Email

The livestream starts in 30 minutes!

| From | Americans for Prosperity <[email protected]> |

| Subject | The livestream starts in 30 minutes! |

| Date | May 6, 2025 6:30 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

Join Rep. McClain and Katie Pavlich to unpack a looming tax hike ͏ ͏ ͏ ͏ ͏

͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

͏ ͏ ͏ ͏ ͏ ͏ ͏

View in browser

<[link removed]>

||Unsubscribe

<[link removed]>

<[link removed]>

Hi John,

We’re just 30 minutes away from our exclusive livestream

<[link removed]>, in which we’ll discuss the

future of the2017 Trump tax cuts and what their potential expiration or

extension could mean for families, taxpayers, and the broader economy.

Don’t miss this important conversation with:

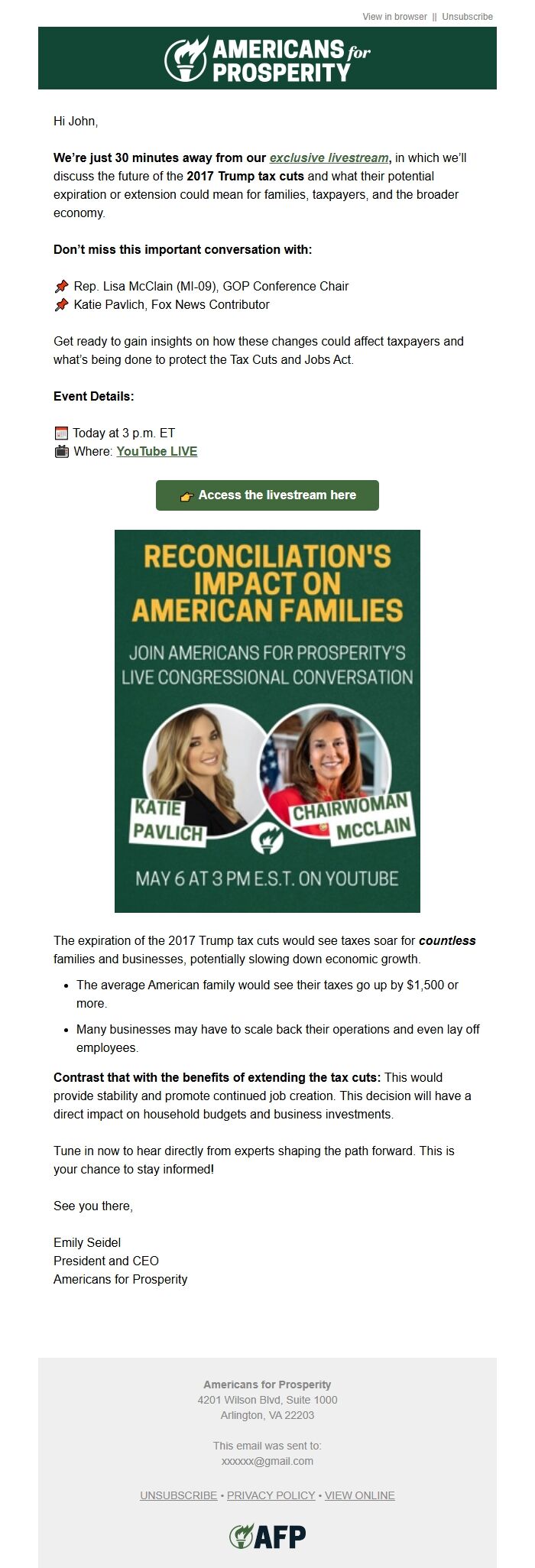

📌 Rep. Lisa McClain (MI-09), GOP Conference Chair

📌 Katie Pavlich, Fox News Contributor

Get ready to gain insights on how these changes could affect taxpayers and

what’s being done to protect the Tax Cuts and Jobs Act.

Event Details:

📅 Today at 3 p.m. ET

📺 Where: YouTube LIVE <[link removed]>

👉 Access the livestream here <[link removed]>

<[link removed]>

The expiration of the 2017 Trump tax cuts would see taxes soar for countless

families and businesses, potentially slowing down economic growth.

* The average American family would see their taxes go up by $1,500 or more.

* Many businesses may have to scale back their operations and even lay off

employees.

Contrast that with the benefits of extending the tax cuts: This would provide

stability and promote continued job creation. This decision will have a direct

impact on household budgets and business investments.

Tune in now to hear directly from experts shaping the path forward. This is

your chance to stay informed!

See you there,

Emily Seidel

President and CEO

Americans for Prosperity

Americans for Prosperity

4201 Wilson Blvd, Suite 1000

Arlington, VA 22203

This email was sent to:

[email protected]

UNSUBSCRIBE

<[link removed]>

•PRIVACY POLICY

<[link removed]>

•VIEW ONLINE

<[link removed]>

<[link removed]>

͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

͏ ͏ ͏ ͏ ͏ ͏ ͏

View in browser

<[link removed]>

||Unsubscribe

<[link removed]>

<[link removed]>

Hi John,

We’re just 30 minutes away from our exclusive livestream

<[link removed]>, in which we’ll discuss the

future of the2017 Trump tax cuts and what their potential expiration or

extension could mean for families, taxpayers, and the broader economy.

Don’t miss this important conversation with:

📌 Rep. Lisa McClain (MI-09), GOP Conference Chair

📌 Katie Pavlich, Fox News Contributor

Get ready to gain insights on how these changes could affect taxpayers and

what’s being done to protect the Tax Cuts and Jobs Act.

Event Details:

📅 Today at 3 p.m. ET

📺 Where: YouTube LIVE <[link removed]>

👉 Access the livestream here <[link removed]>

<[link removed]>

The expiration of the 2017 Trump tax cuts would see taxes soar for countless

families and businesses, potentially slowing down economic growth.

* The average American family would see their taxes go up by $1,500 or more.

* Many businesses may have to scale back their operations and even lay off

employees.

Contrast that with the benefits of extending the tax cuts: This would provide

stability and promote continued job creation. This decision will have a direct

impact on household budgets and business investments.

Tune in now to hear directly from experts shaping the path forward. This is

your chance to stay informed!

See you there,

Emily Seidel

President and CEO

Americans for Prosperity

Americans for Prosperity

4201 Wilson Blvd, Suite 1000

Arlington, VA 22203

This email was sent to:

[email protected]

UNSUBSCRIBE

<[link removed]>

•PRIVACY POLICY

<[link removed]>

•VIEW ONLINE

<[link removed]>

<[link removed]>

Message Analysis

- Sender: n/a

- Political Party: n/a

- Country: n/a

- State/Locality: n/a

- Office: n/a

-

Email Providers:

- Acoustic (formerly Silverpop)