Email

IR-2025-64: IRS Nationwide Tax Forum early bird registration expires June 10

| From | IRS Newswire <[email protected]> |

| Subject | IR-2025-64: IRS Nationwide Tax Forum early bird registration expires June 10 |

| Date | June 5, 2025 2:08 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

Bookmark and Share [ [link removed] ]

a { color:#0073AF !important;} a:hover { color:#004673 !important;} &lt;!-- body { font-family: arial; } p { font-size: 12px; } li { font-size: 12px; } h2 { font-size: 24px; font-style: italic;} --&gt;

IRS.gov Banner

IRS Newswire June 05, 2025

News Essentials

What's Hot [ [link removed] ]

News Releases [ [link removed] ]

IRS - The Basics [ [link removed] ]

IRS Guidance [ [link removed] ]

Media Contacts [ [link removed] ]

Facts & Figures [ [link removed] ]

Around The Nation [ [link removed] ]

e-News Subscriptions [ [link removed] ]

________________________________________________________________________

The Newsroom Topics

Multimedia Center [ [link removed] ]

Noticias en Español [ [link removed] ]

Radio PSAs [ [link removed] ]

Tax Scams [ [link removed] ]

The Tax Gap [ [link removed] ]

Fact Sheets [ [link removed] ]

IRS Tax Tips [ [link removed] ]

Armed Forces [ [link removed] ]

Latest News Home [ [link removed] ]

________________________________________________________________________

IRS Resources

Contact My Local Office [ [link removed] ]

Filing Options [ [link removed] ]

Forms & Instructions [ [link removed] ]

Frequently Asked Questions [ [link removed] ]

News [ [link removed] ]

Taxpayer Advocate [ [link removed] ]

Where to File [ [link removed] ]

IRS Social Media [ [link removed] ]

________________________________________________________________________

Issue Number: IR-2025-64

Inside This Issue

________________________________________________________________________

*IRS Nationwide Tax Forum early bird registration expires June 10 *

IR-2025-64, June 5, 2025

WASHINGTON — The Internal Revenue Service today reminded tax pros the early bird registration rate for the 2025 IRS Nationwide Tax Forum expires on Tuesday, June 10.

Attendees who act by the June 10 early bird deadline can take advantage of the lowest registration rate of $265 per person. Standard pricing of $319 begins after June 10 and ends two weeks before the start of each forum. On-site registration is also available at a cost of $399.

Members of the following partner associations can save an additional $10 on the early bird rate:

* American Bar Association (ABA)

* American Institute of Certified Public Accountants (AICPA)

* National Association of Enrolled Agents (NAEA)

* National Association of Tax Professionals (NATP)

* National Society of Accountants (NSA)

* National Society of Tax Professionals (NSTP)

Members should contact their association directly for an IRS Nationwide Tax Forum discount code.

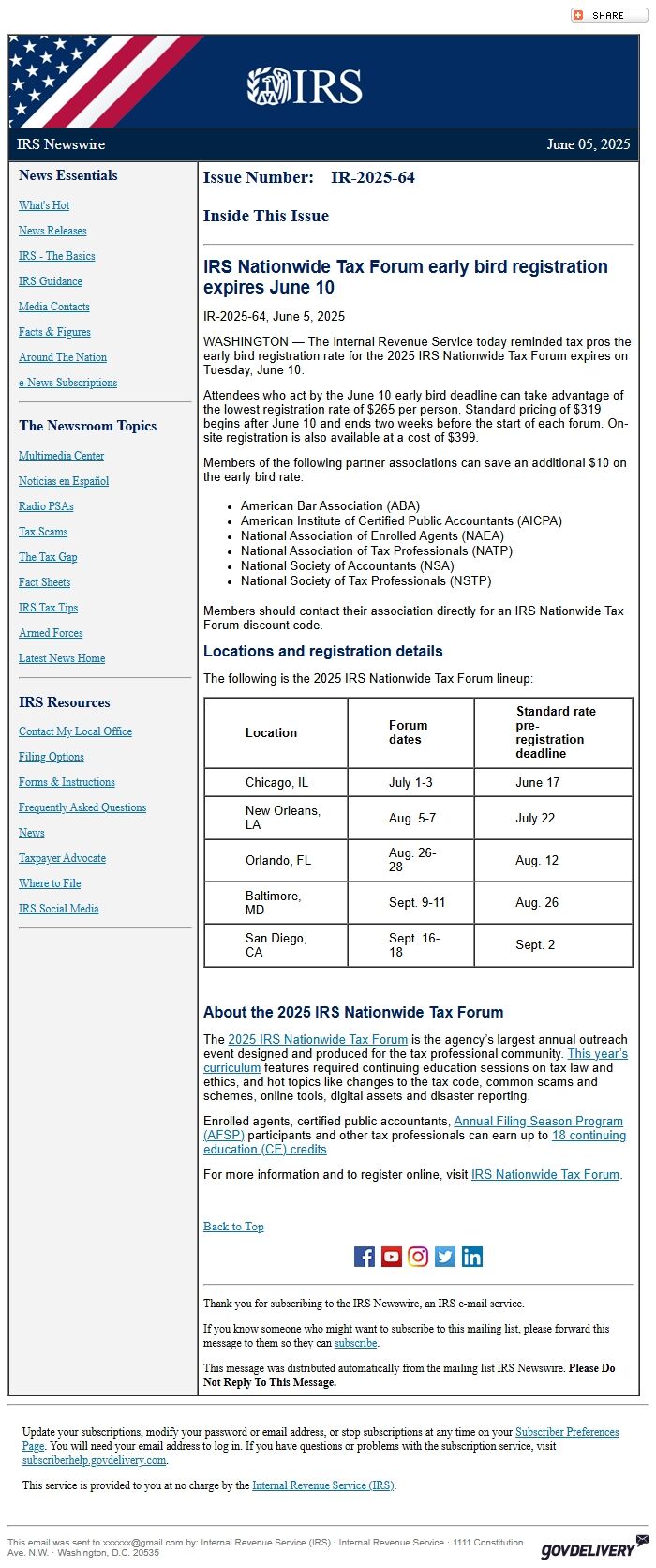

*Locations and registration details***

The following is the 2025 IRS Nationwide Tax Forum lineup:

*Location*

*Forum dates*

*Standard rate pre-registration deadline*

Chicago, IL

July 1-3

June 17

New Orleans, LA

Aug. 5-7

July 22

Orlando, FL

Aug. 26-28

Aug. 12

Baltimore, MD

Sept. 9-11

Aug. 26

San Diego, CA

Sept. 16-18

Sept. 2

*About the 2025 IRS Nationwide Tax Forum*

The 2025 IRS Nationwide Tax Forum [ [link removed] ] is the agency’s largest annual outreach event designed and produced for the tax professional community. This year’s curriculum [ [link removed] ] features required continuing education sessions on tax law and ethics, and hot topics like changes to the tax code, common scams and schemes, online tools, digital assets and disaster reporting.

Enrolled agents, certified public accountants, Annual Filing Season Program (AFSP) [ [link removed] ] participants and other tax professionals can earn up to 18 continuing education (CE) credits [ [link removed] ].

For more information and to register online, visit IRS Nationwide Tax Forum [ [link removed] ].

Back to Top [ #Fifteenth ]

FaceBook Logo [ [link removed] ] YouTube Logo [ [link removed] ] Instagram Logo [ [link removed] ] Twitter Logo [ [link removed] ] LinkedIn Logo [ [link removed] ]

________________________________________________________________________

Thank you for subscribing to the IRS Newswire, an IRS e-mail service.

If you know someone who might want to subscribe to this mailing list, please forward this message to them so they can subscribe [ [link removed] ].

This message was distributed automatically from the mailing list IRS Newswire. *Please Do Not Reply To This Message.*

________________________________________________________________________

Update your subscriptions, modify your password or email address, or stop subscriptions at any time on your Subscriber Preferences Page [ [link removed] ]. You will need your email address to log in. If you have questions or problems with the subscription service, visit subscriberhelp.govdelivery.com [ [link removed] ].

This service is provided to you at no charge by the Internal Revenue Service (IRS) [ [link removed] ].

body .abe-column-block {min-height: 5px;} ________________________________________________________________________

This email was sent to [email protected] by: Internal Revenue Service (IRS) · Internal Revenue Service · 1111 Constitution Ave. N.W. · Washington, D.C. 20535 GovDelivery logo [ [link removed] ]

body .abe-column-block { min-height: 5px; } table.gd_combo_table img {margin-left:10px; margin-right:10px;} table.gd_combo_table div.govd_image_display img, table.gd_combo_table td.gd_combo_image_cell img {margin-left:0px; margin-right:0px;}

a { color:#0073AF !important;} a:hover { color:#004673 !important;} &lt;!-- body { font-family: arial; } p { font-size: 12px; } li { font-size: 12px; } h2 { font-size: 24px; font-style: italic;} --&gt;

IRS.gov Banner

IRS Newswire June 05, 2025

News Essentials

What's Hot [ [link removed] ]

News Releases [ [link removed] ]

IRS - The Basics [ [link removed] ]

IRS Guidance [ [link removed] ]

Media Contacts [ [link removed] ]

Facts & Figures [ [link removed] ]

Around The Nation [ [link removed] ]

e-News Subscriptions [ [link removed] ]

________________________________________________________________________

The Newsroom Topics

Multimedia Center [ [link removed] ]

Noticias en Español [ [link removed] ]

Radio PSAs [ [link removed] ]

Tax Scams [ [link removed] ]

The Tax Gap [ [link removed] ]

Fact Sheets [ [link removed] ]

IRS Tax Tips [ [link removed] ]

Armed Forces [ [link removed] ]

Latest News Home [ [link removed] ]

________________________________________________________________________

IRS Resources

Contact My Local Office [ [link removed] ]

Filing Options [ [link removed] ]

Forms & Instructions [ [link removed] ]

Frequently Asked Questions [ [link removed] ]

News [ [link removed] ]

Taxpayer Advocate [ [link removed] ]

Where to File [ [link removed] ]

IRS Social Media [ [link removed] ]

________________________________________________________________________

Issue Number: IR-2025-64

Inside This Issue

________________________________________________________________________

*IRS Nationwide Tax Forum early bird registration expires June 10 *

IR-2025-64, June 5, 2025

WASHINGTON — The Internal Revenue Service today reminded tax pros the early bird registration rate for the 2025 IRS Nationwide Tax Forum expires on Tuesday, June 10.

Attendees who act by the June 10 early bird deadline can take advantage of the lowest registration rate of $265 per person. Standard pricing of $319 begins after June 10 and ends two weeks before the start of each forum. On-site registration is also available at a cost of $399.

Members of the following partner associations can save an additional $10 on the early bird rate:

* American Bar Association (ABA)

* American Institute of Certified Public Accountants (AICPA)

* National Association of Enrolled Agents (NAEA)

* National Association of Tax Professionals (NATP)

* National Society of Accountants (NSA)

* National Society of Tax Professionals (NSTP)

Members should contact their association directly for an IRS Nationwide Tax Forum discount code.

*Locations and registration details***

The following is the 2025 IRS Nationwide Tax Forum lineup:

*Location*

*Forum dates*

*Standard rate pre-registration deadline*

Chicago, IL

July 1-3

June 17

New Orleans, LA

Aug. 5-7

July 22

Orlando, FL

Aug. 26-28

Aug. 12

Baltimore, MD

Sept. 9-11

Aug. 26

San Diego, CA

Sept. 16-18

Sept. 2

*About the 2025 IRS Nationwide Tax Forum*

The 2025 IRS Nationwide Tax Forum [ [link removed] ] is the agency’s largest annual outreach event designed and produced for the tax professional community. This year’s curriculum [ [link removed] ] features required continuing education sessions on tax law and ethics, and hot topics like changes to the tax code, common scams and schemes, online tools, digital assets and disaster reporting.

Enrolled agents, certified public accountants, Annual Filing Season Program (AFSP) [ [link removed] ] participants and other tax professionals can earn up to 18 continuing education (CE) credits [ [link removed] ].

For more information and to register online, visit IRS Nationwide Tax Forum [ [link removed] ].

Back to Top [ #Fifteenth ]

FaceBook Logo [ [link removed] ] YouTube Logo [ [link removed] ] Instagram Logo [ [link removed] ] Twitter Logo [ [link removed] ] LinkedIn Logo [ [link removed] ]

________________________________________________________________________

Thank you for subscribing to the IRS Newswire, an IRS e-mail service.

If you know someone who might want to subscribe to this mailing list, please forward this message to them so they can subscribe [ [link removed] ].

This message was distributed automatically from the mailing list IRS Newswire. *Please Do Not Reply To This Message.*

________________________________________________________________________

Update your subscriptions, modify your password or email address, or stop subscriptions at any time on your Subscriber Preferences Page [ [link removed] ]. You will need your email address to log in. If you have questions or problems with the subscription service, visit subscriberhelp.govdelivery.com [ [link removed] ].

This service is provided to you at no charge by the Internal Revenue Service (IRS) [ [link removed] ].

body .abe-column-block {min-height: 5px;} ________________________________________________________________________

This email was sent to [email protected] by: Internal Revenue Service (IRS) · Internal Revenue Service · 1111 Constitution Ave. N.W. · Washington, D.C. 20535 GovDelivery logo [ [link removed] ]

body .abe-column-block { min-height: 5px; } table.gd_combo_table img {margin-left:10px; margin-right:10px;} table.gd_combo_table div.govd_image_display img, table.gd_combo_table td.gd_combo_image_cell img {margin-left:0px; margin-right:0px;}

Message Analysis

- Sender: Internal Revenue Service

- Political Party: n/a

- Country: United States

- State/Locality: n/a

- Office: n/a

-

Email Providers:

- govDelivery