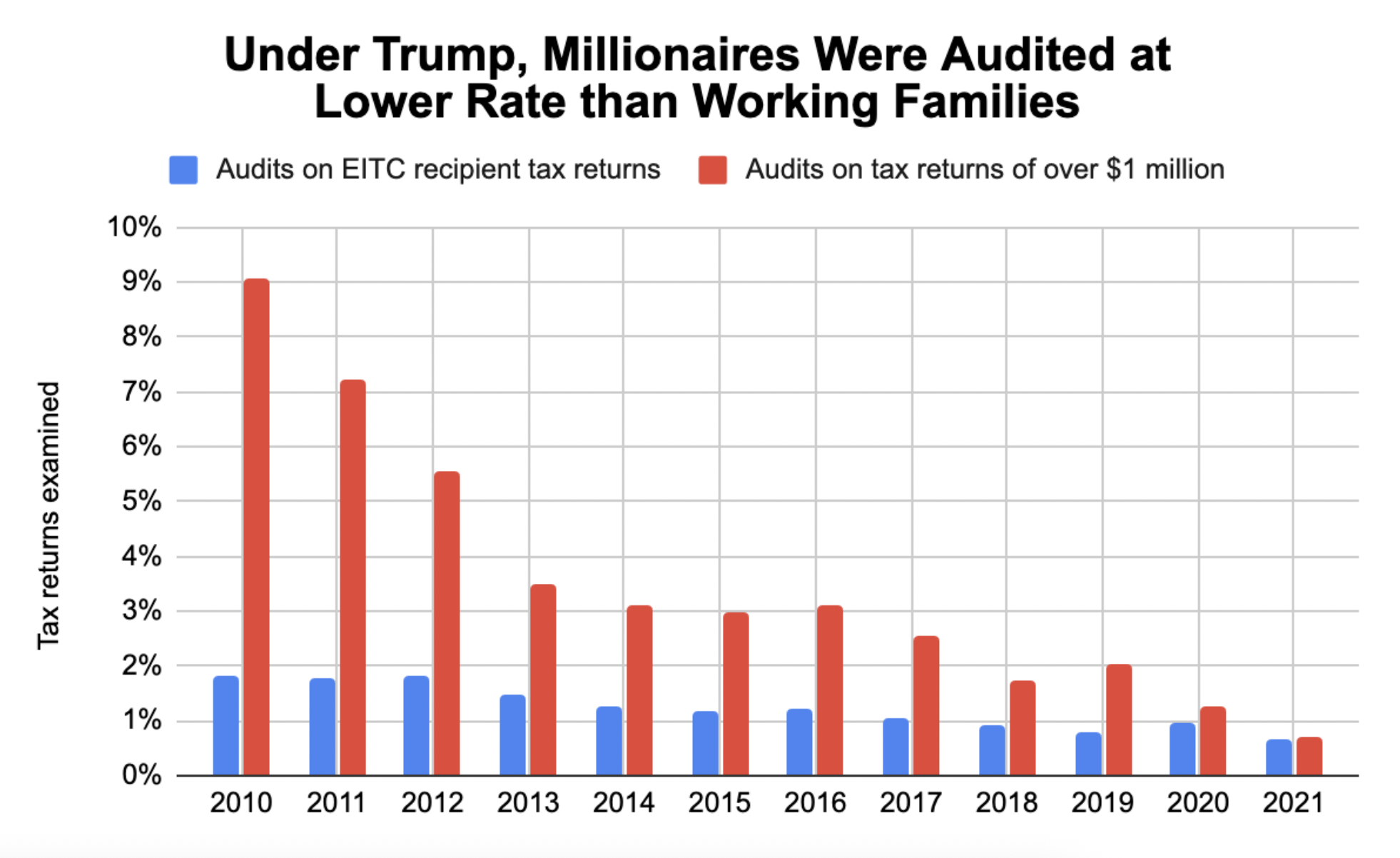

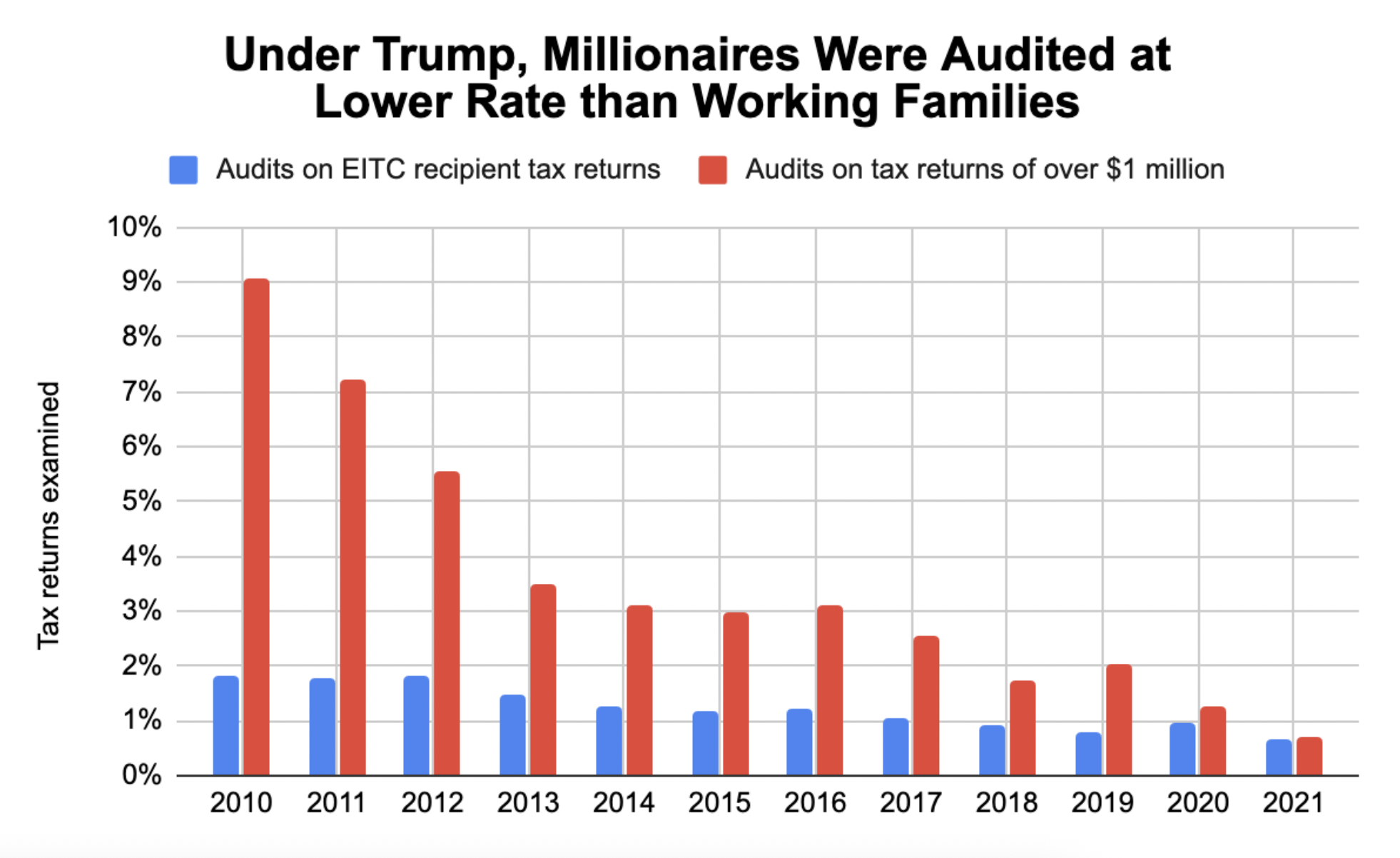

Before President Biden’s IRS reforms, millionaires were being audited less than low-income families receiving the Earned Income Tax Credit because the IRS had been crippled by years of Republican cuts. Just look at this chart, which shows plummeting audit rates of millionaires, which corresponds with Trump and Republicans gutting IRS enforcement:

We can’t allow Republicans to undo all of the progress we’ve made. Call on Congress to oppose any IRS cuts and fully fund the agency to catch rich tax cheats.

The results of actually investing in the IRS speak for themselves After President Biden and congressional Democrats made historic investments in the IRS:

-

Audit rates for the wealthy doubled.

-

Over $1 billion in unpaid taxes from millionaires was recovered.

-

Large corporations finally faced scrutiny after years of evasion.

This is what a fair tax system should look like. But the GOP wants to drag us back to the era when rich tax cheats called the shots and the IRS looked the other way.

It’s up to us to stop this. Because when the rich don’t pay, we all pay: either through higher taxes on us; worse schools, crumbling infrastructure, and other underfunded public services; higher public debt; or some terrible combination of all three.

Demand that Congress reject any cuts to the IRS and stand up for tax fairness.

Together, we can hold the wealthy accountable and protect the public services working families rely on.

John Foti

Legislative Director

Americans for Tax Fairness Action Fund

[1] House appropriators release Financial Services funding bill

[2] House Passes Budget CR in Final Days Before Shutdown

[3] The Effects of Increased Funding for the IRS

-- David's email --

John,

Congressional Republicans are launching another attack on tax fairness, slashing IRS funding by 23% in their latest budget proposal after already rescinding $20 billion earlier this year.[1][2] That’s another nearly $3 billion cut to the agency responsible for enforcing tax laws and catching wealthy tax cheats. The goal couldn’t be clearer: protect billionaires and corporations from paying what they owe.

This is the same playbook they’ve used for years. Between 2010 and 2021, Republican-led budget cuts shrank IRS enforcement staff by nearly a third, causing audits of the wealthy to plunge, and audits of working people to eventually eclipse audits of millionaires.[3] Just look at this graph:

By 2019, the top 1% of earners were evading $163 billion in taxes every year, and Congress had handcuffed the very agency meant to stop them.

President Biden’s investments changed that. The Inflation Reduction Act boosted IRS funding to go after high-income tax dodgers. The results? Audit rates for those earning over $500,000 doubled. The IRS recovered over $1 billion in unpaid taxes from millionaires and was tripling audits of corporations with over $250 million in assets.[4]

But the GOP hates this success because it hits their billionaire donors right in the wallet. They don’t want fairness. They want impunity for the richest tax cheats in the country.

Tell Congress to stop this sabotage and keep the IRS fully funded to catch rich tax cheats.

The GOP’s sabotage of the IRS isn’t about fiscal responsibility, it’s about making it easier for the rich to cheat. Every $1 invested in the IRS yields $7 in recovered revenue. (That kind of smart investment in enforcement is particularly necessary when dealing with wealthy tax cheats, who can afford armies of lawyers and accountants to shield them.) So if Congress cuts nearly $3 billion from IRS tax enforcement, that’s roughly $21 billion in taxes owed that aren’t being collected.

Under the Biden administration, the IRS investigated large partnerships and uncovered complex scams, finally auditing those who’ve gone decades without scrutiny. These audits targeted some of the most profitable and secretive entities in our economy, including hedge funds, private equity firms, and giant law partnerships that have long evaded meaningful oversight.

Now House Republicans want to dismantle all that progress. They want a return to Trump’s first term when the IRS was defunded, audits of the rich were rare, and tax law was a joke for billionaires.

Tell Congress to reject this outrageous 23% cut, restore full IRS funding, and stand up for a tax system where billionaires and corporations finally pay their fair share, just like the rest of us.

Thank you for demanding a tax system that holds those with wealth and power accountable.

David Kass

Executive Director

Americans for Tax Fairness Action

[1] House appropriators release Financial Services funding bill

[2] House Passes Budget CR in Final Days Before Shutdown

[3] Keep The IRS Adequately Funded To Catch Rich Tax Cheats

[4] IRS tops $1 billion in past-due taxes collected from millionaires