Email

Tariff Turmoil

| From | AEI DataPoints <[email protected]> |

| Subject | Tariff Turmoil |

| Date | April 10, 2025 11:01 AM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

Expert analysis made easy. Breaking down the news with data, charts, and maps.

Edited by: James Desio and Hannah Bowen

Happy Thursday! In today’s newsletter, we examine President Donald Trump’s initial tariff formula, the US retirement system, and a plan to make housing affordable again.

Don’t forget—subscribe <[link removed]> and send DataPoints to a friend!

For inquiries, please email [email protected] <[link removed]>.

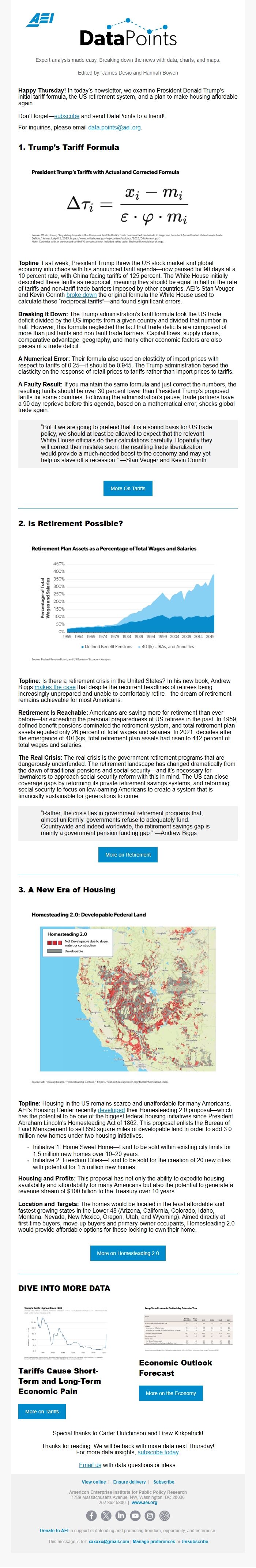

1. Trump’s Tariff Formula

Topline: Last week, President Trump threw the US stock market and global economy into chaos with his announced tariff agenda—now paused for 90 days at a 10 percent rate, with China facing tariffs of 125 percent. The White House initially described these tariffs as reciprocal, meaning they should be equal to half of the rate of tariffs and non-tariff trade barriers imposed by other countries. AEI’s Stan Veuger and Kevin Corinth broke down <[link removed]> the original formula the White House used to calculate these “reciprocal tariffs”—and found significant errors.

Breaking It Down: The Trump administration’s tariff formula took the US trade deficit divided by the US imports from a given country and divided that number in half. However, this formula neglected the fact that trade deficits are composed of more than just tariffs and non-tariff trade barriers. Capital flows, supply chains, comparative advantage, geography, and many other economic factors are also pieces of a trade deficit.

A Numerical Error: Their formula also used an elasticity of import prices with respect to tariffs of 0.25—it should be 0.945. The Trump administration based the elasticity on the response of retail prices to tariffs rather than import prices to tariffs.

A Faulty Result: If you maintain the same formula and just correct the numbers, the resulting tariffs should be over 30 percent lower than President Trump’s proposed tariffs for some countries. Following the administration’s pause, trade partners have a 90 day reprieve before this agenda, based on a mathematical error, shocks global trade again.

“But if we are going to pretend that it is a sound basis for US trade policy, we should at least be allowed to expect that the relevant White House officials do their calculations carefully. Hopefully they will correct their mistake soon: the resulting trade liberalization would provide a much-needed boost to the economy and may yet help us stave off a recession.” —Stan Veuger and Kevin Corinth

2. Is Retirement Possible?

Topline: Is there a retirement crisis in the United States? In his new book, Andrew Biggs makes the case <[link removed]> that despite the recurrent headlines of retirees being increasingly unprepared and unable to comfortably retire—the dream

of retirement remains achievable for most Americans.

Retirement Is Reachable: Americans are saving more for retirement than ever before—far exceeding the personal preparedness of US retirees in the past. In 1959, defined benefit pensions dominated the retirement system, and total retirement plan assets equaled only 26 percent of total wages and salaries. In 2021, decades after the emergence of 401(k)s, total retirement plan assets had risen to 412 percent of total wages and salaries.

The Real Crisis: The real crisis is the government retirement programs that are dangerously underfunded. The retirement landscape has changed dramatically from the dawn of traditional pensions and social security—and it’s necessary for lawmakers to approach social security reform with this in mind. The US can close coverage gaps by reforming its private retirement savings systems, and reforming social security to focus on low-earning Americans to create a system that is financially sustainable for generations to come.

“Rather, the crisis lies in government retirement programs that, almost uniformly, governments refuse to adequately fund. Countrywide and indeed worldwide, the retirement savings gap is mainly a government pension funding gap.” —Andrew Biggs

3. A New Era of Housing

Topline: Housing in the US remains scarce and unaffordable for many Americans. AEI’s Housing Center recently developed <[link removed]> their Homesteading 2.0 proposal—which has the potential to be one of the biggest federal housing initiatives since President Abraham Lincoln’s Homesteading Act of 1862. This proposal enlists the Bureau of Land Management to sell 850 square miles of developable land in order to add 3.0 million new homes under two housing initiatives.

- Initiative 1: Home Sweet Home—Land to be sold within existing city limits for 1.5 million new homes over 10–20 years.

- Initiative 2: Freedom Cities—Land to be sold for the creation of 20 new cities with potential for 1.5 million new homes.

Housing and Profits: This proposal has not only the ability to expedite housing availability and affordability for many Americans but also the potential to generate a revenue stream of $100 billion to the Treasury over 10 years.

Location and Targets: The homes would be located in the least affordable and fastest growing states in the Lower 48 (Arizona, California, Colorado, Idaho, Montana, Nevada, New Mexico, Oregon, Utah, and Wyoming). Aimed directly at first-time buyers, move-up buyers and primary-owner occupants, Homesteading 2.0 would provide affordable options for those looking to own their home.

DIVE INTO MORE DATA

Tariffs Cause Short-Term and Long-Term Economic Pain <[link removed]>

Economic Outlook Forecast <[link removed]>

Special thanks to Carter Hutchinson and Drew Kirkpatrick!

Thanks for reading. We will be back with more data next Thursday!

For more data insights, subscribe today <[link removed]>.

Email us <[link removed]> with data questions or ideas.

View online <[[[link removed]]]> | Ensure delivery <[link removed]> | Subscribe <[link removed]>

American Enterprise Institute for Public Policy Research

1789 Massachusetts Avenue, NW, Washington, DC 20036

202.862.5800 | www.aei.org <[link removed]>

<[link removed]> <[link removed]> <[link removed]> <[link removed]> <[link removed]>

<[link removed]> Donate to AEI <[link removed]> in support of defending and promoting freedom, opportunity, and enterprise.

This message is for: [email protected] <[email protected]> | Manage preferences <[link removed]> or Unsubscribe <[link removed]>

<!-- This is a comment -->

Edited by: James Desio and Hannah Bowen

Happy Thursday! In today’s newsletter, we examine President Donald Trump’s initial tariff formula, the US retirement system, and a plan to make housing affordable again.

Don’t forget—subscribe <[link removed]> and send DataPoints to a friend!

For inquiries, please email [email protected] <[link removed]>.

1. Trump’s Tariff Formula

Topline: Last week, President Trump threw the US stock market and global economy into chaos with his announced tariff agenda—now paused for 90 days at a 10 percent rate, with China facing tariffs of 125 percent. The White House initially described these tariffs as reciprocal, meaning they should be equal to half of the rate of tariffs and non-tariff trade barriers imposed by other countries. AEI’s Stan Veuger and Kevin Corinth broke down <[link removed]> the original formula the White House used to calculate these “reciprocal tariffs”—and found significant errors.

Breaking It Down: The Trump administration’s tariff formula took the US trade deficit divided by the US imports from a given country and divided that number in half. However, this formula neglected the fact that trade deficits are composed of more than just tariffs and non-tariff trade barriers. Capital flows, supply chains, comparative advantage, geography, and many other economic factors are also pieces of a trade deficit.

A Numerical Error: Their formula also used an elasticity of import prices with respect to tariffs of 0.25—it should be 0.945. The Trump administration based the elasticity on the response of retail prices to tariffs rather than import prices to tariffs.

A Faulty Result: If you maintain the same formula and just correct the numbers, the resulting tariffs should be over 30 percent lower than President Trump’s proposed tariffs for some countries. Following the administration’s pause, trade partners have a 90 day reprieve before this agenda, based on a mathematical error, shocks global trade again.

“But if we are going to pretend that it is a sound basis for US trade policy, we should at least be allowed to expect that the relevant White House officials do their calculations carefully. Hopefully they will correct their mistake soon: the resulting trade liberalization would provide a much-needed boost to the economy and may yet help us stave off a recession.” —Stan Veuger and Kevin Corinth

2. Is Retirement Possible?

Topline: Is there a retirement crisis in the United States? In his new book, Andrew Biggs makes the case <[link removed]> that despite the recurrent headlines of retirees being increasingly unprepared and unable to comfortably retire—the dream

of retirement remains achievable for most Americans.

Retirement Is Reachable: Americans are saving more for retirement than ever before—far exceeding the personal preparedness of US retirees in the past. In 1959, defined benefit pensions dominated the retirement system, and total retirement plan assets equaled only 26 percent of total wages and salaries. In 2021, decades after the emergence of 401(k)s, total retirement plan assets had risen to 412 percent of total wages and salaries.

The Real Crisis: The real crisis is the government retirement programs that are dangerously underfunded. The retirement landscape has changed dramatically from the dawn of traditional pensions and social security—and it’s necessary for lawmakers to approach social security reform with this in mind. The US can close coverage gaps by reforming its private retirement savings systems, and reforming social security to focus on low-earning Americans to create a system that is financially sustainable for generations to come.

“Rather, the crisis lies in government retirement programs that, almost uniformly, governments refuse to adequately fund. Countrywide and indeed worldwide, the retirement savings gap is mainly a government pension funding gap.” —Andrew Biggs

3. A New Era of Housing

Topline: Housing in the US remains scarce and unaffordable for many Americans. AEI’s Housing Center recently developed <[link removed]> their Homesteading 2.0 proposal—which has the potential to be one of the biggest federal housing initiatives since President Abraham Lincoln’s Homesteading Act of 1862. This proposal enlists the Bureau of Land Management to sell 850 square miles of developable land in order to add 3.0 million new homes under two housing initiatives.

- Initiative 1: Home Sweet Home—Land to be sold within existing city limits for 1.5 million new homes over 10–20 years.

- Initiative 2: Freedom Cities—Land to be sold for the creation of 20 new cities with potential for 1.5 million new homes.

Housing and Profits: This proposal has not only the ability to expedite housing availability and affordability for many Americans but also the potential to generate a revenue stream of $100 billion to the Treasury over 10 years.

Location and Targets: The homes would be located in the least affordable and fastest growing states in the Lower 48 (Arizona, California, Colorado, Idaho, Montana, Nevada, New Mexico, Oregon, Utah, and Wyoming). Aimed directly at first-time buyers, move-up buyers and primary-owner occupants, Homesteading 2.0 would provide affordable options for those looking to own their home.

DIVE INTO MORE DATA

Tariffs Cause Short-Term and Long-Term Economic Pain <[link removed]>

Economic Outlook Forecast <[link removed]>

Special thanks to Carter Hutchinson and Drew Kirkpatrick!

Thanks for reading. We will be back with more data next Thursday!

For more data insights, subscribe today <[link removed]>.

Email us <[link removed]> with data questions or ideas.

View online <[[[link removed]]]> | Ensure delivery <[link removed]> | Subscribe <[link removed]>

American Enterprise Institute for Public Policy Research

1789 Massachusetts Avenue, NW, Washington, DC 20036

202.862.5800 | www.aei.org <[link removed]>

<[link removed]> <[link removed]> <[link removed]> <[link removed]> <[link removed]>

<[link removed]> Donate to AEI <[link removed]> in support of defending and promoting freedom, opportunity, and enterprise.

This message is for: [email protected] <[email protected]> | Manage preferences <[link removed]> or Unsubscribe <[link removed]>

<!-- This is a comment -->

Message Analysis

- Sender: n/a

- Political Party: n/a

- Country: n/a

- State/Locality: n/a

- Office: n/a

-

Email Providers:

- Marketo