| From | Global Alliance for Tax Justice <[email protected]> |

| Subject | GATJ News 🌍 June 2025 |

| Date | June 5, 2025 3:32 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

[link removed]

June Newsletter

[link removed]

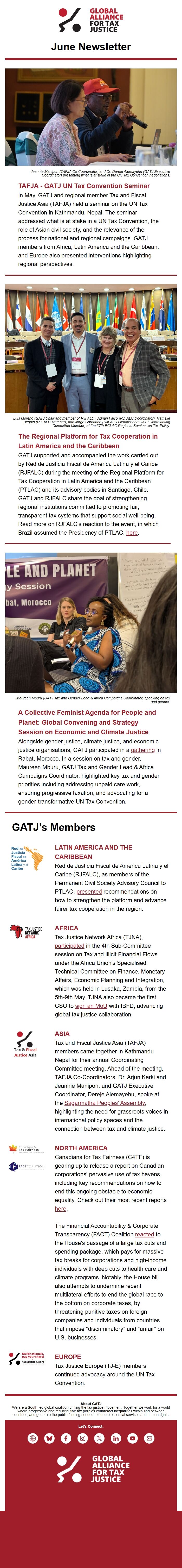

Jeannie Manipon (TAFJA Co-Coordinator) and Dr. Dereje Alemayehu (GATJ Executive Coordinator) presenting what is at stake in the UN Tax Convention negotiations.

TAFJA - GATJ UN Tax Convention Seminar

In May, GATJ and regional member Tax and Fiscal Justice Asia (TAFJA) held a seminar on the UN Tax Convention in Kathmandu, Nepal. The seminar addressed what is at stake in a UN Tax Convention, the role of Asian civil society, and the relevance of the process for national and regional campaigns. GATJ members from Africa, Latin America and the Caribbean, and Europe also presented interventions highlighting regional perspectives.

[link removed]

Luis Moreno (GATJ Chair and member of RJFALC), Adrián Falco (RJFALC Coordinator), Nathalie Beghin (RJFALC Member), and Jorge Coronado (RJFALC Member and GATJ Coordinating Committee Member) at the 37th ECLAC Regional Seminar on Tax Policy.

The Regional Platform for Tax Cooperation in Latin America and the Caribbean

GATJ supported and accompanied the work carried out by Red de Justicia Fiscal de América Latina y el Caribe (RJFALC) during the meeting of the Regional Platform for Tax Cooperation in Latin America and the Caribbean (PTLAC) and its advisory bodies in Santiago, Chile. GATJ and RJFALC share the goal of strengthening regional institutions committed to promoting fair, transparent tax systems that support social well-being. Read more on RJFALC’s reaction to the event, in which Brazil assumed the Presidency of PTLAC, here ([link removed]) .

[link removed]

Maureen Mburu (GATJ Tax and Gender Lead & Africa Campaigns Coordinator) speaking on tax and gender.

A Collective Feminist Agenda for People and Planet: Global Convening and Strategy Session on Economic and Climate Justice

Alongside gender justice, climate justice, and economic justice organisations, GATJ participated in a gatherin ([link removed]) g in Rabat, Morocco. In a session on tax and gender, Maureen Mburu, GATJ Tax and Gender Lead & Africa Campaigns Coordinator, highlighted key tax and gender priorities including addressing unpaid care work, ensuring progressive taxation, and advocating for a gender-transformative UN Tax Convention.

** GATJ’s Members

------------------------------------------------------------

[link removed]

LATIN AMERICA AND THE CARIBBEAN

Red de Justicia Fiscal de América Latina y el Caribe (RJFALC), as members of the Permanent Civil Society Advisory Council to PTLAC, presented ([link removed]) recommendations on how to strengthen the platform and advance fairer tax cooperation in the region.

AFRICA

Tax Justice Network Africa (TJNA), participated ([link removed]) in the 4th Sub-Committee session on Tax and Illicit Financial Flows under the Africa Union's Specialised Technical Committee on Finance, Monetary Affairs, Economic Planning and Integration, which was held in Lusaka, Zambia, from the 5th-9th May. TJNA also became the first CSO to sign an MoU ([link removed]) with IBFD, advancing global tax justice collaboration.

ASIA

Tax and Fiscal Justice Asia (TAFJA) members came together in Kathmandu Nepal for their annual Coordinating Committee meeting. Ahead of the meeting, TAFJA Co-Coordinators, Dr. Arjun Karki and Jeannie Manipon, and GATJ Executive Coordinator, Dereje Alemayehu, spoke at the Sagarmatha Peoples' Assembly ([link removed]) , highlighting the need for grassroots voices in international policy spaces and the connection between tax and climate justice.

[link removed]

NORTH AMERICA

Canadians for Tax Fairness (C4TF) is gearing up to release a report on Canadian corporations' pervasive use of tax havens, including key recommendations on how to end this ongoing obstacle to economic equality. Check out their most recent reports here ([link removed]) .

The Financial Accountability & Corporate Transparency (FACT) Coalition reacted ([link removed]) to the House's passage of a large tax cuts and spending package, which pays for massive tax breaks for corporations and high-income individuals with deep cuts to health care and climate programs. Notably, the House bill also attempts to undermine recent multilateral efforts to end the global race to the bottom on corporate taxes, by threatening punitive taxes on foreign companies and individuals from countries that impose “discriminatory” and “unfair” on U.S. businesses.

EUROPE

Tax Justice Europe (TJ-E) members continued advocacy around the UN Tax Convention.

About GATJ

We are a South-led global coalition uniting the tax justice movement. Together we work for a world where progressive and redistributive tax policies counteract inequalities within and between countries, and generate the public funding needed to ensure essential services and human rights.

Let’s Connect:

[link removed]

[link removed]

[link removed]

[link removed]

[link removed]

[link removed]

[link removed]

mailto:[email protected]

[link removed]

This email was sent to [email protected] (mailto:[email protected])

why did I get this? ([link removed]) unsubscribe from this list ([link removed]) update subscription preferences ([link removed])

Global Alliance for Tax Justice . Avenue du Parc Royal, 3 . Bruxelles 1020 . Belgium

June Newsletter

[link removed]

Jeannie Manipon (TAFJA Co-Coordinator) and Dr. Dereje Alemayehu (GATJ Executive Coordinator) presenting what is at stake in the UN Tax Convention negotiations.

TAFJA - GATJ UN Tax Convention Seminar

In May, GATJ and regional member Tax and Fiscal Justice Asia (TAFJA) held a seminar on the UN Tax Convention in Kathmandu, Nepal. The seminar addressed what is at stake in a UN Tax Convention, the role of Asian civil society, and the relevance of the process for national and regional campaigns. GATJ members from Africa, Latin America and the Caribbean, and Europe also presented interventions highlighting regional perspectives.

[link removed]

Luis Moreno (GATJ Chair and member of RJFALC), Adrián Falco (RJFALC Coordinator), Nathalie Beghin (RJFALC Member), and Jorge Coronado (RJFALC Member and GATJ Coordinating Committee Member) at the 37th ECLAC Regional Seminar on Tax Policy.

The Regional Platform for Tax Cooperation in Latin America and the Caribbean

GATJ supported and accompanied the work carried out by Red de Justicia Fiscal de América Latina y el Caribe (RJFALC) during the meeting of the Regional Platform for Tax Cooperation in Latin America and the Caribbean (PTLAC) and its advisory bodies in Santiago, Chile. GATJ and RJFALC share the goal of strengthening regional institutions committed to promoting fair, transparent tax systems that support social well-being. Read more on RJFALC’s reaction to the event, in which Brazil assumed the Presidency of PTLAC, here ([link removed]) .

[link removed]

Maureen Mburu (GATJ Tax and Gender Lead & Africa Campaigns Coordinator) speaking on tax and gender.

A Collective Feminist Agenda for People and Planet: Global Convening and Strategy Session on Economic and Climate Justice

Alongside gender justice, climate justice, and economic justice organisations, GATJ participated in a gatherin ([link removed]) g in Rabat, Morocco. In a session on tax and gender, Maureen Mburu, GATJ Tax and Gender Lead & Africa Campaigns Coordinator, highlighted key tax and gender priorities including addressing unpaid care work, ensuring progressive taxation, and advocating for a gender-transformative UN Tax Convention.

** GATJ’s Members

------------------------------------------------------------

[link removed]

LATIN AMERICA AND THE CARIBBEAN

Red de Justicia Fiscal de América Latina y el Caribe (RJFALC), as members of the Permanent Civil Society Advisory Council to PTLAC, presented ([link removed]) recommendations on how to strengthen the platform and advance fairer tax cooperation in the region.

AFRICA

Tax Justice Network Africa (TJNA), participated ([link removed]) in the 4th Sub-Committee session on Tax and Illicit Financial Flows under the Africa Union's Specialised Technical Committee on Finance, Monetary Affairs, Economic Planning and Integration, which was held in Lusaka, Zambia, from the 5th-9th May. TJNA also became the first CSO to sign an MoU ([link removed]) with IBFD, advancing global tax justice collaboration.

ASIA

Tax and Fiscal Justice Asia (TAFJA) members came together in Kathmandu Nepal for their annual Coordinating Committee meeting. Ahead of the meeting, TAFJA Co-Coordinators, Dr. Arjun Karki and Jeannie Manipon, and GATJ Executive Coordinator, Dereje Alemayehu, spoke at the Sagarmatha Peoples' Assembly ([link removed]) , highlighting the need for grassroots voices in international policy spaces and the connection between tax and climate justice.

[link removed]

NORTH AMERICA

Canadians for Tax Fairness (C4TF) is gearing up to release a report on Canadian corporations' pervasive use of tax havens, including key recommendations on how to end this ongoing obstacle to economic equality. Check out their most recent reports here ([link removed]) .

The Financial Accountability & Corporate Transparency (FACT) Coalition reacted ([link removed]) to the House's passage of a large tax cuts and spending package, which pays for massive tax breaks for corporations and high-income individuals with deep cuts to health care and climate programs. Notably, the House bill also attempts to undermine recent multilateral efforts to end the global race to the bottom on corporate taxes, by threatening punitive taxes on foreign companies and individuals from countries that impose “discriminatory” and “unfair” on U.S. businesses.

EUROPE

Tax Justice Europe (TJ-E) members continued advocacy around the UN Tax Convention.

About GATJ

We are a South-led global coalition uniting the tax justice movement. Together we work for a world where progressive and redistributive tax policies counteract inequalities within and between countries, and generate the public funding needed to ensure essential services and human rights.

Let’s Connect:

[link removed]

[link removed]

[link removed]

[link removed]

[link removed]

[link removed]

[link removed]

mailto:[email protected]

[link removed]

This email was sent to [email protected] (mailto:[email protected])

why did I get this? ([link removed]) unsubscribe from this list ([link removed]) update subscription preferences ([link removed])

Global Alliance for Tax Justice . Avenue du Parc Royal, 3 . Bruxelles 1020 . Belgium

Message Analysis

- Sender: Global Alliance for Tax Justice

- Political Party: n/a

- Country: n/a

- State/Locality: n/a

- Office: n/a

-

Email Providers:

- MailChimp