Email

Expand the benefits of the Trump tax cuts

| From | Americans for Prosperity <[email protected]> |

| Subject | Expand the benefits of the Trump tax cuts |

| Date | April 1, 2025 7:31 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

What if your state taxes went down too? ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

View in browser

<[link removed]>

||Unsubscribe

<[link removed]>

<[link removed]>

This is The Torchlight, our weekly newsletter keeping you informed on the

fight to reignite the American Dream — and how you can make a difference in

your community.

Chuck Schumer doesn’t trust you with your own money

Chuck Shumer flips the script, calling you selfish for wanting to keep more of

what you’ve earned.

But history tells a different story.

When Americans have more control over their income, they generate real

economic progress — not bureaucrats in Washington.

The 2017 Trump tax cuts delivered direct relief to families and businesses and

spurred a wave of state-level tax reforms. According to National Review, this

federal policy created a blueprint for states to lower taxes, cut government

waste, and reinvest in local communities.

You’ve heard us say non-stop how extending the tax cuts will prevent your

taxes from going up. But what if this policy not only saved families like yours

thousands, but drove your tax saving even further?

States like Arizona, Iowa, and North Carolina have recently used the

foundation set by these federal tax cuts to slash their own income taxes,

providing taxpayers with relief and giving businesses more room to grow.

With federal taxes reduced, states had the flexibility to implement their own

pro-growth strategies like reducing and reforming state income taxes, creating

a ripple effect throughout the economy.

If the Trump tax cuts expire, this momentum could stall.

Higher federal taxes would not only take more from your paycheck but limit

states' ability to continue their tax reforms.

This is your chance to directly shape a more prosperous future.

<[link removed]>

Tell your lawmakers to protect and extend these tax cuts. By doing so, we can

ensure continued economic freedom and opportunity — not just from Washington,

but in every state across America.

Sign the Letter Today

<[link removed]>

In Case You Missed It

<[link removed]>

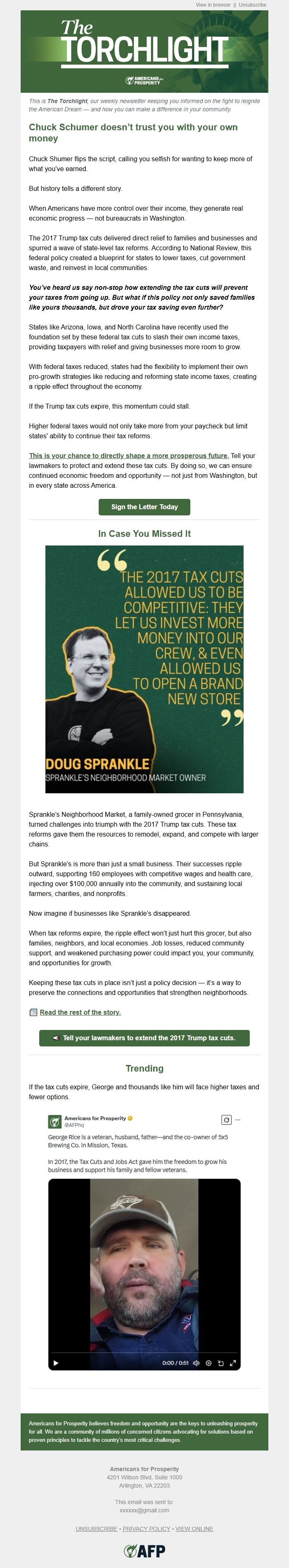

Sprankle’s Neighborhood Market, a family-owned grocer in Pennsylvania, turned

challenges into triumph with the 2017 Trump tax cuts. These tax reforms gave

them the resources to remodel, expand, and compete with larger chains.

But Sprankle’s is more than just a small business. Their successes ripple

outward, supporting 160 employees with competitive wages and health care,

injecting over $100,000 annually into the community, and sustaining local

farmers, charities, and nonprofits.

Now imagine if businesses like Sprankle’s disappeared.

When tax reforms expire, the ripple effect won’t just hurt this grocer, but

also families, neighbors, and local economies. Job losses, reduced community

support, and weakened purchasing power could impact you, your community, and

opportunities for growth.

Keeping these tax cuts in place isn’t just a policy decision — it’s a way to

preserve the connections and opportunities that strengthen neighborhoods.

📰 Read the rest of the story.

<[link removed]>

📣 Tell your lawmakers to extend the 2017 Trump tax cuts.

<[link removed]>

Trending

If the tax cuts expire, George and thousands like him will face higher taxes

and fewer options.

<[link removed]>

Americans for Prosperity believes freedom and opportunity are the keys to

unleashing prosperity for all. We are a community of millions of concerned

citizens advocating for solutions based on proven principles to tackle the

country’s most critical challenges.

Americans for Prosperity

4201 Wilson Blvd, Suite 1000

Arlington, VA 22203

This email was sent to:

[email protected]

UNSUBSCRIBE

<[link removed]>

•PRIVACY POLICY

<[link removed]>

•VIEW ONLINE

<[link removed]>

<[link removed]>

͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

View in browser

<[link removed]>

||Unsubscribe

<[link removed]>

<[link removed]>

This is The Torchlight, our weekly newsletter keeping you informed on the

fight to reignite the American Dream — and how you can make a difference in

your community.

Chuck Schumer doesn’t trust you with your own money

Chuck Shumer flips the script, calling you selfish for wanting to keep more of

what you’ve earned.

But history tells a different story.

When Americans have more control over their income, they generate real

economic progress — not bureaucrats in Washington.

The 2017 Trump tax cuts delivered direct relief to families and businesses and

spurred a wave of state-level tax reforms. According to National Review, this

federal policy created a blueprint for states to lower taxes, cut government

waste, and reinvest in local communities.

You’ve heard us say non-stop how extending the tax cuts will prevent your

taxes from going up. But what if this policy not only saved families like yours

thousands, but drove your tax saving even further?

States like Arizona, Iowa, and North Carolina have recently used the

foundation set by these federal tax cuts to slash their own income taxes,

providing taxpayers with relief and giving businesses more room to grow.

With federal taxes reduced, states had the flexibility to implement their own

pro-growth strategies like reducing and reforming state income taxes, creating

a ripple effect throughout the economy.

If the Trump tax cuts expire, this momentum could stall.

Higher federal taxes would not only take more from your paycheck but limit

states' ability to continue their tax reforms.

This is your chance to directly shape a more prosperous future.

<[link removed]>

Tell your lawmakers to protect and extend these tax cuts. By doing so, we can

ensure continued economic freedom and opportunity — not just from Washington,

but in every state across America.

Sign the Letter Today

<[link removed]>

In Case You Missed It

<[link removed]>

Sprankle’s Neighborhood Market, a family-owned grocer in Pennsylvania, turned

challenges into triumph with the 2017 Trump tax cuts. These tax reforms gave

them the resources to remodel, expand, and compete with larger chains.

But Sprankle’s is more than just a small business. Their successes ripple

outward, supporting 160 employees with competitive wages and health care,

injecting over $100,000 annually into the community, and sustaining local

farmers, charities, and nonprofits.

Now imagine if businesses like Sprankle’s disappeared.

When tax reforms expire, the ripple effect won’t just hurt this grocer, but

also families, neighbors, and local economies. Job losses, reduced community

support, and weakened purchasing power could impact you, your community, and

opportunities for growth.

Keeping these tax cuts in place isn’t just a policy decision — it’s a way to

preserve the connections and opportunities that strengthen neighborhoods.

📰 Read the rest of the story.

<[link removed]>

📣 Tell your lawmakers to extend the 2017 Trump tax cuts.

<[link removed]>

Trending

If the tax cuts expire, George and thousands like him will face higher taxes

and fewer options.

<[link removed]>

Americans for Prosperity believes freedom and opportunity are the keys to

unleashing prosperity for all. We are a community of millions of concerned

citizens advocating for solutions based on proven principles to tackle the

country’s most critical challenges.

Americans for Prosperity

4201 Wilson Blvd, Suite 1000

Arlington, VA 22203

This email was sent to:

[email protected]

UNSUBSCRIBE

<[link removed]>

•PRIVACY POLICY

<[link removed]>

•VIEW ONLINE

<[link removed]>

<[link removed]>

Message Analysis

- Sender: n/a

- Political Party: n/a

- Country: n/a

- State/Locality: n/a

- Office: n/a

-

Email Providers:

- Acoustic (formerly Silverpop)