Email

American Unilateralism

| From | AEI DataPoints <[email protected]> |

| Subject | American Unilateralism |

| Date | April 24, 2025 11:01 AM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

Expert analysis made easy. Breaking down the news with data, charts, and maps.

Edited by: James Desio and Hannah Bowen

Happy Thursday! In today’s newsletter, we examine the United States’ turn toward unilateralism, American trade schools and the manufacturing revival, and China’s $100 billion investment in the United Kingdom.

Don’t forget—subscribe <[link removed]> and send DataPoints to a friend!

For inquiries, please email [email protected] <[link removed]>.

1. American Unilateralism

Topline: The United States is at a foreign policy crossroads. AEI’s Michael Beckley argues <[link removed]> that the most likely trajectory for the US in geopolitics is not purely isolationist or internationalist—instead the US stands to become a rogue superpower, increasingly out for itself.

Economic Independence: Because of its dominance in the international market and its powerful domestic economy, America can afford a higher level of economic independence.

- The American consumer market rivals those of China and the Eurozone combined.

- 50 percent of global trade and 90 percent of international finance transactions are conducted in US dollars.

- The US has one of the least trade-dependent economies in the world, with exports accounting for only 11 percent of GDP (the global average is 30 percent).

Reality Check: President Donald Trump’s recent policy decisions—such as implementing tariffs, cutting foreign aid, and proposing to take control of foreign territory—channel frustrations with the global order and structural forces. But alienating trade partners and enforcing an era of isolationism threatens to unravel alliances and push for confrontation with geopolitical rivals like Russia and China.

“The goal isn’t just to win a great-power contest. It’s to channel it; to fix what’s broken at home and shape a world that reflects American interests and values. A free world that works—for the United States and for those willing and able to stand with it.” —Michael Beckley

2. Can Trade Schools Lead a Manufacturing Revival?

Topline: Does the American education system have what it takes to produce the workforce needed for a manufacturing revival? AEI’s Robert Pondiscio investigates <[link removed]> whether the American school system can adequately

teach career and technical education (CTE) in order to provide the workforce needed to support the Trump administration’s push for new manufacturing jobs in the US.

The Numbers: At its best, CTE aligns education with practical demands of the labor market by offering students a stable pathway toward careers that don’t require a four-year degree. In 2019, 85 percent of high school graduates earned at least one CTE credit. In 2023, 97 percent of CTE students graduated on time.

The Challenge of Modern Manufacturing: Automation has changed manufacturing and requires advanced skills like robotics and computer numerical control programming. This new era of manufacturing may not just require the standard skills that CTE teaches; it will likely require skills from both CTE and standard academics, like mathematics and reading. To provide the workforce needed to support a manufacturing revival, CTE programs must be aligned with local economies and include forward thinking skills that can support automation.

“If we’re serious about this revival, we’ll need more than tariffs and rhetoric. We’ll need to ensure CTE programs are tightly aligned with local economies and forward-looking enough to prepare students for an automated future. We’ll need to fix the academic foundations—math, literacy, problem-solving—that underpin technical skills.” —Robert Pondiscio

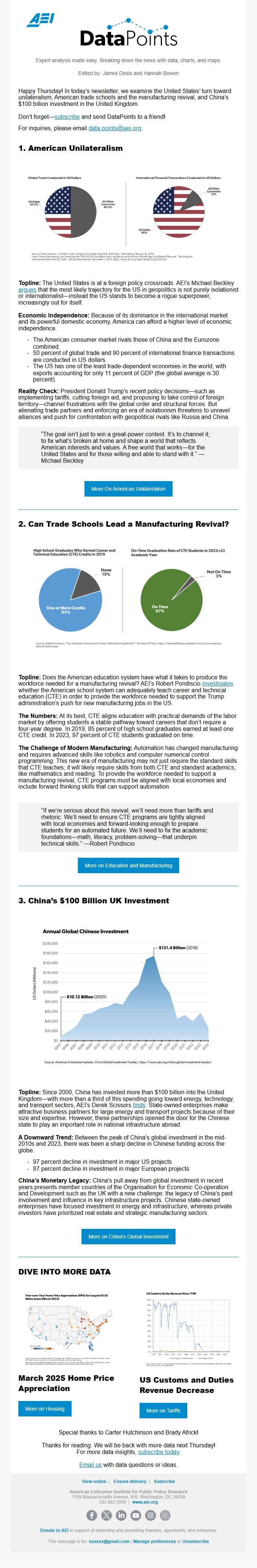

3. China’s $100 Billion UK Investment

Topline: Since 2000, China has invested more than $100 billion into the United Kingdom—with more than a third of this spending going toward energy, technology, and transport sectors, AEI’s Derek Scissors finds <[link removed]>. State-owned enterprises make attractive business partners for large energy and transport projects because of their size and expertise. However, these partnerships opened the door for the Chinese state to play an important role in national infrastructure abroad.

A Downward Trend: Between the peak of China’s global investment in the mid-2010s and 2023, there was been a sharp decline in Chinese funding across the globe.

- 97 percent decline in investment in major US projects

- 87 percent decline in investment in major European projects

China’s Monetary Legacy: China’s pull away from global investment in recent years presents member countries of the Organisation for Economic Co-operation and Development such as the UK with a new challenge: the legacy of China’s past involvement and influence in key infrastructure projects. Chinese state-owned enterprises have focused investment in energy and infrastructure, whereas private investors have prioritized real estate and strategic manufacturing sectors.

DIVE INTO MORE DATA

March 2025 Home Price Appreciation <[link removed]>

US Customs and Duties Revenue Decrease <[link removed]>

Special thanks to Carter Hutchinson and Brady Africk!

Thanks for reading. We will be back with more data next Thursday!

For more data insights, subscribe today <[link removed]>.

Email us <[link removed]> with data questions or ideas.

View online <[[[link removed]]]> | Ensure delivery <[link removed]> | Subscribe <[link removed]>

American Enterprise Institute for Public Policy Research

1789 Massachusetts Avenue, NW, Washington, DC 20036

202.862.5800 | www.aei.org <[link removed]>

<[link removed]> <[link removed]> <[link removed]> <[link removed]> <[link removed]>

<[link removed]> Donate to AEI <[link removed]> in support of defending and promoting freedom, opportunity, and enterprise.

This message is for: [email protected] <[email protected]> | Manage preferences <[link removed]> or Unsubscribe <[link removed]>

<!-- This is a comment -->

Edited by: James Desio and Hannah Bowen

Happy Thursday! In today’s newsletter, we examine the United States’ turn toward unilateralism, American trade schools and the manufacturing revival, and China’s $100 billion investment in the United Kingdom.

Don’t forget—subscribe <[link removed]> and send DataPoints to a friend!

For inquiries, please email [email protected] <[link removed]>.

1. American Unilateralism

Topline: The United States is at a foreign policy crossroads. AEI’s Michael Beckley argues <[link removed]> that the most likely trajectory for the US in geopolitics is not purely isolationist or internationalist—instead the US stands to become a rogue superpower, increasingly out for itself.

Economic Independence: Because of its dominance in the international market and its powerful domestic economy, America can afford a higher level of economic independence.

- The American consumer market rivals those of China and the Eurozone combined.

- 50 percent of global trade and 90 percent of international finance transactions are conducted in US dollars.

- The US has one of the least trade-dependent economies in the world, with exports accounting for only 11 percent of GDP (the global average is 30 percent).

Reality Check: President Donald Trump’s recent policy decisions—such as implementing tariffs, cutting foreign aid, and proposing to take control of foreign territory—channel frustrations with the global order and structural forces. But alienating trade partners and enforcing an era of isolationism threatens to unravel alliances and push for confrontation with geopolitical rivals like Russia and China.

“The goal isn’t just to win a great-power contest. It’s to channel it; to fix what’s broken at home and shape a world that reflects American interests and values. A free world that works—for the United States and for those willing and able to stand with it.” —Michael Beckley

2. Can Trade Schools Lead a Manufacturing Revival?

Topline: Does the American education system have what it takes to produce the workforce needed for a manufacturing revival? AEI’s Robert Pondiscio investigates <[link removed]> whether the American school system can adequately

teach career and technical education (CTE) in order to provide the workforce needed to support the Trump administration’s push for new manufacturing jobs in the US.

The Numbers: At its best, CTE aligns education with practical demands of the labor market by offering students a stable pathway toward careers that don’t require a four-year degree. In 2019, 85 percent of high school graduates earned at least one CTE credit. In 2023, 97 percent of CTE students graduated on time.

The Challenge of Modern Manufacturing: Automation has changed manufacturing and requires advanced skills like robotics and computer numerical control programming. This new era of manufacturing may not just require the standard skills that CTE teaches; it will likely require skills from both CTE and standard academics, like mathematics and reading. To provide the workforce needed to support a manufacturing revival, CTE programs must be aligned with local economies and include forward thinking skills that can support automation.

“If we’re serious about this revival, we’ll need more than tariffs and rhetoric. We’ll need to ensure CTE programs are tightly aligned with local economies and forward-looking enough to prepare students for an automated future. We’ll need to fix the academic foundations—math, literacy, problem-solving—that underpin technical skills.” —Robert Pondiscio

3. China’s $100 Billion UK Investment

Topline: Since 2000, China has invested more than $100 billion into the United Kingdom—with more than a third of this spending going toward energy, technology, and transport sectors, AEI’s Derek Scissors finds <[link removed]>. State-owned enterprises make attractive business partners for large energy and transport projects because of their size and expertise. However, these partnerships opened the door for the Chinese state to play an important role in national infrastructure abroad.

A Downward Trend: Between the peak of China’s global investment in the mid-2010s and 2023, there was been a sharp decline in Chinese funding across the globe.

- 97 percent decline in investment in major US projects

- 87 percent decline in investment in major European projects

China’s Monetary Legacy: China’s pull away from global investment in recent years presents member countries of the Organisation for Economic Co-operation and Development such as the UK with a new challenge: the legacy of China’s past involvement and influence in key infrastructure projects. Chinese state-owned enterprises have focused investment in energy and infrastructure, whereas private investors have prioritized real estate and strategic manufacturing sectors.

DIVE INTO MORE DATA

March 2025 Home Price Appreciation <[link removed]>

US Customs and Duties Revenue Decrease <[link removed]>

Special thanks to Carter Hutchinson and Brady Africk!

Thanks for reading. We will be back with more data next Thursday!

For more data insights, subscribe today <[link removed]>.

Email us <[link removed]> with data questions or ideas.

View online <[[[link removed]]]> | Ensure delivery <[link removed]> | Subscribe <[link removed]>

American Enterprise Institute for Public Policy Research

1789 Massachusetts Avenue, NW, Washington, DC 20036

202.862.5800 | www.aei.org <[link removed]>

<[link removed]> <[link removed]> <[link removed]> <[link removed]> <[link removed]>

<[link removed]> Donate to AEI <[link removed]> in support of defending and promoting freedom, opportunity, and enterprise.

This message is for: [email protected] <[email protected]> | Manage preferences <[link removed]> or Unsubscribe <[link removed]>

<!-- This is a comment -->

Message Analysis

- Sender: n/a

- Political Party: n/a

- Country: n/a

- State/Locality: n/a

- Office: n/a

-

Email Providers:

- Marketo