Email

Student Loans Face New Limits

| From | AEI DataPoints <[email protected]> |

| Subject | Student Loans Face New Limits |

| Date | July 24, 2025 11:01 AM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

Expert analysis made easy. Breaking down the news with data, charts, and maps.

Edited by: Brady Africk and Carter Hutchinson

Happy Thursday! In today’s newsletter, we examine the new limits for graduate student borrowers under the One Big Beautiful Bill Act, the Federal Reserve’s rate cut policy, and Chinese global investment in the first half of 2025.

Don’t forget––subscribe <[link removed]> and send DataPoints to a friend!

For inquiries, please email [email protected] <[link removed]>.

1. Graduate Student Loan Limits

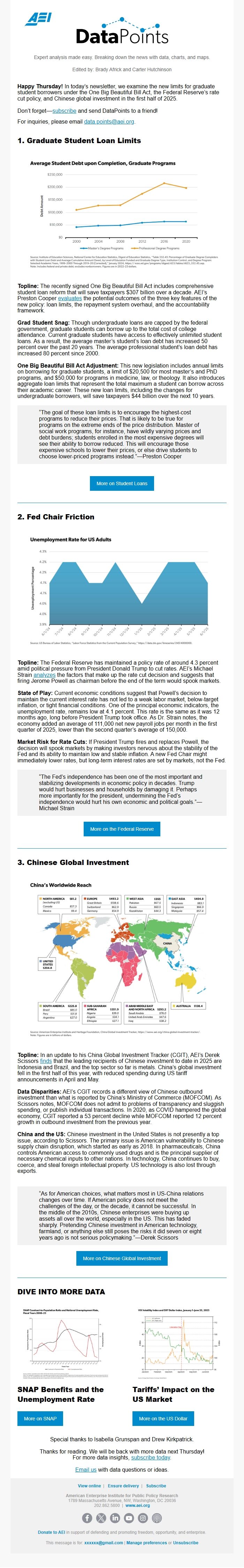

Topline: The recently signed One Big Beautiful Bill Act includes comprehensive student loan reform that will save taxpayers $307 billion over a decade. AEI’s Preston Cooper evaluates <[link removed]> the potential outcomes of the three key features of the new policy: loan limits, the repayment system overhaul, and the accountability framework.

Grad Student Snag: Though undergraduate loans are capped by the federal government, graduate students can borrow up to the total cost of college attendance. Current graduate students have access to effectively unlimited student loans. As a result, the average master’s student’s loan debt has increased 50 percent over the past 20 years. The average professional student’s loan debt has increased 80 percent since 2000.

One Big Beautiful Bill Act Adjustment: This new legislation includes annual limits on borrowing for graduate students, a limit of $20,500 for most master’s and PhD programs, and $50,000 for programs in medicine, law, or theology. It also introduces aggregate loan limits that represent the total maximum a student can borrow across their academic career. These new loan limits, including the changes for undergraduate borrowers, will save taxpayers $44 billion over the next 10 years.

“The goal of these loan limits is to encourage the highest-cost programs to reduce their prices. That is likely to be true for programs on the extreme ends of the price distribution. Master of social work programs, for instance, have wildly varying prices and debt burdens; students enrolled in the most expensive degrees will see their ability to borrow reduced. This will encourage those expensive schools to lower their prices, or else drive students to choose lower-priced programs instead.”—Preston Cooper

2. Fed Chair Friction

Topline: The Federal Reserve has maintained a policy rate of around 4.3 percent amid political pressure from President Donald Trump to cut rates. AEI’s Michael Strain analyzes <[link removed]> the factors that make up the rate cut decision and suggests that firing Jerome Powell as chairman before the end of the term would spook markets.

State of Play: Current economic conditions suggest that Powell’s decision to maintain the current interest rate has not led to a weak labor market, below-target inflation, or tight financial conditions. One of the principal economic indicators, the unemployment rate, remains low at 4.1 percent. This rate is the same as it was 12 months ago, long before President Trump took office. As Dr. Strain notes, the economy added an average of 111,000 net new payroll jobs per month in the first quarter of 2025, lower than the second quarter’s average of 150,000.

Market Risk for Rate Cuts: If President Trump fires and replaces Powell, the decision will spook markets by making investors nervous about the stability of the Fed and its ability to maintain low

and stable inflation. A new Fed Chair might immediately lower rates, but long-term interest rates are set by markets, not the Fed.

“The Fed’s independence has been one of the most important and stabilizing developments in economic policy in decades. Trump would hurt businesses and households by damaging it. Perhaps more importantly for the president, undermining the Fed’s independence would hurt his own economic and political goals.”—Michael Strain

3. Chinese Global Investment

Topline: In an update to his China Global Investment Tracker (CGIT), AEI’s Derek Scissors finds <[link removed]> that the leading recipients of Chinese investment to date in

2025 are Indonesia and Brazil, and the top sector so far is metals. China’s global investment fell in the first half of this year, with reduced spending during US tariff announcements in April and May.

Data Disparities: AEI’s CGIT records a different view of Chinese outbound investment than what is reported by China’s Ministry of Commerce (MOFCOM). As Scissors notes, MOFCOM does not admit to problems of transparency and sluggish spending, or publish individual transactions. In 2020, as COVID hampered the global economy, CGIT reported a 53 percent decline while MOFCOM reported 12 percent growth in outbound investment from the previous year.

China and the US: Chinese investment in the United States is not presently a top issue, according to Scissors. The primary issue is American vulnerability to Chinese supply chain disruption, which started as early as 2018. In pharmaceuticals, China controls American access to commonly used drugs and is the principal supplier of necessary chemical inputs to other nations. In technology, China continues to buy, coerce, and steal foreign intellectual property. US technology is also lost through exports.

“As for American choices, what matters most in US-China relations changes over time. If American policy does not meet the challenges of the day, or the decade, it cannot be successful. In the middle of the 2010s, Chinese enterprises were buying up assets all over the world, especially in the US. This has faded sharply. Pretending Chinese investment in American technology, farmland, or anything else still poses the risks it did seven or eight years ago is not serious policymaking.”—Derek Scissors

DIVE INTO MORE DATA

SNAP Benefits and the Unemployment Rate <[link removed]>

Tariffs’ Impact on the US Market <[link removed]>

Special thanks to Isabella Grunspan and Drew Kirkpatrick.

Thanks for reading. We will be back with more data next Thursday!

For more data insights, subscribe today <[link removed]>.

Email us <[link removed]> with data questions or ideas.

View online <[[[link removed]]]> | Ensure delivery <[link removed]> | Subscribe <[link removed]>

American Enterprise Institute for Public Policy Research

1789 Massachusetts Avenue, NW, Washington, DC 20036

202.862.5800 | www.aei.org <[link removed]>

<[link removed]> <[link removed]> <[link removed]> <[link removed]> <[link removed]>

<[link removed]> Donate to AEI <[link removed]> in support of defending and promoting freedom, opportunity, and enterprise.

This message is for: [email protected] <[email protected]> | Manage preferences <[link removed]> or Unsubscribe <[link removed]>

<!-- This is a comment -->

Edited by: Brady Africk and Carter Hutchinson

Happy Thursday! In today’s newsletter, we examine the new limits for graduate student borrowers under the One Big Beautiful Bill Act, the Federal Reserve’s rate cut policy, and Chinese global investment in the first half of 2025.

Don’t forget––subscribe <[link removed]> and send DataPoints to a friend!

For inquiries, please email [email protected] <[link removed]>.

1. Graduate Student Loan Limits

Topline: The recently signed One Big Beautiful Bill Act includes comprehensive student loan reform that will save taxpayers $307 billion over a decade. AEI’s Preston Cooper evaluates <[link removed]> the potential outcomes of the three key features of the new policy: loan limits, the repayment system overhaul, and the accountability framework.

Grad Student Snag: Though undergraduate loans are capped by the federal government, graduate students can borrow up to the total cost of college attendance. Current graduate students have access to effectively unlimited student loans. As a result, the average master’s student’s loan debt has increased 50 percent over the past 20 years. The average professional student’s loan debt has increased 80 percent since 2000.

One Big Beautiful Bill Act Adjustment: This new legislation includes annual limits on borrowing for graduate students, a limit of $20,500 for most master’s and PhD programs, and $50,000 for programs in medicine, law, or theology. It also introduces aggregate loan limits that represent the total maximum a student can borrow across their academic career. These new loan limits, including the changes for undergraduate borrowers, will save taxpayers $44 billion over the next 10 years.

“The goal of these loan limits is to encourage the highest-cost programs to reduce their prices. That is likely to be true for programs on the extreme ends of the price distribution. Master of social work programs, for instance, have wildly varying prices and debt burdens; students enrolled in the most expensive degrees will see their ability to borrow reduced. This will encourage those expensive schools to lower their prices, or else drive students to choose lower-priced programs instead.”—Preston Cooper

2. Fed Chair Friction

Topline: The Federal Reserve has maintained a policy rate of around 4.3 percent amid political pressure from President Donald Trump to cut rates. AEI’s Michael Strain analyzes <[link removed]> the factors that make up the rate cut decision and suggests that firing Jerome Powell as chairman before the end of the term would spook markets.

State of Play: Current economic conditions suggest that Powell’s decision to maintain the current interest rate has not led to a weak labor market, below-target inflation, or tight financial conditions. One of the principal economic indicators, the unemployment rate, remains low at 4.1 percent. This rate is the same as it was 12 months ago, long before President Trump took office. As Dr. Strain notes, the economy added an average of 111,000 net new payroll jobs per month in the first quarter of 2025, lower than the second quarter’s average of 150,000.

Market Risk for Rate Cuts: If President Trump fires and replaces Powell, the decision will spook markets by making investors nervous about the stability of the Fed and its ability to maintain low

and stable inflation. A new Fed Chair might immediately lower rates, but long-term interest rates are set by markets, not the Fed.

“The Fed’s independence has been one of the most important and stabilizing developments in economic policy in decades. Trump would hurt businesses and households by damaging it. Perhaps more importantly for the president, undermining the Fed’s independence would hurt his own economic and political goals.”—Michael Strain

3. Chinese Global Investment

Topline: In an update to his China Global Investment Tracker (CGIT), AEI’s Derek Scissors finds <[link removed]> that the leading recipients of Chinese investment to date in

2025 are Indonesia and Brazil, and the top sector so far is metals. China’s global investment fell in the first half of this year, with reduced spending during US tariff announcements in April and May.

Data Disparities: AEI’s CGIT records a different view of Chinese outbound investment than what is reported by China’s Ministry of Commerce (MOFCOM). As Scissors notes, MOFCOM does not admit to problems of transparency and sluggish spending, or publish individual transactions. In 2020, as COVID hampered the global economy, CGIT reported a 53 percent decline while MOFCOM reported 12 percent growth in outbound investment from the previous year.

China and the US: Chinese investment in the United States is not presently a top issue, according to Scissors. The primary issue is American vulnerability to Chinese supply chain disruption, which started as early as 2018. In pharmaceuticals, China controls American access to commonly used drugs and is the principal supplier of necessary chemical inputs to other nations. In technology, China continues to buy, coerce, and steal foreign intellectual property. US technology is also lost through exports.

“As for American choices, what matters most in US-China relations changes over time. If American policy does not meet the challenges of the day, or the decade, it cannot be successful. In the middle of the 2010s, Chinese enterprises were buying up assets all over the world, especially in the US. This has faded sharply. Pretending Chinese investment in American technology, farmland, or anything else still poses the risks it did seven or eight years ago is not serious policymaking.”—Derek Scissors

DIVE INTO MORE DATA

SNAP Benefits and the Unemployment Rate <[link removed]>

Tariffs’ Impact on the US Market <[link removed]>

Special thanks to Isabella Grunspan and Drew Kirkpatrick.

Thanks for reading. We will be back with more data next Thursday!

For more data insights, subscribe today <[link removed]>.

Email us <[link removed]> with data questions or ideas.

View online <[[[link removed]]]> | Ensure delivery <[link removed]> | Subscribe <[link removed]>

American Enterprise Institute for Public Policy Research

1789 Massachusetts Avenue, NW, Washington, DC 20036

202.862.5800 | www.aei.org <[link removed]>

<[link removed]> <[link removed]> <[link removed]> <[link removed]> <[link removed]>

<[link removed]> Donate to AEI <[link removed]> in support of defending and promoting freedom, opportunity, and enterprise.

This message is for: [email protected] <[email protected]> | Manage preferences <[link removed]> or Unsubscribe <[link removed]>

<!-- This is a comment -->

Message Analysis

- Sender: n/a

- Political Party: n/a

- Country: n/a

- State/Locality: n/a

- Office: n/a

-

Email Providers:

- Marketo