|

|

|

|

|

|

|

Please find below a

special message from our advertising sponsor, Electric Royalties.

|

|

|

|

|

The All-In-One Play On Critical

Metals

|

|

|

The electrification trend that

was putting pressure on critical metals like copper, zinc, lithium, graphite,

manganese, tin and vanadium was already one of the top investing themes in today???s

world.

Now the tariff war has

turbocharged the entire sector, sending investors scrambling for the best

plays.

They???ll find one perfectly

positioned, all-in-one, critical metals bet — Electric Royalties (ELEC.V;

ELECF.OTC) — a company that also happens to be severely undervalued in light

of its upcoming cash flow.

|

|

|

Dear Fellow Investor,

The energy revolution is a long-term

trend that will drive demand for critical metals for decades to come.

From copper to zinc, to graphite to

vanadium, critical metals face either looming or ongoing supply deficits.

The price pressure that these deficits

will put on these metals creates opportunity for investors.

As luck would have it, there???s a

unique and undervalued way to play the trend.

|

It???s called Electric

Royalties (ELEC.V; ELECF), the under-the-radar company that has quietly built

its royalty portfolio in energy metals from 11 royalties to 43 royalties over the

past five years.

|

If you want critical metals exposure

and diversification, it???s hard to imagine anything better:

|

Electric Royalties???

portfolio is spread across no less than nine critical metals and five continents.

It also includes another 17 optioned properties that could be converted into

royalties.

|

And then there???s this: Despite the

rapid-fire growth of this portfolio...and despite significant cash flow on the

way... Electric Royalties is currently trading below its IPO levels five years

ago.

As you???re about to see, that???s a

valuation mismatch that could soon resolve in a lucrative re-rating for nimble

investors.

|

|

|

|

Significant Cash Flow On The

Way

|

|

|

How undervalued is Electric Royalties

and how much money could this royalty company produce?

Consider that just a fraction of

the company???s projects could generate about as much annual cash flow as the

company???s current market cap.

They include (1):

- Punitaqui (0.75% Gross

Revenue Royalty): A copper-gold project that could produce between 19 million

and 23 million pounds of copper a year. Electric is entitled to 0.75% of the

annual revenues from the mine.

- Bisset Creek (1.5%

GRR): This graphite project is projected to generate 33,183 tonnes of graphite

annually. Once the project is in production, Electric is entitled to 1.5% of

annual revenues.

- Battery Hill (2% Gross

Metal Royalty): Battery Hills is a manganese project that could produce 68,000

tonnes of the metal a year. Once the project is in production, Electric is

entitled to 2% of annual revenues.

- Kenbridge (0.5% GRR and 1%

GRR on Kenbridge North): With projected annual production of 7.3 million

pounds of nickel equivalent, Electric???s Kenbridge royalty entitles it to 0.5% of

annual revenues from the project.

- Mont Sorcier (1% GMR on

vanadium): This project could produce five million tonnes per year of

vanadium. Once Mont Sorcier is in production, Electric is entitled to 1% of the

annual revenues from the project???s vanadium sales.

|

|

|

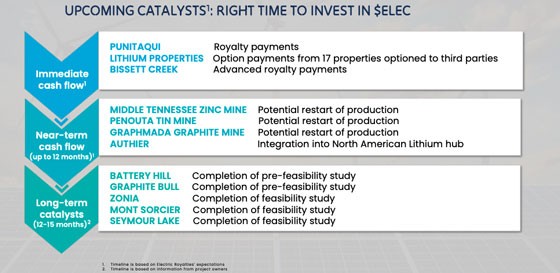

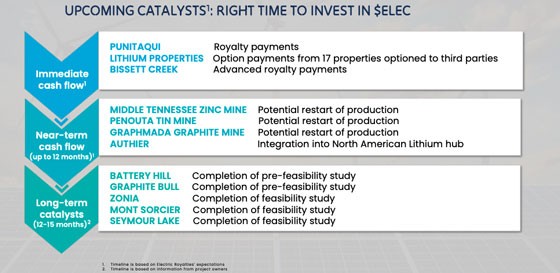

Click image to enlarge.

Electric Royalties has several

royalties in its portfolio that could soon generate cash flow for the company.

|

|

|

These projects are in advanced stages

of development and could come online anytime from this year to just a few years

down the road.

In addition to Punitaqui, Electric

Royalties has another four royalty projects (the Middle Tennessee Zinc mine, the

Gramphada Graphite mine, the Penouta tin mine and the Authier Lithium Project)

that could either recommence production or enter production for the first time

this year.

|

|

|

|

The Big Advantage Of Royalty

Companies

|

|

|

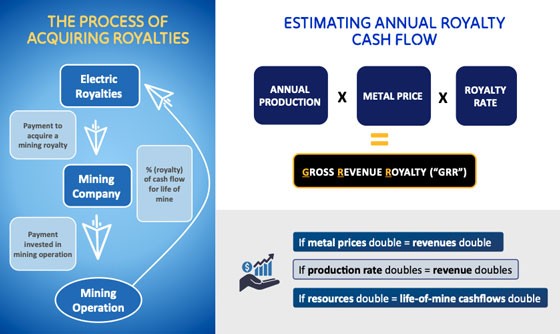

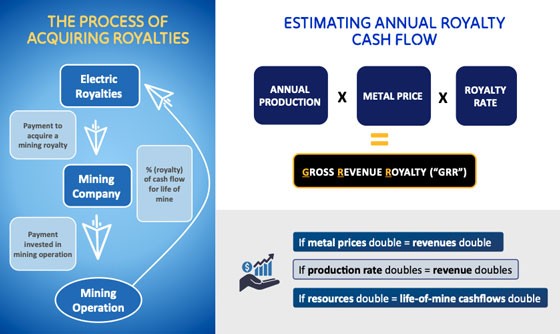

In providing one-stop exposure to nine

critical metals, Electric Royalties offers investors all the advantages that come

with being a royalty company.

Royalty companies do not

operate mines or need large and highly specialized teams to operate.

Royalty companies offer

turnkey diversification.

They offer lower risk than

mining companies, as royalties are typically based on revenues and paid

irrespective of profitability. Once the company buys the royalty, no further

capital outlay is required.

|

And, most importantly for investors,

the royalty/streaming business model has been proven to outperform mining

companies during metals bull markets.

|

|

|

|

Management With Skin In The

Game

|

|

|

If you want proof that the company???s

management truly believes Electric Royalties is undervalued, consider that it and

high-net-worth investors have a ton of skin in the game.

The company???s Founder and CEO, Brendan

Yurik, and his extended family own 18% of Electric???s outstanding stock.

Noteworthy investor Stefan Gleason

owns 28% of the company, and Globex Mining owns approximately 11%.

|

Just between Yurik and his

family, Mr. Gleason and Globex Mining, these players account for roughly 57% of

stock outstanding.

|

When you invest in a company in the

junior mining sector, you want to do so with an investment group that???s on your

side. That???s very much the case with Electric Royalties.

|

|

|

|

Getting In Cheap Increases Profit

Potential

|

|

|

Once again, despite the value Electric

Royalties has added to its portfolio in the past five years, the company???s shares

have never been so heavily discounted.

This is true even though the company

has a wealth of catalysts that could soon move its share price higher.

|

|

|

Click image to enlarge.

Electric Royalties has numerous

upcoming catalysts that could drive its share price considerably higher over the

next 12-15 months.

|

|

|

Those include immediate cash flow from

Punitaqui, options payments from Electric???s lithium portfolio and advanced royalty

payments from Bissett Creek.

They also include the near-term

catalysts of the aforementioned mines that could come online this year, and the

potential longer-term cash flow of a series of projects well along the development

curve.

|

Bottom line: One of the

hottest sectors in the market just got hotter...yet one of the single best and

most leveraged plays is temporarily mired in near all-time lows.

|

Opportunities like this come rarely.

If you want to make a diversified wager on the growing global demand for critical

metals, you???ll want to start doing your homework on Electric Royalties now, before

the upcoming catalysts can spark a rerating.

|

|

|

CLICK

HERE

To Learn More about Electric

Royalties and the Projects Referenced

|

|

|

1. Projected annual production from

sources below:

- Punitaqui: full annual copper

production rate projected at 19 million to 23 million pounds of copper in

concentrate (Battery Mineral Resources Corp. news release dated May 13, 2024;

Battery Mineral Resources Corp. website

https://bmrcorp.com/projects/projects-map/)

- Bissett Creek: Northern

Graphite Corporation Bissett Creek Project PEA; Leduc, M; Effective Date December

6, 2013; Further information and technical reports can be obtained through the

Northern Graphite profile at sedarplus.ca or northerngraphite.com.

- Battery Hill: Technical report

titled "NI 43-101 Technical Report on the Preliminary Economic Assessment of the

Battery Hill Manganese Project, Woodstock, New Brunswick, Canada" with an

effective date of May 12, 2022, available under Manganese X Energy Corp.'s profile

on sedarplus.ca

- Kenbridge: Technical report

titled ???Preliminary Economic Assessment of the Kenbridge Nickel Project, Kenora,

Ontario??? with an effective date of July 6, 2022, available under Tartisan Nickel

Corp.???s profile on sedarplus.ca

- Mont Sorcier: Technical report

titled ???Preliminary Economic Assessment (PEA) for the Mont Sorcier Project –

Quebec, Canada,??? effective date September 8, 2022 available under Voyager Metals???

profile on sedarplus.ca

PEAs are preliminary in nature and

include Inferred Mineral Resources that are considered too speculative

geologically to have the economic considerations applied to them that would enable

them to be categorized as Mineral Reserves as defined under NI 43-101 regulations

for Canadian Public Companies. There is no certainty that the PEA will be

realized. Mineral Resources that are not Mineral Reserves do not have demonstrated

economic viability.

|

|

|

Warnings and Disclaimers: As you

know, every investment entails risk. Money Metals Exchange hasn???t researched and

cannot assess the suitability of any investments mentioned or advertised by our

advertisers. We recommend you conduct your own due diligence and consult with your

financial adviser before entering into any type of financial investment. This

profile should be viewed as a paid advertisement. The publisher and staff of this

publication may hold positions in the securities of companies discussed. The

information contained herein has been received from sources which the publisher

deems reliable. However, the publisher cannot guarantee that such information is

complete and true in all respects. The advertiser provided a review of the content

of this advertisement at the time of publication. The publisher is not a

registered investment adviser and does not purport to offer personalized

investment related advice. Each person must separately determine whether such

advice and recommendations are suitable and whether they fit within such person???s

goals and portfolio. The advertiser featured in this edition of Money Metals

Exchange has paid the publisher for the costs and compensation related to the

authorship, overhead, design, and/or distributing this email, in the amount of

$300. This email includes certain statements that may be deemed "forward-looking

statements." All statements in this email, other than statements of historical

facts, that address anticipated future events are forward-looking statements.

Although the expectations expressed in such forward-looking statements are based

on reasonable assumptions, such statements are not guarantees of future

performance and actual results or developments may differ materially from those in

the forward-looking statements.

|

|

|

|

|

|

|

|

This copyrighted material may not

be republished without express permission. Offer only available through email

promotion. Offer does not apply to previous orders and may not be combined with

any other offer or program. Special shipping rates or other restrictions may apply

to international orders. The information presented here is for general educational

purposes only. Money Metals Exchange and its staff do not act as personal

investment advisors. Nor do we advocate the purchase or sale of any regulated

security listed on any exchange for any specific individual. While our track

record is excellent, investment markets have inherent risks and there can be no

assurance of future profits. You are responsible for your investment decisions,

and they should be made in consultation with your own advisors. By purchasing from

Money Metals, you understand our company is not responsible for any losses caused

by your investment decisions, nor do we have any claim to any market gains you may

enjoy. Money Metals Exchange is not a regulated trading ???exchange??? as defined by

the CFTC and the SEC.

|

|

|