|

Goldstein For Congress - Please Subscribe and also visit us at www.goldsteinforcongress.com

Provider Taxes - Healthcare Crisis in Connecticut

$300 Million Medicaid Shortfall with May 21 Deadline Approaching

Since the establishment of the Affordable Care Act, most Americans know that healthcare has become more unaffordable. One Reason - Provider Taxes

Health insurance premiums have drastically increased as those who have health insurance subsidize those who do not. Meanwhile states like Connecticut are unable to manage resources and balance budgets without tax increases.

The Connecticut Medicaid System (HUSKY)

Medicaid and the children’s version Children's Health Insurance Program (CHIP) provide coverage for approximately 79 million low-income and disabled people in this country. These programs are jointly funded by the federal government and the states.

In Connecticut, Medicaid has been conveniently rebranded HUSKY while the children’s corollary is still called CHIP.

According to the Connecticut Health Foundation – HUSKY/CHIP provide coverage to more than 900,000 state residents – including more than 366,000 children. Source

Behind the scenes, more and more Medicaid is being provided. What you may not realize is that all states, except Alaska, use “provider taxes” to boost their federal Medicaid dollars. These are used to cover the 30 percent or more of the costs not covered by the federal government.

What is a Provider Tax?

Provider Taxes have been around since the 1980s and they are taxes on health care providers, and the most common provider taxes are levied on nursing facilities and hospitals. Here in CT Ther are 3 types of provider taxes: hospital tax, resident user fees imposed on nursing homes and user fees on certain intermediate care facilities. For more about the hospital tax see a report by the State’s Office of Legislative Research from 2016 here.

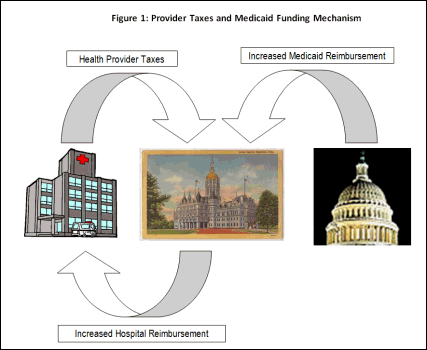

They provide a lovely graphic on How Provider Taxes Work:

These taxes levied on providers are used to increase payments to healthcare providers and help address the difference paid by Medicaid as compared with the fees paid by Medicare and most hospitals lose money on Medicare and Medicaid patients. These are costing you the taxpayer (with health insurance) to further subsidize these mismanaged programs.

While the percentages change based on the user, Federal dollars match state payments with no limit increasing the reimbursements.

Provider Taxes are a Brilliant Government Shell Game.

The hospitals, the states, and the state governments are all big winners in this scheme probably making it impossible to shut down.

Hospitals love the tax because they get more back in higher reimbursements than they pay in the taxes - its a Win-Win for Hospitals

Provider Taxes Increase Premiums.

Provider taxes were intended to curb and prevent the dramatic rise in healthcare premiums, copays and deductibles covered by employer health plans.

Healthcare premiums have increased are as a result of this tax.

It also increases the costs of the federal share of Medicaid costs that is paid for by the taxpayers. So regular taxpayers with health insurance pay higher premiums due to the tax and higher taxes to cover the federal government’s higher Medicaid costs. Taxpayers are paying at all ends of the spectrum.

Provider Taxes on the Budget Chopping Block

Provider taxes are up for consideration to be eliminated as part of the cuts to Medicaid which is a $900 billion program. The Congressional Budget Office estimates eliminating provider taxes would save the federal government more than $600 billion over the next decade as many lawmakers see these taxes as forms of waste.

The waste is due to a lack of incentives to reduce spending. Under current programs, states and healthcare facilities are not held accountable for how the tax money is used and no accountability is required as these programs lack incentives to curb and control Medicaid spending.

Expect a lot of pushback here, especially in Connecticut as the State struggles with massive Husky/CHIP shortfalls due to the wild success of enrollments, especially among the undocumented that has drastically increased since Husky for immigrants launched in June 2023 with significant shortfalls.

THE CONNECTICUT HUSKY CRISIS - May 21 deadline

Currently there is a 300 million Medicaid Deficit in Connecticut and Governor Lamont and Democrat lawmakers are att odds as to how to solve it with less than one week to go. If they cannot agree before the May 21 deadline, the state would have to stop sending Medicaid reimbursement checks to providers as early as next Friday.

It is time for more efficient healthcare and reductions in costs. Unfortunately without incentives, states like Connecticut will just raise taxes to cover shortfalls. It is somewhat refreshing to see Governor Lamont at issue with his fellow Democrat lawmakers.

We would love to hear your comments on this article.

Thank you for your continued support and please reach out for assistance. Please subscribe and spread the word as we need your support to grow this message.

Dr. Michael Goldstein & Jonathan Goldstein

The father-son team continues on so please spread the word and lets really rebuild CT and this country together in a meaningful way.

The Goldstein Substack is free today. But if you enjoyed this post, you can tell The Goldstein Substack that their writing is valuable by pledging a future subscription. You won't be charged unless they enable payments.