| From | Fraser Institute <[email protected]> |

| Subject | BC Debt accumulation, and Tax competitiveness in Atlantic Canada |

| Date | July 5, 2025 5:00 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

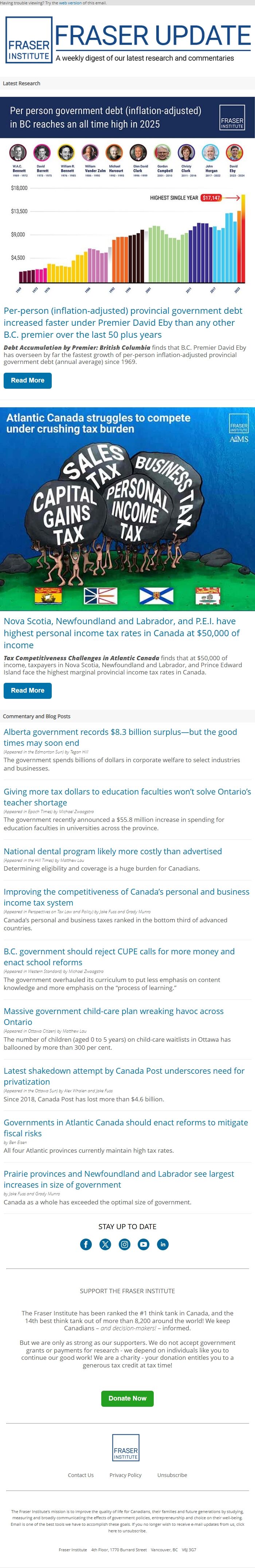

Having trouble viewing? Try the web version [link removed] of this email. Latest Research Per-person (inflation-adjusted) provincial government debt increased faster under Premier David Eby than any other B.C. premier over the last 50 plus years [[link removed]]

Debt Accumulation by Premier: British Columbia finds that B.C. Premier David Eby has overseen by far the fastest growth of per-person inflation-adjusted provincial government debt (annual average) since 1969.

Read More [[link removed]] Nova Scotia, Newfoundland and Labrador, and P.E.I. have highest personal income tax rates in Canada at $50,000 of income [[link removed]]

Tax Competitiveness Challenges in Atlantic Canada finds that at $50,000 of income, taxpayers in Nova Scotia, Newfoundland and Labrador, and Prince Edward Island face the highest marginal provincial income tax rates in Canada.

Read More [[link removed]] Commentary and Blog Posts Alberta government records $8.3 billion surplus—but the good times may soon end [[link removed]] (Appeared in the Edmonton Sun) by Tegan Hill

The government spends billions of dollars in corporate welfare to select industries and businesses.

Giving more tax dollars to education faculties won’t solve Ontario’s teacher shortage [[link removed]] (Appeared in Epoch Times) by Michael Zwaagstra

The government recently announced a $55.8 million increase in spending for education faculties in universities across the province.

National dental program likely more costly than advertised [[link removed]] (Appeared in the Hill Times) by Matthew Lau

Determining eligibility and coverage is a huge burden for Canadians.

Improving the competitiveness of Canada’s personal and business income tax system [[link removed]] (Appeared in Perspectives on Tax Law and Policy) by Jake Fuss and Grady Munro

Canada’s personal and business taxes ranked in the bottom third of advanced countries.

B.C. government should reject CUPE calls for more money and enact school reforms [[link removed]] (Appeared in Western Standard) by Michael Zwaagstra

The government overhauled its curriculum to put less emphasis on content knowledge and more emphasis on the “process of learning.”

Massive government child-care plan wreaking havoc across Ontario [[link removed]] (Appeared in Ottawa Citizen) by Matthew Lau

The number of children (aged 0 to 5 years) on child-care waitlists in Ottawa has ballooned by more than 300 per cent.

Latest shakedown attempt by Canada Post underscores need for privatization [[link removed]] (Appeared in the Ottawa Sun) by Alex Whalen and Jake Fuss

Since 2018, Canada Post has lost more than $4.6 billion.

Governments in Atlantic Canada should enact reforms to mitigate fiscal risks [[link removed]] by Ben Eisen

All four Atlantic provinces currently maintain high tax rates.

Prairie provinces and Newfoundland and Labrador see largest increases in size of government [[link removed]] by Jake Fuss and Grady Munro

Canada as a whole has exceeded the optimal size of government.

STAY UP TO DATE

SUPPORT THE FRASER INSTITUTE

The Fraser Institute has been ranked the #1 think tank in Canada, and the 14th best think tank out of more than 8,200 around the world! We keep Canadians – and decision-makers! – informed.

But we are only as strong as our supporters. We do not accept government grants or payments for research - we depend on individuals like you to continue our good work! We are a charity - your donation entitles you to a generous tax credit at tax time!

Donate Now [[link removed][campaignid]]

Contact Us [[link removed]] Privacy Policy [[link removed]] Unsubscribe [link removed] The Fraser Institute's mission is to improve the quality of life for Canadians, their families and future generations by studying, measuring and broadly communicating the effects of government policies, entrepreneurship and choice on their well-being. Email is one of the best tools we have to accomplish these goals. If you no longer wish to receive e-mail updates from us, click here to unsubscribe [link removed].

Fraser Institute 4th Floor, 1770 Burrard Street Vancouver, BC V6J 3G7

Debt Accumulation by Premier: British Columbia finds that B.C. Premier David Eby has overseen by far the fastest growth of per-person inflation-adjusted provincial government debt (annual average) since 1969.

Read More [[link removed]] Nova Scotia, Newfoundland and Labrador, and P.E.I. have highest personal income tax rates in Canada at $50,000 of income [[link removed]]

Tax Competitiveness Challenges in Atlantic Canada finds that at $50,000 of income, taxpayers in Nova Scotia, Newfoundland and Labrador, and Prince Edward Island face the highest marginal provincial income tax rates in Canada.

Read More [[link removed]] Commentary and Blog Posts Alberta government records $8.3 billion surplus—but the good times may soon end [[link removed]] (Appeared in the Edmonton Sun) by Tegan Hill

The government spends billions of dollars in corporate welfare to select industries and businesses.

Giving more tax dollars to education faculties won’t solve Ontario’s teacher shortage [[link removed]] (Appeared in Epoch Times) by Michael Zwaagstra

The government recently announced a $55.8 million increase in spending for education faculties in universities across the province.

National dental program likely more costly than advertised [[link removed]] (Appeared in the Hill Times) by Matthew Lau

Determining eligibility and coverage is a huge burden for Canadians.

Improving the competitiveness of Canada’s personal and business income tax system [[link removed]] (Appeared in Perspectives on Tax Law and Policy) by Jake Fuss and Grady Munro

Canada’s personal and business taxes ranked in the bottom third of advanced countries.

B.C. government should reject CUPE calls for more money and enact school reforms [[link removed]] (Appeared in Western Standard) by Michael Zwaagstra

The government overhauled its curriculum to put less emphasis on content knowledge and more emphasis on the “process of learning.”

Massive government child-care plan wreaking havoc across Ontario [[link removed]] (Appeared in Ottawa Citizen) by Matthew Lau

The number of children (aged 0 to 5 years) on child-care waitlists in Ottawa has ballooned by more than 300 per cent.

Latest shakedown attempt by Canada Post underscores need for privatization [[link removed]] (Appeared in the Ottawa Sun) by Alex Whalen and Jake Fuss

Since 2018, Canada Post has lost more than $4.6 billion.

Governments in Atlantic Canada should enact reforms to mitigate fiscal risks [[link removed]] by Ben Eisen

All four Atlantic provinces currently maintain high tax rates.

Prairie provinces and Newfoundland and Labrador see largest increases in size of government [[link removed]] by Jake Fuss and Grady Munro

Canada as a whole has exceeded the optimal size of government.

STAY UP TO DATE

SUPPORT THE FRASER INSTITUTE

The Fraser Institute has been ranked the #1 think tank in Canada, and the 14th best think tank out of more than 8,200 around the world! We keep Canadians – and decision-makers! – informed.

But we are only as strong as our supporters. We do not accept government grants or payments for research - we depend on individuals like you to continue our good work! We are a charity - your donation entitles you to a generous tax credit at tax time!

Donate Now [[link removed][campaignid]]

Contact Us [[link removed]] Privacy Policy [[link removed]] Unsubscribe [link removed] The Fraser Institute's mission is to improve the quality of life for Canadians, their families and future generations by studying, measuring and broadly communicating the effects of government policies, entrepreneurship and choice on their well-being. Email is one of the best tools we have to accomplish these goals. If you no longer wish to receive e-mail updates from us, click here to unsubscribe [link removed].

Fraser Institute 4th Floor, 1770 Burrard Street Vancouver, BC V6J 3G7

Message Analysis

- Sender: Fraser Institute

- Political Party: n/a

- Country: Canada

- State/Locality: n/a

- Office: n/a

-

Email Providers:

- Campaign Monitor