May 9, 2025

Permission to republish original opeds and cartoons granted.

Independent Voters Tend To Predict Sweeping Midterm Election Victories And That Is Bad News For Democrats In 2026

|

|

|

Americans identifying as independent is at a record high. According to Gallup, 43 percent of voters refuse to identify with either major party and claim political independence, while 28 percent say they are Democrats and 28 percent say they are Republicans. In the 2006 midterm elections, with George W. Bush in the White House, independents supported Congressional Democrats by a sweeping 18 points, 59 percent to 41 percent. Compare that to the way independents voted two years into Obama’s first term in the 2010 midterms. Independents had become deeply disillusioned with Democrats, and flipped to support Republicans by 18 points, 59 percent to 41 percent. Independents stuck with Republicans in 2014, near the tail-end of Obama’s second term, and supported Congressional Republicans by twelve points, 56 percent to 44 percent. In the 2018 independents supported Democrats by 12 points, 54 percent to 42 percent. In 2022, the independent vote was nearly split, with independents narrowly supporting Democrats by two points, 49 percent to 47 percent. This nearly split vote correlated with a split balance of power, with Republicans narrowly winning control of the House while Democrats narrowly expanded their majority in the Senate. A detailed report from Democratic-leaning firm Navigator Research that circulated among Democrats this spring points to a deeply worrying midterm election cycle for Democrats. House Republicans have an approval rating that is underwater by 13 points with independents, 55 percent to 42 percent. Meanwhile, House Democrats are underwater by a striking 28 points among independents, 62 percent to 34 percent. |

As Other Central Banks Around The World Cuts Rates And Prices Collapse, The Federal Reserve Holds Rates High

|

|

|

The Bank Of England cut its interest rate on May 8 by 0.25 percent to 4.25 percent. The Bank of China cut its rate on May 6 by 0.1 percent from 1.5 percent to 1.4 percent. The European Central bank cut its rate on April 16 by 0.25 percent to 4.25 percent. The Bank of Korea cut its rate on Feb. 25 by 0.25 percent to 2.75 percent. All are forecasting cooling inflation and slowing growth in their outlooks, which usually happens at the end of economic cycles and signals it’s time to lower rates. But in the U.S., the Federal Reserve on May 7 bucked that trend and kept its own federal funds rate elevated at 4.25 percent to 4.5 percent, and is continuing to sell its treasuries and mortgage-backed securities holdings, thus keeping market interest rates artificially higher. This despite the fact that inflation at 2.4 percent, its lowest since March 2021, has been cooling for almost three years now, and unemployment at 7.16 million, its highest since October 2021, has been rising for more than two years. Criticizing the move, President Donald Trump on Truth Social on May 8 stated that the Fed was acting “too late”: “‘Too Late’ Jerome Powell is a FOOL, who doesn’t have a clue. Other than that, I like him very much! Oil and Energy way down, almost all costs (groceries and ‘eggs’) down, virtually NO INFLATION, Tariff Money Pouring Into the U.S. — THE EXACT OPPOSITE OF ‘TOO LATE!’ ENJOY!” The President has got a point. It would not be the first time the Fed was slow to act. |

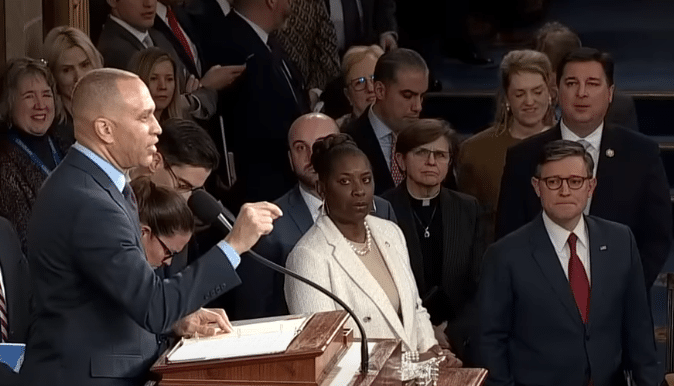

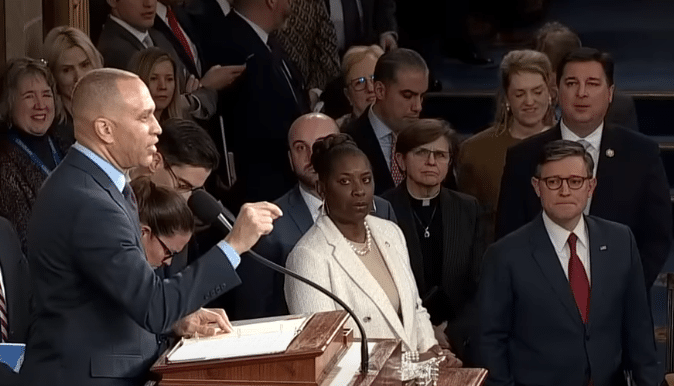

Independent Voters Tend To Predict Sweeping Midterm Election Victories And That Is Bad News For Democrats In 2026

By Manzanita Miller

More Americans are identifying as independents than at any other time in recent history, and at the same time independents are highly skeptical of the Democratic Party, calling into question the narrative that Democrats will recoup significant power in the midterm elections in 2026.

Americans identifying as independent is at a record high. According to Gallup, 43 percent of voters refuse to identify with either major party and claim political independence, while 28 percent say they are Democrats and 28 percent say they are Republicans. Of course, the vast majority of political independents who end up voting gravitate toward one of the two major parties during elections.

Historically, the voting preference of independents tends to correlate with large cultural shifts that upturn existing power structures, and in a majority of modern midterm election cycles the party that has won the independent vote gains power.

In the 2006 midterm elections, with George W. Bush in the White House, independents supported Congressional Democrats by a sweeping 18 points, 59 percent to 41 percent. This alignment of independents toward Democrats coincided with the party winning 30 House seats, and marked a powerful political alignment toward the left, which included the independent vote throwing itself behind Barack Obama in 2008.

Compare that to the way independents voted two years into Obama’s first term in the 2010 midterms. Independents had become deeply disillusioned with Democrats, and flipped to support Republicans by 18 points, 59 percent to 41 percent. Republicans won 63 House seats in 2010, buoyed by a vast advantage in the independent vote.

Independents stuck with Republicans in 2014, near the tail-end of Obama’s second term, and supported Congressional Republicans by twelve points, 56 percent to 44 percent. The GOP gained thirteen seats in that election.

In the 2018 midterms with Trump in the White House, independents shifted again, but this time their vote aligned with gains for Democrats. Independents supported Democrats by 12 points, 54 percent to 42 percent, and this coincided with Democrats winning 40 House seats.

In 2022, the independent vote was nearly split, with independents narrowly supporting Democrats by two points, 49 percent to 47 percent. This nearly split vote correlated with a split balance of power, with Republicans narrowly winning control of the House while Democrats narrowly expanded their majority in the Senate.

The correlations are not perfectly proportional, but independent voters’ preferences tend to predict the party that wins power in the midterm election cycle. Looking ahead to 2026, Democrats could struggle significantly to regain the power they hope to, particularly considering approval ratings for Democrats are far worse than for Republicans among independents.

A detailed report from Democratic-leaning firm Navigator Research that circulated among Democrats this spring points to a deeply worrying midterm election cycle for Democrats. The survey polled voters across 62 competitive House districts and found faith in Congressional Democrats was down across the board, but particularly with independents and undecided or persuadable voters.

The Navigator survey found that Congressional Democrats are underwater by over twice as many points as Congressional Republicans with independent voters in battleground House districts.

House Republicans have an approval rating that is underwater by 13 points with independents, 55 percent to 42 percent. Meanwhile, House Democrats are underwater by a striking 28 points among independents, 62 percent to 34 percent.

The poll also sectioned out persuadable voters – those who are on the fence about their support – and found that Republicans hold a 16 percentage point advantage over Democrats among persuadable voters.

While Republicans are underwater by eighteen points among persuadable voters, 55 percent to 37 percent, Democrats are underwater by 34 points, 61 percent to 27 percent.

Democrats are significantly underperforming with independent and swing voters compared to other historic election cycles where the out-of-power party won sweeping Congressional victories. Combine that with the fact that the independent vote often predicts electoral victories, and the outlook for Democrats in 2026 may not be nearly as optimistic as mainstream analysts project.

Manzanita Miller is the senior political analyst at Americans for Limited Government Foundation.

To view online: https://dailytorch.com/2025/05/independent-voters-tend-to-predict-sweeping-midterm-election-victories-and-that-is-bad-news-for-democrats-in-2026/

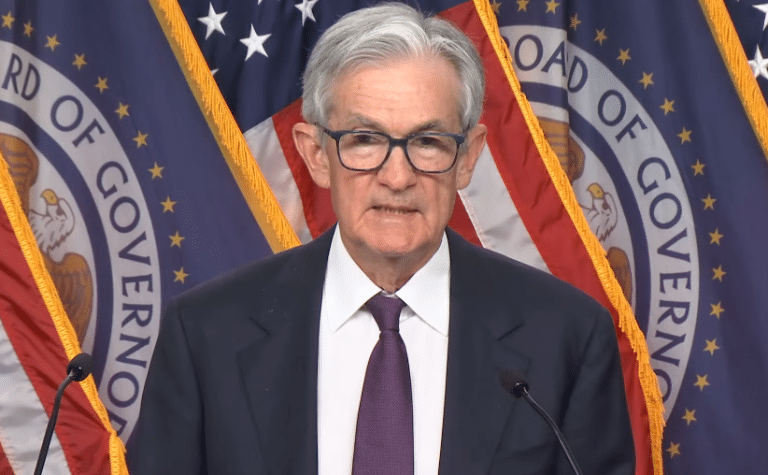

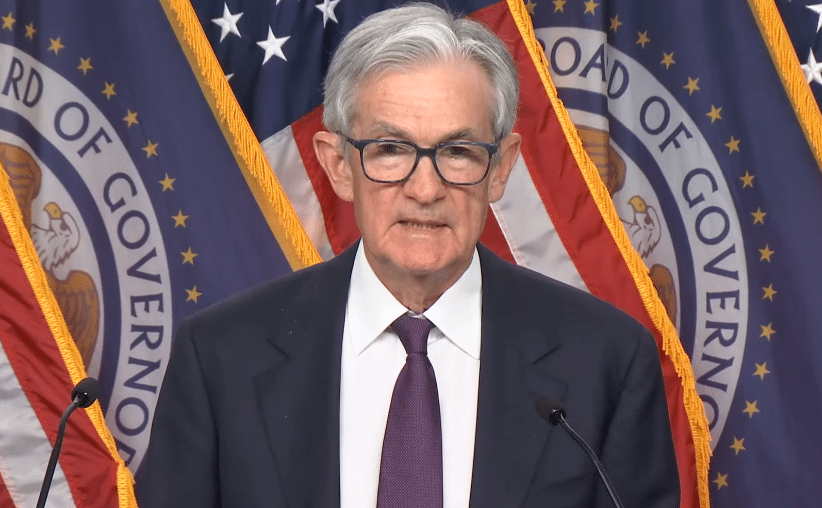

As Other Central Banks Around The World Cuts Rates And Prices Collapse, The Federal Reserve Holds Rates High

By Robert Romano

The Bank Of England cut its interest rate on May 8 by 0.25 percent to 4.25 percent.

The Bank of China cut its rate on May 6 by 0.1 percent from 1.5 percent to 1.4 percent.

The European Central bank cut its rate on April 16 by 0.25 percent to 4.25 percent.

The Bank of Korea cut its rate on Feb. 25 by 0.25 percent to 2.75 percent.

All are forecasting cooling inflation and slowing growth in their outlooks, which usually happens at the end of economic cycles and signals it’s time to lower rates.

But in the U.S., the Federal Reserve on May 7 bucked that trend and kept its own federal funds rate elevated at 4.25 percent to 4.5 percent, and is continuing to sell its treasuries and mortgage-backed securities holdings, thus keeping market interest rates artificially higher.

This despite the fact that inflation at 2.4 percent, its lowest since March 2021, has been cooling for almost three years now, and unemployment at 7.16 million, its highest since October 2021, has been rising for more than two years.

Criticizing the move, President Donald Trump on Truth Social on May 8 stated that the Fed was acting “too late”: “‘Too Late’ Jerome Powell is a FOOL, who doesn’t have a clue. Other than that, I like him very much! Oil and Energy way down, almost all costs (groceries and ‘eggs’) down, virtually NO INFLATION, Tariff Money Pouring Into the U.S. — THE EXACT OPPOSITE OF ‘TOO LATE!’ ENJOY!”

The President has got a point. It would not be the first time the Fed was slow to act.

During Covid in 2020, it brought its policy rate to near-zero percent, leaving it there all the way through 2021 even as inflation was already above 5 percent by June 2021.

By the time January 2022 rolled around the inflation rate was already up to 7.5 percent as global production was slow to catch up to the reopening economy following the pandemic. It was not until after Russia invaded Ukraine the Fed stepped into action and started hiking rates, something it could have started in 2021.

Instead, at the time, the Fed was favoring the maximum employment side of its dual mandate.

Now, after being caught off guard by the inflation of 2021 and 2022, where it peaked at 9.1 percent in June 2022, the central bank appears to be favoring stopping inflation side of its mandate.

Generally, the unemployment rate at 4.2 percent is near historic lows, although is up from April 2023’s low of 3.4 percent as it has slowly but steadily increased the past couple of years. It could be that the Fed is okay with an unemployment rate higher than that if it means avoiding more inflation.

While there was no mention of tariffs in the central bank’s May 7 release, it did come up quite a bit in Federal Reserve Chairman Jerome Powell’s news conference, where Powell expressed uncertainty about whether inflation would go up again thanks to tariffs: “If the large increases in tariffs that have been announced are sustained, they're likely to… generate a rise in inflation, a slowdown in economic growth, and an increase in unemployment.”

But Powell could not decide if the impacts would be short-lived or not: “The effects on inflation could be short-lived, reflecting a one-time shift in the price level. It is also possible that the inflationary effects could instead be more persistent. Avoiding that outcome will depend on the size of the tariffs … on how long it takes for them to pass through fully into prices and ultimately on keeping longer term inflation expectations well anchored.”

In the meantime, prices have been slowing and globally, commodities like oil have been dropping amid increased production by OPEC. Meaning the higher inflation expected by some might not materialize across the board as anticipated. As it is, the Fed might be waiting for unemployment to go much higher before it decides to move at all and could be late to the party again. We’ll see. Stay tuned.

Robert Romano is the Executive Director at Americans for Limited Government Foundation.

To view online: https://dailytorch.com/2025/05/as-other-central-banks-around-the-world-cuts-rates-and-prices-collapse-the-federal-reserve-holds-rates-high/