Email

What reconciliation means for your tax cuts

| From | Americans for Prosperity <[email protected]> |

| Subject | What reconciliation means for your tax cuts |

| Date | May 5, 2025 9:01 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

Rep. McClain and Fox News’ Katie Pavlich break it down live tomorrow ͏ ͏ ͏

͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

͏ ͏ ͏ ͏ ͏

View in browser

<[link removed]>

||Unsubscribe

<[link removed]>

<[link removed]>

This is The Torchlight, our weekly newsletter keeping you informed on the

fight to reignite the American Dream — and how you can make a difference in

your community.

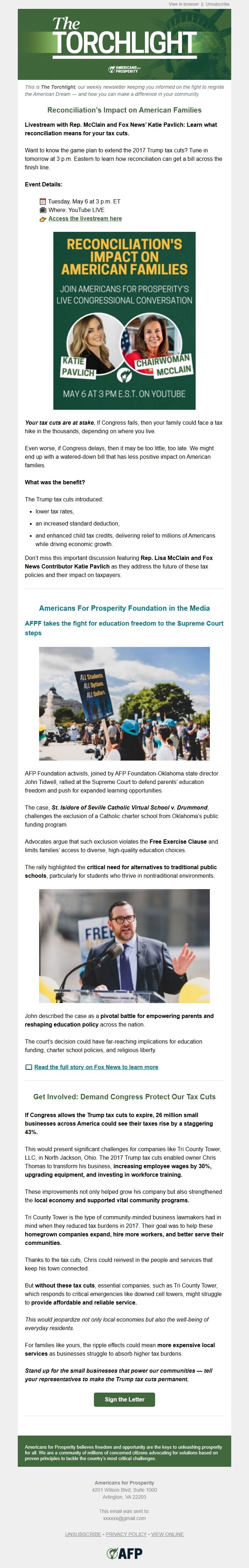

Reconciliation’s Impact on American Families

Livestream with Rep. McClain and Fox News’ Katie Pavlich: Learn what

reconciliation means for your tax cuts.

Want to know the game plan to extend the 2017 Trump tax cuts? Tune in tomorrow

at 3 p.m. Eastern to learn how reconciliation can get a bill across the finish

line.

Event Details:

📅 Tuesday, May 6 at 3 p.m. ET

📺 Where: YouTube LIVE

👉 Access the livestream here <[link removed]>

<[link removed]>

Your tax cuts are at stake. If Congress fails, then your family could face a

tax hike in the thousands, depending on where you live.

Even worse, if Congress delays, then it may be too little, too late. We might

end up with a watered-down bill that has less positive impact on American

families.

What was the benefit?

The Trump tax cuts introduced:

* lower tax rates,

* an increased standard deduction,

* and enhanced child tax credits, delivering relief to millions of Americans

while driving economic growth.

Don’t miss this important discussion featuring Rep. Lisa McClain and Fox News

Contributor Katie Pavlich as they address the future of these tax policies and

their impact on taxpayers.

Americans For Prosperity Foundation in the Media

AFPF takes the fight for education freedom to the Supreme Court steps

<[link removed]>

AFP Foundation activists, joined by AFP Foundation-Oklahoma state director

John Tidwell, rallied at the Supreme Court to defend parents’ education freedom

and push for expanded learning opportunities.

The case, St. Isidore of Seville Catholic Virtual School v. Drummond,

challenges the exclusion of a Catholic charter school from Oklahoma’s public

funding program.

Advocates argue that such exclusion violates the Free Exercise Clause and

limits families’ access to diverse, high-quality education choices.

The rally highlighted the critical need for alternatives to traditional public

schools, particularly for students who thrive in nontraditional environments.

<[link removed]>

John described the case as a pivotal battle for empowering parents and

reshaping education policy across the nation.

The court’s decision could have far-reaching implications for education

funding, charter school policies, and religious liberty.

📖 Read the full story on Fox News to learn more

<[link removed]>

.

Get Involved: Demand Congress Protect Our Tax Cuts

If Congress allows the Trump tax cuts to expire, 26 million small businesses

across America could see their taxes rise by a staggering 43%.

This would present significant challenges for companies like Tri County Tower,

LLC, in North Jackson, Ohio. The 2017 Trump tax cuts enabled owner Chris Thomas

to transform his business,increasing employee wages by 30%, upgrading

equipment, and investing in workforce training.

These improvements not only helped grow his company but also strengthened the

local economy and supported vital community programs.

Tri County Tower is the type of community-minded business lawmakers had in

mind when they reduced tax burdens in 2017. Their goal was to help these

homegrown companies expand, hire more workers, and better serve their

communities.

Thanks to the tax cuts, Chris could reinvest in the people and services that

keep his town connected.

But without these tax cuts, essential companies, such as Tri County Tower,

which responds to critical emergencies like downed cell towers, might struggle

toprovide affordable and reliable service.

This would jeopardize not only local economies but also the well-being of

everyday residents.

For families like yours, the ripple effects could mean more expensive local

services as businesses struggle to absorb higher tax burdens.

Stand up for the small businesses that power our communities — tell your

representatives to make the Trump tax cuts permanent.

Sign the Letter

<[link removed]>

Americans for Prosperity believes freedom and opportunity are the keys to

unleashing prosperity for all. We are a community of millions of concerned

citizens advocating for solutions based on proven principles to tackle the

country’s most critical challenges.

Americans for Prosperity

4201 Wilson Blvd, Suite 1000

Arlington, VA 22203

This email was sent to:

[email protected]

UNSUBSCRIBE

<[link removed]>

•PRIVACY POLICY

<[link removed]>

•VIEW ONLINE

<[link removed]>

<[link removed]>

͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

͏ ͏ ͏ ͏ ͏

View in browser

<[link removed]>

||Unsubscribe

<[link removed]>

<[link removed]>

This is The Torchlight, our weekly newsletter keeping you informed on the

fight to reignite the American Dream — and how you can make a difference in

your community.

Reconciliation’s Impact on American Families

Livestream with Rep. McClain and Fox News’ Katie Pavlich: Learn what

reconciliation means for your tax cuts.

Want to know the game plan to extend the 2017 Trump tax cuts? Tune in tomorrow

at 3 p.m. Eastern to learn how reconciliation can get a bill across the finish

line.

Event Details:

📅 Tuesday, May 6 at 3 p.m. ET

📺 Where: YouTube LIVE

👉 Access the livestream here <[link removed]>

<[link removed]>

Your tax cuts are at stake. If Congress fails, then your family could face a

tax hike in the thousands, depending on where you live.

Even worse, if Congress delays, then it may be too little, too late. We might

end up with a watered-down bill that has less positive impact on American

families.

What was the benefit?

The Trump tax cuts introduced:

* lower tax rates,

* an increased standard deduction,

* and enhanced child tax credits, delivering relief to millions of Americans

while driving economic growth.

Don’t miss this important discussion featuring Rep. Lisa McClain and Fox News

Contributor Katie Pavlich as they address the future of these tax policies and

their impact on taxpayers.

Americans For Prosperity Foundation in the Media

AFPF takes the fight for education freedom to the Supreme Court steps

<[link removed]>

AFP Foundation activists, joined by AFP Foundation-Oklahoma state director

John Tidwell, rallied at the Supreme Court to defend parents’ education freedom

and push for expanded learning opportunities.

The case, St. Isidore of Seville Catholic Virtual School v. Drummond,

challenges the exclusion of a Catholic charter school from Oklahoma’s public

funding program.

Advocates argue that such exclusion violates the Free Exercise Clause and

limits families’ access to diverse, high-quality education choices.

The rally highlighted the critical need for alternatives to traditional public

schools, particularly for students who thrive in nontraditional environments.

<[link removed]>

John described the case as a pivotal battle for empowering parents and

reshaping education policy across the nation.

The court’s decision could have far-reaching implications for education

funding, charter school policies, and religious liberty.

📖 Read the full story on Fox News to learn more

<[link removed]>

.

Get Involved: Demand Congress Protect Our Tax Cuts

If Congress allows the Trump tax cuts to expire, 26 million small businesses

across America could see their taxes rise by a staggering 43%.

This would present significant challenges for companies like Tri County Tower,

LLC, in North Jackson, Ohio. The 2017 Trump tax cuts enabled owner Chris Thomas

to transform his business,increasing employee wages by 30%, upgrading

equipment, and investing in workforce training.

These improvements not only helped grow his company but also strengthened the

local economy and supported vital community programs.

Tri County Tower is the type of community-minded business lawmakers had in

mind when they reduced tax burdens in 2017. Their goal was to help these

homegrown companies expand, hire more workers, and better serve their

communities.

Thanks to the tax cuts, Chris could reinvest in the people and services that

keep his town connected.

But without these tax cuts, essential companies, such as Tri County Tower,

which responds to critical emergencies like downed cell towers, might struggle

toprovide affordable and reliable service.

This would jeopardize not only local economies but also the well-being of

everyday residents.

For families like yours, the ripple effects could mean more expensive local

services as businesses struggle to absorb higher tax burdens.

Stand up for the small businesses that power our communities — tell your

representatives to make the Trump tax cuts permanent.

Sign the Letter

<[link removed]>

Americans for Prosperity believes freedom and opportunity are the keys to

unleashing prosperity for all. We are a community of millions of concerned

citizens advocating for solutions based on proven principles to tackle the

country’s most critical challenges.

Americans for Prosperity

4201 Wilson Blvd, Suite 1000

Arlington, VA 22203

This email was sent to:

[email protected]

UNSUBSCRIBE

<[link removed]>

•PRIVACY POLICY

<[link removed]>

•VIEW ONLINE

<[link removed]>

<[link removed]>

Message Analysis

- Sender: n/a

- Political Party: n/a

- Country: n/a

- State/Locality: n/a

- Office: n/a

-

Email Providers:

- Acoustic (formerly Silverpop)