| From | Nicole Malliotakis <[email protected]> |

| Subject | I have big news to report |

| Date | May 15, 2025 8:31 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

Hi , My colleagues and I on the House Ways and Means Committee passed the extension and expansion of the Trump Tax Cut. Now, our One Big Beautiful Bill must be passed by the full House and the Senate before it can be signed by President Trump. ??????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????

[link removed]

**, help me get the word out about this huge new tax cut and make sure it reaches President Trump's desk!**

DONATE ??? [link removed]

DONATE ??? [link removed]

Hi -

I have big news to report.

My colleagues and I on the House Ways and Means Committee

**passed the extension and expansion of the Trump Tax Cut.** Now, our One Big Beautiful Bill must be passed by the full House and the Senate before it can be signed by President Trump.

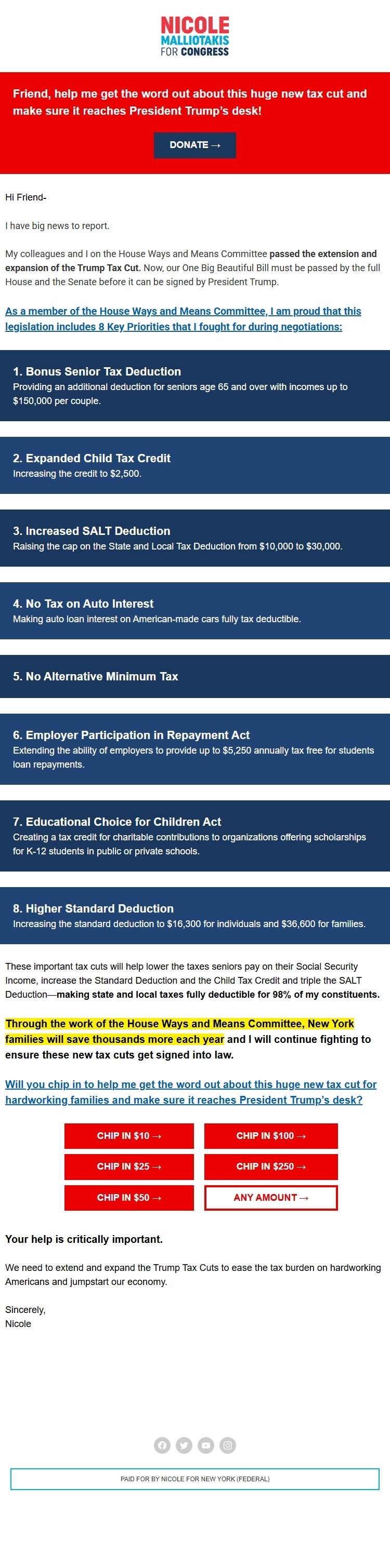

As a member of the House Ways and Means Committee, I am proud that this legislation includes 8 Key Priorities that I fought for during negotiations:

[link removed]

**1. Bonus Senior Tax Deduction**

Providing an additional deduction for seniors age 65 and over with incomes up to $150,000 per couple.

**2. Expanded Child Tax Credit**

Increasing the credit to $2,500.

**3. Increased SALT Deduction**

Raising the cap on the State and Local Tax Deduction from $10,000 to $30,000.

**4. No Tax on Auto Interest**

Making auto loan interest on American-made cars fully tax deductible.

**5. No Alternative Minimum Tax**

**6. Employer Participation in Repayment Act**

Extending the ability of employers to provide up to $5,250 annually tax free for students loan repayments.

**7. Educational Choice for Children Act**

Creating a tax credit for charitable contributions to organizations offering scholarships for K-12 students in public or private schools.

**8. Higher Standard Deduction**

Increasing the standard deduction

to $16,300 for individuals and $36,600 for families.

These important tax cuts will help lower the taxes seniors pay on their Social Security Income, increase the Standard Deduction and the Child Tax Credit and triple the SALT Deduction-

**making state and local taxes fully deductible for 98% of my constituents.**

Through the work of the House Ways and Means Committee, New York families will save thousands more each year and I will continue fighting to ensure these new tax cuts get signed into law.

Will you chip in to help me get the word out about this huge new tax cut for hardworking families and make sure it reaches President Trump's desk? [link removed]

CHIP IN $10 ??? [link removed]

CHIP IN $25 ???

[link removed]

CHIP IN $50 ??? [link removed]

CHIP IN $100 ??? [link removed]

CHIP IN $250 ??? [link removed]

ANY AMOUNT ??? [link removed]

$10 [link removed]

$25 [link removed]

$50

[link removed]

$100 [link removed]

$250 [link removed]

$500 [link removed]

ANY AMOUNT [link removed]

**Your help is critically important.**

We need to extend and expand the Trump Tax Cuts to ease the tax burden on hardworking Americans and jumpstart our economy.

Sincerely,

Nicole

[link removed]

[link removed]

[link removed]

[link removed]

PAID FOR BY NICOLE FOR NEW YORK (FEDERAL)

Sent to: [email protected]

Unsubscribe [link removed]

Nicole for New York, PO Box 60487, Staten Island, NY 10306, United States

[link removed]

**, help me get the word out about this huge new tax cut and make sure it reaches President Trump's desk!**

DONATE ??? [link removed]

DONATE ??? [link removed]

Hi -

I have big news to report.

My colleagues and I on the House Ways and Means Committee

**passed the extension and expansion of the Trump Tax Cut.** Now, our One Big Beautiful Bill must be passed by the full House and the Senate before it can be signed by President Trump.

As a member of the House Ways and Means Committee, I am proud that this legislation includes 8 Key Priorities that I fought for during negotiations:

[link removed]

**1. Bonus Senior Tax Deduction**

Providing an additional deduction for seniors age 65 and over with incomes up to $150,000 per couple.

**2. Expanded Child Tax Credit**

Increasing the credit to $2,500.

**3. Increased SALT Deduction**

Raising the cap on the State and Local Tax Deduction from $10,000 to $30,000.

**4. No Tax on Auto Interest**

Making auto loan interest on American-made cars fully tax deductible.

**5. No Alternative Minimum Tax**

**6. Employer Participation in Repayment Act**

Extending the ability of employers to provide up to $5,250 annually tax free for students loan repayments.

**7. Educational Choice for Children Act**

Creating a tax credit for charitable contributions to organizations offering scholarships for K-12 students in public or private schools.

**8. Higher Standard Deduction**

Increasing the standard deduction

to $16,300 for individuals and $36,600 for families.

These important tax cuts will help lower the taxes seniors pay on their Social Security Income, increase the Standard Deduction and the Child Tax Credit and triple the SALT Deduction-

**making state and local taxes fully deductible for 98% of my constituents.**

Through the work of the House Ways and Means Committee, New York families will save thousands more each year and I will continue fighting to ensure these new tax cuts get signed into law.

Will you chip in to help me get the word out about this huge new tax cut for hardworking families and make sure it reaches President Trump's desk? [link removed]

CHIP IN $10 ??? [link removed]

CHIP IN $25 ???

[link removed]

CHIP IN $50 ??? [link removed]

CHIP IN $100 ??? [link removed]

CHIP IN $250 ??? [link removed]

ANY AMOUNT ??? [link removed]

$10 [link removed]

$25 [link removed]

$50

[link removed]

$100 [link removed]

$250 [link removed]

$500 [link removed]

ANY AMOUNT [link removed]

**Your help is critically important.**

We need to extend and expand the Trump Tax Cuts to ease the tax burden on hardworking Americans and jumpstart our economy.

Sincerely,

Nicole

[link removed]

[link removed]

[link removed]

[link removed]

PAID FOR BY NICOLE FOR NEW YORK (FEDERAL)

Sent to: [email protected]

Unsubscribe [link removed]

Nicole for New York, PO Box 60487, Staten Island, NY 10306, United States

Message Analysis

- Sender: Nicole Malliotakis

- Political Party: Republican

- Country: United States

- State/Locality: New York

- Office: United States House of Representatives