Email

Southern Company Retreats on Clean Energy Ambition as Emissions Cuts Stall

| From | Energy and Policy Institute <[email protected]> |

| Subject | Southern Company Retreats on Clean Energy Ambition as Emissions Cuts Stall |

| Date | April 22, 2025 12:14 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

** Southern Company Retreats on Clean Energy Ambition as Emissions Cuts Stall ([link removed])

------------------------------------------------------------

By Daniel Tait on Apr 21, 2025 12:20 pm

Southern Company has quietly weakened the key greenhouse gas reduction metric used in its executive compensation program — a move that makes it easier for top executives to receive performance payouts while doing less to reduce emissions.

In its newly released2025 proxy statement ([link removed]) , Southern lowered the megawatt (MW) thresholds it uses to reward its executives with bonus payments for “fleet transition ([link removed]) ” progress — the metric intended to track the company’s shift toward cleaner energy. Compared to Southern’s 2024 proxy, the new figures for the 2024–2026 performance period are 25% to 33% lower.

At the same time, the company broadened ([link removed]) the definition of what counts toward that target by including energy efficiency and demand response. Adding those zero-carbon resources to the metric could motivate executives to add the resources to the grid; however, with a weakening overall target threshold, the addition of energy efficiency and demand response may not change the executives’ incentives, or result in material changes in the company’s behavior. Because Southern’s electric system is growing, and the company currently projects ([link removed]) it to continue growing rapidly, even a static GHG reduction target would represent a weakening in real terms.

Southern now is telling investors ([link removed]) that it is unlikely to achieve its 2023-2025 goals due to load growth, primarily for data centers, and planned extensions of coal and gas plants ([link removed]) .

Payout Level 2023–2025 Target (in MW) 2024–2026 Target (in MW) Change (in MW)

Threshold (50%) 1,297 1,044 –253

Target (100%) 2,526 1,843 –683

Maximum (150%) 4,541 3,044 –1,497

** A Metric Built to Avoid Accountability

------------------------------------------------------------

Southern has never tied executive compensation to actual emissions reductions. The company uses the term “GHG reduction metric ([link removed]) ” to describe the incentive program in its investor materials, but that is a misnomer ([link removed]) in the sense that the program would allow for a payout even if emissions increased and the utility expanded its fossil fuel investments. Instead of hinging executive pay to increases or decreases in emissions, Southern has instead counted megawatts of new clean resources or the retirement of legacy coal and gas, without accounting at all for how fossil fuel additions increase total system emissions.

Southern’s “net zero greenhouse gas emissions by 2050 ([link removed]) ” pledge has consistently relied on unstated assumptions, the potential use of carbon offset accounting, and undefined “negative carbon” technologies. Southern has not paired its 2050 pledge with specific short-term targets or a limit on fossil fuel investments. In public statements and investor materials, the company has celebrated ([link removed]) the commercial operation of new nuclear units at Plant Vogtle, but also continues to operate a significant fleet of coal and gas plants — and to build new ones. Former CEO Tom Fanning once suggested ([link removed]) that the company could reach net zero without truly eliminating emissions, so long as

the math worked out on paper.

** Fuzzy Math Distorts Emissions Reductions Progress in the South

------------------------------------------------------------

Another way Southern distorts its emissions reduction progress is by claiming credit for renewable energy projects that the company no longer owns all or some of the rights to, or for which other utilities or companies claim credit. Companies use a system of “renewable energy credits” (RECs) to determine who gets to take credit for the environmental attributes of renewable energy installations like wind and solar farms. The system is designed to account for the fact that once electricity is generated, it flows onto the electrical grid in a way that is inherently untraceable. In principle, no two parties are supposed to be able to take credit for the same megawatt-hour of renewably generated electricity, a principle called “double counting.”

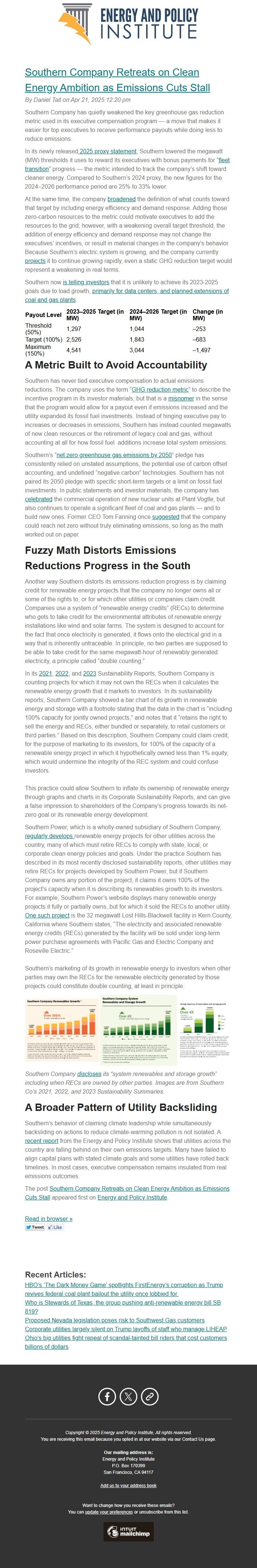

In its 2021 ([link removed]) , 2022 ([link removed]) , and 2023 ([link removed]) Sustainability Reports, Southern Company is counting projects for which it may not own the RECs when it calculates the renewable energy growth that it markets to investors. In its sustainability reports, Southern Company showed a bar chart of its growth in renewable energy and storage with a footnote stating that the data in the chart is “including 100% capacity for jointly owned projects,” and notes that it “retains the right to sell the energy and RECs, either bundled or separately, to retail customers or third parties.” Based on this description, Southern Company could claim

credit, for the purpose of marketing to its investors, for 100% of the capacity of a renewable energy project in which it hypothetically owned less than 1% equity, which would undermine the integrity of the REC system and could confuse investors.

This practice could allow Southern to inflate its ownership of renewable energy through graphs and charts in its Corporate Sustainability Reports, and can give a false impression to shareholders of the Company’s progress towards its net-zero goal or its renewable energy development.

Southern Power, which is a wholly-owned subsidiary of Southern Company, regularly develops ([link removed]) renewable energy projects for other utilities across the country, many of which must retire RECs to comply with state, local, or corporate clean energy policies and goals. Under the practice Southern has described in its most recently disclosed sustainability reports, other utilities may retire RECs for projects developed by Southern Power, but if Southern Company owns any portion of the project, it claims it owns 100% of the project’s capacity when it is describing its renewables growth to its investors. For example, Southern Power’s website displays many renewable energy projects it fully or partially owns, but for which it sold the RECs to another utility. One such project ([link removed]) is the 32 megawatt Lost Hills-Blackwell

facility in Kern County, California where Southern states, “The electricity and associated renewable energy credits (RECs) generated by the facility will be sold under long-term power purchase agreements with Pacific Gas and Electric Company and Roseville Electric.”

Southern’s marketing of its growth in renewable energy to investors when other parties may own the RECs for the renewable electricity generated by those projects could constitute double counting, at least in principle.

Southern Company discloses ([link removed]) its “system renewables and storage growth” including when RECs are owned by other parties. Images are from Southern Co’s 2021, 2022, and 2023 Sustainability Summaries.

** A Broader Pattern of Utility Backsliding

------------------------------------------------------------

Southern’s behavior of claiming climate leadership while simultaneously backsliding on actions to reduce climate-warming pollution is not isolated. A recent report ([link removed]) from the Energy and Policy Institute shows that utilities across the country are falling behind on their own emissions targets. Many have failed to align capital plans with stated climate goals and some utilities have rolled back timelines. In most cases, executive compensation remains insulated from real emissions outcomes.

The post Southern Company Retreats on Clean Energy Ambition as Emissions Cuts Stall ([link removed]) appeared first on Energy and Policy Institute ([link removed]) .

Read in browser » ([link removed])

[link removed] [link removed]

** Recent Articles:

------------------------------------------------------------

** HBO’s ‘The Dark Money Game’ spotlights FirstEnergy’s corruption as Trump revives federal coal plant bailout the utility once lobbied for ([link removed])

** Who is Stewards of Texas, the group pushing anti-renewable energy bill SB 819? ([link removed])

** Proposed Nevada legislation poses risk to Southwest Gas customers ([link removed])

** Corporate utilities largely silent on Trump layoffs of staff who manage LIHEAP ([link removed])

** Ohio’s big utilities fight repeal of scandal-tainted bill riders that cost customers billions of dollars ([link removed]

============================================================

** Facebook ([link removed])

** Twitter ([link removed])

** Website ([link removed])

Copyright © 2025 Energy and Policy Institute, All rights reserved.

You are receiving this email because you opted in at our website via our Contact Us page.

Our mailing address is:

Energy and Policy Institute

P.O. Box 170399

San Francisco, CA 94117

USA

Want to change how you receive these emails?

You can ** update your preferences ([link removed])

or ** unsubscribe from this list ([link removed])

.

Email Marketing Powered by Mailchimp

[link removed]

------------------------------------------------------------

By Daniel Tait on Apr 21, 2025 12:20 pm

Southern Company has quietly weakened the key greenhouse gas reduction metric used in its executive compensation program — a move that makes it easier for top executives to receive performance payouts while doing less to reduce emissions.

In its newly released2025 proxy statement ([link removed]) , Southern lowered the megawatt (MW) thresholds it uses to reward its executives with bonus payments for “fleet transition ([link removed]) ” progress — the metric intended to track the company’s shift toward cleaner energy. Compared to Southern’s 2024 proxy, the new figures for the 2024–2026 performance period are 25% to 33% lower.

At the same time, the company broadened ([link removed]) the definition of what counts toward that target by including energy efficiency and demand response. Adding those zero-carbon resources to the metric could motivate executives to add the resources to the grid; however, with a weakening overall target threshold, the addition of energy efficiency and demand response may not change the executives’ incentives, or result in material changes in the company’s behavior. Because Southern’s electric system is growing, and the company currently projects ([link removed]) it to continue growing rapidly, even a static GHG reduction target would represent a weakening in real terms.

Southern now is telling investors ([link removed]) that it is unlikely to achieve its 2023-2025 goals due to load growth, primarily for data centers, and planned extensions of coal and gas plants ([link removed]) .

Payout Level 2023–2025 Target (in MW) 2024–2026 Target (in MW) Change (in MW)

Threshold (50%) 1,297 1,044 –253

Target (100%) 2,526 1,843 –683

Maximum (150%) 4,541 3,044 –1,497

** A Metric Built to Avoid Accountability

------------------------------------------------------------

Southern has never tied executive compensation to actual emissions reductions. The company uses the term “GHG reduction metric ([link removed]) ” to describe the incentive program in its investor materials, but that is a misnomer ([link removed]) in the sense that the program would allow for a payout even if emissions increased and the utility expanded its fossil fuel investments. Instead of hinging executive pay to increases or decreases in emissions, Southern has instead counted megawatts of new clean resources or the retirement of legacy coal and gas, without accounting at all for how fossil fuel additions increase total system emissions.

Southern’s “net zero greenhouse gas emissions by 2050 ([link removed]) ” pledge has consistently relied on unstated assumptions, the potential use of carbon offset accounting, and undefined “negative carbon” technologies. Southern has not paired its 2050 pledge with specific short-term targets or a limit on fossil fuel investments. In public statements and investor materials, the company has celebrated ([link removed]) the commercial operation of new nuclear units at Plant Vogtle, but also continues to operate a significant fleet of coal and gas plants — and to build new ones. Former CEO Tom Fanning once suggested ([link removed]) that the company could reach net zero without truly eliminating emissions, so long as

the math worked out on paper.

** Fuzzy Math Distorts Emissions Reductions Progress in the South

------------------------------------------------------------

Another way Southern distorts its emissions reduction progress is by claiming credit for renewable energy projects that the company no longer owns all or some of the rights to, or for which other utilities or companies claim credit. Companies use a system of “renewable energy credits” (RECs) to determine who gets to take credit for the environmental attributes of renewable energy installations like wind and solar farms. The system is designed to account for the fact that once electricity is generated, it flows onto the electrical grid in a way that is inherently untraceable. In principle, no two parties are supposed to be able to take credit for the same megawatt-hour of renewably generated electricity, a principle called “double counting.”

In its 2021 ([link removed]) , 2022 ([link removed]) , and 2023 ([link removed]) Sustainability Reports, Southern Company is counting projects for which it may not own the RECs when it calculates the renewable energy growth that it markets to investors. In its sustainability reports, Southern Company showed a bar chart of its growth in renewable energy and storage with a footnote stating that the data in the chart is “including 100% capacity for jointly owned projects,” and notes that it “retains the right to sell the energy and RECs, either bundled or separately, to retail customers or third parties.” Based on this description, Southern Company could claim

credit, for the purpose of marketing to its investors, for 100% of the capacity of a renewable energy project in which it hypothetically owned less than 1% equity, which would undermine the integrity of the REC system and could confuse investors.

This practice could allow Southern to inflate its ownership of renewable energy through graphs and charts in its Corporate Sustainability Reports, and can give a false impression to shareholders of the Company’s progress towards its net-zero goal or its renewable energy development.

Southern Power, which is a wholly-owned subsidiary of Southern Company, regularly develops ([link removed]) renewable energy projects for other utilities across the country, many of which must retire RECs to comply with state, local, or corporate clean energy policies and goals. Under the practice Southern has described in its most recently disclosed sustainability reports, other utilities may retire RECs for projects developed by Southern Power, but if Southern Company owns any portion of the project, it claims it owns 100% of the project’s capacity when it is describing its renewables growth to its investors. For example, Southern Power’s website displays many renewable energy projects it fully or partially owns, but for which it sold the RECs to another utility. One such project ([link removed]) is the 32 megawatt Lost Hills-Blackwell

facility in Kern County, California where Southern states, “The electricity and associated renewable energy credits (RECs) generated by the facility will be sold under long-term power purchase agreements with Pacific Gas and Electric Company and Roseville Electric.”

Southern’s marketing of its growth in renewable energy to investors when other parties may own the RECs for the renewable electricity generated by those projects could constitute double counting, at least in principle.

Southern Company discloses ([link removed]) its “system renewables and storage growth” including when RECs are owned by other parties. Images are from Southern Co’s 2021, 2022, and 2023 Sustainability Summaries.

** A Broader Pattern of Utility Backsliding

------------------------------------------------------------

Southern’s behavior of claiming climate leadership while simultaneously backsliding on actions to reduce climate-warming pollution is not isolated. A recent report ([link removed]) from the Energy and Policy Institute shows that utilities across the country are falling behind on their own emissions targets. Many have failed to align capital plans with stated climate goals and some utilities have rolled back timelines. In most cases, executive compensation remains insulated from real emissions outcomes.

The post Southern Company Retreats on Clean Energy Ambition as Emissions Cuts Stall ([link removed]) appeared first on Energy and Policy Institute ([link removed]) .

Read in browser » ([link removed])

[link removed] [link removed]

** Recent Articles:

------------------------------------------------------------

** HBO’s ‘The Dark Money Game’ spotlights FirstEnergy’s corruption as Trump revives federal coal plant bailout the utility once lobbied for ([link removed])

** Who is Stewards of Texas, the group pushing anti-renewable energy bill SB 819? ([link removed])

** Proposed Nevada legislation poses risk to Southwest Gas customers ([link removed])

** Corporate utilities largely silent on Trump layoffs of staff who manage LIHEAP ([link removed])

** Ohio’s big utilities fight repeal of scandal-tainted bill riders that cost customers billions of dollars ([link removed]

============================================================

** Facebook ([link removed])

** Twitter ([link removed])

** Website ([link removed])

Copyright © 2025 Energy and Policy Institute, All rights reserved.

You are receiving this email because you opted in at our website via our Contact Us page.

Our mailing address is:

Energy and Policy Institute

P.O. Box 170399

San Francisco, CA 94117

USA

Want to change how you receive these emails?

You can ** update your preferences ([link removed])

or ** unsubscribe from this list ([link removed])

.

Email Marketing Powered by Mailchimp

[link removed]

Message Analysis

- Sender: Energy and Policy Institute

- Political Party: n/a

- Country: United States

- State/Locality: n/a

- Office: n/a

-

Email Providers:

- MailChimp