| From | Internal Revenue Service (IRS) <[email protected]> |

| Subject | e-News for Tax Professionals 2025-23 |

| Date | June 6, 2025 5:57 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

Bookmark and Share [ [link removed] ]

a { color:#0073AF !important;} a:hover { color:#004673 !important;} &amp;amp;amp;amp;amp;amp;lt;!-- body { font-family: arial; } p { font-size: 12px; } li { font-size: 12px; } h2 { font-size: 24px; font-style: italic;} --&amp;amp;amp;amp;amp;amp;gt;

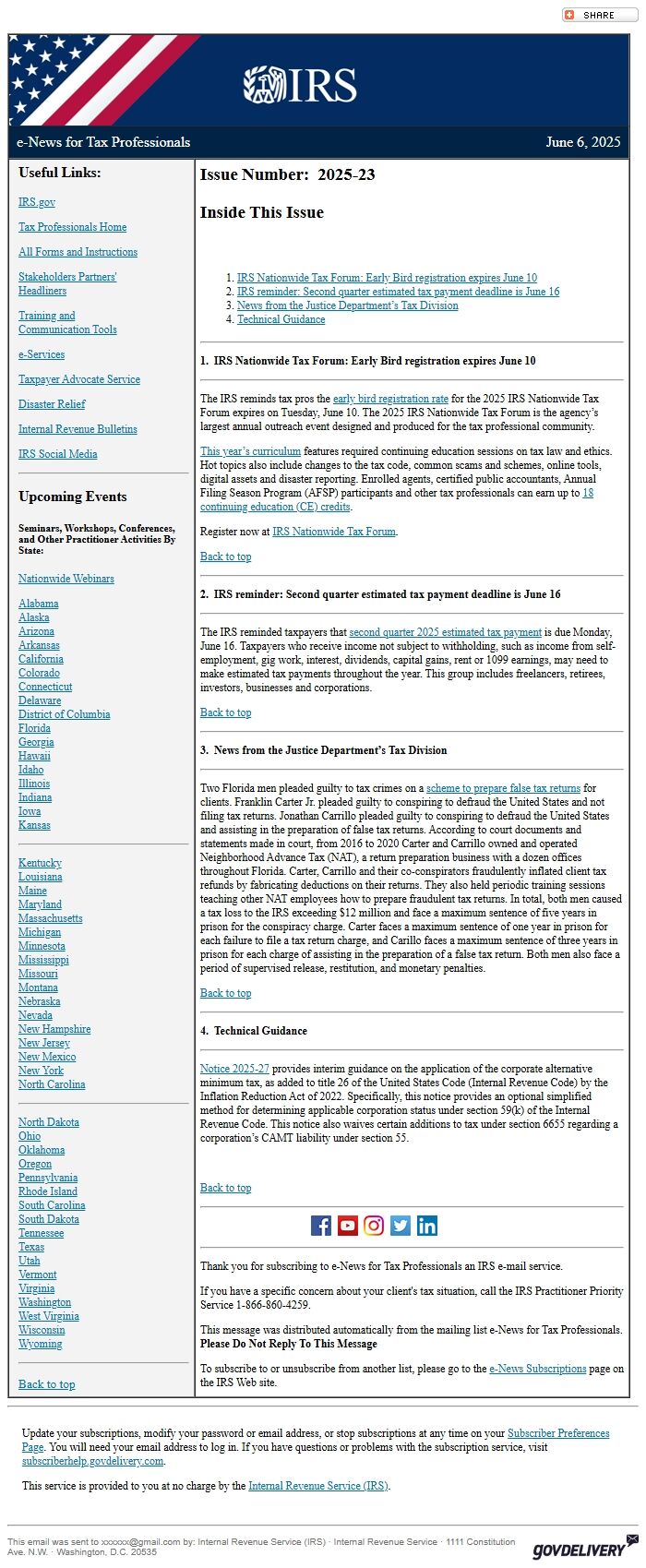

IRS.gov Banner

e-News for Tax Professionals June 6, 2025

Useful Links:

IRS.gov [ [link removed] ]

Tax Professionals Home [ [link removed] ]

All Forms and Instructions [ [link removed] ]

Stakeholders Partners' [ [link removed] ]

Headliners [ [link removed] ]

Training and [ [link removed] ]

Communication Tools [ [link removed] ]

e-Services [ [link removed] ]

Taxpayer Advocate Service [ [link removed] ]

Disaster Relief [ [link removed] ]

Internal Revenue Bulletins [ [link removed] ]

IRS Social Media [ [link removed] ]

________________________________________________________________________

Upcoming Events

Seminars, Workshops, Conferences, and Other Practitioner Activities By State:

Nationwide Webinars [ [link removed] ]

Alabama [ [link removed] ]

Alaska [ [link removed] ]

Arizona [ [link removed] ]

Arkansas [ [link removed] ]

California [ [link removed] ]

Colorado [ [link removed] ]

Connecticut [ [link removed] ]

Delaware [ [link removed] ]

District of Columbia [ [link removed] ]

Florida [ [link removed] ]

Georgia [ [link removed] ]

Hawaii [ [link removed] ]

Idaho [ [link removed] ]

Illinois [ [link removed] ]

Indiana [ [link removed] ]

Iowa [ [link removed] ]

Kansas [ [link removed] ]

________________________________________________________________________

Kentucky [ [link removed] ]

Louisiana [ [link removed] ]

Maine [ [link removed] ]

Maryland [ [link removed] ]

Massachusetts [ [link removed] ]

Michigan [ [link removed] ]

Minnesota [ [link removed] ]

Mississippi [ [link removed] ]

Missouri [ [link removed] ]

Montana [ [link removed] ]

Nebraska [ [link removed] ]

Nevada [ [link removed] ]

New Hampshire [ [link removed] ]

New Jersey [ [link removed] ]

New Mexico [ [link removed] ]

New York [ [link removed] ]

North Carolina [ [link removed] ]

________________________________________________________________________

North Dakota [ [link removed] ]

Ohio [ [link removed] ]

Oklahoma [ [link removed] ]

Oregon [ [link removed] ]

Pennsylvania [ [link removed] ]

Rhode Island [ [link removed] ]

South Carolina [ [link removed] ]

South Dakota [ [link removed] ]

Tennessee [ [link removed] ]

Texas [ [link removed] ]

Utah [ [link removed] ]

Vermont [ [link removed] ]

Virginia [ [link removed] ]

Washington [ [link removed] ]

West Virginia [ [link removed] ]

Wisconsin [ [link removed] ]

Wyoming [ [link removed] ]

________________________________________________________________________

Back to top [ #top ]

Issue Number: 2025-23

Inside This Issue

* IRS Nationwide Tax Forum: Early Bird registration expires June 10 [ #First ]

* IRS reminder: Second quarter estimated tax payment deadline is June 16 [ #Second ]

* News from the Justice Department’s Tax Division [ #Third ]

* Technical Guidance [ #Fourth ] [ #Fourteenth ]

________________________________________________________________________

*1. IRS Nationwide Tax Forum: Early Bird registration expires June 10*

________________________________________________________________________

The IRS reminds tax pros the early bird registration rate [ [link removed] ] for the 2025 IRS Nationwide Tax Forum expires on Tuesday, June 10. The 2025 IRS Nationwide Tax Forum is the agency’s largest annual outreach event designed and produced for the tax professional community.

This year’s curriculum [ [link removed] ] features required continuing education sessions on tax law and ethics. Hot topics also include changes to the tax code, common scams and schemes, online tools, digital assets and disaster reporting. Enrolled agents, certified public accountants, Annual Filing Season Program (AFSP) participants and other tax professionals can earn up to 18 continuing education (CE) credits [ [link removed] ].

Register now at IRS Nationwide Tax Forum [ [link removed] ].

Back to top [ #top ]

________________________________________________________________________

*2. IRS reminder: Second quarter estimated tax payment deadline is June 16*

________________________________________________________________________

The IRS reminded taxpayers that second quarter 2025 estimated tax payment [ [link removed] ] is due Monday, June 16. Taxpayers who receive income not subject to withholding, such as income from self-employment, gig work, interest, dividends, capital gains, rent or 1099 earnings, may need to make estimated tax payments throughout the year. This group includes freelancers, retirees, investors, businesses and corporations.

Back to top [ #top ]

________________________________________________________________________

*3. News from the Justice Department’s Tax Division*

________________________________________________________________________

Two Florida men pleaded guilty to tax crimes on a scheme to prepare false tax returns [ [link removed] ] for clients. Franklin Carter Jr. pleaded guilty to conspiring to defraud the United States and not filing tax returns. Jonathan Carrillo pleaded guilty to conspiring to defraud the United States and assisting in the preparation of false tax returns. According to court documents and statements made in court, from 2016 to 2020 Carter and Carrillo owned and operated Neighborhood Advance Tax (NAT), a return preparation business with a dozen offices throughout Florida. Carter, Carrillo and their co-conspirators fraudulently inflated client tax refunds by fabricating deductions on their returns. They also held periodic training sessions teaching other NAT employees how to prepare fraudulent tax returns. In total, both men caused a tax loss to the IRS exceeding $12 million and face a maximum sentence of five years in prison for the conspiracy charge. Carter faces a maximum sentence of one year in prison for each failure to file a tax return charge, and Carillo faces a maximum sentence of three years in prison for each charge of assisting in the preparation of a false tax return. Both men also face a period of supervised release, restitution, and monetary penalties.

Back to top [ #top ]

________________________________________________________________________

*4. Technical Guidance*

________________________________________________________________________

Notice 2025-27 [ [link removed] ] provides interim guidance on the application of the corporate alternative minimum tax, as added to title 26 of the United States Code (Internal Revenue Code) by the Inflation Reduction Act of 2022. Specifically, this notice provides an optional simplified method for determining applicable corporation status under section 59(k) of the Internal Revenue Code. This notice also waives certain additions to tax under section 6655 regarding a corporation’s CAMT liability under section 55.

Back to top [ #top ]

________________________________________________________________________

FaceBook Logo [ [link removed] ] YouTube Logo [ [link removed] ] Instagram Logo [ [link removed] ] Twitter Logo [ [link removed] ] LinkedIn Logo [ [link removed] ]________________________________________________________________________

Thank you for subscribing to e-News for Tax Professionals an IRS e-mail service.

If you have a specific concern about your client's tax situation, call the IRS Practitioner Priority Service 1-866-860-4259.

This message was distributed automatically from the mailing list e-News for Tax Professionals. *Please Do Not Reply To This Message *

To subscribe to or unsubscribe from another list, please go to the e-News Subscriptions [ [link removed] ] page on the IRS Web site.

________________________________________________________________________

Update your subscriptions, modify your password or email address, or stop subscriptions at any time on your Subscriber Preferences Page [ [link removed] ]. You will need your email address to log in. If you have questions or problems with the subscription service, visit subscriberhelp.govdelivery.com [ [link removed] ].

This service is provided to you at no charge by the Internal Revenue Service (IRS) [ [link removed] ].

body .abe-column-block {min-height: 5px;} ________________________________________________________________________

This email was sent to [email protected] by: Internal Revenue Service (IRS) · Internal Revenue Service · 1111 Constitution Ave. N.W. · Washington, D.C. 20535 GovDelivery logo [ [link removed] ]

body .abe-column-block { min-height: 5px; } table.gd_combo_table img {margin-left:10px; margin-right:10px;} table.gd_combo_table div.govd_image_display img, table.gd_combo_table td.gd_combo_image_cell img {margin-left:0px; margin-right:0px;}

a { color:#0073AF !important;} a:hover { color:#004673 !important;} &amp;amp;amp;amp;amp;amp;lt;!-- body { font-family: arial; } p { font-size: 12px; } li { font-size: 12px; } h2 { font-size: 24px; font-style: italic;} --&amp;amp;amp;amp;amp;amp;gt;

IRS.gov Banner

e-News for Tax Professionals June 6, 2025

Useful Links:

IRS.gov [ [link removed] ]

Tax Professionals Home [ [link removed] ]

All Forms and Instructions [ [link removed] ]

Stakeholders Partners' [ [link removed] ]

Headliners [ [link removed] ]

Training and [ [link removed] ]

Communication Tools [ [link removed] ]

e-Services [ [link removed] ]

Taxpayer Advocate Service [ [link removed] ]

Disaster Relief [ [link removed] ]

Internal Revenue Bulletins [ [link removed] ]

IRS Social Media [ [link removed] ]

________________________________________________________________________

Upcoming Events

Seminars, Workshops, Conferences, and Other Practitioner Activities By State:

Nationwide Webinars [ [link removed] ]

Alabama [ [link removed] ]

Alaska [ [link removed] ]

Arizona [ [link removed] ]

Arkansas [ [link removed] ]

California [ [link removed] ]

Colorado [ [link removed] ]

Connecticut [ [link removed] ]

Delaware [ [link removed] ]

District of Columbia [ [link removed] ]

Florida [ [link removed] ]

Georgia [ [link removed] ]

Hawaii [ [link removed] ]

Idaho [ [link removed] ]

Illinois [ [link removed] ]

Indiana [ [link removed] ]

Iowa [ [link removed] ]

Kansas [ [link removed] ]

________________________________________________________________________

Kentucky [ [link removed] ]

Louisiana [ [link removed] ]

Maine [ [link removed] ]

Maryland [ [link removed] ]

Massachusetts [ [link removed] ]

Michigan [ [link removed] ]

Minnesota [ [link removed] ]

Mississippi [ [link removed] ]

Missouri [ [link removed] ]

Montana [ [link removed] ]

Nebraska [ [link removed] ]

Nevada [ [link removed] ]

New Hampshire [ [link removed] ]

New Jersey [ [link removed] ]

New Mexico [ [link removed] ]

New York [ [link removed] ]

North Carolina [ [link removed] ]

________________________________________________________________________

North Dakota [ [link removed] ]

Ohio [ [link removed] ]

Oklahoma [ [link removed] ]

Oregon [ [link removed] ]

Pennsylvania [ [link removed] ]

Rhode Island [ [link removed] ]

South Carolina [ [link removed] ]

South Dakota [ [link removed] ]

Tennessee [ [link removed] ]

Texas [ [link removed] ]

Utah [ [link removed] ]

Vermont [ [link removed] ]

Virginia [ [link removed] ]

Washington [ [link removed] ]

West Virginia [ [link removed] ]

Wisconsin [ [link removed] ]

Wyoming [ [link removed] ]

________________________________________________________________________

Back to top [ #top ]

Issue Number: 2025-23

Inside This Issue

* IRS Nationwide Tax Forum: Early Bird registration expires June 10 [ #First ]

* IRS reminder: Second quarter estimated tax payment deadline is June 16 [ #Second ]

* News from the Justice Department’s Tax Division [ #Third ]

* Technical Guidance [ #Fourth ] [ #Fourteenth ]

________________________________________________________________________

*1. IRS Nationwide Tax Forum: Early Bird registration expires June 10*

________________________________________________________________________

The IRS reminds tax pros the early bird registration rate [ [link removed] ] for the 2025 IRS Nationwide Tax Forum expires on Tuesday, June 10. The 2025 IRS Nationwide Tax Forum is the agency’s largest annual outreach event designed and produced for the tax professional community.

This year’s curriculum [ [link removed] ] features required continuing education sessions on tax law and ethics. Hot topics also include changes to the tax code, common scams and schemes, online tools, digital assets and disaster reporting. Enrolled agents, certified public accountants, Annual Filing Season Program (AFSP) participants and other tax professionals can earn up to 18 continuing education (CE) credits [ [link removed] ].

Register now at IRS Nationwide Tax Forum [ [link removed] ].

Back to top [ #top ]

________________________________________________________________________

*2. IRS reminder: Second quarter estimated tax payment deadline is June 16*

________________________________________________________________________

The IRS reminded taxpayers that second quarter 2025 estimated tax payment [ [link removed] ] is due Monday, June 16. Taxpayers who receive income not subject to withholding, such as income from self-employment, gig work, interest, dividends, capital gains, rent or 1099 earnings, may need to make estimated tax payments throughout the year. This group includes freelancers, retirees, investors, businesses and corporations.

Back to top [ #top ]

________________________________________________________________________

*3. News from the Justice Department’s Tax Division*

________________________________________________________________________

Two Florida men pleaded guilty to tax crimes on a scheme to prepare false tax returns [ [link removed] ] for clients. Franklin Carter Jr. pleaded guilty to conspiring to defraud the United States and not filing tax returns. Jonathan Carrillo pleaded guilty to conspiring to defraud the United States and assisting in the preparation of false tax returns. According to court documents and statements made in court, from 2016 to 2020 Carter and Carrillo owned and operated Neighborhood Advance Tax (NAT), a return preparation business with a dozen offices throughout Florida. Carter, Carrillo and their co-conspirators fraudulently inflated client tax refunds by fabricating deductions on their returns. They also held periodic training sessions teaching other NAT employees how to prepare fraudulent tax returns. In total, both men caused a tax loss to the IRS exceeding $12 million and face a maximum sentence of five years in prison for the conspiracy charge. Carter faces a maximum sentence of one year in prison for each failure to file a tax return charge, and Carillo faces a maximum sentence of three years in prison for each charge of assisting in the preparation of a false tax return. Both men also face a period of supervised release, restitution, and monetary penalties.

Back to top [ #top ]

________________________________________________________________________

*4. Technical Guidance*

________________________________________________________________________

Notice 2025-27 [ [link removed] ] provides interim guidance on the application of the corporate alternative minimum tax, as added to title 26 of the United States Code (Internal Revenue Code) by the Inflation Reduction Act of 2022. Specifically, this notice provides an optional simplified method for determining applicable corporation status under section 59(k) of the Internal Revenue Code. This notice also waives certain additions to tax under section 6655 regarding a corporation’s CAMT liability under section 55.

Back to top [ #top ]

________________________________________________________________________

FaceBook Logo [ [link removed] ] YouTube Logo [ [link removed] ] Instagram Logo [ [link removed] ] Twitter Logo [ [link removed] ] LinkedIn Logo [ [link removed] ]________________________________________________________________________

Thank you for subscribing to e-News for Tax Professionals an IRS e-mail service.

If you have a specific concern about your client's tax situation, call the IRS Practitioner Priority Service 1-866-860-4259.

This message was distributed automatically from the mailing list e-News for Tax Professionals. *Please Do Not Reply To This Message *

To subscribe to or unsubscribe from another list, please go to the e-News Subscriptions [ [link removed] ] page on the IRS Web site.

________________________________________________________________________

Update your subscriptions, modify your password or email address, or stop subscriptions at any time on your Subscriber Preferences Page [ [link removed] ]. You will need your email address to log in. If you have questions or problems with the subscription service, visit subscriberhelp.govdelivery.com [ [link removed] ].

This service is provided to you at no charge by the Internal Revenue Service (IRS) [ [link removed] ].

body .abe-column-block {min-height: 5px;} ________________________________________________________________________

This email was sent to [email protected] by: Internal Revenue Service (IRS) · Internal Revenue Service · 1111 Constitution Ave. N.W. · Washington, D.C. 20535 GovDelivery logo [ [link removed] ]

body .abe-column-block { min-height: 5px; } table.gd_combo_table img {margin-left:10px; margin-right:10px;} table.gd_combo_table div.govd_image_display img, table.gd_combo_table td.gd_combo_image_cell img {margin-left:0px; margin-right:0px;}

Message Analysis

- Sender: Internal Revenue Service

- Political Party: n/a

- Country: United States

- State/Locality: n/a

- Office: n/a

-

Email Providers:

- govDelivery