Email

RFK’s Political Lessons

| From | AEI DataPoints <[email protected]> |

| Subject | RFK’s Political Lessons |

| Date | July 17, 2025 11:01 AM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

Expert analysis made easy. Breaking down the news with data, charts, and maps.

Edited by: Brady Africk and Hannah Bowen

Happy Thursday! In today’s newsletter, we examine historical lessons on building coalitions in times of deep political divisions, the President's push for the Federal Reserve to lower interest rates, and new endowment taxes for US universities.

Don’t forget—subscribe <[link removed]> and send DataPoints to a friend!

For inquiries, please email [email protected] <[link removed]>.

1. RFK’s Legacy in Today’s Politics

Topline: In present-day US politics, neither the Democratic nor the Republican Party can hold a durable majority in the United States. Looking retrospectively, AEI’s Ruy Teixeira, alongside coauthor Richard D. Kahlenberg, evaluate <[link removed]> what another time of national division—1968—and the presidential nomination run of Robert F. Kennedy may teach current political leaders about building powerful political coalitions in a deeply divided nation.

Modern Context: The authors find that partisan polarization in the United States has escalated since Robert F. Kennedy’s bid for a presidential nomination. In the 1960s, only 4 percent of Americans were concerned about marriage across different political parties. By 2019, that number had increased to 45 percent of Democrats and 35 percent of Republicans saying they would be unhappy if their child married someone from the other political party.

Lessons in History: The 1960s were plagued by high political tensions, racial divisions, rioting, assassinations, and antiwar protests. RFK, however, still managed to build a political coalition of working-class black and Hispanic voters alongside working-class white voters.

History Today: Can lessons from RFK’s political career be translated to the current political landscape? Teixeira and Kahlenberg make the case that applying Kennedy’s patriotic and unifying themes today would include teaching schoolchildren a reflective patriotism, promoting civil rights without racial preferences, combating lawlessness, and honoring the

dignity of work to build powerful political coalitions in today’s divisive landscape.

“Having said all that, there is good reason to think Kennedy’s 1968 campaign is more than a mere historic curiosity. He advanced critical themes and approaches that translate across time and candidates and could inform the approach of liberals today—and indeed those of any political persuasion who are seeking to bring the country together in an era of polarization and intense conflict.” —Ruy Teixeira and Richard D. Kahlenberg

2. The Fight over Interest Rates

Topline: President Donald Trump has recently put relentless pressure on US Fed Chair Jerome Powell to lower interest rates, despite inflation remaining above the Fed’s 2 percent target and high tariffs expected to add price pressures. AEI’s Desmond Lachman argues <[link removed]> that Trump’s recent criticisms of the Fed’s policy overlook a key component in the US economy—the 10-year Treasury bond rate.

Affordability: Mortgage rates, automobile lending rates, and other key loan

rates that are important to Americans are tied to the 10-year Treasury bond rate. Premature rate cuts within the context of worsening US public finances could lead to higher long-term interest rates. The recently enacted “One Big Beautiful Bill” is projected to add $3.5 trillion to the US budget deficit over the next decade and push the ratio of public debt to gross domestic product to 127 percent by 2034—making public finances for the US even more unsustainable.

Economic Strategy: Foreign investors are already questioning America's economic

strength because of the poor state of the country’s public finances, with US Treasury yields remaining high, even amid market volatility, and the US dollar having lost 10 percent of its value since the start of the year. Trump’s pressure on the Fed to take a more dovish approach and cut interest rates risks signaling to foreign investors that the US intends to renege on debt commitments. If a premature interest-rate cut in the current market context leads to higher bond rates for the 10-year Treasury, the US economy will face adverse impacts and Americans may face worsening economic conditions.

“In clamoring for a low interest rate Fed, Trump should be careful about that for which he wishes. In the current economic and market context, a low interest rate Fed could trigger a dollar and bond market crisis in the run up to next year’s midterm elections.”—Desmond Lachman

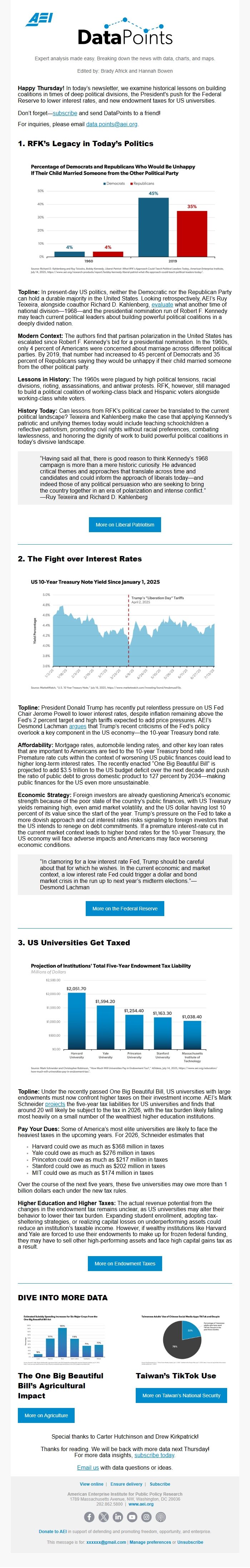

3. US Universities Get Taxed

Topline: Under the recently passed One Big Beautiful Bill, US universities with large endowments must now confront higher taxes on their investment income. AEI’s Mark Schneider projects <[link removed]> the five-year tax liabilities for US universities and finds that around 20 will likely be subject to the tax in 2026, with the tax burden likely falling most heavily on a small number of the wealthiest higher education institutions.

Pay Your Dues: Some of America’s most elite universities are likely to face the heaviest taxes in the upcoming years. For 2026, Schneider estimates that

- Harvard could owe as much as $368 million in taxes

- Yale could owe as much as $276 million in taxes

- Princeton could owe as much as $217 million in taxes

- Stanford could owe as much as $202 million in taxes

- MIT could owe as much as $174 million in taxes

Over the course of the next five years, these five universities may owe more than 1 billion dollars each under the new tax rules.

Higher Education and Higher Taxes: The actual revenue potential from the changes in the endowment tax remains unclear, as US universities may alter their behavior to lower their tax burden. Expanding student enrollment, adopting tax-sheltering strategies, or realizing capital losses on underperforming assets could reduce an institution’s taxable income. However, if wealthy institutions like Harvard and Yale are forced to use their endowments to make up for frozen federal funding, they may have to sell other high-performing assets and face high capital gains tax as a result.

DIVE INTO MORE DATA

The One Big Beautiful Bill’s Agricultural Impact <[link removed]>

Taiwan’s TikTok Use <[link removed]>

Special thanks to Carter Hutchinson and Drew Kirkpatrick!

Thanks for reading. We will be back with more data next Thursday!

For more data insights, subscribe today <[link removed]>.

Email us <[link removed]> with data questions or ideas.

View online <[[[link removed]]]> | Ensure delivery <[link removed]> | Subscribe <[link removed]>

American Enterprise Institute for Public Policy Research

1789 Massachusetts Avenue, NW, Washington, DC 20036

202.862.5800 | www.aei.org <[link removed]>

<[link removed]> <[link removed]> <[link removed]> <[link removed]> <[link removed]>

<[link removed]> Donate to AEI <[link removed]> in support of defending and promoting freedom, opportunity, and enterprise.

This message is for: [email protected] <[email protected]> | Manage preferences <[link removed]> or Unsubscribe <[link removed]>

<!-- This is a comment -->

Edited by: Brady Africk and Hannah Bowen

Happy Thursday! In today’s newsletter, we examine historical lessons on building coalitions in times of deep political divisions, the President's push for the Federal Reserve to lower interest rates, and new endowment taxes for US universities.

Don’t forget—subscribe <[link removed]> and send DataPoints to a friend!

For inquiries, please email [email protected] <[link removed]>.

1. RFK’s Legacy in Today’s Politics

Topline: In present-day US politics, neither the Democratic nor the Republican Party can hold a durable majority in the United States. Looking retrospectively, AEI’s Ruy Teixeira, alongside coauthor Richard D. Kahlenberg, evaluate <[link removed]> what another time of national division—1968—and the presidential nomination run of Robert F. Kennedy may teach current political leaders about building powerful political coalitions in a deeply divided nation.

Modern Context: The authors find that partisan polarization in the United States has escalated since Robert F. Kennedy’s bid for a presidential nomination. In the 1960s, only 4 percent of Americans were concerned about marriage across different political parties. By 2019, that number had increased to 45 percent of Democrats and 35 percent of Republicans saying they would be unhappy if their child married someone from the other political party.

Lessons in History: The 1960s were plagued by high political tensions, racial divisions, rioting, assassinations, and antiwar protests. RFK, however, still managed to build a political coalition of working-class black and Hispanic voters alongside working-class white voters.

History Today: Can lessons from RFK’s political career be translated to the current political landscape? Teixeira and Kahlenberg make the case that applying Kennedy’s patriotic and unifying themes today would include teaching schoolchildren a reflective patriotism, promoting civil rights without racial preferences, combating lawlessness, and honoring the

dignity of work to build powerful political coalitions in today’s divisive landscape.

“Having said all that, there is good reason to think Kennedy’s 1968 campaign is more than a mere historic curiosity. He advanced critical themes and approaches that translate across time and candidates and could inform the approach of liberals today—and indeed those of any political persuasion who are seeking to bring the country together in an era of polarization and intense conflict.” —Ruy Teixeira and Richard D. Kahlenberg

2. The Fight over Interest Rates

Topline: President Donald Trump has recently put relentless pressure on US Fed Chair Jerome Powell to lower interest rates, despite inflation remaining above the Fed’s 2 percent target and high tariffs expected to add price pressures. AEI’s Desmond Lachman argues <[link removed]> that Trump’s recent criticisms of the Fed’s policy overlook a key component in the US economy—the 10-year Treasury bond rate.

Affordability: Mortgage rates, automobile lending rates, and other key loan

rates that are important to Americans are tied to the 10-year Treasury bond rate. Premature rate cuts within the context of worsening US public finances could lead to higher long-term interest rates. The recently enacted “One Big Beautiful Bill” is projected to add $3.5 trillion to the US budget deficit over the next decade and push the ratio of public debt to gross domestic product to 127 percent by 2034—making public finances for the US even more unsustainable.

Economic Strategy: Foreign investors are already questioning America's economic

strength because of the poor state of the country’s public finances, with US Treasury yields remaining high, even amid market volatility, and the US dollar having lost 10 percent of its value since the start of the year. Trump’s pressure on the Fed to take a more dovish approach and cut interest rates risks signaling to foreign investors that the US intends to renege on debt commitments. If a premature interest-rate cut in the current market context leads to higher bond rates for the 10-year Treasury, the US economy will face adverse impacts and Americans may face worsening economic conditions.

“In clamoring for a low interest rate Fed, Trump should be careful about that for which he wishes. In the current economic and market context, a low interest rate Fed could trigger a dollar and bond market crisis in the run up to next year’s midterm elections.”—Desmond Lachman

3. US Universities Get Taxed

Topline: Under the recently passed One Big Beautiful Bill, US universities with large endowments must now confront higher taxes on their investment income. AEI’s Mark Schneider projects <[link removed]> the five-year tax liabilities for US universities and finds that around 20 will likely be subject to the tax in 2026, with the tax burden likely falling most heavily on a small number of the wealthiest higher education institutions.

Pay Your Dues: Some of America’s most elite universities are likely to face the heaviest taxes in the upcoming years. For 2026, Schneider estimates that

- Harvard could owe as much as $368 million in taxes

- Yale could owe as much as $276 million in taxes

- Princeton could owe as much as $217 million in taxes

- Stanford could owe as much as $202 million in taxes

- MIT could owe as much as $174 million in taxes

Over the course of the next five years, these five universities may owe more than 1 billion dollars each under the new tax rules.

Higher Education and Higher Taxes: The actual revenue potential from the changes in the endowment tax remains unclear, as US universities may alter their behavior to lower their tax burden. Expanding student enrollment, adopting tax-sheltering strategies, or realizing capital losses on underperforming assets could reduce an institution’s taxable income. However, if wealthy institutions like Harvard and Yale are forced to use their endowments to make up for frozen federal funding, they may have to sell other high-performing assets and face high capital gains tax as a result.

DIVE INTO MORE DATA

The One Big Beautiful Bill’s Agricultural Impact <[link removed]>

Taiwan’s TikTok Use <[link removed]>

Special thanks to Carter Hutchinson and Drew Kirkpatrick!

Thanks for reading. We will be back with more data next Thursday!

For more data insights, subscribe today <[link removed]>.

Email us <[link removed]> with data questions or ideas.

View online <[[[link removed]]]> | Ensure delivery <[link removed]> | Subscribe <[link removed]>

American Enterprise Institute for Public Policy Research

1789 Massachusetts Avenue, NW, Washington, DC 20036

202.862.5800 | www.aei.org <[link removed]>

<[link removed]> <[link removed]> <[link removed]> <[link removed]> <[link removed]>

<[link removed]> Donate to AEI <[link removed]> in support of defending and promoting freedom, opportunity, and enterprise.

This message is for: [email protected] <[email protected]> | Manage preferences <[link removed]> or Unsubscribe <[link removed]>

<!-- This is a comment -->

Message Analysis

- Sender: n/a

- Political Party: n/a

- Country: n/a

- State/Locality: n/a

- Office: n/a

-

Email Providers:

- Marketo