Email

NAFCU-sought CFPB commission bill introduced in Senate

| From | NAFCU Today <[email protected]> |

| Subject | NAFCU-sought CFPB commission bill introduced in Senate |

| Date | June 18, 2020 11:00 AM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

Also: EZ application for PPP loan forgiveness released; FHFA extends moratorium on foreclosures, evictions

NAFCU TODAY | The News You Need Daily.

June 18, 2020

----------

----------

NAFCU-supported CFPB commission bill introduced in Senate [ [link removed] ]

Sen. Deb Fischer, R-Neb., yesterday introduced legislation to reform the CFPB's structure from a single director to a bipartisan commission. NAFCU has consistently advocated that the bureau's leadership structure should be reformed to a commission-based model to ensure transparency and stability.

SBA, Treasury release revised PPP forgiveness application, EZ version [ [link removed] ]

The Small Business Administration (SBA), in collaboration with the Treasury Department, Wednesday released a revised, borrower-friendly paycheck protection program (PPP) loan forgiveness application implementing changes made by the recently enacted Paycheck Protection Program Flexibility Act (H.R. 7010).

Moratorium on GSEs' foreclosures, evictions extended through August [ [link removed] ]

The Federal Housing Finance Agency (FHFA) has further extended its moratorium on foreclosures and evictions for government-sponsored enterprise (GSE)-backed single-family mortgages. The moratorium aims to support those borrowers who are at risk of losing their homes as a result of the coronavirus pandemic.

NCUA directs CUs to resources on BSA/AML, remittances, business lending [ [link removed] ]

The NCUA Wednesday notified credit unions of resources available to help institutions understand recent regulatory and supervisory changes and new programs to help businesses weather the coronavirus pandemic.

NAFCU highlights CFPB's proposed rule to ease LIBOR transition, requests CU feedback [ [link removed] ]

The CFPB earlier this month released a notice of proposed rulemaking in an effort to ease the transition away from the London Inter-bank Offered Rate (LIBOR) for consumers and regulated entities. In a new Regulatory Alert, NAFCU highlights key aspects of the rule that could impact credit unions and seeks feedback from members.

NAFCU's Online Training Center set for upgrades [ [link removed] ]

NAFCU's Online Training Center is getting a makeover with updates to give credit unions easier access to new content and improve the overall user experience. To transition to the new platform, the Online Training Center will not be accessible June 22-23.

----------

----------

----------

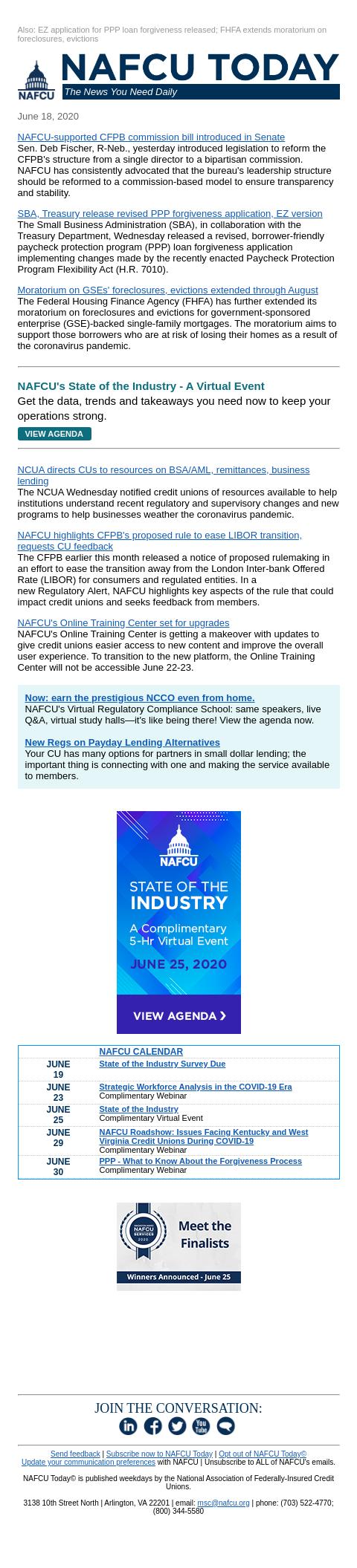

NAFCU Calendar: [link removed]

----------

--------------------------------------------

JOIN THE CONVERSATION:

LINKEDIN: [link removed]

FACEBOOK: [link removed]

TWITTER: [link removed]

YOUTUBE: [link removed]

BLOGS: [link removed] ]

---------------------------------------------

Send feedback [ mailto:[email protected] ]

Subscribe now to NAFCU Today [ [link removed] ]

Opt out of NAFCU Today? [ [link removed] ]

Update your communication preferences [ [link removed] ]

Unsubscribe to ALL of NAFCU's emails. [ [link removed] ]

NAFCU Today? is published weekdays by the National Association of Federal Credit Unions.

3138 10th Street North | Arlington, VA 22201 | email: [email protected] [ mailto:[email protected] ] | phone: (703) 522-4770; (800) 344-5580

?

Powered by Higher Logic [link removed]

NAFCU TODAY | The News You Need Daily.

June 18, 2020

----------

----------

NAFCU-supported CFPB commission bill introduced in Senate [ [link removed] ]

Sen. Deb Fischer, R-Neb., yesterday introduced legislation to reform the CFPB's structure from a single director to a bipartisan commission. NAFCU has consistently advocated that the bureau's leadership structure should be reformed to a commission-based model to ensure transparency and stability.

SBA, Treasury release revised PPP forgiveness application, EZ version [ [link removed] ]

The Small Business Administration (SBA), in collaboration with the Treasury Department, Wednesday released a revised, borrower-friendly paycheck protection program (PPP) loan forgiveness application implementing changes made by the recently enacted Paycheck Protection Program Flexibility Act (H.R. 7010).

Moratorium on GSEs' foreclosures, evictions extended through August [ [link removed] ]

The Federal Housing Finance Agency (FHFA) has further extended its moratorium on foreclosures and evictions for government-sponsored enterprise (GSE)-backed single-family mortgages. The moratorium aims to support those borrowers who are at risk of losing their homes as a result of the coronavirus pandemic.

NCUA directs CUs to resources on BSA/AML, remittances, business lending [ [link removed] ]

The NCUA Wednesday notified credit unions of resources available to help institutions understand recent regulatory and supervisory changes and new programs to help businesses weather the coronavirus pandemic.

NAFCU highlights CFPB's proposed rule to ease LIBOR transition, requests CU feedback [ [link removed] ]

The CFPB earlier this month released a notice of proposed rulemaking in an effort to ease the transition away from the London Inter-bank Offered Rate (LIBOR) for consumers and regulated entities. In a new Regulatory Alert, NAFCU highlights key aspects of the rule that could impact credit unions and seeks feedback from members.

NAFCU's Online Training Center set for upgrades [ [link removed] ]

NAFCU's Online Training Center is getting a makeover with updates to give credit unions easier access to new content and improve the overall user experience. To transition to the new platform, the Online Training Center will not be accessible June 22-23.

----------

----------

----------

NAFCU Calendar: [link removed]

----------

--------------------------------------------

JOIN THE CONVERSATION:

LINKEDIN: [link removed]

FACEBOOK: [link removed]

TWITTER: [link removed]

YOUTUBE: [link removed]

BLOGS: [link removed] ]

---------------------------------------------

Send feedback [ mailto:[email protected] ]

Subscribe now to NAFCU Today [ [link removed] ]

Opt out of NAFCU Today? [ [link removed] ]

Update your communication preferences [ [link removed] ]

Unsubscribe to ALL of NAFCU's emails. [ [link removed] ]

NAFCU Today? is published weekdays by the National Association of Federal Credit Unions.

3138 10th Street North | Arlington, VA 22201 | email: [email protected] [ mailto:[email protected] ] | phone: (703) 522-4770; (800) 344-5580

?

Powered by Higher Logic [link removed]

Message Analysis

- Sender: National Association of Federally-Insured Credit Unions

- Political Party: n/a

- Country: United States

- State/Locality: n/a

- Office: n/a