| From | ADEA <[email protected]> |

| Subject | ADEA – Advocate – May 21, 2025 |

| Date | May 21, 2025 2:44 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

View this email in your browser [ [link removed] ] .

American Dental Education Association

Volume 3, No. 82, May 21, 2025

House Reconciliation Bill Advances to the Full House

It

has been a busy couple of weeks for the U. S. House of Representatives, whose Committees were tasked with producing legislation that would comply with their instructions in House Concurrent Resolution 14 (H. Con. Res. 14 [

[link removed] ] ), the Concurrent Resolution on the Budget for Fiscal Year 2025. The House Committee on the Budget,

met on May 16, to assemble the provisions from the other House committees into one reconciliation bill and report that legislation to the House as required by the Congressional Budget Act. However, the package was defeated

by a vote of 16 to 21, with five Republicans joining all 16 committee Democrats to vote no. The main Republican objection was that the bill would increase the Federal deficit over the next 10 years. However, the Committee

met again, on May 18, to reconsider the vote. This time, the measure passed by a vote of 17 to 16, with three Republican members voting “Present.”

The measure will now go to the House floor this week, according to Speaker of the House Mike Johnson (R-LA). It is likely that there will be unspecified changes made to the bill by the House Rules Committee, which sets the terms for all legislation considered in the lower body, to satisfy the recalcitrant majority party members.

The Senate Committees will also put together their own package to comply with their instructions under H. Con. Res. 14. They will do so possibly this week, or they may wait for final action by the House.

The House Committees with jurisdiction over programs important to oral health education included several provisions of concern:

The

House Energy and Commerce Committee (E&C) held a 26-hour markup earlier last week on its instructions to reduce the deficit by $880 billion over the next 10 years. The markup ended with the health care section of the bill

being passed 30 to 24 along party lines. The Committee oversees a broad range of issues, including energy, environment, commerce and technology, but the primary focus of the markup was on the health-related provisions, particularly

those affecting the Medicaid program.

• In his opening statement, U.S. Rep. Brett Guthrie (R-KY), Committee Chair, emphasized proposed reforms to Medicaid, describing them as efforts to enhance the program’s long-term sustainability and better serve populations such as mothers, children, the elderly and individuals with disabilities. He said the reforms in the reconciliation bill will stop waste, fraud and abuse of Medicaid and work to close loopholes and inefficiencies.

• U.S. Rep. Frank Pallone (D-NJ), E&C Committee Ranking Member, criticized the proposed changes, arguing that the bill would result in significant Medicaid cuts and millions of Americans losing access to health insurance coverage.

• Throughout

the markup, Democrats and Republicans clashed over whether the reconciliation bill would result in significant cuts and loss of coverage for vulnerable Americans. Republicans contended that the reforms in the bill

will only clean up waste, fraud and abuse while adding work requirements. Democrats argued that the bill would harm health outcomes for those who rely on Medicaid. Both sides of the aisle drew on constituent stories to support

their argument. Republicans rejected numerous amendments offered by Democrats that attempted to limit Medicaid cuts.

The rejected bill contains multiple provisions with changes to the Medicaid program, which include the following measures:

• Beginning in 2029, able-bodied Medicaid recipients aged 19 to 24 will be required to work at least 80 hours per month.

• State provider taxes will be frozen, which all but one state uses to finance Medicaid. States are also prohibited from establishing new taxes. (These taxes affect mostly hospitals and extended stay facilities.)

• States will be required to conduct eligibility assessments for Medicaid expansion enrollees every six months, rather than annually.

• Medicaid expansion recipients with incomes above 100% of the federal poverty level will be subject to out-of-pocket costs of up to $35.

The Congressional Budget Office estimates that 10.3 million beneficiaries would lose coverage on the provisions contained in the E&C bill.

The House Ways and Means Committee, the tax-writing committee, has instructions to produce legislation that would add $4.5 trillion to the deficit over the next decade. It completed its markup of legislation to do that on May 14.

One

of the provisions contained in Sec. 112021 of their bill would amend a provision included in the 2017 tax bill that became Sec. 4968 of the Internal Revenue Code entitled, “Excise tax based on investment income of private

colleges and universities.” The 2017 provision provided for a 1.4% excise tax on the net investment income of private institutions with at least 500 tuition-paying students. The new provision creates a tiered system based on

the institution’s student-adjusted endowment (see the table below). The student-adjusted endowment is derived by dividing the fair market value of the institution’s investment income at the end of the previous tax year by the

number of eligible students. (An eligible student must be a U.S. citizen, permanent resident or temporarily in the United States with the intention of becoming a citizen or permanent resident.)

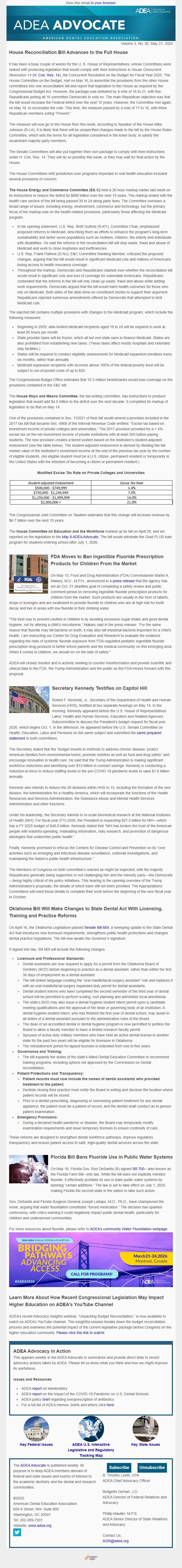

Modified Excise Tax Rate on Private Colleges and Universities

The Congressional Joint Committee on Taxation estimates that this change will increase revenue by $6.7 billion over the next 10 years.

The House Committee on Education and the Workforce marked up its bill on April 29, and we reported on the legislation in the May 8 ADEA Advocate [ [link removed] ] . The bill would eliminate the Grad PLUS loan program for students entering school after July 1, 2026.

FDA Moves to Ban Ingestible Fluoride Prescription Products for Children From the Market

On

May 13, Food and Drug Administration (FDA) Commissioner Martin A. Makary, M.D., M.P.H., announced in a press release [ [link removed]

] that the agency has set an Oct. 31 deadline goal of completing a safety review and public comment period on removing ingestible fluoride prescription products for children from the market.

Such products are usually in the form of tablets, drops or lozenges and are swallowed to provide fluoride to children who are at high risk for tooth decay and live in areas with low fluoride in their drinking water.

"The

best way to prevent cavities in children is by avoiding excessive sugar intake and good dental hygiene, not by altering a child’s microbiome,” Makary said in the press release. “For the same reason that fluoride may kill

bacteria on teeth, it may also kill intestinal bacteria important for a child’s health. I am instructing our Center for Drug Evaluation and Research to evaluate the evidence regarding the risks of systemic fluoride exposure from

FDA-regulated pediatric ingestible fluoride prescription drug products to better inform parents and the medical community on this emerging area. When it comes to children, we should err on the side of safety."

ADEA will closely monitor and is actively seeking to counter misinformation and provide scientific and clinical data to the FDA, the Trump Administration and the public as the FDA moves forward with this proposal.

Secretary Kennedy Testifies on Capitol Hill

Robert

F. Kennedy, Jr., Secretary of the Department of Health and Human Services (HHS), testified at two separate hearings on May 14. In the morning, Kennedy appeared before the U.S. House of Representatives Labor, Health and

Human Services, Education and Related Agencies Subcommittee to discuss the President’s budget request for fiscal year 2026, which begins Oct. 1. In the afternoon, he appeared before the U.S. Senate Committee on Health, Education,

Labor and Pensions on the same subject and submitted the same prepared statement [ [link removed] ] to both committees.

The Secretary stated that the “budget invests in methods to address chronic disease;

protect American families from environmental toxins; promote nutrition as well as food and drug safety” and encourage innovation in health care.

He said that the Trump Administration is making significant workforce reductions and identifying over $13 billion in contract savings. Kennedy is conducting a reduction-in-force to reduce staffing levels to the pre-COVID-19

pandemic levels to save $1.8 billion annually.

Kennedy also intends to reduce the 28 divisions within HHS to 15, including the formation of the new division, the Administration for a Healthy America, which will incorporate the functions of the Health Resources and Services Administration, the Substance Abuse and Mental Health Services Administration and other functions.

Under his leadership, the Secretary intends to re-scale biomedical research at the National Institutes of Health (NIH). For fiscal year (FY) 2026, the President is requesting $27.5 billion for NIH—which has a FY 2025 budget of $48.6 billion. Kennedy stated that “NIH has broken the trust of the American people with wasteful spending, misleading information, risky research, and promotion of dangerous ideologies that undermine public health.”

Finally, Kennedy promised to refocus the Centers for Disease Control and Prevention on its “core activities such as emerging and infectious disease surveillance, outbreak investigations, and maintaining the Nation’s public health infrastructure.”

The

Members of Congress on both committee’s reacted as might be expected, with the majority Republicans generally being supportive or not challenging him and the minority party—the Democrats—being highly critical of his policy

initiatives. This hearing is the opening overview of the Trump Administration’s proposals, the details of which have still not been provided. The Appropriations Committees will need those details to complete their work before

the beginning of the new fiscal year in October.

Oklahoma Bill Will Make Changes to State Dental Act With Licensing, Training and Practice Reforms

On April 16, the Oklahoma Legislature passed Senate Bill 669 [ [link removed] ] , a sweeping update to the State Dental Act that introduces new licensure requirements, strengthens public health protections and changes dental practice regulations. The bill now awaits the Governor’s signature.

If signed into law, SB 669 will include the following changes:

• Licensure and Professional Standards:

◦ Dental assistants are now required to apply for a permit from the Oklahoma Board of Dentistry (BOD) before beginning to practice as a dental assistant, rather than within the first 30 days of employment as a dental assistant.

◦ The bill strikes language creating the “oral maxillofacial surgery assistant” role and replaces it with an oral maxillofacial surgery expanded duty permit for dental assistants.

◦ Dental student interns who have completed the second semester of the third year of dental school will be permitted to perform scaling, root planning and administer local anesthesia.

◦ The state’s BOD may also issue a dental hygiene student intern permit upon a candidate meeting qualifications and the approval of the dean or governing body of an institution. A dental hygiene student intern, who has finished the first year of dental school, may assist in all duties of a dental assistant pursuant to the administrative rules of the Board.

◦ The dean of an accredited dental or dental hygiene program is now permitted to petition the Board to allow a faculty member to have a limited research faculty permit.

◦ Spouses of active-duty military members who have held an active dental license in another state for the past two years will be eligible for licensure in Oklahoma.

◦ The reinstatement period for lapsed licenses is extended from one to five years.

• Governance and Training:

◦ The bill expands the duties of the state’s Allied Dental Education Committee to recommend training programs, including options not approved by the Commission on Dental Accreditation.

• Patient Protections and Transparency:

◦ Patient records must now include the names of dental assistants who provided treatment to the patient.

◦ Dentists closing their practice must notify the Board in writing and disclose the location where patient records will be stored.

◦ Prior to a dentist prescribing, diagnosing or overseeing patient treatment for any dental appliance, the patient must be a patient of record, and the dentist shall conduct an in-person patient examination.

• Emergency Provisions:

◦ During a declared health pandemic or disaster, the Board may temporarily modify examination requirements and issue temporary licenses to ensure continuity of care.

These reforms are designed to strengthen dental workforce pathways, improve regulatory transparency and ensure patient access to safe, high-quality dental services across the state.

Florida Bill Bans Fluoride Use in Public Water Systems

On May 16, Florida Gov. Ron DeSantis (R) signed SB 700 [ [link removed] ] —also known as the Florida Farm Bill—into law. While the bill does not explicitly mention fluoride, it effectively prohibits its use in state public water systems by banning “certain additives.” The law is set to take effect on July 1, 2025, making Florida the second state in the nation to take such action.

Gov. DeSantis and Florida Surgeon General Joseph Ladapo, M.D., Ph.D., have championed the move, arguing that water fluoridation constitutes “forced medication.” The decision has sparked controversy, with critics warning it could negatively impact public dental health, particularly for children and underserved communities.

For more resources about fluoride, please refer to ADEA’s community Water Fluoridation webpage. [ [link removed] ]

[[link removed]]

Learn More About How Recent Congressional Legislation May Impact Higher Education on ADEA’s YouTube Channel

ADEA’s recent Advocacy Insights webinar, “Unpacking Budget Reconciliation,” is now available to watch on ADEA’s YouTube channel. This insightful session breaks down the budget reconciliation process and examines the potential impact of the current legislative package before Congress on the higher education community. Please click this link to watch! [ [link removed] ]

ADEA Advocacy in Action

This appears weekly in the ADEA Advocate to summarize and provide direct links to recent advocacy actions taken by ADEA. Please let us know what you think and how we might improve its usefulness.

Issues and Resources

• ADEA report [ [link removed] ] on teledentistry

• ADEA report [ [link removed] ] on the Impact of the COVID-19 Pandemic on U.S. Dental Schools

• ADEA policy brief [ [link removed] ] regarding overprescription of antibiotics

• For a full list of ADEA memos, briefs and letters click here [ [link removed] ] .

Key Federal Issues [ [link removed] ]

ADEA U.S. Interactive Legislative and Regulatory Tracking Map [ [link removed] ]

Key State Issues [ [link removed] ]

The ADEA Advocate [ [link removed] ] is published weekly. Its purpose is to keep ADEA members abreast of federal and state issues and events of interest to the academic dentistry and the dental and research communities.

©2025

American Dental Education Association

655 K Street, NW, Suite 800

Washington, DC 20001

Tel: 202-289-7201

Website: www.adea.org [ [link removed] ]

twitter

[[link removed]]

Subscribe

[link removed][0]&p_colname=p_last_nm&p_varname=p_val_arr[1]&p_colname=p_alias&p_varname=p_val_arr[2]&p_colname=p_login_id&p_varname=p_val_arr[3]&p_colname=p_passwd&p_context=NEWSLETTER&p_success_url=censsaindprofile.section_update%3Fp_profile_ty%3DINDIVIDUAL_PROFILE%26p_skip_confirm_fl%3DY%26p_section_nm%3DNewsletters%26p_format%3D110%26p_msg_txt%3D%26p_cust_id%3D%26p_referrer%3D

Unsubscribe

[link removed]

B. Timothy Leeth, CPA

ADEA Chief Advocacy Officer

Bridgette DeHart, J.D.

ADEA Director of Federal Relations and Advocacy

Phillip Mauller, M.P.S.

ADEA Senior Director of State Relations and Advocacy

Contact Us:

[email protected] [ mailto:[email protected] ]

Powered by Higher Logic [link removed]

American Dental Education Association

Volume 3, No. 82, May 21, 2025

House Reconciliation Bill Advances to the Full House

It

has been a busy couple of weeks for the U. S. House of Representatives, whose Committees were tasked with producing legislation that would comply with their instructions in House Concurrent Resolution 14 (H. Con. Res. 14 [

[link removed] ] ), the Concurrent Resolution on the Budget for Fiscal Year 2025. The House Committee on the Budget,

met on May 16, to assemble the provisions from the other House committees into one reconciliation bill and report that legislation to the House as required by the Congressional Budget Act. However, the package was defeated

by a vote of 16 to 21, with five Republicans joining all 16 committee Democrats to vote no. The main Republican objection was that the bill would increase the Federal deficit over the next 10 years. However, the Committee

met again, on May 18, to reconsider the vote. This time, the measure passed by a vote of 17 to 16, with three Republican members voting “Present.”

The measure will now go to the House floor this week, according to Speaker of the House Mike Johnson (R-LA). It is likely that there will be unspecified changes made to the bill by the House Rules Committee, which sets the terms for all legislation considered in the lower body, to satisfy the recalcitrant majority party members.

The Senate Committees will also put together their own package to comply with their instructions under H. Con. Res. 14. They will do so possibly this week, or they may wait for final action by the House.

The House Committees with jurisdiction over programs important to oral health education included several provisions of concern:

The

House Energy and Commerce Committee (E&C) held a 26-hour markup earlier last week on its instructions to reduce the deficit by $880 billion over the next 10 years. The markup ended with the health care section of the bill

being passed 30 to 24 along party lines. The Committee oversees a broad range of issues, including energy, environment, commerce and technology, but the primary focus of the markup was on the health-related provisions, particularly

those affecting the Medicaid program.

• In his opening statement, U.S. Rep. Brett Guthrie (R-KY), Committee Chair, emphasized proposed reforms to Medicaid, describing them as efforts to enhance the program’s long-term sustainability and better serve populations such as mothers, children, the elderly and individuals with disabilities. He said the reforms in the reconciliation bill will stop waste, fraud and abuse of Medicaid and work to close loopholes and inefficiencies.

• U.S. Rep. Frank Pallone (D-NJ), E&C Committee Ranking Member, criticized the proposed changes, arguing that the bill would result in significant Medicaid cuts and millions of Americans losing access to health insurance coverage.

• Throughout

the markup, Democrats and Republicans clashed over whether the reconciliation bill would result in significant cuts and loss of coverage for vulnerable Americans. Republicans contended that the reforms in the bill

will only clean up waste, fraud and abuse while adding work requirements. Democrats argued that the bill would harm health outcomes for those who rely on Medicaid. Both sides of the aisle drew on constituent stories to support

their argument. Republicans rejected numerous amendments offered by Democrats that attempted to limit Medicaid cuts.

The rejected bill contains multiple provisions with changes to the Medicaid program, which include the following measures:

• Beginning in 2029, able-bodied Medicaid recipients aged 19 to 24 will be required to work at least 80 hours per month.

• State provider taxes will be frozen, which all but one state uses to finance Medicaid. States are also prohibited from establishing new taxes. (These taxes affect mostly hospitals and extended stay facilities.)

• States will be required to conduct eligibility assessments for Medicaid expansion enrollees every six months, rather than annually.

• Medicaid expansion recipients with incomes above 100% of the federal poverty level will be subject to out-of-pocket costs of up to $35.

The Congressional Budget Office estimates that 10.3 million beneficiaries would lose coverage on the provisions contained in the E&C bill.

The House Ways and Means Committee, the tax-writing committee, has instructions to produce legislation that would add $4.5 trillion to the deficit over the next decade. It completed its markup of legislation to do that on May 14.

One

of the provisions contained in Sec. 112021 of their bill would amend a provision included in the 2017 tax bill that became Sec. 4968 of the Internal Revenue Code entitled, “Excise tax based on investment income of private

colleges and universities.” The 2017 provision provided for a 1.4% excise tax on the net investment income of private institutions with at least 500 tuition-paying students. The new provision creates a tiered system based on

the institution’s student-adjusted endowment (see the table below). The student-adjusted endowment is derived by dividing the fair market value of the institution’s investment income at the end of the previous tax year by the

number of eligible students. (An eligible student must be a U.S. citizen, permanent resident or temporarily in the United States with the intention of becoming a citizen or permanent resident.)

Modified Excise Tax Rate on Private Colleges and Universities

The Congressional Joint Committee on Taxation estimates that this change will increase revenue by $6.7 billion over the next 10 years.

The House Committee on Education and the Workforce marked up its bill on April 29, and we reported on the legislation in the May 8 ADEA Advocate [ [link removed] ] . The bill would eliminate the Grad PLUS loan program for students entering school after July 1, 2026.

FDA Moves to Ban Ingestible Fluoride Prescription Products for Children From the Market

On

May 13, Food and Drug Administration (FDA) Commissioner Martin A. Makary, M.D., M.P.H., announced in a press release [ [link removed]

] that the agency has set an Oct. 31 deadline goal of completing a safety review and public comment period on removing ingestible fluoride prescription products for children from the market.

Such products are usually in the form of tablets, drops or lozenges and are swallowed to provide fluoride to children who are at high risk for tooth decay and live in areas with low fluoride in their drinking water.

"The

best way to prevent cavities in children is by avoiding excessive sugar intake and good dental hygiene, not by altering a child’s microbiome,” Makary said in the press release. “For the same reason that fluoride may kill

bacteria on teeth, it may also kill intestinal bacteria important for a child’s health. I am instructing our Center for Drug Evaluation and Research to evaluate the evidence regarding the risks of systemic fluoride exposure from

FDA-regulated pediatric ingestible fluoride prescription drug products to better inform parents and the medical community on this emerging area. When it comes to children, we should err on the side of safety."

ADEA will closely monitor and is actively seeking to counter misinformation and provide scientific and clinical data to the FDA, the Trump Administration and the public as the FDA moves forward with this proposal.

Secretary Kennedy Testifies on Capitol Hill

Robert

F. Kennedy, Jr., Secretary of the Department of Health and Human Services (HHS), testified at two separate hearings on May 14. In the morning, Kennedy appeared before the U.S. House of Representatives Labor, Health and

Human Services, Education and Related Agencies Subcommittee to discuss the President’s budget request for fiscal year 2026, which begins Oct. 1. In the afternoon, he appeared before the U.S. Senate Committee on Health, Education,

Labor and Pensions on the same subject and submitted the same prepared statement [ [link removed] ] to both committees.

The Secretary stated that the “budget invests in methods to address chronic disease;

protect American families from environmental toxins; promote nutrition as well as food and drug safety” and encourage innovation in health care.

He said that the Trump Administration is making significant workforce reductions and identifying over $13 billion in contract savings. Kennedy is conducting a reduction-in-force to reduce staffing levels to the pre-COVID-19

pandemic levels to save $1.8 billion annually.

Kennedy also intends to reduce the 28 divisions within HHS to 15, including the formation of the new division, the Administration for a Healthy America, which will incorporate the functions of the Health Resources and Services Administration, the Substance Abuse and Mental Health Services Administration and other functions.

Under his leadership, the Secretary intends to re-scale biomedical research at the National Institutes of Health (NIH). For fiscal year (FY) 2026, the President is requesting $27.5 billion for NIH—which has a FY 2025 budget of $48.6 billion. Kennedy stated that “NIH has broken the trust of the American people with wasteful spending, misleading information, risky research, and promotion of dangerous ideologies that undermine public health.”

Finally, Kennedy promised to refocus the Centers for Disease Control and Prevention on its “core activities such as emerging and infectious disease surveillance, outbreak investigations, and maintaining the Nation’s public health infrastructure.”

The

Members of Congress on both committee’s reacted as might be expected, with the majority Republicans generally being supportive or not challenging him and the minority party—the Democrats—being highly critical of his policy

initiatives. This hearing is the opening overview of the Trump Administration’s proposals, the details of which have still not been provided. The Appropriations Committees will need those details to complete their work before

the beginning of the new fiscal year in October.

Oklahoma Bill Will Make Changes to State Dental Act With Licensing, Training and Practice Reforms

On April 16, the Oklahoma Legislature passed Senate Bill 669 [ [link removed] ] , a sweeping update to the State Dental Act that introduces new licensure requirements, strengthens public health protections and changes dental practice regulations. The bill now awaits the Governor’s signature.

If signed into law, SB 669 will include the following changes:

• Licensure and Professional Standards:

◦ Dental assistants are now required to apply for a permit from the Oklahoma Board of Dentistry (BOD) before beginning to practice as a dental assistant, rather than within the first 30 days of employment as a dental assistant.

◦ The bill strikes language creating the “oral maxillofacial surgery assistant” role and replaces it with an oral maxillofacial surgery expanded duty permit for dental assistants.

◦ Dental student interns who have completed the second semester of the third year of dental school will be permitted to perform scaling, root planning and administer local anesthesia.

◦ The state’s BOD may also issue a dental hygiene student intern permit upon a candidate meeting qualifications and the approval of the dean or governing body of an institution. A dental hygiene student intern, who has finished the first year of dental school, may assist in all duties of a dental assistant pursuant to the administrative rules of the Board.

◦ The dean of an accredited dental or dental hygiene program is now permitted to petition the Board to allow a faculty member to have a limited research faculty permit.

◦ Spouses of active-duty military members who have held an active dental license in another state for the past two years will be eligible for licensure in Oklahoma.

◦ The reinstatement period for lapsed licenses is extended from one to five years.

• Governance and Training:

◦ The bill expands the duties of the state’s Allied Dental Education Committee to recommend training programs, including options not approved by the Commission on Dental Accreditation.

• Patient Protections and Transparency:

◦ Patient records must now include the names of dental assistants who provided treatment to the patient.

◦ Dentists closing their practice must notify the Board in writing and disclose the location where patient records will be stored.

◦ Prior to a dentist prescribing, diagnosing or overseeing patient treatment for any dental appliance, the patient must be a patient of record, and the dentist shall conduct an in-person patient examination.

• Emergency Provisions:

◦ During a declared health pandemic or disaster, the Board may temporarily modify examination requirements and issue temporary licenses to ensure continuity of care.

These reforms are designed to strengthen dental workforce pathways, improve regulatory transparency and ensure patient access to safe, high-quality dental services across the state.

Florida Bill Bans Fluoride Use in Public Water Systems

On May 16, Florida Gov. Ron DeSantis (R) signed SB 700 [ [link removed] ] —also known as the Florida Farm Bill—into law. While the bill does not explicitly mention fluoride, it effectively prohibits its use in state public water systems by banning “certain additives.” The law is set to take effect on July 1, 2025, making Florida the second state in the nation to take such action.

Gov. DeSantis and Florida Surgeon General Joseph Ladapo, M.D., Ph.D., have championed the move, arguing that water fluoridation constitutes “forced medication.” The decision has sparked controversy, with critics warning it could negatively impact public dental health, particularly for children and underserved communities.

For more resources about fluoride, please refer to ADEA’s community Water Fluoridation webpage. [ [link removed] ]

[[link removed]]

Learn More About How Recent Congressional Legislation May Impact Higher Education on ADEA’s YouTube Channel

ADEA’s recent Advocacy Insights webinar, “Unpacking Budget Reconciliation,” is now available to watch on ADEA’s YouTube channel. This insightful session breaks down the budget reconciliation process and examines the potential impact of the current legislative package before Congress on the higher education community. Please click this link to watch! [ [link removed] ]

ADEA Advocacy in Action

This appears weekly in the ADEA Advocate to summarize and provide direct links to recent advocacy actions taken by ADEA. Please let us know what you think and how we might improve its usefulness.

Issues and Resources

• ADEA report [ [link removed] ] on teledentistry

• ADEA report [ [link removed] ] on the Impact of the COVID-19 Pandemic on U.S. Dental Schools

• ADEA policy brief [ [link removed] ] regarding overprescription of antibiotics

• For a full list of ADEA memos, briefs and letters click here [ [link removed] ] .

Key Federal Issues [ [link removed] ]

ADEA U.S. Interactive Legislative and Regulatory Tracking Map [ [link removed] ]

Key State Issues [ [link removed] ]

The ADEA Advocate [ [link removed] ] is published weekly. Its purpose is to keep ADEA members abreast of federal and state issues and events of interest to the academic dentistry and the dental and research communities.

©2025

American Dental Education Association

655 K Street, NW, Suite 800

Washington, DC 20001

Tel: 202-289-7201

Website: www.adea.org [ [link removed] ]

[[link removed]]

Subscribe

[link removed][0]&p_colname=p_last_nm&p_varname=p_val_arr[1]&p_colname=p_alias&p_varname=p_val_arr[2]&p_colname=p_login_id&p_varname=p_val_arr[3]&p_colname=p_passwd&p_context=NEWSLETTER&p_success_url=censsaindprofile.section_update%3Fp_profile_ty%3DINDIVIDUAL_PROFILE%26p_skip_confirm_fl%3DY%26p_section_nm%3DNewsletters%26p_format%3D110%26p_msg_txt%3D%26p_cust_id%3D%26p_referrer%3D

Unsubscribe

[link removed]

B. Timothy Leeth, CPA

ADEA Chief Advocacy Officer

Bridgette DeHart, J.D.

ADEA Director of Federal Relations and Advocacy

Phillip Mauller, M.P.S.

ADEA Senior Director of State Relations and Advocacy

Contact Us:

[email protected] [ mailto:[email protected] ]

Powered by Higher Logic [link removed]

Message Analysis

- Sender: American Dental Education Association (ADEA)

- Political Party: n/a

- Country: United States

- State/Locality: n/a

- Office: n/a