Email

Your wallet called, it’s voting for tax cuts

| From | Americans for Prosperity <[email protected]> |

| Subject | Your wallet called, it’s voting for tax cuts |

| Date | May 13, 2025 7:27 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

Turning tax cuts into economic wins for everyone ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

View in browser

<[link removed]>

||Unsubscribe

<[link removed]>

<[link removed]>

This is The Torchlight, our weekly newsletter keeping you informed on the

fight to reignite the American Dream — and how you can make a difference in

your community.

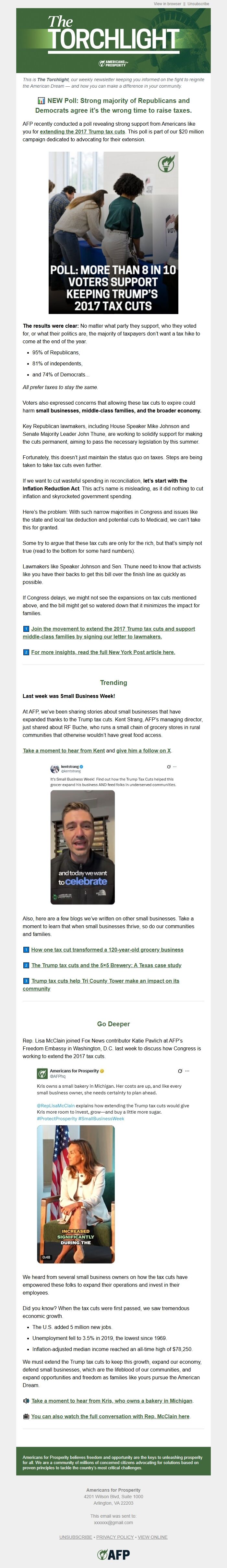

📊 NEW Poll: Strong majority of Republicans and Democrats agree it’s the wrong

time to raise taxes.

AFP recently conducted a poll revealing strong support from Americans like you

forextending the 2017 Trump tax cuts

<[link removed]>

. This poll is part of our $20 million campaign dedicated to advocating for

their extension.

<[link removed]>

The results were clear: No matter what party they support, who they voted for,

or what their politics are, the majority of taxpayers don’t want a tax hike to

come at the end of the year.

* 95% of Republicans,

* 81% of independents,

* and 74% of Democrats...

All prefer taxes to stay the same.

Voters also expressed concerns that allowing these tax cuts to expire could

harmsmall businesses, middle-class families, and the broader economy.

Key Republican lawmakers, including House Speaker Mike Johnson and Senate

Majority Leader John Thune, are working to solidify support for making the cuts

permanent, aiming to pass the necessary legislation by this summer.

Fortunately, this doesn’t just maintain the status quo on taxes. Steps are

being taken to take tax cuts even further.

If we want to cut wasteful spending in reconciliation, let’s start with the

Inflation Reduction Act. This act’s name is misleading, as it did nothing to

cut inflation and skyrocketed government spending.

Here’s the problem: With such narrow majorities in Congress and issues like

the state and local tax deduction and potential cuts to Medicaid, we can’t take

this for granted.

Some try to argue that these tax cuts are only for the rich, but that’s simply

not true (read to the bottom for some hard numbers).

Lawmakers like Speaker Johnson and Sen. Thune need to know that activists like

you have their backs to get this bill over the finish line as quickly as

possible.

If Congress delays, we might not see the expansions on tax cuts mentioned

above, and the bill might get so watered down that it minimizes the impact for

families.

1️⃣ Join the movement to extend the 2017 Trump tax cuts and support

middle-class families by signing our letter to lawmakers.

<[link removed]>

2️⃣ For more insights, read the full New York Post article here.

<[link removed]>

Trending

Last week was Small Business Week!

At AFP, we’ve been sharing stories about small businesses that have expanded

thanks to the Trump tax cuts. Kent Strang, AFP’s managing director, just shared

about RF Buche, who runs a small chain of grocery stores in rural communities

that otherwise wouldn’t have great food access.

Take a moment to hear from Kent

<[link removed]> and give him a follow on X

<[link removed]>.

<[link removed]>

Also, here are a few blogs we’ve written on other small businesses. Take a

moment to learn that when small businesses thrive, so do our communities and

families.

1️ How one tax cut transformed a 120-year-old grocery business

<[link removed]>

2️ The Trump tax cuts and the 5×5 Brewery: A Texas case study

<[link removed]>

3️⃣ Trump tax cuts help Tri County Tower make an impact on its community

<[link removed]>

Go Deeper

Rep. Lisa McClain joined Fox News contributor Katie Pavlich at AFP’s Freedom

Embassy in Washington, D.C. last week to discuss how Congress is working to

extend the 2017 tax cuts.

<[link removed]>

We heard from several small business owners on how the tax cuts have empowered

these folks to expand their operations and invest in their employees.

Did you know? When the tax cuts were first passed, we saw tremendous economic

growth.

* The U.S. added 5 million new jobs.

* Unemployment fell to 3.5% in 2019, the lowest since 1969.

* Inflation-adjusted median income reached an all-time high of $78,250.

We must extend the Trump tax cuts to keep this growth, expand our economy,

defend small businesses, which are the lifeblood of our communities, and expand

opportunities and freedom as families like yours pursue the American Dream.

🔊 Take a moment to hear from Kris, who owns a bakery in Michigan

<[link removed]>.

📺 You can also watch the full conversation with Rep. McClain here

<[link removed]>.

Americans for Prosperity believes freedom and opportunity are the keys to

unleashing prosperity for all. We are a community of millions of concerned

citizens advocating for solutions based on proven principles to tackle the

country’s most critical challenges.

Americans for Prosperity

4201 Wilson Blvd, Suite 1000

Arlington, VA 22203

This email was sent to:

[email protected]

UNSUBSCRIBE

<[link removed]>

•PRIVACY POLICY

<[link removed]>

•VIEW ONLINE

<[link removed]>

<[link removed]>

͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

View in browser

<[link removed]>

||Unsubscribe

<[link removed]>

<[link removed]>

This is The Torchlight, our weekly newsletter keeping you informed on the

fight to reignite the American Dream — and how you can make a difference in

your community.

📊 NEW Poll: Strong majority of Republicans and Democrats agree it’s the wrong

time to raise taxes.

AFP recently conducted a poll revealing strong support from Americans like you

forextending the 2017 Trump tax cuts

<[link removed]>

. This poll is part of our $20 million campaign dedicated to advocating for

their extension.

<[link removed]>

The results were clear: No matter what party they support, who they voted for,

or what their politics are, the majority of taxpayers don’t want a tax hike to

come at the end of the year.

* 95% of Republicans,

* 81% of independents,

* and 74% of Democrats...

All prefer taxes to stay the same.

Voters also expressed concerns that allowing these tax cuts to expire could

harmsmall businesses, middle-class families, and the broader economy.

Key Republican lawmakers, including House Speaker Mike Johnson and Senate

Majority Leader John Thune, are working to solidify support for making the cuts

permanent, aiming to pass the necessary legislation by this summer.

Fortunately, this doesn’t just maintain the status quo on taxes. Steps are

being taken to take tax cuts even further.

If we want to cut wasteful spending in reconciliation, let’s start with the

Inflation Reduction Act. This act’s name is misleading, as it did nothing to

cut inflation and skyrocketed government spending.

Here’s the problem: With such narrow majorities in Congress and issues like

the state and local tax deduction and potential cuts to Medicaid, we can’t take

this for granted.

Some try to argue that these tax cuts are only for the rich, but that’s simply

not true (read to the bottom for some hard numbers).

Lawmakers like Speaker Johnson and Sen. Thune need to know that activists like

you have their backs to get this bill over the finish line as quickly as

possible.

If Congress delays, we might not see the expansions on tax cuts mentioned

above, and the bill might get so watered down that it minimizes the impact for

families.

1️⃣ Join the movement to extend the 2017 Trump tax cuts and support

middle-class families by signing our letter to lawmakers.

<[link removed]>

2️⃣ For more insights, read the full New York Post article here.

<[link removed]>

Trending

Last week was Small Business Week!

At AFP, we’ve been sharing stories about small businesses that have expanded

thanks to the Trump tax cuts. Kent Strang, AFP’s managing director, just shared

about RF Buche, who runs a small chain of grocery stores in rural communities

that otherwise wouldn’t have great food access.

Take a moment to hear from Kent

<[link removed]> and give him a follow on X

<[link removed]>.

<[link removed]>

Also, here are a few blogs we’ve written on other small businesses. Take a

moment to learn that when small businesses thrive, so do our communities and

families.

1️ How one tax cut transformed a 120-year-old grocery business

<[link removed]>

2️ The Trump tax cuts and the 5×5 Brewery: A Texas case study

<[link removed]>

3️⃣ Trump tax cuts help Tri County Tower make an impact on its community

<[link removed]>

Go Deeper

Rep. Lisa McClain joined Fox News contributor Katie Pavlich at AFP’s Freedom

Embassy in Washington, D.C. last week to discuss how Congress is working to

extend the 2017 tax cuts.

<[link removed]>

We heard from several small business owners on how the tax cuts have empowered

these folks to expand their operations and invest in their employees.

Did you know? When the tax cuts were first passed, we saw tremendous economic

growth.

* The U.S. added 5 million new jobs.

* Unemployment fell to 3.5% in 2019, the lowest since 1969.

* Inflation-adjusted median income reached an all-time high of $78,250.

We must extend the Trump tax cuts to keep this growth, expand our economy,

defend small businesses, which are the lifeblood of our communities, and expand

opportunities and freedom as families like yours pursue the American Dream.

🔊 Take a moment to hear from Kris, who owns a bakery in Michigan

<[link removed]>.

📺 You can also watch the full conversation with Rep. McClain here

<[link removed]>.

Americans for Prosperity believes freedom and opportunity are the keys to

unleashing prosperity for all. We are a community of millions of concerned

citizens advocating for solutions based on proven principles to tackle the

country’s most critical challenges.

Americans for Prosperity

4201 Wilson Blvd, Suite 1000

Arlington, VA 22203

This email was sent to:

[email protected]

UNSUBSCRIBE

<[link removed]>

•PRIVACY POLICY

<[link removed]>

•VIEW ONLINE

<[link removed]>

<[link removed]>

Message Analysis

- Sender: n/a

- Political Party: n/a

- Country: n/a

- State/Locality: n/a

- Office: n/a

-

Email Providers:

- Acoustic (formerly Silverpop)