The Senate continued their work on the One Big Beautiful Bill (OB3) this week. The success of the OB3 may ultimately define the 119th Congress, the first two years of President Trump’s return to the White House. Republicans have to deliver for the American people.

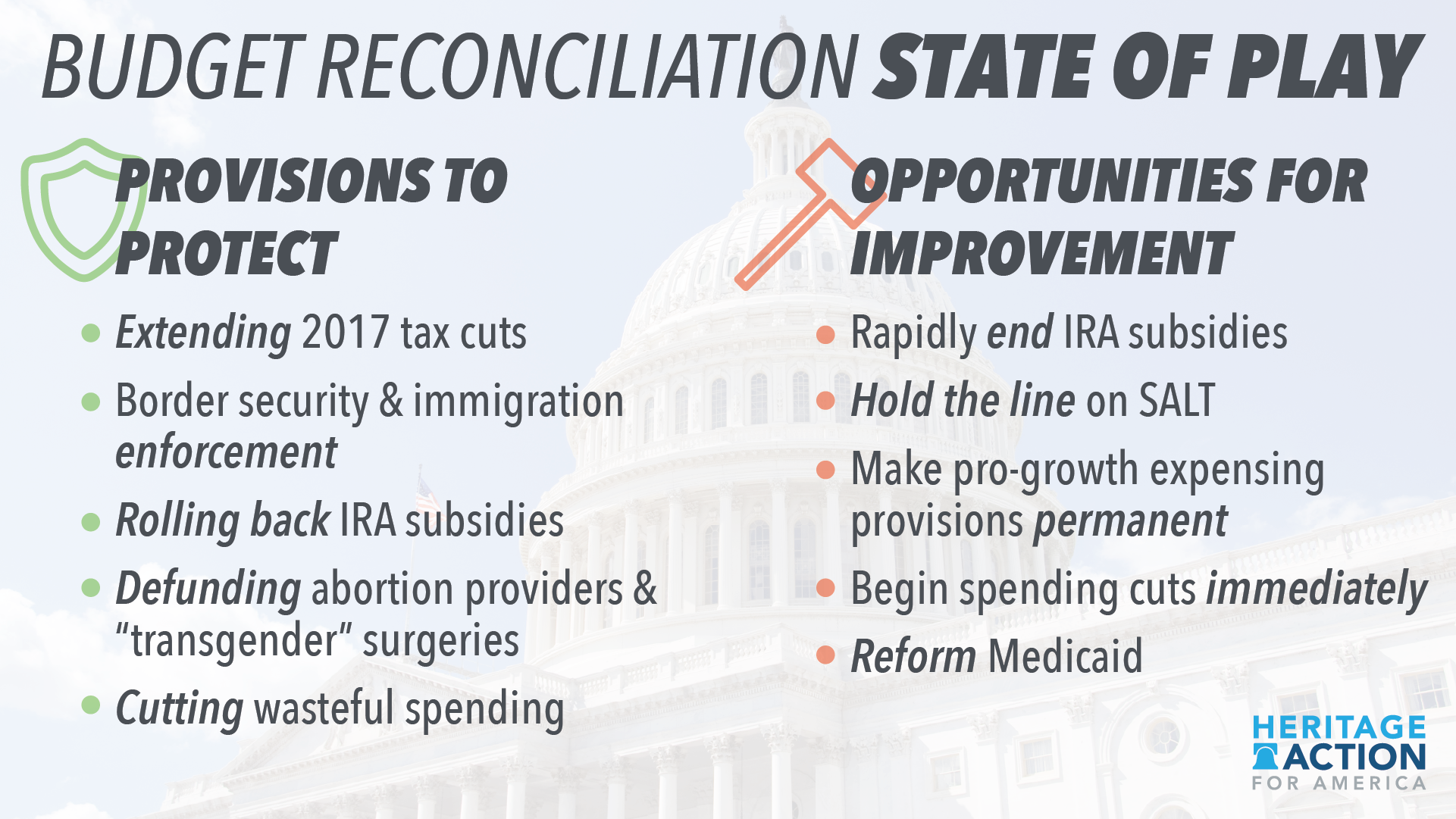

On Monday, the Senate Finance Committee released their text which contains many of the most consequential provisions such as Medicaid and tax cuts. Here are the key takeaways compared to the House-passed version:

-

Makes permanent the expiring individual tax provisions from the 2017 Tax Cuts and Jobs Act (included in both the House and Senate versions)

-

Improves on the Medicaid reforms from the House-passed bill

-

Makes permanent key expiring business expensing provisions for equipment and machinery, R&D, and the business interest limitation (the House version would allow them to expire after 2029)

-

Allows full expensing for factories and other structures used in the production or refinement of goods for structures placed in service by the end of 2030 (the House version would expire after 2029)

-

Reduces the provider tax to 3.5% over 5 years (the House version locks in the provider tax at 6%)

-

Strengthens work requirements for Medicaid (included in both the House and Senate versions)

-

Includes a placeholder for the SALT deduction, as negotiations continue (the House version would quadruple the SALT cap to $40,000)

-

Increases the child tax credit from $2,000 ($1,000 if TCJA expired) to $2,200 and adds annual cost-of-living adjustments thereafter (the House bill would increase the credit to $2,400 through 2028 but would revert to a lower $2,000 credit with cost-of-living adjustments thereafter)

-

Phases out tax credits for wind and solar companies more gradually than the House version of the bill

Over the weekend and into next week, the Senate bill will go through what’s known as a “Byrd bath” where the Senate parliamentarian will consider procedural arguments from Republicans and Democrats in closed door meetings in order to advise whether certain provisions comply with the Byrd Rule. A provision may violate the Byrd Rule if it:

-

Does not produce a change in outlays or revenues

-

Produces an outlay increase or revenue decrease when the instructed committee is not in compliance with its instructions

-

Is outside of the jurisdiction of the committee that submitted the title or provision for inclusion in the reconciliation measure

-

Produces a change in outlays or revenues which is merely incidental to the non-budgetary components of the provision

-

Would increase the deficit for a fiscal year beyond the “budget window” covered by the reconciliation measure

-

Recommends changes in Social Security.

After the “Byrd bath,” the Senate is expected to begin floor debate on the bill, which ends with a “vote-a-rama.” During a vote-a-rama, senators can force votes on an unlimited number of amendments. Following the vote-a-rama, the Senate will vote on final passage and send the amended bill back to the House, which can either accept the Senate changes or make further changes, if necessary.

>> Take a moment to urge your Senators to stand with President Trump and put Americans first in OB3. Heritage Action created our reconciliation toolkit to equip both seasoned activists and first timers with the information necessary to make a difference in this fight. Check it out below

>>> Heritage Action Reconciliation Toolkit <<<

.png)