| From | Mary Sagatelova <[email protected]> |

| Subject | On the Grid: The Cost of Confusion |

| Date | April 4, 2025 5:48 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

The new tariffs are equivalent to the single largest tax increase on the American public in more than 50 years.

View this email in your browser

[link removed]

[link removed]

Hi John,

Welcome back to On the Grid, Third Way’s bi-weekly newsletter, where we’ll recap how we’re working to deploy every clean energy technology as quickly and affordably as possible. We’re excited to have you join us!

This week, President Trump announced sweeping tariffs

[link removed]

unseen in the United States since the infamous Smoot-Hawley Tariff Act of 1930

[link removed]

that accelerated the Great Depression. The new tariffs, which are equivalent to the single largest tax increase

[link removed]

on the American public in more than 50 years, includes:

A new 10% baseline tariff

[link removed]

on all imported goods

A 25% tariff on autos

[link removed]

effective immediately

A 25% tariff on auto parts

[link removed]

taking effect in May

A broad set of so-called “reciprocal” tariffs

[link removed]

This week’s announcements are in addition to previously announced tariffs

[link removed]

, including prior levies against Mexico and Canada

[link removed]

.

Outside the energy sector, that means higher prices

[link removed]

for consumers–up to $15,000 more for imported cars and as much as $8,000 more for some domestically-made vehicles. And it’s not just big purchases but small ones as well; clothes and groceries will be especially hard hit, according to a recent analysis

[link removed]

by the Budget Lab at Yale.

For businesses that rely on long-term planning, like those in the energy industry, this kind of uncertainty is killer. Companies cannot build or invest when the rules change this quickly. As our trading partners consider retaliatory tariffs

[link removed]

or an all-out moratorium on investing in the US

[link removed]

, businesses may simply choose to hold capital until the market seems more stable and the full impact of Trump’s agenda can be understood.

What Does This Mean for the Energy Sector? While these tariffs did not explicitly target energy, the industry will take a hit. Chaotic trade policy injects deep uncertainty into any industry that depends on stability to operate, invest, and build. This is especially true for energy, where capital-intensive, long-term projects hinge on predictable regulatory and financing structures.

Consumers will feel the energy impacts of Trump’s tariff policy in the form of higher prices for oil and gas. The infrastructure needed to drill will become more expensive and more difficult to obtain in the coming weeks and months, which will, in turn, increase the likelihood of oil and gas projects being severely delayed or cancelled altogether.

The industry was already worried about the impact of Trump’s tariff policy. In the Dallas Fed’s March survey

[link removed]

, oil and gas executives made their concerns clear, with one executive putting it particularly plainly: "Tariff policy is impossible for us to predict and doesn't have a clear goal. We want more stability.”

What About Clean Energy? Every clean energy project relies on a complex global supply chain. When prices spike, financing becomes riskier, timelines stretch out, and deployment slows. You can’t homeshore entire supply chains overnight–real production capacity takes years to build–and you certainly can’t do it when the rules change every few weeks. For industries like nuclear, this level of uncertainty is generating real anxiety

[link removed]

, especially around nuclear fuel, since the US imports 27% of its uranium

[link removed]

from Canada.

The Bottom Line: This is not just about inputs and projects–it’s about an entire economic system struggling to retain its footing amid market uncertainty. President Donald Trump promised to “unleash American energy dominance” and lower energy costs. But energy projects have long timelines and require a stable policy environment and predictable supply chains to reach completion. The Trump Administration’s policies threaten all three and put Trump’s stated goals of lower prices and a dominant energy sector further out of reach.

Despite this stated goal of advancing energy dominance, the Trump Administration has taken both legislative and administrative steps that threaten to derail clean energy investment. For instance:

Proposed IRA Tax Credit Rollback: Speaker Mike Johnson has signaled strong support for repealing clean energy tax credits, even though they serve as the financial backbone for many clean energy projects.

Funding Freezes: Even though formal freezes have been lifted, billions in clean energy dollars remain stalled–leaving projects in limbo, companies unable to move forward, and investors stuck on the sidelines.

Tariff Volatility: As we outline above, inconsistent and unpredictable tariffs are rattling supply chains, driving up costs, and pushing back timelines–making it harder to build anything on budget or on time.

And now, internal Department of Energy documents reveal

[link removed]

that vital clean energy projects–like regional hydrogen hubs, carbon capture pilots, and industrial decarbonization efforts–are on the chopping block.

Why This Matters: China is doubling down on clean energy as global demand continues to grow for nuclear, storage, and renewable technologies that can increase energy independence, and batteries. All of these moves–funding rollbacks, freezes, tariffs, and cuts–are leaving hundreds of billions in clean energy investment stuck in limbo and threaten entire subsectors of the domestic economy. In the immediate term, that’s money that is ready to flow into communities, create jobs, and build critical infrastructure. That could quickly turn into the collapse of domestic clean energy companies and even entire supply chains, especially with the double-whammy of tariffs and likely inflation.

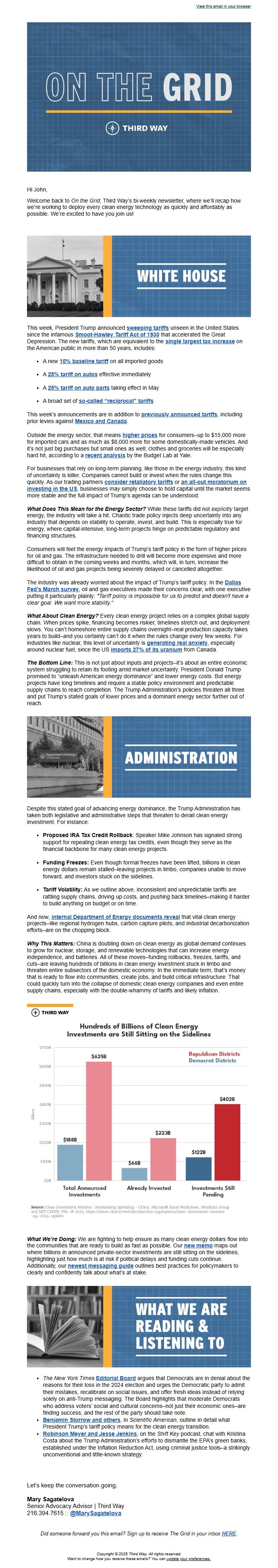

What We’re Doing: We are fighting to help ensure as many clean energy dollars flow into the communities that are ready to build as fast as possible. Our new memo

[link removed]

maps out where billions in announced private-sector investments are still sitting on the sidelines, highlighting just how much is at risk if political delays and funding cuts continue. Additionally, our newest messaging guide

[link removed]

outlines best practices for policymakers to clearly and confidently talk about what’s at stake.

The New York Times Editorial Board

[link removed]

argues that Democrats are in denial about the reasons for their loss in the 2024 election and urges the Democratic party to admit their mistakes, recalibrate on social issues, and offer fresh ideas instead of relying solely on anti-Trump messaging. The Board highlights that moderate Democrats who address voters’ social and cultural concerns–not just their economic ones–are finding success, and the rest of the party should take note.

Benjamin Storrow and others

[link removed]

, in Scientific American, outline in detail what President Trump’s tariff policy means for the clean energy transition.

Robinson Meyer and Jesse Jenkins

[link removed]

, on the Shift Key podcast, chat with Kristina Costa about the Trump Administration’s efforts to dismantle the EPA’s green banks, established under the Inflation Reduction Act, using criminal justice tools–a strikingly unconventional and little-known strategy.

Let’s keep the conversation going,

Mary Sagatelova

Senior Advocacy Advisor | Third Way

216.394.7615 :: @MarySagatelova

[link removed]

Did someone forward you this email? Sign up to receive The Grid in your inbox HERE

[link removed]

.

Copyright © 2025 Third Way. All rights reserved.

Want to change how you receive these emails? You can update your preferences.

[link removed]

View this email in your browser

[link removed]

[link removed]

Hi John,

Welcome back to On the Grid, Third Way’s bi-weekly newsletter, where we’ll recap how we’re working to deploy every clean energy technology as quickly and affordably as possible. We’re excited to have you join us!

This week, President Trump announced sweeping tariffs

[link removed]

unseen in the United States since the infamous Smoot-Hawley Tariff Act of 1930

[link removed]

that accelerated the Great Depression. The new tariffs, which are equivalent to the single largest tax increase

[link removed]

on the American public in more than 50 years, includes:

A new 10% baseline tariff

[link removed]

on all imported goods

A 25% tariff on autos

[link removed]

effective immediately

A 25% tariff on auto parts

[link removed]

taking effect in May

A broad set of so-called “reciprocal” tariffs

[link removed]

This week’s announcements are in addition to previously announced tariffs

[link removed]

, including prior levies against Mexico and Canada

[link removed]

.

Outside the energy sector, that means higher prices

[link removed]

for consumers–up to $15,000 more for imported cars and as much as $8,000 more for some domestically-made vehicles. And it’s not just big purchases but small ones as well; clothes and groceries will be especially hard hit, according to a recent analysis

[link removed]

by the Budget Lab at Yale.

For businesses that rely on long-term planning, like those in the energy industry, this kind of uncertainty is killer. Companies cannot build or invest when the rules change this quickly. As our trading partners consider retaliatory tariffs

[link removed]

or an all-out moratorium on investing in the US

[link removed]

, businesses may simply choose to hold capital until the market seems more stable and the full impact of Trump’s agenda can be understood.

What Does This Mean for the Energy Sector? While these tariffs did not explicitly target energy, the industry will take a hit. Chaotic trade policy injects deep uncertainty into any industry that depends on stability to operate, invest, and build. This is especially true for energy, where capital-intensive, long-term projects hinge on predictable regulatory and financing structures.

Consumers will feel the energy impacts of Trump’s tariff policy in the form of higher prices for oil and gas. The infrastructure needed to drill will become more expensive and more difficult to obtain in the coming weeks and months, which will, in turn, increase the likelihood of oil and gas projects being severely delayed or cancelled altogether.

The industry was already worried about the impact of Trump’s tariff policy. In the Dallas Fed’s March survey

[link removed]

, oil and gas executives made their concerns clear, with one executive putting it particularly plainly: "Tariff policy is impossible for us to predict and doesn't have a clear goal. We want more stability.”

What About Clean Energy? Every clean energy project relies on a complex global supply chain. When prices spike, financing becomes riskier, timelines stretch out, and deployment slows. You can’t homeshore entire supply chains overnight–real production capacity takes years to build–and you certainly can’t do it when the rules change every few weeks. For industries like nuclear, this level of uncertainty is generating real anxiety

[link removed]

, especially around nuclear fuel, since the US imports 27% of its uranium

[link removed]

from Canada.

The Bottom Line: This is not just about inputs and projects–it’s about an entire economic system struggling to retain its footing amid market uncertainty. President Donald Trump promised to “unleash American energy dominance” and lower energy costs. But energy projects have long timelines and require a stable policy environment and predictable supply chains to reach completion. The Trump Administration’s policies threaten all three and put Trump’s stated goals of lower prices and a dominant energy sector further out of reach.

Despite this stated goal of advancing energy dominance, the Trump Administration has taken both legislative and administrative steps that threaten to derail clean energy investment. For instance:

Proposed IRA Tax Credit Rollback: Speaker Mike Johnson has signaled strong support for repealing clean energy tax credits, even though they serve as the financial backbone for many clean energy projects.

Funding Freezes: Even though formal freezes have been lifted, billions in clean energy dollars remain stalled–leaving projects in limbo, companies unable to move forward, and investors stuck on the sidelines.

Tariff Volatility: As we outline above, inconsistent and unpredictable tariffs are rattling supply chains, driving up costs, and pushing back timelines–making it harder to build anything on budget or on time.

And now, internal Department of Energy documents reveal

[link removed]

that vital clean energy projects–like regional hydrogen hubs, carbon capture pilots, and industrial decarbonization efforts–are on the chopping block.

Why This Matters: China is doubling down on clean energy as global demand continues to grow for nuclear, storage, and renewable technologies that can increase energy independence, and batteries. All of these moves–funding rollbacks, freezes, tariffs, and cuts–are leaving hundreds of billions in clean energy investment stuck in limbo and threaten entire subsectors of the domestic economy. In the immediate term, that’s money that is ready to flow into communities, create jobs, and build critical infrastructure. That could quickly turn into the collapse of domestic clean energy companies and even entire supply chains, especially with the double-whammy of tariffs and likely inflation.

What We’re Doing: We are fighting to help ensure as many clean energy dollars flow into the communities that are ready to build as fast as possible. Our new memo

[link removed]

maps out where billions in announced private-sector investments are still sitting on the sidelines, highlighting just how much is at risk if political delays and funding cuts continue. Additionally, our newest messaging guide

[link removed]

outlines best practices for policymakers to clearly and confidently talk about what’s at stake.

The New York Times Editorial Board

[link removed]

argues that Democrats are in denial about the reasons for their loss in the 2024 election and urges the Democratic party to admit their mistakes, recalibrate on social issues, and offer fresh ideas instead of relying solely on anti-Trump messaging. The Board highlights that moderate Democrats who address voters’ social and cultural concerns–not just their economic ones–are finding success, and the rest of the party should take note.

Benjamin Storrow and others

[link removed]

, in Scientific American, outline in detail what President Trump’s tariff policy means for the clean energy transition.

Robinson Meyer and Jesse Jenkins

[link removed]

, on the Shift Key podcast, chat with Kristina Costa about the Trump Administration’s efforts to dismantle the EPA’s green banks, established under the Inflation Reduction Act, using criminal justice tools–a strikingly unconventional and little-known strategy.

Let’s keep the conversation going,

Mary Sagatelova

Senior Advocacy Advisor | Third Way

216.394.7615 :: @MarySagatelova

[link removed]

Did someone forward you this email? Sign up to receive The Grid in your inbox HERE

[link removed]

.

Copyright © 2025 Third Way. All rights reserved.

Want to change how you receive these emails? You can update your preferences.

[link removed]

Message Analysis

- Sender: Third Way

- Political Party: n/a

- Country: United States

- State/Locality: n/a

- Office: n/a

-

Email Providers:

- Pardot

- Litmus