|

New Analysis: the cost of tax hikes

Taxes raised next week will cost British families over £1,000 per year on average

By Nikhil Woodruff, Policy Engine

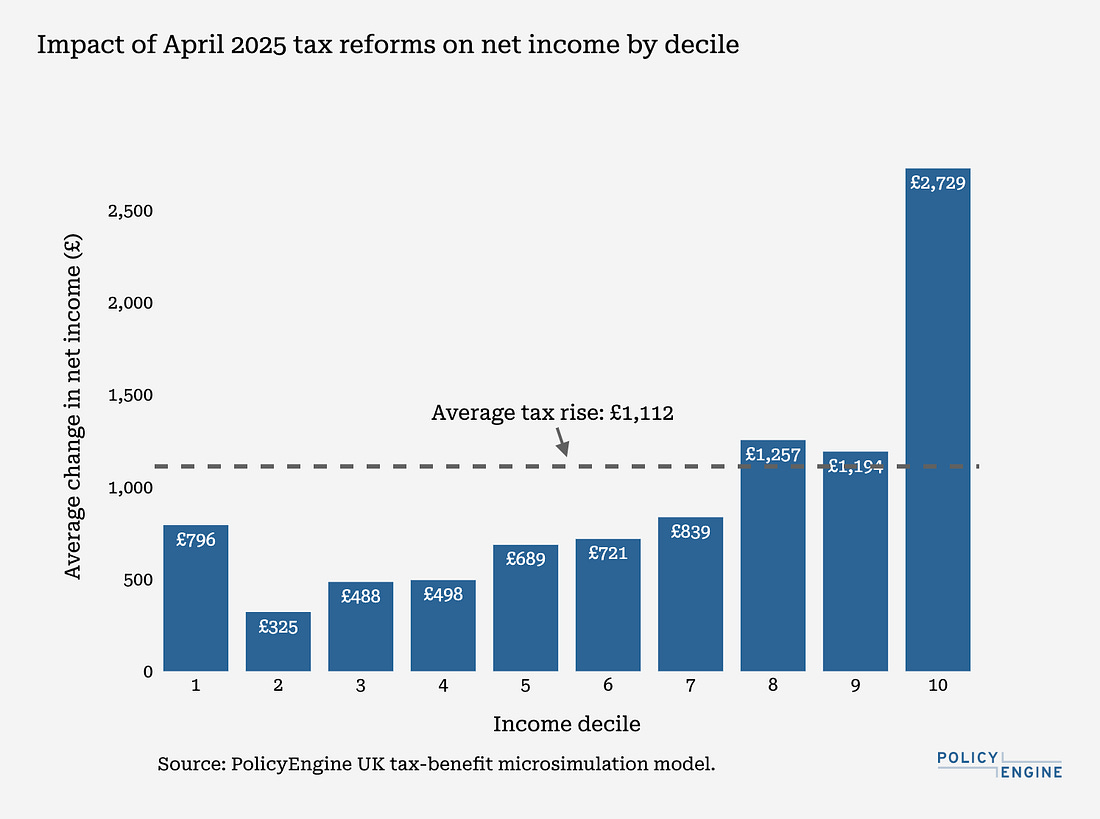

Four tax reforms will take effect in April 2025. Using the Policy Engine UK tax-benefit microsimulation model, we analysed these reforms, which will increase taxes by an average of £1,112 per household.

Policy changes

The April 2025 tax reforms introduce several changes to the UK tax system:

Stamp Duty Land Tax nil-rate thresholds will be set at £300,000 (from £425,000) for first-time buyers and £125,000 (from £250,000) for subsequent purchases. These thresholds determine the property value at which SDLT begins to apply. First-time buyers maintain a higher threshold than subsequent purchasers under this reform.

Employer's National Insurance rate will change to 15% with the secondary threshold set to £96.14 (from £175) per week. We assume that the employer NI changes will be passed on to employees at 40% in 2025, 50% in 2026, 60% in 2027, and 70% in 2028-2029, with the remainder split between business owners and prices.

Capital Gains Tax rates will change to 18% (from 10%) for basic rate taxpayers and 24% (from 20%) for both higher and additional rate taxpayers. CGT applies to profits from the sale of assets that have increased in value, with various exemptions including primary residences.

Council Tax will increase by 5% on average from 2024.

Economic impacts

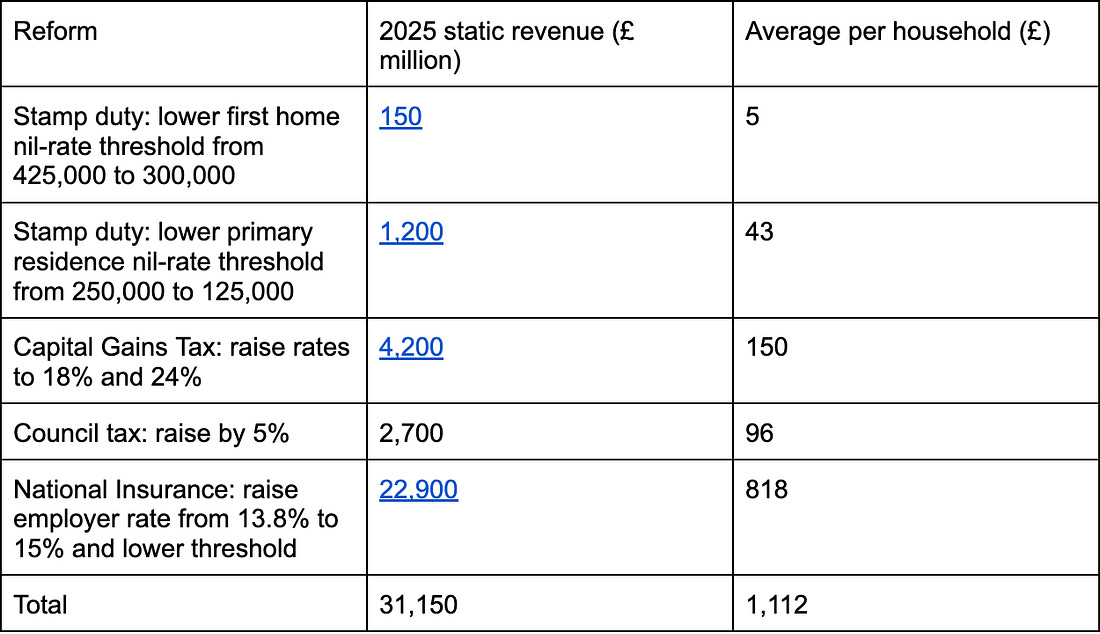

We estimate the following revenue impacts for these reforms in 2025/26 (Table 1). For each tax, we include its static revenue impact. This assumes that individuals do not adjust their behaviour in response, representing simply the impact of the change in policy on existing households.

Figure 1 shows the impact of these reforms on average in each household income decile. The highest decile’s household net income falls by £2,729, and the lowest decile £796.

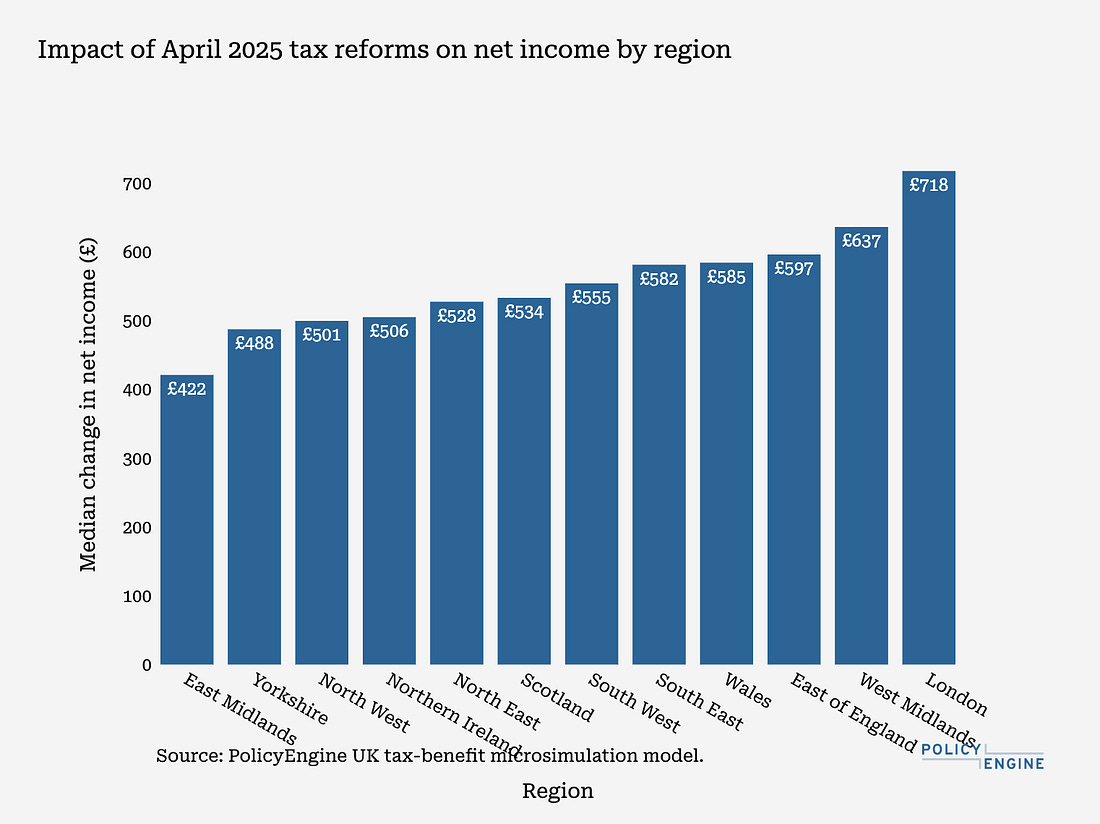

Figure 2 shows the median tax rise by region.

This analysis was done using the Policy Engine UK tax-benefit microsimulation model, by Nikhil Woodruff

You’re currently a free subscriber to Insider. For the full experience, upgrade your subscription.

Paid subscribers support the IEA's charitable mission and receive special invites to exclusive events, including the thought-provoking IEA Book Club.

We are offering all new subscribers a special offer. For a limited time only, you will receive 15% off and a complimentary copy of Dr Stephen Davies’ latest book, Apocalypse Next: The Economics of Global Catastrophic Risks.