Email

Chuck Schumer thinks you’re greedy

| From | Americans for Prosperity <[email protected]> |

| Subject | Chuck Schumer thinks you’re greedy |

| Date | March 31, 2025 8:34 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

Let’s set the record straight ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

͏ ͏ ͏ ͏ ͏

View in browser

<[link removed]>

||Unsubscribe

<[link removed]>

<[link removed]>

Hello John,

The year was 2001. The first Harry Potter movie (“Harry Potter and the

Sorcerer’s Stone”) was released in theaters. Usher and Nickelback(!) topped the

charts. The Arizona Diamondbacks were World Series champs.

The year 2001 was also the last time the federal government had a budget

surplus — $128 billion. In fact, the Congressional Budget Office projected that

the federal government would pay off the national debt by 2009!

Fast forward to today, and we’re looking at $2 trillion annual budget deficits

as far as the eye can see. So, what happened? How did we go from such a rosy

scenario to such a bleak one?

To hear those on the left tell it, tax cuts caused our growing deficits —

including the Trump tax cuts of 2017. And they are making the same argument

against renewing those tax cuts, which are set to expire at the end of this

year.

If you want to know the mindset we are up against in trying to renew those tax

cuts, just read this revealing quote from Senate Minority Leader Chuck Schumer

(D-New York) on greedy American taxpayers:

“You know what their attitude is? ‘I made my money all by myself. How dare

your government take my money from me? I don’t want to pay taxes.’ Or, ‘I built

my company with my bare hands. How dare your government tell me how I should

treat my customers, the land and water that I own, or my employees.’ They hate

government. Government is a barrier to people, a barrier to stop people from

doing things. They want to destroy it.”

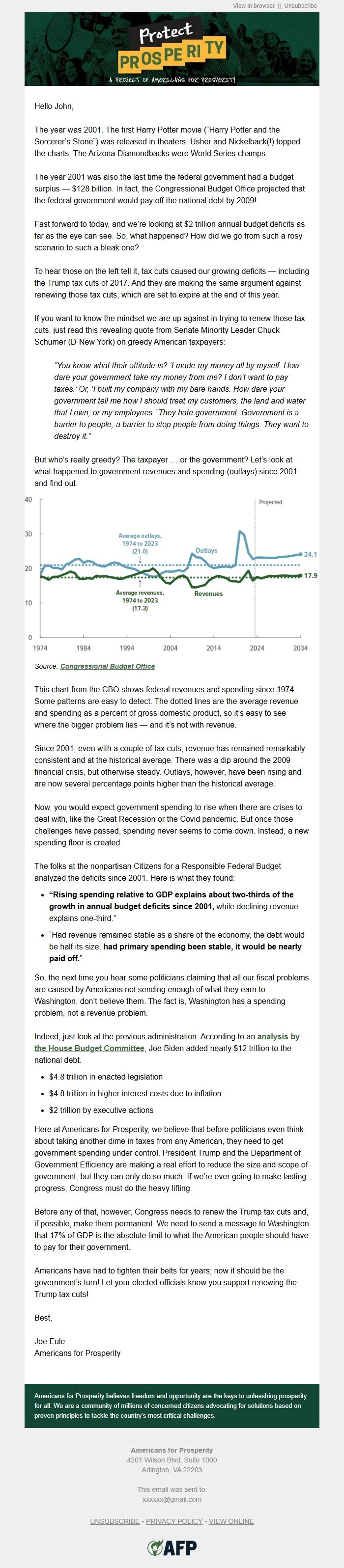

But who’s really greedy? The taxpayer … or the government? Let’s look at what

happened to government revenues and spending (outlays) since 2001 and find out.

<[link removed]>

Source: Congressional Budget Office <[link removed]>

This chart from the CBO shows federal revenues and spending since 1974. Some

patterns are easy to detect. The dotted lines are the average revenue and

spending as a percent of gross domestic product, so it’s easy to see where the

bigger problem lies — and it’s not with revenue.

Since 2001, even with a couple of tax cuts, revenue has remained remarkably

consistent and at the historical average. There was a dip around the 2009

financial crisis, but otherwise steady. Outlays, however, have been rising and

are now several percentage points higher than the historical average.

Now, you would expect government spending to rise when there are crises to

deal with, like the Great Recession or the Covid pandemic. But once those

challenges have passed, spending never seems to come down. Instead, a new

spending floor is created.

The folks at the nonpartisan Citizens for a Responsible Federal Budget

analyzed the deficits since 2001. Here is what they found:

* “Rising spending relative to GDP explains about two-thirds of the growth in

annual budget deficits since 2001, while declining revenue explains one-third.”

* “Had revenue remained stable as a share of the economy, the debt would be

half its size;had primary spending been stable, it would be nearly paid off.”

So, the next time you hear some politicians claiming that all our fiscal

problems are caused by Americans not sending enough of what they earn to

Washington, don’t believe them. The fact is, Washington has a spending problem,

not a revenue problem.

Indeed, just look at the previous administration. According to an analysis by

the House Budget Committee

<[link removed]>

, Joe Biden added nearly $12 trillion to the national debt.

* $4.8 trillion in enacted legislation

* $4.8 trillion in higher interest costs due to inflation

* $2 trillion by executive actions

Here at Americans for Prosperity, we believe that before politicians even

think about taking another dime in taxes from any American, they need to get

government spending under control. President Trump and the Department of

Government Efficiency are making a real effort to reduce the size and scope of

government, but they can only do so much. If we’re ever going to make lasting

progress, Congress must do the heavy lifting.

Before any of that, however, Congress needs to renew the Trump tax cuts and,

if possible, make them permanent. We need to send a message to Washington that

17% of GDP is the absolute limit to what the American people should have to pay

for their government.

Americans have had to tighten their belts for years; now it should be the

government’s turn! Let your elected officials know you support renewing the

Trump tax cuts!

Best,

Joe Eule

Americans for Prosperity

Americans for Prosperity believes freedom and opportunity are the keys to

unleashing prosperity for all. We are a community of millions of concerned

citizens advocating for solutions based on proven principles to tackle the

country's most critical challenges.

Americans for Prosperity

4201 Wilson Blvd, Suite 1000

Arlington, VA 22203

This email was sent to:

[email protected]

UNSUBSCRIBE

<[link removed]>

•PRIVACY POLICY

<[link removed]>

•VIEW ONLINE

<[link removed]>

<[link removed]>

͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

͏ ͏ ͏ ͏ ͏

View in browser

<[link removed]>

||Unsubscribe

<[link removed]>

<[link removed]>

Hello John,

The year was 2001. The first Harry Potter movie (“Harry Potter and the

Sorcerer’s Stone”) was released in theaters. Usher and Nickelback(!) topped the

charts. The Arizona Diamondbacks were World Series champs.

The year 2001 was also the last time the federal government had a budget

surplus — $128 billion. In fact, the Congressional Budget Office projected that

the federal government would pay off the national debt by 2009!

Fast forward to today, and we’re looking at $2 trillion annual budget deficits

as far as the eye can see. So, what happened? How did we go from such a rosy

scenario to such a bleak one?

To hear those on the left tell it, tax cuts caused our growing deficits —

including the Trump tax cuts of 2017. And they are making the same argument

against renewing those tax cuts, which are set to expire at the end of this

year.

If you want to know the mindset we are up against in trying to renew those tax

cuts, just read this revealing quote from Senate Minority Leader Chuck Schumer

(D-New York) on greedy American taxpayers:

“You know what their attitude is? ‘I made my money all by myself. How dare

your government take my money from me? I don’t want to pay taxes.’ Or, ‘I built

my company with my bare hands. How dare your government tell me how I should

treat my customers, the land and water that I own, or my employees.’ They hate

government. Government is a barrier to people, a barrier to stop people from

doing things. They want to destroy it.”

But who’s really greedy? The taxpayer … or the government? Let’s look at what

happened to government revenues and spending (outlays) since 2001 and find out.

<[link removed]>

Source: Congressional Budget Office <[link removed]>

This chart from the CBO shows federal revenues and spending since 1974. Some

patterns are easy to detect. The dotted lines are the average revenue and

spending as a percent of gross domestic product, so it’s easy to see where the

bigger problem lies — and it’s not with revenue.

Since 2001, even with a couple of tax cuts, revenue has remained remarkably

consistent and at the historical average. There was a dip around the 2009

financial crisis, but otherwise steady. Outlays, however, have been rising and

are now several percentage points higher than the historical average.

Now, you would expect government spending to rise when there are crises to

deal with, like the Great Recession or the Covid pandemic. But once those

challenges have passed, spending never seems to come down. Instead, a new

spending floor is created.

The folks at the nonpartisan Citizens for a Responsible Federal Budget

analyzed the deficits since 2001. Here is what they found:

* “Rising spending relative to GDP explains about two-thirds of the growth in

annual budget deficits since 2001, while declining revenue explains one-third.”

* “Had revenue remained stable as a share of the economy, the debt would be

half its size;had primary spending been stable, it would be nearly paid off.”

So, the next time you hear some politicians claiming that all our fiscal

problems are caused by Americans not sending enough of what they earn to

Washington, don’t believe them. The fact is, Washington has a spending problem,

not a revenue problem.

Indeed, just look at the previous administration. According to an analysis by

the House Budget Committee

<[link removed]>

, Joe Biden added nearly $12 trillion to the national debt.

* $4.8 trillion in enacted legislation

* $4.8 trillion in higher interest costs due to inflation

* $2 trillion by executive actions

Here at Americans for Prosperity, we believe that before politicians even

think about taking another dime in taxes from any American, they need to get

government spending under control. President Trump and the Department of

Government Efficiency are making a real effort to reduce the size and scope of

government, but they can only do so much. If we’re ever going to make lasting

progress, Congress must do the heavy lifting.

Before any of that, however, Congress needs to renew the Trump tax cuts and,

if possible, make them permanent. We need to send a message to Washington that

17% of GDP is the absolute limit to what the American people should have to pay

for their government.

Americans have had to tighten their belts for years; now it should be the

government’s turn! Let your elected officials know you support renewing the

Trump tax cuts!

Best,

Joe Eule

Americans for Prosperity

Americans for Prosperity believes freedom and opportunity are the keys to

unleashing prosperity for all. We are a community of millions of concerned

citizens advocating for solutions based on proven principles to tackle the

country's most critical challenges.

Americans for Prosperity

4201 Wilson Blvd, Suite 1000

Arlington, VA 22203

This email was sent to:

[email protected]

UNSUBSCRIBE

<[link removed]>

•PRIVACY POLICY

<[link removed]>

•VIEW ONLINE

<[link removed]>

<[link removed]>

Message Analysis

- Sender: n/a

- Political Party: n/a

- Country: n/a

- State/Locality: n/a

- Office: n/a

-

Email Providers:

- Acoustic (formerly Silverpop)