Email

Yes, There Is Fraud And Abuse: Let’s Attack It The Right Way

| From | Eugene Steuerle & The Government We Deserve <[email protected]> |

| Subject | Yes, There Is Fraud And Abuse: Let’s Attack It The Right Way |

| Date | July 22, 2025 12:19 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

View this post on the web at [link removed]

With the latest attack on an agency that serves the country by limiting waste, fraud, and abuse—this time, an attempt to dramatically cut funding for the Government Accountability Office [ [link removed] ]—it’s time to get the story straight on the pervasiveness of the problem throughout private and public sectors and what to do about it.

At the end of his first 100 days in office, President Trump claimed [ [link removed] ] that his Department of Government Efficiency (DOGE) had uncovered “hundreds of billions of dollars in waste, fraud, and abuse [ [link removed] ].” As is well-known now, he was wrong about DOGE [ [link removed] ], but his numbers weren’t off the mark.

The Government We Deserve is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

Fraud, waste, and abuse in government—and beyond—are significant ongoing challenges across all societies. However, it is essential to distinguish between how DOGE has addressed these issues and what constructive actions could be taken in the future to address them.

Reducing them requires ongoing, targeted improvements in oversight, enforcement, and policy design, rather than short-term and temporary responses that fail to address the root causes.

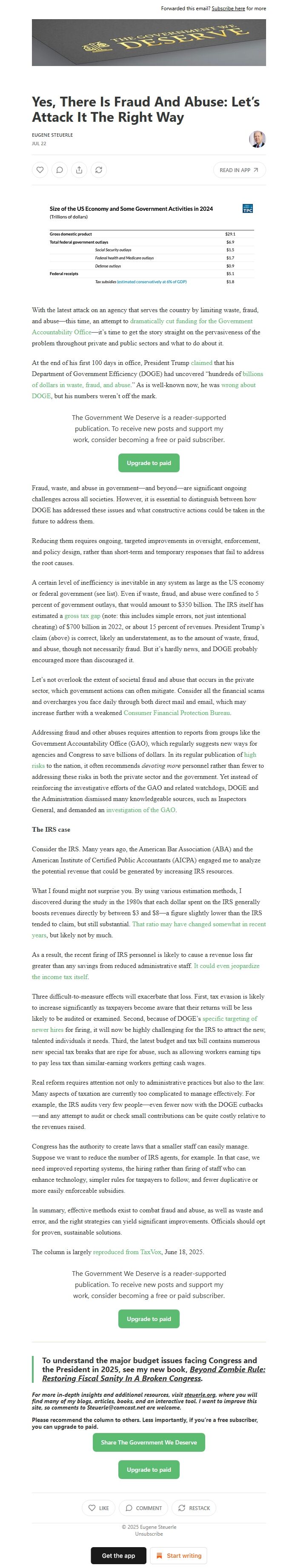

A certain level of inefficiency is inevitable in any system as large as the US economy or federal government (see list). Even if waste, fraud, and abuse were confined to 5 percent of government outlays, that would amount to $350 billion. The IRS itself has estimated a gross tax gap [ [link removed] ] (note: this includes simple errors, not just intentional cheating) of $700 billion in 2022, or about 15 percent of revenues. President Trump’s claim (above) is correct, likely an understatement, as to the amount of waste, fraud, and abuse, though not necessarily fraud. But it’s hardly news, and DOGE probably encouraged more than discouraged it.

Let’s not overlook the extent of societal fraud and abuse that occurs in the private sector, which government actions can often mitigate. Consider all the financial scams and overcharges you face daily through both direct mail and email, which may increase further with a weakened Consumer Financial Protection Bureau [ [link removed] ].

Addressing fraud and other abuses requires attention to reports from groups like the Government Accountability Office (GAO), which regularly suggests new ways for agencies and Congress to save billions of dollars. In its regular publication of high risks [ [link removed] ] to the nation, it often recommends devoting more personnel rather than fewer to addressing these risks in both the private sector and the government. Yet instead of reinforcing the investigative efforts of the GAO and related watchdogs, DOGE and the Administration dismissed many knowledgeable sources, such as Inspectors General, and demanded an investigation of the GAO [ [link removed] ].

The IRS case

Consider the IRS. Many years ago, the American Bar Association (ABA) and the American Institute of Certified Public Accountants (AICPA) engaged me to analyze the potential revenue that could be generated by increasing IRS resources.

What I found might not surprise you. By using various estimation methods, I discovered during the study in the 1980s that each dollar spent on the IRS generally boosts revenues directly by between $3 and $8—a figure slightly lower than the IRS tended to claim, but still substantial. That ratio may have changed somewhat in recent years [ [link removed] ], but likely not by much.

As a result, the recent firing of IRS personnel is likely to cause a revenue loss far greater than any savings from reduced administrative staff. It could even jeopardize the income tax itself [ [link removed] ].

Three difficult-to-measure effects will exacerbate that loss. First, tax evasion is likely to increase significantly as taxpayers become aware that their returns will be less likely to be audited or examined. Second, because of DOGE’s specific targeting of newer hires [ [link removed] ] for firing, it will now be highly challenging for the IRS to attract the new, talented individuals it needs. Third, the latest budget and tax bill contains numerous new special tax breaks that are ripe for abuse, such as allowing workers earning tips to pay less tax than similar-earning workers getting cash wages.

Real reform requires attention not only to administrative practices but also to the law. Many aspects of taxation are currently too complicated to manage effectively. For example, the IRS audits very few people—even fewer now with the DOGE cutbacks—and any attempt to audit or check small contributions can be quite costly relative to the revenues raised.

Congress has the authority to create laws that a smaller staff can easily manage. Suppose we want to reduce the number of IRS agents, for example. In that case, we need improved reporting systems, the hiring rather than firing of staff who can enhance technology, simpler rules for taxpayers to follow, and fewer duplicative or more easily enforceable subsidies.

In summary, effective methods exist to combat fraud and abuse, as well as waste and error, and the right strategies can yield significant improvements. Officials should opt for proven, sustainable solutions.

The column is largely reproduced from TaxVox [ [link removed] ], June 18, 2025.

The Government We Deserve is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

Unsubscribe [link removed]?

With the latest attack on an agency that serves the country by limiting waste, fraud, and abuse—this time, an attempt to dramatically cut funding for the Government Accountability Office [ [link removed] ]—it’s time to get the story straight on the pervasiveness of the problem throughout private and public sectors and what to do about it.

At the end of his first 100 days in office, President Trump claimed [ [link removed] ] that his Department of Government Efficiency (DOGE) had uncovered “hundreds of billions of dollars in waste, fraud, and abuse [ [link removed] ].” As is well-known now, he was wrong about DOGE [ [link removed] ], but his numbers weren’t off the mark.

The Government We Deserve is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

Fraud, waste, and abuse in government—and beyond—are significant ongoing challenges across all societies. However, it is essential to distinguish between how DOGE has addressed these issues and what constructive actions could be taken in the future to address them.

Reducing them requires ongoing, targeted improvements in oversight, enforcement, and policy design, rather than short-term and temporary responses that fail to address the root causes.

A certain level of inefficiency is inevitable in any system as large as the US economy or federal government (see list). Even if waste, fraud, and abuse were confined to 5 percent of government outlays, that would amount to $350 billion. The IRS itself has estimated a gross tax gap [ [link removed] ] (note: this includes simple errors, not just intentional cheating) of $700 billion in 2022, or about 15 percent of revenues. President Trump’s claim (above) is correct, likely an understatement, as to the amount of waste, fraud, and abuse, though not necessarily fraud. But it’s hardly news, and DOGE probably encouraged more than discouraged it.

Let’s not overlook the extent of societal fraud and abuse that occurs in the private sector, which government actions can often mitigate. Consider all the financial scams and overcharges you face daily through both direct mail and email, which may increase further with a weakened Consumer Financial Protection Bureau [ [link removed] ].

Addressing fraud and other abuses requires attention to reports from groups like the Government Accountability Office (GAO), which regularly suggests new ways for agencies and Congress to save billions of dollars. In its regular publication of high risks [ [link removed] ] to the nation, it often recommends devoting more personnel rather than fewer to addressing these risks in both the private sector and the government. Yet instead of reinforcing the investigative efforts of the GAO and related watchdogs, DOGE and the Administration dismissed many knowledgeable sources, such as Inspectors General, and demanded an investigation of the GAO [ [link removed] ].

The IRS case

Consider the IRS. Many years ago, the American Bar Association (ABA) and the American Institute of Certified Public Accountants (AICPA) engaged me to analyze the potential revenue that could be generated by increasing IRS resources.

What I found might not surprise you. By using various estimation methods, I discovered during the study in the 1980s that each dollar spent on the IRS generally boosts revenues directly by between $3 and $8—a figure slightly lower than the IRS tended to claim, but still substantial. That ratio may have changed somewhat in recent years [ [link removed] ], but likely not by much.

As a result, the recent firing of IRS personnel is likely to cause a revenue loss far greater than any savings from reduced administrative staff. It could even jeopardize the income tax itself [ [link removed] ].

Three difficult-to-measure effects will exacerbate that loss. First, tax evasion is likely to increase significantly as taxpayers become aware that their returns will be less likely to be audited or examined. Second, because of DOGE’s specific targeting of newer hires [ [link removed] ] for firing, it will now be highly challenging for the IRS to attract the new, talented individuals it needs. Third, the latest budget and tax bill contains numerous new special tax breaks that are ripe for abuse, such as allowing workers earning tips to pay less tax than similar-earning workers getting cash wages.

Real reform requires attention not only to administrative practices but also to the law. Many aspects of taxation are currently too complicated to manage effectively. For example, the IRS audits very few people—even fewer now with the DOGE cutbacks—and any attempt to audit or check small contributions can be quite costly relative to the revenues raised.

Congress has the authority to create laws that a smaller staff can easily manage. Suppose we want to reduce the number of IRS agents, for example. In that case, we need improved reporting systems, the hiring rather than firing of staff who can enhance technology, simpler rules for taxpayers to follow, and fewer duplicative or more easily enforceable subsidies.

In summary, effective methods exist to combat fraud and abuse, as well as waste and error, and the right strategies can yield significant improvements. Officials should opt for proven, sustainable solutions.

The column is largely reproduced from TaxVox [ [link removed] ], June 18, 2025.

The Government We Deserve is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

Unsubscribe [link removed]?

Message Analysis

- Sender: n/a

- Political Party: n/a

- Country: n/a

- State/Locality: n/a

- Office: n/a