Email

Tariffs Crash Markets, Investors Look For Support (Weekly Cheat Sheet)

| From | Irving Wilkinson <[email protected]> |

| Subject | Tariffs Crash Markets, Investors Look For Support (Weekly Cheat Sheet) |

| Date | April 7, 2025 2:07 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

View image: ([link removed])

Follow image link: ([link removed])

Caption:

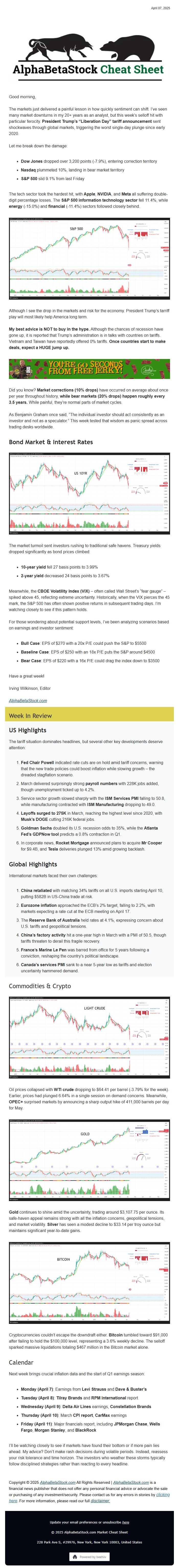

Good morning,

The markets just delivered a painful lesson in how quickly sentiment can shift. I’ve seen many market downturns in my 20+ years as an analyst, but this week’s selloff hit with particular ferocity. **President Trump’s “Liberation Day” tariff announcement** sent shockwaves through global markets, triggering the worst single-day plunge since early 2020.

Let me break down the damage:

* **Dow Jones** dropped over 3,200 points (-7.9%), entering correction territory

* **Nasdaq** plummeted 10%, landing in bear market territory

* **S&P 500** slid 9.1% from last Friday

The tech sector took the hardest hit, with **Apple**, **NVIDIA**, and **Meta** all suffering double-digit percentage losses. The **S&P 500 information technology sector** fell 11.4%, while **energy** (-15.0%) and **financial** (-11.4%) sectors followed closely behind.

View image: ([link removed])

Caption:

Although I see the drop in the markets and risk for the economy. President Trump’s tarriff play will most likely help America long term.

**My best advice is NOT to buy in the hype.** Although the chances of recession have gone up, it is reported that Trump’s administration is in talks with countries on tariffs. Vietnam and Taiwan have reportedly offered 0% tariffs. **Once countries start to make deals, expect a HUGE jump up.**

View image: ([link removed])

Caption:

Did you know? **Market corrections (10% drops)** have occurred on average about once per year throughout history, **while bear markets (20% drops) happen roughly every 3.5 years.** While painful, they’re normal parts of market cycles.

As Benjamin Graham once said, “The individual investor should act consistently as an investor and not as a speculator.” This week tested that wisdom as panic spread across trading desks worldwide.

## **Bond Market & Interest Rates**

View image: ([link removed])

Caption:

The market turmoil sent investors rushing to traditional safe havens. Treasury yields dropped significantly as bond prices climbed:

* **10-year yield** fell 27 basis points to 3.99%

* **2-year yield** decreased 24 basis points to 3.67%

Meanwhile, the **CBOE Volatility Index (VIX)** – often called Wall Street’s “fear gauge” – spiked above 45, reflecting extreme uncertainty. Historically, when the VIX pierces the 45 mark, the S&P 500 has often shown positive returns in subsequent trading days. I’m watching closely to see if this pattern holds.

For those wondering about potential support levels, I’ve been analyzing scenarios based on earnings and investor sentiment:

* **Bull Case**: EPS of $270 with a 20x P/E could push the S&P to $5500

* **Baseline Case**: EPS of $250 with an 18x P/E puts the S&P around $4500

* **Bear Case**: EPS of $220 with a 16x P/E could drag the index down to $3500

Have a great week!

Irving Wilkinson, Editor

[AlphaBetaStock.com]([link removed])

----------

## Week In Review

--------------------

## **US Highlights**

The tariff situation dominates headlines, but several other key developments deserve attention:

1. **Fed Chair Powell** indicated rate cuts are on hold amid tariff concerns, warning that the new trade policies could boost inflation while slowing growth – the dreaded stagflation scenario.

2. March delivered surprisingly strong **payroll numbers** with 228K jobs added, though unemployment ticked up to 4.2%.

3. Service sector growth slowed sharply with the **ISM Services PMI** falling to 50.8, while manufacturing contracted with **ISM Manufacturing** dropping to 49.0.

4. **Layoffs surged to 275K** in March, reaching the highest level since 2020, with **Musk’s DOGE** cutting 216K federal jobs.

5. **Goldman Sachs** doubled its U.S. recession odds to 35%, while the **Atlanta Fed’s GDPNow tool** predicts a 0.8% contraction in Q1.

6. In corporate news, **Rocket Mortgage** announced plans to acquire **Mr Cooper** for $9.4B, and **Tesla** deliveries plunged 13% amid growing backlash.

## **Global Highlights**

International markets faced their own challenges:

1. **China retaliated** with matching 34% tariffs on all U.S. imports starting April 10, putting $582B in US-China trade at risk.

2. **Eurozone inflation** approached the ECB’s 2% target, falling to 2.2%, with markets expecting a rate cut at the ECB meeting on April 17.

3. The **Reserve Bank of Australia** held rates at 4.1%, expressing concern about U.S. tariffs and geopolitical tensions.

4. **China’s factory activity** hit a one-year high in March with a PMI of 50.5, though tariffs threaten to derail this fragile recovery.

5. **France’s Marine Le Pen** was barred from office for 5 years following a conviction, reshaping the country’s political landscape.

6. **Canada’s services PMI** sank to a near 5-year low as tariffs and election uncertainty hammered demand.

----------## Commodities & Crypto

View image: ([link removed])

Caption:

Oil prices collapsed with **WTI crude** dropping to $64.41 per barrel (-3.79% for the week). Earlier, prices had plunged 6.64% in a single session on demand concerns. Meanwhile, **OPEC+** surprised markets by announcing a sharp output hike of 411,000 barrels per day for May.

View image: ([link removed])

Caption:

**Gold** continues to shine amid the uncertainty, trading around $3,107.75 per ounce. Its safe-haven appeal remains strong with all the inflation concerns, geopolitical tensions, and market volatility. **Silver** has seen a modest decline to $33.14 per troy ounce but maintains significant year-to-date gains.

View image: ([link removed])

Caption:

Cryptocurrencies couldn’t escape the downdraft either. **Bitcoin** tumbled toward $91,000 after failing to hold the $100,000 level, representing a 3.6% weekly decline. The selloff sparked massive liquidations totaling $467 million in the Bitcoin market alone.

## Calendar

Next week brings crucial inflation data and the start of Q1 earnings season:

* **Monday (April 7)**: Earnings from **Levi Strauss** and **Dave & Buster’s**

* **Tuesday (April 8)**: **Tilray Brands** and **RPM International** report

* **Wednesday (April 9)**: **Delta Air Lines** earnings, **Constellation Brands**

* **Thursday (April 10)**: March **CPI report**, **CarMax** earnings

* **Friday (April 11)**: Major financials report, including **JPMorgan Chase**, **Wells Fargo**, **Morgan Stanley**, and **BlackRock**

I’ll be watching closely to see if markets have found their bottom or if more pain lies ahead. My advice? Don’t make rash decisions during volatile periods. Instead, reassess your risk tolerance and time horizon. The investors who weather these storms typically follow disciplined strategies rather than reacting to every headline.

Copyright © 2025 [AlphaBetaStock.com]([link removed]) All Rights Reserved | [AlphaBetaStock.com]([link removed]) is a financial news publisher that does not offer any personal financial advice or advocate the sale or purchasing of any investment/security. Please contact us for any errors in stories by [clicking here]([link removed]). For more information, please read our full [disclaimer.]([link removed])

———

You are reading a plain text version of this post. For the best experience, copy and paste this link in your browser to view the post online:

[link removed]

Follow image link: ([link removed])

Caption:

Good morning,

The markets just delivered a painful lesson in how quickly sentiment can shift. I’ve seen many market downturns in my 20+ years as an analyst, but this week’s selloff hit with particular ferocity. **President Trump’s “Liberation Day” tariff announcement** sent shockwaves through global markets, triggering the worst single-day plunge since early 2020.

Let me break down the damage:

* **Dow Jones** dropped over 3,200 points (-7.9%), entering correction territory

* **Nasdaq** plummeted 10%, landing in bear market territory

* **S&P 500** slid 9.1% from last Friday

The tech sector took the hardest hit, with **Apple**, **NVIDIA**, and **Meta** all suffering double-digit percentage losses. The **S&P 500 information technology sector** fell 11.4%, while **energy** (-15.0%) and **financial** (-11.4%) sectors followed closely behind.

View image: ([link removed])

Caption:

Although I see the drop in the markets and risk for the economy. President Trump’s tarriff play will most likely help America long term.

**My best advice is NOT to buy in the hype.** Although the chances of recession have gone up, it is reported that Trump’s administration is in talks with countries on tariffs. Vietnam and Taiwan have reportedly offered 0% tariffs. **Once countries start to make deals, expect a HUGE jump up.**

View image: ([link removed])

Caption:

Did you know? **Market corrections (10% drops)** have occurred on average about once per year throughout history, **while bear markets (20% drops) happen roughly every 3.5 years.** While painful, they’re normal parts of market cycles.

As Benjamin Graham once said, “The individual investor should act consistently as an investor and not as a speculator.” This week tested that wisdom as panic spread across trading desks worldwide.

## **Bond Market & Interest Rates**

View image: ([link removed])

Caption:

The market turmoil sent investors rushing to traditional safe havens. Treasury yields dropped significantly as bond prices climbed:

* **10-year yield** fell 27 basis points to 3.99%

* **2-year yield** decreased 24 basis points to 3.67%

Meanwhile, the **CBOE Volatility Index (VIX)** – often called Wall Street’s “fear gauge” – spiked above 45, reflecting extreme uncertainty. Historically, when the VIX pierces the 45 mark, the S&P 500 has often shown positive returns in subsequent trading days. I’m watching closely to see if this pattern holds.

For those wondering about potential support levels, I’ve been analyzing scenarios based on earnings and investor sentiment:

* **Bull Case**: EPS of $270 with a 20x P/E could push the S&P to $5500

* **Baseline Case**: EPS of $250 with an 18x P/E puts the S&P around $4500

* **Bear Case**: EPS of $220 with a 16x P/E could drag the index down to $3500

Have a great week!

Irving Wilkinson, Editor

[AlphaBetaStock.com]([link removed])

----------

## Week In Review

--------------------

## **US Highlights**

The tariff situation dominates headlines, but several other key developments deserve attention:

1. **Fed Chair Powell** indicated rate cuts are on hold amid tariff concerns, warning that the new trade policies could boost inflation while slowing growth – the dreaded stagflation scenario.

2. March delivered surprisingly strong **payroll numbers** with 228K jobs added, though unemployment ticked up to 4.2%.

3. Service sector growth slowed sharply with the **ISM Services PMI** falling to 50.8, while manufacturing contracted with **ISM Manufacturing** dropping to 49.0.

4. **Layoffs surged to 275K** in March, reaching the highest level since 2020, with **Musk’s DOGE** cutting 216K federal jobs.

5. **Goldman Sachs** doubled its U.S. recession odds to 35%, while the **Atlanta Fed’s GDPNow tool** predicts a 0.8% contraction in Q1.

6. In corporate news, **Rocket Mortgage** announced plans to acquire **Mr Cooper** for $9.4B, and **Tesla** deliveries plunged 13% amid growing backlash.

## **Global Highlights**

International markets faced their own challenges:

1. **China retaliated** with matching 34% tariffs on all U.S. imports starting April 10, putting $582B in US-China trade at risk.

2. **Eurozone inflation** approached the ECB’s 2% target, falling to 2.2%, with markets expecting a rate cut at the ECB meeting on April 17.

3. The **Reserve Bank of Australia** held rates at 4.1%, expressing concern about U.S. tariffs and geopolitical tensions.

4. **China’s factory activity** hit a one-year high in March with a PMI of 50.5, though tariffs threaten to derail this fragile recovery.

5. **France’s Marine Le Pen** was barred from office for 5 years following a conviction, reshaping the country’s political landscape.

6. **Canada’s services PMI** sank to a near 5-year low as tariffs and election uncertainty hammered demand.

----------## Commodities & Crypto

View image: ([link removed])

Caption:

Oil prices collapsed with **WTI crude** dropping to $64.41 per barrel (-3.79% for the week). Earlier, prices had plunged 6.64% in a single session on demand concerns. Meanwhile, **OPEC+** surprised markets by announcing a sharp output hike of 411,000 barrels per day for May.

View image: ([link removed])

Caption:

**Gold** continues to shine amid the uncertainty, trading around $3,107.75 per ounce. Its safe-haven appeal remains strong with all the inflation concerns, geopolitical tensions, and market volatility. **Silver** has seen a modest decline to $33.14 per troy ounce but maintains significant year-to-date gains.

View image: ([link removed])

Caption:

Cryptocurrencies couldn’t escape the downdraft either. **Bitcoin** tumbled toward $91,000 after failing to hold the $100,000 level, representing a 3.6% weekly decline. The selloff sparked massive liquidations totaling $467 million in the Bitcoin market alone.

## Calendar

Next week brings crucial inflation data and the start of Q1 earnings season:

* **Monday (April 7)**: Earnings from **Levi Strauss** and **Dave & Buster’s**

* **Tuesday (April 8)**: **Tilray Brands** and **RPM International** report

* **Wednesday (April 9)**: **Delta Air Lines** earnings, **Constellation Brands**

* **Thursday (April 10)**: March **CPI report**, **CarMax** earnings

* **Friday (April 11)**: Major financials report, including **JPMorgan Chase**, **Wells Fargo**, **Morgan Stanley**, and **BlackRock**

I’ll be watching closely to see if markets have found their bottom or if more pain lies ahead. My advice? Don’t make rash decisions during volatile periods. Instead, reassess your risk tolerance and time horizon. The investors who weather these storms typically follow disciplined strategies rather than reacting to every headline.

Copyright © 2025 [AlphaBetaStock.com]([link removed]) All Rights Reserved | [AlphaBetaStock.com]([link removed]) is a financial news publisher that does not offer any personal financial advice or advocate the sale or purchasing of any investment/security. Please contact us for any errors in stories by [clicking here]([link removed]). For more information, please read our full [disclaimer.]([link removed])

———

You are reading a plain text version of this post. For the best experience, copy and paste this link in your browser to view the post online:

[link removed]

Message Analysis

- Sender: n/a

- Political Party: n/a

- Country: n/a

- State/Locality: n/a

- Office: n/a