Email

The Democrats’ Unpopular Energy Policy

| From | AEI DataPoints <[email protected]> |

| Subject | The Democrats’ Unpopular Energy Policy |

| Date | June 5, 2025 11:00 AM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

Expert analysis made easy. Breaking down the news with data, charts, and maps.

Edited by: James Desio and Hannah Bowen

Happy Thursday! In today’s newsletter, we examine voters’ opinions toward renewable energy and fossil fuels, electronic supply chains, and trends for large developers and first-time home buyers.

Don’t forget—subscribe <[link removed]> and send DataPoints to a friend!

For inquiries, please email [email protected] <[link removed]>.

1. Voters Still Want Fossil Fuels

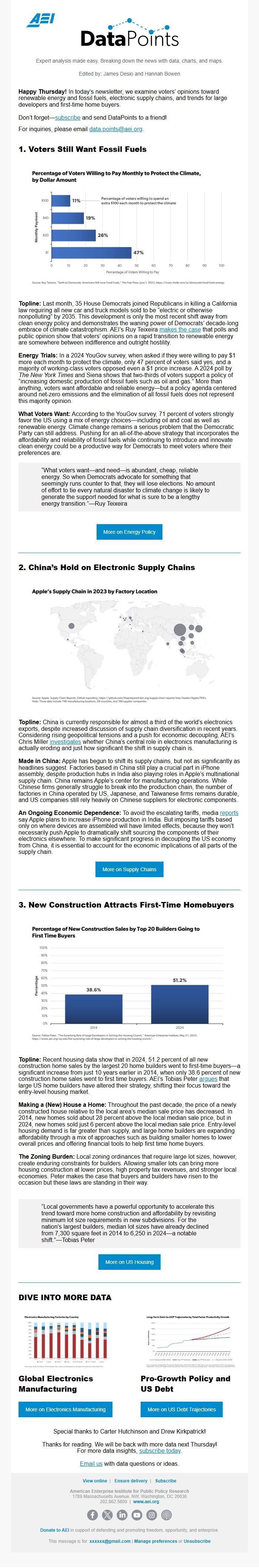

Topline: Last month, 35 House Democrats joined Republicans in killing a California law requiring all new car and truck models sold to be “electric or otherwise nonpolluting” by 2035. This development is only the most recent shift away from clean energy policy and demonstrates the waning power of Democrats’ decade-long embrace of climate catastrophism. AEI’s Ruy Teixeira makes the case <[link removed]> that polls and public opinion show that voters’ opinions on a rapid transition to renewable energy are somewhere between indifference and outright hostility.

Energy Trials: In a 2024 YouGov survey, when asked if they were willing to

pay $1 more each month to protect the climate, only 47 percent of voters said yes, and a majority of working-class voters opposed even a $1 price increase. A 2024 poll by The New York Times and Siena shows that two-thirds of voters support a policy of “increasing domestic production of fossil fuels such as oil and gas.” More than anything, voters want affordable and reliable energy—but a policy agenda centered around net-zero emissions and the elimination of all fossil fuels does not represent this majority opinion.

What Voters Want: According to the YouGov survey, 71 percent of voters strongly favor the US using a mix of energy choices—including oil and coal as well as renewable energy. Climate change remains a serious problem that the Democratic Party can still address. Pushing for an all-of-the-above strategy that incorporates the affordability and reliability of fossil fuels while continuing to introduce and innovate clean energy could be a productive way for Democrats to meet voters where their preferences are.

“What voters want—and need—is abundant, cheap, reliable energy. So when Democrats advocate for something that seemingly runs counter to that, they will lose elections. No amount of effort to tie every natural disaster to climate change is likely to generate the support needed for what is sure to be a lengthy energy transition.”—Ruy Teixeira

2. China’s Hold on Electronic Supply Chains

Topline: China is currently responsible for almost a third of the world’s electronics exports, despite increased discussion of supply chain diversification in recent years. Considering rising geopolitical tensions and a push for economic decoupling, AEI’s Chris Miller investigates <[link removed]> whether China’s central role in electronics manufacturing is actually eroding and just how significant the shift in supply chain is.

Made in China: Apple has begun to shift its supply chains, but not as significantly as headlines suggest. Factories based in China still play a crucial part in iPhone assembly, despite production hubs in India also playing roles in Apple’s multinational supply chain. China remains Apple’s center for manufacturing operations. While Chinese firms generally struggle to break into the production chain, the number of factories in China operated by US, Japanese, and Taiwanese firms remains durable, and US companies still rely heavily on Chinese suppliers for electronic components.

An Ongoing Economic Dependence: To avoid the escalating tariffs, media reports <[link removed]> say Apple plans to increase iPhone production in India. But imposing tariffs based only on where devices are assembled will have limited effects, because they won’t necessarily push Apple to dramatically shift sourcing the components of their electronics elsewhere. To make significant progress in decoupling the US economy from China, it is essential to account for the economic implications of all parts of the supply chain.

3. New Construction Attracts First-Time Homebuyers

Topline: Recent housing data show that in 2024, 51.2 percent of all new construction home sales by the largest 20 home builders went to first-time buyers—a significant increase from just 10 years earlier in 2014, when only 38.6 percent of new construction home sales went to first time buyers. AEI’s Tobias Peter argues <[link removed]> that large US home builders have altered their strategy, shifting their focus toward the entry-level housing market.

Making a (New) House a Home: Throughout the past decade, the price of a newly

constructed house relative to the local area’s median sale price has decreased. In 2014, new homes sold about 28 percent above the local median sale price, but in 2024, new homes sold just 6 percent above the local median sale price. Entry-level housing demand is far greater than supply, and large home builders are expanding affordability through a mix of approaches such as building smaller homes to lower overall prices and offering financial tools to help first time home buyers.

The Zoning Burden: Local zoning ordinances that require large lot sizes, however, create enduring constraints for builders. Allowing smaller lots can bring more housing construction at lower prices, high property tax revenues, and stronger local economies. Peter makes the case that buyers and builders have risen to the occasion but these laws are standing in their way.

“Local governments have a powerful opportunity to accelerate this trend toward more home construction and

affordability by revisiting minimum lot size requirements in new subdivisions. For the nation’s largest builders, median lot sizes have already declined from 7,300 square feet in 2014 to 6,250 in 2024—a notable shift.”—Tobias Peter

DIVE INTO MORE DATA

Global Electronics Manufacturing <[link removed]>

Pro-Growth Policy and US Debt <[link removed]>

Special thanks to Carter Hutchinson and Drew Kirkpatrick!

Thanks for reading. We will be back with more data next Thursday!

For more data insights, subscribe today <[link removed]>.

Email us <[link removed]> with data questions or ideas.

View online <[[[link removed]]]> | Ensure delivery <[link removed]> | Subscribe <[link removed]>

American Enterprise Institute for Public Policy Research

1789 Massachusetts Avenue, NW, Washington, DC 20036

202.862.5800 | www.aei.org <[link removed]>

<[link removed]> <[link removed]> <[link removed]> <[link removed]> <[link removed]>

<[link removed]> Donate to AEI <[link removed]> in support of defending and promoting freedom, opportunity, and enterprise.

This message is for: [email protected] <[email protected]> | Manage preferences <[link removed]> or Unsubscribe <[link removed]>

<!-- This is a comment -->

Edited by: James Desio and Hannah Bowen

Happy Thursday! In today’s newsletter, we examine voters’ opinions toward renewable energy and fossil fuels, electronic supply chains, and trends for large developers and first-time home buyers.

Don’t forget—subscribe <[link removed]> and send DataPoints to a friend!

For inquiries, please email [email protected] <[link removed]>.

1. Voters Still Want Fossil Fuels

Topline: Last month, 35 House Democrats joined Republicans in killing a California law requiring all new car and truck models sold to be “electric or otherwise nonpolluting” by 2035. This development is only the most recent shift away from clean energy policy and demonstrates the waning power of Democrats’ decade-long embrace of climate catastrophism. AEI’s Ruy Teixeira makes the case <[link removed]> that polls and public opinion show that voters’ opinions on a rapid transition to renewable energy are somewhere between indifference and outright hostility.

Energy Trials: In a 2024 YouGov survey, when asked if they were willing to

pay $1 more each month to protect the climate, only 47 percent of voters said yes, and a majority of working-class voters opposed even a $1 price increase. A 2024 poll by The New York Times and Siena shows that two-thirds of voters support a policy of “increasing domestic production of fossil fuels such as oil and gas.” More than anything, voters want affordable and reliable energy—but a policy agenda centered around net-zero emissions and the elimination of all fossil fuels does not represent this majority opinion.

What Voters Want: According to the YouGov survey, 71 percent of voters strongly favor the US using a mix of energy choices—including oil and coal as well as renewable energy. Climate change remains a serious problem that the Democratic Party can still address. Pushing for an all-of-the-above strategy that incorporates the affordability and reliability of fossil fuels while continuing to introduce and innovate clean energy could be a productive way for Democrats to meet voters where their preferences are.

“What voters want—and need—is abundant, cheap, reliable energy. So when Democrats advocate for something that seemingly runs counter to that, they will lose elections. No amount of effort to tie every natural disaster to climate change is likely to generate the support needed for what is sure to be a lengthy energy transition.”—Ruy Teixeira

2. China’s Hold on Electronic Supply Chains

Topline: China is currently responsible for almost a third of the world’s electronics exports, despite increased discussion of supply chain diversification in recent years. Considering rising geopolitical tensions and a push for economic decoupling, AEI’s Chris Miller investigates <[link removed]> whether China’s central role in electronics manufacturing is actually eroding and just how significant the shift in supply chain is.

Made in China: Apple has begun to shift its supply chains, but not as significantly as headlines suggest. Factories based in China still play a crucial part in iPhone assembly, despite production hubs in India also playing roles in Apple’s multinational supply chain. China remains Apple’s center for manufacturing operations. While Chinese firms generally struggle to break into the production chain, the number of factories in China operated by US, Japanese, and Taiwanese firms remains durable, and US companies still rely heavily on Chinese suppliers for electronic components.

An Ongoing Economic Dependence: To avoid the escalating tariffs, media reports <[link removed]> say Apple plans to increase iPhone production in India. But imposing tariffs based only on where devices are assembled will have limited effects, because they won’t necessarily push Apple to dramatically shift sourcing the components of their electronics elsewhere. To make significant progress in decoupling the US economy from China, it is essential to account for the economic implications of all parts of the supply chain.

3. New Construction Attracts First-Time Homebuyers

Topline: Recent housing data show that in 2024, 51.2 percent of all new construction home sales by the largest 20 home builders went to first-time buyers—a significant increase from just 10 years earlier in 2014, when only 38.6 percent of new construction home sales went to first time buyers. AEI’s Tobias Peter argues <[link removed]> that large US home builders have altered their strategy, shifting their focus toward the entry-level housing market.

Making a (New) House a Home: Throughout the past decade, the price of a newly

constructed house relative to the local area’s median sale price has decreased. In 2014, new homes sold about 28 percent above the local median sale price, but in 2024, new homes sold just 6 percent above the local median sale price. Entry-level housing demand is far greater than supply, and large home builders are expanding affordability through a mix of approaches such as building smaller homes to lower overall prices and offering financial tools to help first time home buyers.

The Zoning Burden: Local zoning ordinances that require large lot sizes, however, create enduring constraints for builders. Allowing smaller lots can bring more housing construction at lower prices, high property tax revenues, and stronger local economies. Peter makes the case that buyers and builders have risen to the occasion but these laws are standing in their way.

“Local governments have a powerful opportunity to accelerate this trend toward more home construction and

affordability by revisiting minimum lot size requirements in new subdivisions. For the nation’s largest builders, median lot sizes have already declined from 7,300 square feet in 2014 to 6,250 in 2024—a notable shift.”—Tobias Peter

DIVE INTO MORE DATA

Global Electronics Manufacturing <[link removed]>

Pro-Growth Policy and US Debt <[link removed]>

Special thanks to Carter Hutchinson and Drew Kirkpatrick!

Thanks for reading. We will be back with more data next Thursday!

For more data insights, subscribe today <[link removed]>.

Email us <[link removed]> with data questions or ideas.

View online <[[[link removed]]]> | Ensure delivery <[link removed]> | Subscribe <[link removed]>

American Enterprise Institute for Public Policy Research

1789 Massachusetts Avenue, NW, Washington, DC 20036

202.862.5800 | www.aei.org <[link removed]>

<[link removed]> <[link removed]> <[link removed]> <[link removed]> <[link removed]>

<[link removed]> Donate to AEI <[link removed]> in support of defending and promoting freedom, opportunity, and enterprise.

This message is for: [email protected] <[email protected]> | Manage preferences <[link removed]> or Unsubscribe <[link removed]>

<!-- This is a comment -->

Message Analysis

- Sender: n/a

- Political Party: n/a

- Country: n/a

- State/Locality: n/a

- Office: n/a

-

Email Providers:

- Marketo