Email

URGENT: We need your voice 🚨

| From | Stewardship Utah <[email protected]> |

| Subject | URGENT: We need your voice 🚨 |

| Date | June 4, 2025 9:30 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

www.stewardshiputah.org [www.stewardshiputah.org]

Hi John ,

This week, the U.S. Senate kicks off their negotiations of the FY 2025 budget reconciliation bill, which recently passed the House of Representatives. The current version is primed to cut millions in funding for renewable energy tax credits. Senators, including Sen. John Curtis, have expressed their support for preserving these tax credits and have vowed to work to tailor back the House’s version of the bill before it is voted on and signed by the President, with an expected date of July 4th. We must keep this momentum and show Senator John Curtis that Utahns support the energy tax credits and other provisions of the Inflation Reduction Act.

Energy tax incentive programs that support our local businesses and residents’ transition to renewable energy, all while reducing long-term costs, are part of the Inflation Reduction Act, the biggest climate legislation ever passed. The new budget, as proposed by the House, decimates it.

Ask Senator Curtis to Save Energy Tax Credits! [[link removed]]

[link removed] [[link removed]]

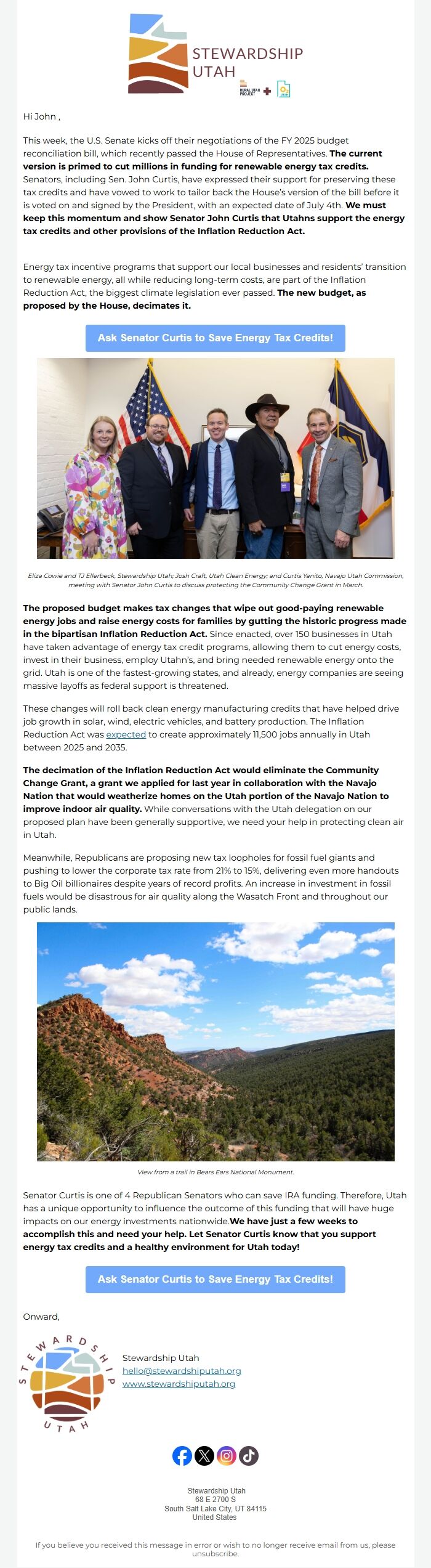

Eliza Cowie and TJ Ellerbeck, Stewardship Utah; Josh Craft, Utah Clean Energy; and Curtis Yanito, Navajo Utah Commission, meeting with Senator John Curtis to discuss protecting the Community Change Grant in March.

The proposed budget makes tax changes that wipe out good-paying renewable energy jobs and raise energy costs for families by gutting the historic progress made in the bipartisan Inflation Reduction Act. Since enacted, over 150 businesses in Utah have taken advantage of energy tax credit programs, allowing them to cut energy costs, invest in their business, employ Utahn’s, and bring needed renewable energy onto the grid. Utah is one of the fastest-growing states, and already, energy companies are seeing massive layoffs as federal support is threatened.

These changes will roll back clean energy manufacturing credits that have helped drive job growth in solar, wind, electric vehicles, and battery production. The Inflation Reduction Act was expected [[link removed]] to create approximately 11,500 jobs annually in Utah between 2025 and 2035.

The decimation of the Inflation Reduction Act would eliminate the Community Change Grant, a grant we applied for last year in collaboration with the Navajo Nation that would weatherize homes on the Utah portion of the Navajo Nation to improve indoor air quality. While conversations with the Utah delegation on our proposed plan have been generally supportive, we need your help in protecting clean air in Utah.

Meanwhile, Republicans are proposing new tax loopholes for fossil fuel giants and pushing to lower the corporate tax rate from 21% to 15%, delivering even more handouts to Big Oil billionaires despite years of record profits. An increase in investment in fossil fuels would be disastrous for air quality along the Wasatch Front and throughout our public lands.

[link removed] [[link removed]]

View from a trail in Bears Ears National Monument.

Senator Curtis is one of 4 Republican Senators who can save IRA funding. Therefore, Utah has a unique opportunity to influence the outcome of this funding that will have huge impacts on our energy investments nationwide. We have just a few weeks to accomplish this and need your help. Let Senator Curtis know that you support energy tax credits and a healthy environment for Utah today!

Ask Senator Curtis to Save Energy Tax Credits! [[link removed]]

Onward,

www.stewardshiputah.org [www.stewardshiputah.org] Stewardship Utah

[email protected] [[email protected]]

www.stewardshiputah.org [[link removed]]

[link removed] [[link removed]] [link removed] [[link removed]] [link removed] [[link removed]] [link removed] [[link removed]]

Stewardship Utah

68 E 2700 S

South Salt Lake City, UT 84115

United States

If you believe you received this message in error or wish to no longer receive email from us, please unsubscribe: [link removed] .

Hi John ,

This week, the U.S. Senate kicks off their negotiations of the FY 2025 budget reconciliation bill, which recently passed the House of Representatives. The current version is primed to cut millions in funding for renewable energy tax credits. Senators, including Sen. John Curtis, have expressed their support for preserving these tax credits and have vowed to work to tailor back the House’s version of the bill before it is voted on and signed by the President, with an expected date of July 4th. We must keep this momentum and show Senator John Curtis that Utahns support the energy tax credits and other provisions of the Inflation Reduction Act.

Energy tax incentive programs that support our local businesses and residents’ transition to renewable energy, all while reducing long-term costs, are part of the Inflation Reduction Act, the biggest climate legislation ever passed. The new budget, as proposed by the House, decimates it.

Ask Senator Curtis to Save Energy Tax Credits! [[link removed]]

[link removed] [[link removed]]

Eliza Cowie and TJ Ellerbeck, Stewardship Utah; Josh Craft, Utah Clean Energy; and Curtis Yanito, Navajo Utah Commission, meeting with Senator John Curtis to discuss protecting the Community Change Grant in March.

The proposed budget makes tax changes that wipe out good-paying renewable energy jobs and raise energy costs for families by gutting the historic progress made in the bipartisan Inflation Reduction Act. Since enacted, over 150 businesses in Utah have taken advantage of energy tax credit programs, allowing them to cut energy costs, invest in their business, employ Utahn’s, and bring needed renewable energy onto the grid. Utah is one of the fastest-growing states, and already, energy companies are seeing massive layoffs as federal support is threatened.

These changes will roll back clean energy manufacturing credits that have helped drive job growth in solar, wind, electric vehicles, and battery production. The Inflation Reduction Act was expected [[link removed]] to create approximately 11,500 jobs annually in Utah between 2025 and 2035.

The decimation of the Inflation Reduction Act would eliminate the Community Change Grant, a grant we applied for last year in collaboration with the Navajo Nation that would weatherize homes on the Utah portion of the Navajo Nation to improve indoor air quality. While conversations with the Utah delegation on our proposed plan have been generally supportive, we need your help in protecting clean air in Utah.

Meanwhile, Republicans are proposing new tax loopholes for fossil fuel giants and pushing to lower the corporate tax rate from 21% to 15%, delivering even more handouts to Big Oil billionaires despite years of record profits. An increase in investment in fossil fuels would be disastrous for air quality along the Wasatch Front and throughout our public lands.

[link removed] [[link removed]]

View from a trail in Bears Ears National Monument.

Senator Curtis is one of 4 Republican Senators who can save IRA funding. Therefore, Utah has a unique opportunity to influence the outcome of this funding that will have huge impacts on our energy investments nationwide. We have just a few weeks to accomplish this and need your help. Let Senator Curtis know that you support energy tax credits and a healthy environment for Utah today!

Ask Senator Curtis to Save Energy Tax Credits! [[link removed]]

Onward,

www.stewardshiputah.org [www.stewardshiputah.org] Stewardship Utah

[email protected] [[email protected]]

www.stewardshiputah.org [[link removed]]

[link removed] [[link removed]] [link removed] [[link removed]] [link removed] [[link removed]] [link removed] [[link removed]]

Stewardship Utah

68 E 2700 S

South Salt Lake City, UT 84115

United States

If you believe you received this message in error or wish to no longer receive email from us, please unsubscribe: [link removed] .

Message Analysis

- Sender: n/a

- Political Party: n/a

- Country: n/a

- State/Locality: n/a

- Office: n/a

-

Email Providers:

- EveryAction