| From | Fraser Institute <[email protected]> |

| Subject | Measuring progressivity in the tax system, and Alberta's pension plan |

| Date | July 19, 2025 5:00 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

Having trouble viewing? Try the web version [link removed] of this email. Latest Research Top 20% of Canadian income-earning families pay 57% of all taxes [[link removed]]

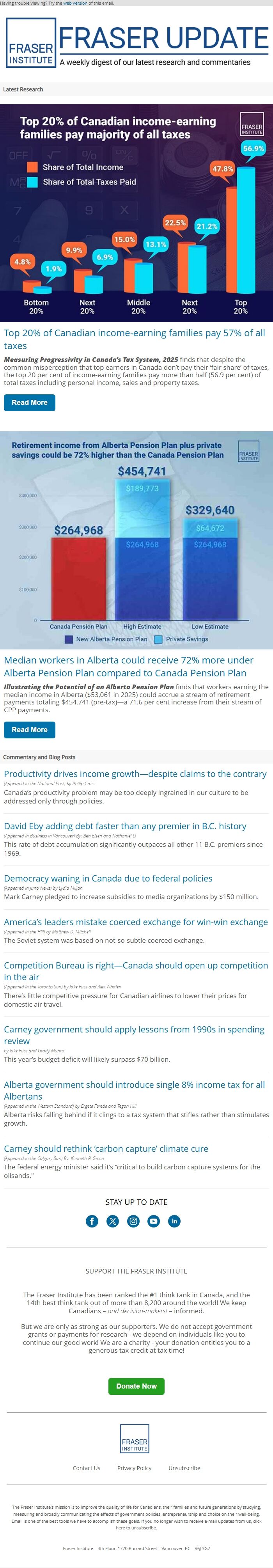

Measuring Progressivity in Canada’s Tax System, 2025 finds that despite the common misperception that top earners in Canada don’t pay their ‘fair share’ of taxes, the top 20 per cent of income-earning families pay more than half (56.9 per cent) of total taxes including personal income, sales and property taxes.

Read More [[link removed]] Median workers in Alberta could receive 72% more under Alberta Pension Plan compared to Canada Pension Plan [[link removed]]

Illustrating the Potential of an Alberta Pension Plan finds that workers earning the median income in Alberta ($53,061 in 2025) could accrue a stream of retirement payments totaling $454,741 (pre-tax)—a 71.6 per cent increase from their stream of CPP payments.

Read More [[link removed]] Commentary and Blog Posts Productivity drives income growth—despite claims to the contrary [[link removed]] (Appeared in the National Post) by Philip Cross

Canada’s productivity problem may be too deeply ingrained in our culture to be addressed only through policies.

David Eby adding debt faster than any premier in B.C. history [[link removed]] (Appeared in Business in Vancouver) By: Ben Eisen and Nathaniel Li

This rate of debt accumulation significantly outpaces all other 11 B.C. premiers since 1969.

Democracy waning in Canada due to federal policies [[link removed]] (Appeared in Juno News) by Lydia Miljan

Mark Carney pledged to increase subsidies to media organizations by $150 million.

America’s leaders mistake coerced exchange for win-win exchange [[link removed]] (Appeared in the Hill) by Matthew D. Mitchell

The Soviet system was based on not-so-subtle coerced exchange.

Competition Bureau is right—Canada should open up competition in the air [[link removed]] (Appeared in the Toronto Sun) by Jake Fuss and Alex Whalen

There’s little competitive pressure for Canadian airlines to lower their prices for domestic air travel.

Carney government should apply lessons from 1990s in spending review [[link removed]] by Jake Fuss and Grady Munro

This year’s budget deficit will likely surpass $70 billion.

Alberta government should introduce single 8% income tax for all Albertans [[link removed]] (Appeared in the Western Standard) by Ergete Ferede and Tegan Hill

Alberta risks falling behind if it clings to a tax system that stifles rather than stimulates growth.

Carney should rethink ‘carbon capture’ climate cure [[link removed]] (Appeared in the Calgary Sun) By: Kenneth P. Green

The federal energy minister said it’s “critical to build carbon capture systems for the oilsands."

STAY UP TO DATE

SUPPORT THE FRASER INSTITUTE

The Fraser Institute has been ranked the #1 think tank in Canada, and the 14th best think tank out of more than 8,200 around the world! We keep Canadians – and decision-makers! – informed.

But we are only as strong as our supporters. We do not accept government grants or payments for research - we depend on individuals like you to continue our good work! We are a charity - your donation entitles you to a generous tax credit at tax time!

Donate Now [[link removed][campaignid]]

Contact Us [[link removed]] Privacy Policy [[link removed]] Unsubscribe [link removed] The Fraser Institute's mission is to improve the quality of life for Canadians, their families and future generations by studying, measuring and broadly communicating the effects of government policies, entrepreneurship and choice on their well-being. Email is one of the best tools we have to accomplish these goals. If you no longer wish to receive e-mail updates from us, click here to unsubscribe [link removed].

Fraser Institute 4th Floor, 1770 Burrard Street Vancouver, BC V6J 3G7

Measuring Progressivity in Canada’s Tax System, 2025 finds that despite the common misperception that top earners in Canada don’t pay their ‘fair share’ of taxes, the top 20 per cent of income-earning families pay more than half (56.9 per cent) of total taxes including personal income, sales and property taxes.

Read More [[link removed]] Median workers in Alberta could receive 72% more under Alberta Pension Plan compared to Canada Pension Plan [[link removed]]

Illustrating the Potential of an Alberta Pension Plan finds that workers earning the median income in Alberta ($53,061 in 2025) could accrue a stream of retirement payments totaling $454,741 (pre-tax)—a 71.6 per cent increase from their stream of CPP payments.

Read More [[link removed]] Commentary and Blog Posts Productivity drives income growth—despite claims to the contrary [[link removed]] (Appeared in the National Post) by Philip Cross

Canada’s productivity problem may be too deeply ingrained in our culture to be addressed only through policies.

David Eby adding debt faster than any premier in B.C. history [[link removed]] (Appeared in Business in Vancouver) By: Ben Eisen and Nathaniel Li

This rate of debt accumulation significantly outpaces all other 11 B.C. premiers since 1969.

Democracy waning in Canada due to federal policies [[link removed]] (Appeared in Juno News) by Lydia Miljan

Mark Carney pledged to increase subsidies to media organizations by $150 million.

America’s leaders mistake coerced exchange for win-win exchange [[link removed]] (Appeared in the Hill) by Matthew D. Mitchell

The Soviet system was based on not-so-subtle coerced exchange.

Competition Bureau is right—Canada should open up competition in the air [[link removed]] (Appeared in the Toronto Sun) by Jake Fuss and Alex Whalen

There’s little competitive pressure for Canadian airlines to lower their prices for domestic air travel.

Carney government should apply lessons from 1990s in spending review [[link removed]] by Jake Fuss and Grady Munro

This year’s budget deficit will likely surpass $70 billion.

Alberta government should introduce single 8% income tax for all Albertans [[link removed]] (Appeared in the Western Standard) by Ergete Ferede and Tegan Hill

Alberta risks falling behind if it clings to a tax system that stifles rather than stimulates growth.

Carney should rethink ‘carbon capture’ climate cure [[link removed]] (Appeared in the Calgary Sun) By: Kenneth P. Green

The federal energy minister said it’s “critical to build carbon capture systems for the oilsands."

STAY UP TO DATE

SUPPORT THE FRASER INSTITUTE

The Fraser Institute has been ranked the #1 think tank in Canada, and the 14th best think tank out of more than 8,200 around the world! We keep Canadians – and decision-makers! – informed.

But we are only as strong as our supporters. We do not accept government grants or payments for research - we depend on individuals like you to continue our good work! We are a charity - your donation entitles you to a generous tax credit at tax time!

Donate Now [[link removed][campaignid]]

Contact Us [[link removed]] Privacy Policy [[link removed]] Unsubscribe [link removed] The Fraser Institute's mission is to improve the quality of life for Canadians, their families and future generations by studying, measuring and broadly communicating the effects of government policies, entrepreneurship and choice on their well-being. Email is one of the best tools we have to accomplish these goals. If you no longer wish to receive e-mail updates from us, click here to unsubscribe [link removed].

Fraser Institute 4th Floor, 1770 Burrard Street Vancouver, BC V6J 3G7

Message Analysis

- Sender: Fraser Institute

- Political Party: n/a

- Country: Canada

- State/Locality: n/a

- Office: n/a

-

Email Providers:

- Campaign Monitor