Email

[NEWS RELEASE] Treasury: Average Individual Income Tax Refund Rises to $843, Up 50% in 3 Years

| From | Michigan Department of Treasury <[email protected]> |

| Subject | [NEWS RELEASE] Treasury: Average Individual Income Tax Refund Rises to $843, Up 50% in 3 Years |

| Date | May 15, 2025 8:14 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

Treasury Logo

*FOR IMMEDIATE RELEASE

**May 15, 2025*

*Contact: Ron Leix <[email protected]>, Treasury, 517-335-2167*

Treasury: Average Individual Income Tax Refund Rises to $843, [ [link removed] ]

Up 50% in 3 Years [ [link removed] ]

"Returns for some retirees up by average of $600, for working families up $900, total of more than $2.98 billion in refunds delivered to Michiganders"

LANSING, Mich. – State individual income tax refunds increased for Michiganders during the 2025 tax filing season, according to the Michigan Department of Treasury (Treasury).

Nearly a month since the April 15 “Tax Day” deadline, more than 3.5 million refunds were issued at an average of $843 per return, up 50% since 2022. To date, Michigan has issued more than $2.98 billion in refunds.

“Working families are getting the tax relief they deserve,” Gov. Gretchen Whitmer said. “Our work to roll back the retirement tax and quintuple the Working Families Tax Credit has already saved hundreds of thousands of Michiganders on their taxes and put more money back in their pockets. Our average refund for individual filers is up to $843, which is up 50% in three years, meaning more families can pay the bills, put food on the table, or save for a rainy day.”

This filing season, 207,000 retiree tax returns saw increased refunds because of the retirement tax changes. Refunds for these retirees jumped nearly $600 on average, distributing roughly $120 million. In addition, the Homestead Property Tax Credit increased about $70 million, providing additional refund relief to taxpayers due to increasing housing costs.

The quintupling of the Michigan Earned Income Tax Credit for Working Families has also meant an average refund of $900 for working families.

“The Michigan Department of Treasury is committed to issuing refunds as soon as practical,” State Treasurer Rachael Eubanks said. “My team has worked hard to ensure taxpayers receive their refunds in a timely manner. Putting more money in the pockets of Michiganders helps as we navigate federal policy uncertainty.”

In 2023, Governor Whitmer signed legislation to quintuple the Michigan Earned Income Tax Credit for Working Families and roll back the retirement tax.

To learn more about Michigan’s income tax, go to www.michigan.gov/incometax [ [link removed] ].

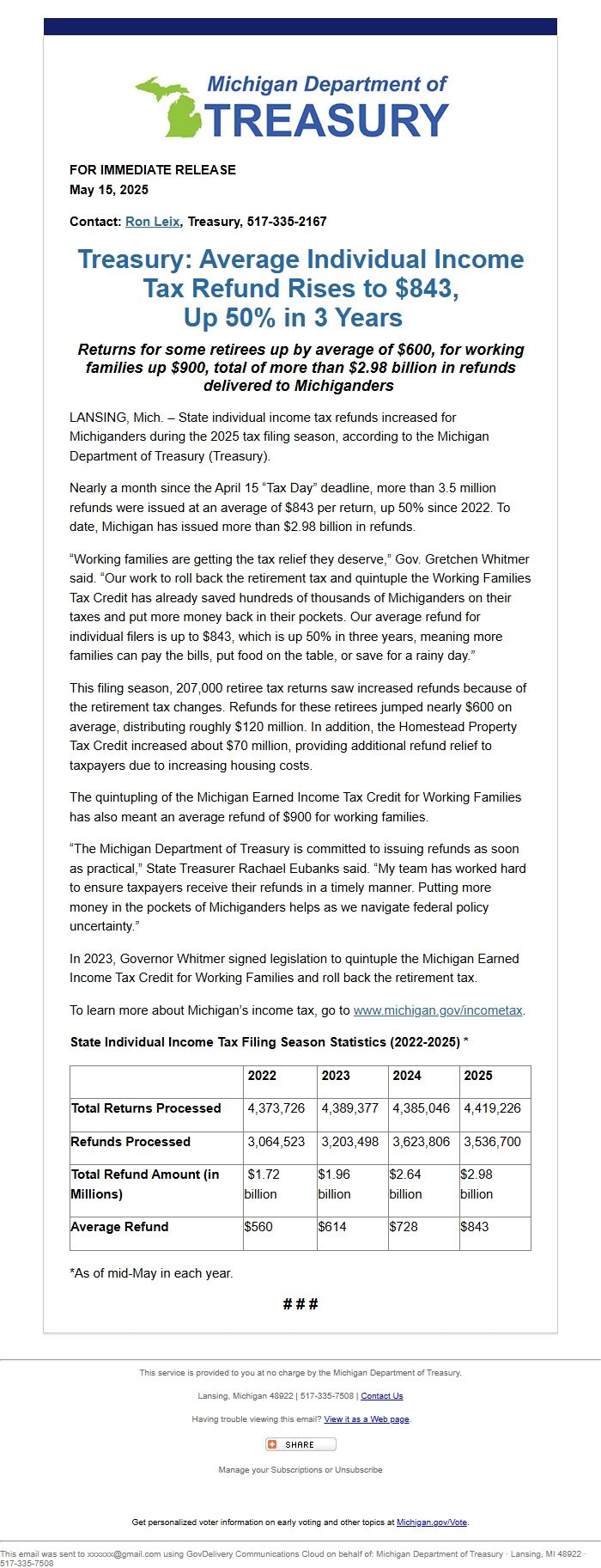

*State Individual Income Tax Filing Season Statistics (2022-2025) **

* 2022*

* 2023*

* 2024*

* 2025*

*Total Returns Processed *

4,373,726

4,389,377

4,385,046

4,419,226

*Refunds Processed *

3,064,523

3,203,498

3,623,806

3,536,700

*Total Refund Amount (in Millions) *

$1.72 billion

$1.96 billion

$2.64 billion

$2.98 billion

*Average Refund *

$560

$614

$728

$843

*As of mid-May in each year.

# # #

________________________________________________________________________

This service is provided to you at no charge by the Michigan Department of Treasury.

Lansing, Michigan 48922 | 517-335-7508 | Contact Us [ [link removed] ]

Having trouble viewing this email? View it as a Web page [ [link removed] ].

Bookmark and Share [ [link removed] ]

Manage your Subscriptions or Unsubscribe [ [link removed] ]

Get personalized voter information on early voting and other topics at Michigan.gov/Vote [ [link removed] ].

________________________________________________________________________

This email was sent to [email protected] using GovDelivery Communications Cloud on behalf of: Michigan Department of Treasury · Lansing, MI 48922 · 517-335-7508

body .abe-column-block { min-height: 5px; } table.gd_combo_table img {margin-left:10px; margin-right:10px;} table.gd_combo_table div.govd_image_display img, table.gd_combo_table td.gd_combo_image_cell img {margin-left:0px; margin-right:0px;}

*FOR IMMEDIATE RELEASE

**May 15, 2025*

*Contact: Ron Leix <[email protected]>, Treasury, 517-335-2167*

Treasury: Average Individual Income Tax Refund Rises to $843, [ [link removed] ]

Up 50% in 3 Years [ [link removed] ]

"Returns for some retirees up by average of $600, for working families up $900, total of more than $2.98 billion in refunds delivered to Michiganders"

LANSING, Mich. – State individual income tax refunds increased for Michiganders during the 2025 tax filing season, according to the Michigan Department of Treasury (Treasury).

Nearly a month since the April 15 “Tax Day” deadline, more than 3.5 million refunds were issued at an average of $843 per return, up 50% since 2022. To date, Michigan has issued more than $2.98 billion in refunds.

“Working families are getting the tax relief they deserve,” Gov. Gretchen Whitmer said. “Our work to roll back the retirement tax and quintuple the Working Families Tax Credit has already saved hundreds of thousands of Michiganders on their taxes and put more money back in their pockets. Our average refund for individual filers is up to $843, which is up 50% in three years, meaning more families can pay the bills, put food on the table, or save for a rainy day.”

This filing season, 207,000 retiree tax returns saw increased refunds because of the retirement tax changes. Refunds for these retirees jumped nearly $600 on average, distributing roughly $120 million. In addition, the Homestead Property Tax Credit increased about $70 million, providing additional refund relief to taxpayers due to increasing housing costs.

The quintupling of the Michigan Earned Income Tax Credit for Working Families has also meant an average refund of $900 for working families.

“The Michigan Department of Treasury is committed to issuing refunds as soon as practical,” State Treasurer Rachael Eubanks said. “My team has worked hard to ensure taxpayers receive their refunds in a timely manner. Putting more money in the pockets of Michiganders helps as we navigate federal policy uncertainty.”

In 2023, Governor Whitmer signed legislation to quintuple the Michigan Earned Income Tax Credit for Working Families and roll back the retirement tax.

To learn more about Michigan’s income tax, go to www.michigan.gov/incometax [ [link removed] ].

*State Individual Income Tax Filing Season Statistics (2022-2025) **

* 2022*

* 2023*

* 2024*

* 2025*

*Total Returns Processed *

4,373,726

4,389,377

4,385,046

4,419,226

*Refunds Processed *

3,064,523

3,203,498

3,623,806

3,536,700

*Total Refund Amount (in Millions) *

$1.72 billion

$1.96 billion

$2.64 billion

$2.98 billion

*Average Refund *

$560

$614

$728

$843

*As of mid-May in each year.

# # #

________________________________________________________________________

This service is provided to you at no charge by the Michigan Department of Treasury.

Lansing, Michigan 48922 | 517-335-7508 | Contact Us [ [link removed] ]

Having trouble viewing this email? View it as a Web page [ [link removed] ].

Bookmark and Share [ [link removed] ]

Manage your Subscriptions or Unsubscribe [ [link removed] ]

Get personalized voter information on early voting and other topics at Michigan.gov/Vote [ [link removed] ].

________________________________________________________________________

This email was sent to [email protected] using GovDelivery Communications Cloud on behalf of: Michigan Department of Treasury · Lansing, MI 48922 · 517-335-7508

body .abe-column-block { min-height: 5px; } table.gd_combo_table img {margin-left:10px; margin-right:10px;} table.gd_combo_table div.govd_image_display img, table.gd_combo_table td.gd_combo_image_cell img {margin-left:0px; margin-right:0px;}

Message Analysis

- Sender: Michigan Department of Treasury

- Political Party: n/a

- Country: United States

- State/Locality: MIchigan

- Office: n/a

-

Email Providers:

- govDelivery