Email

Golden Booms & Busts

| From | Navigating Uncertainty (by Vikram Mansharamani) <[email protected]> |

| Subject | Golden Booms & Busts |

| Date | March 27, 2025 8:01 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

View this post on the web at [link removed]

I recently wrote about the surging price of eggs; they were so expensive that instead of a goose laying golden eggs, I joked, it was now chickens [ [link removed] ]. The price of eggs is such that use of the cliche “worth their weight in gold” abounds. Ironically, what’s being overlooked is that if there is something that is worth its weight in gold, it’s, well, gold itself.

The price of gold has been on a run as of late, recently setting records. So much so, in fact, that some are warning that we could be witnessing a gold bubble. Indeed, bubbles have been on my mind as of late - even more so than usual [ [link removed] ] - in part because this week marks the 25th anniversary of the infamous Dot Com Bubble reaching its zenith [ [link removed] ]. From August 1995 to March 2000, the S&P 500 tripled and the NASDAQ increased over 700 percent. After the bubble finally burst, the S&P 500 was cut in half and the NASDAQ saw 80 percent of its value go up in smoke.

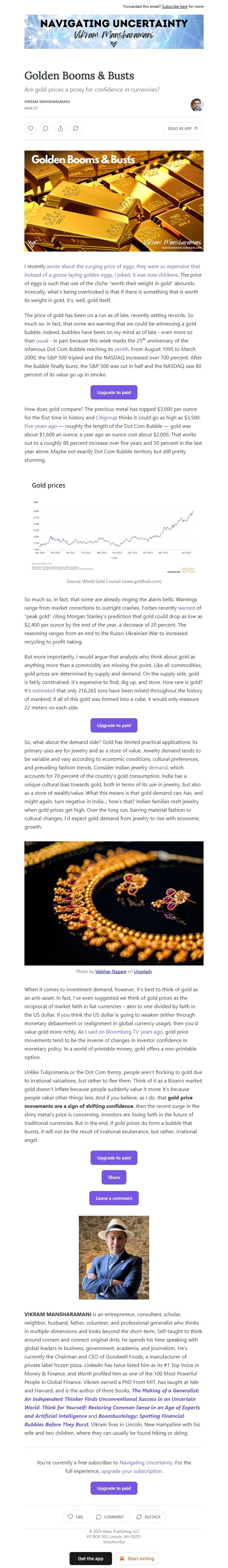

How does gold compare? The precious metal has topped $3,000 per ounce for the first time in history and Citigroup [ [link removed] ] thinks it could go as high as $3,500. Five years ago [ [link removed] ] — roughly the length of the Dot Com Bubble — gold was about $1,600 an ounce; a year ago an ounce cost about $2,000. That works out to a roughly 88 percent increase over five years and 50 percent in the last year alone. Maybe not exactly Dot Com Bubble territory but still pretty stunning.

So much so, in fact, that some are already ringing the alarm bells. Warnings range from market corrections to outright crashes. Forbes recently warned [ [link removed] ] of “peak gold” citing Morgan Stanley’s prediction that gold could drop as low as $2,400 per ounce by the end of the year, a decrease of 20 percent. The reasoning ranges from an end to the Russo-Ukrainian War to increased recycling to profit-taking.

But more importantly, I would argue that analysts who think about gold as anything more than a commodity are missing the point. Like all commodities, gold prices are determined by supply and demand. On the supply side, gold is fairly constrained. It’s expensive to find, dig up, and store. How rare is gold? It’s estimated [ [link removed] ] that only 216,265 tons have been mined throughout the history of mankind; if all of this gold was formed into a cube, it would only measure 22 meters on each side.

So, what about the demand side? Gold has limited practical applications; its primary uses are for jewelry and as a store of value. Jewelry demand tends to be variable and vary according to economic conditions, cultural preferences, and prevailing fashion trends. Consider Indian jewelry demand [ [link removed] ], which accounts for 70 percent of the country’s gold consumption. India has a unique cultural bias towards gold, both in terms of its use in jewelry, but also as a store of wealth/value. What this means is that gold demand can, has, and might again, turn negative in India… how’s that? Indian families melt jewelry when gold prices get high. Over the long run, barring material fashion or cultural changes, I’d expect gold demand from jewelry to rise with economic growth.

When it comes to investment demand, however, it’s best to think of gold as an anti-asset. In fact, I’ve even suggested we think of gold prices as the reciprocal of market faith in fiat currencies – akin to one divided by faith in the US dollar. If you think the US dollar is going to weaken (either through monetary debasement or realignment in global currency usage), then you’d value gold more richly. As I said on Bloomberg TV years ago [ [link removed] ], gold price movements tend to be the inverse of changes in investor confidence in monetary policy. In a world of printable money, gold offers a non-printable option.

Unlike Tulipomania or the Dot Com frenzy, people aren’t flocking to gold due to irrational valuations, but rather to flee them. Think of it as a Bizarro market; gold doesn’t inflate because people suddenly value it more; it’s because people value other things less. And if you believe, as I do, that gold price movements are a sign of shifting confidence, then the recent surge in the shiny metal’s price is concerning. Investors are losing faith in the future of traditional currencies. But in the end, if gold prices do form a bubble that bursts, it will not be the result of irrational exuberance, but rather, irrational angst.

VIKRAM MANSHARAMANI is an entrepreneur, consultant, scholar, neighbor, husband, father, volunteer, and professional generalist who thinks in multiple-dimensions and looks beyond the short-term. Self-taught to think around corners and connect original dots, he spends his time speaking with global leaders in business, government, academia, and journalism. He’s currently the Chairman and CEO of Goodwell Foods, a manufacturer of private label frozen pizza. LinkedIn has twice listed him as its #1 Top Voice in Money & Finance, and Worth profiled him as one of the 100 Most Powerful People in Global Finance. Vikram earned a PhD From MIT, has taught at Yale and Harvard, and is the author of three books, The Making of a Generalist: An Independent Thinker Finds Unconventional Success in an Uncertain World [ [link removed] ], Think for Yourself: Restoring Common Sense in an Age of Experts and Artificial Intelligence [ [link removed] ] and Boombustology: Spotting Financial Bubbles Before They Burst [ [link removed] ]. Vikram lives in Lincoln, New Hampshire with his wife and two children, where they can usually be found hiking or skiing.

Unsubscribe [link removed]?

I recently wrote about the surging price of eggs; they were so expensive that instead of a goose laying golden eggs, I joked, it was now chickens [ [link removed] ]. The price of eggs is such that use of the cliche “worth their weight in gold” abounds. Ironically, what’s being overlooked is that if there is something that is worth its weight in gold, it’s, well, gold itself.

The price of gold has been on a run as of late, recently setting records. So much so, in fact, that some are warning that we could be witnessing a gold bubble. Indeed, bubbles have been on my mind as of late - even more so than usual [ [link removed] ] - in part because this week marks the 25th anniversary of the infamous Dot Com Bubble reaching its zenith [ [link removed] ]. From August 1995 to March 2000, the S&P 500 tripled and the NASDAQ increased over 700 percent. After the bubble finally burst, the S&P 500 was cut in half and the NASDAQ saw 80 percent of its value go up in smoke.

How does gold compare? The precious metal has topped $3,000 per ounce for the first time in history and Citigroup [ [link removed] ] thinks it could go as high as $3,500. Five years ago [ [link removed] ] — roughly the length of the Dot Com Bubble — gold was about $1,600 an ounce; a year ago an ounce cost about $2,000. That works out to a roughly 88 percent increase over five years and 50 percent in the last year alone. Maybe not exactly Dot Com Bubble territory but still pretty stunning.

So much so, in fact, that some are already ringing the alarm bells. Warnings range from market corrections to outright crashes. Forbes recently warned [ [link removed] ] of “peak gold” citing Morgan Stanley’s prediction that gold could drop as low as $2,400 per ounce by the end of the year, a decrease of 20 percent. The reasoning ranges from an end to the Russo-Ukrainian War to increased recycling to profit-taking.

But more importantly, I would argue that analysts who think about gold as anything more than a commodity are missing the point. Like all commodities, gold prices are determined by supply and demand. On the supply side, gold is fairly constrained. It’s expensive to find, dig up, and store. How rare is gold? It’s estimated [ [link removed] ] that only 216,265 tons have been mined throughout the history of mankind; if all of this gold was formed into a cube, it would only measure 22 meters on each side.

So, what about the demand side? Gold has limited practical applications; its primary uses are for jewelry and as a store of value. Jewelry demand tends to be variable and vary according to economic conditions, cultural preferences, and prevailing fashion trends. Consider Indian jewelry demand [ [link removed] ], which accounts for 70 percent of the country’s gold consumption. India has a unique cultural bias towards gold, both in terms of its use in jewelry, but also as a store of wealth/value. What this means is that gold demand can, has, and might again, turn negative in India… how’s that? Indian families melt jewelry when gold prices get high. Over the long run, barring material fashion or cultural changes, I’d expect gold demand from jewelry to rise with economic growth.

When it comes to investment demand, however, it’s best to think of gold as an anti-asset. In fact, I’ve even suggested we think of gold prices as the reciprocal of market faith in fiat currencies – akin to one divided by faith in the US dollar. If you think the US dollar is going to weaken (either through monetary debasement or realignment in global currency usage), then you’d value gold more richly. As I said on Bloomberg TV years ago [ [link removed] ], gold price movements tend to be the inverse of changes in investor confidence in monetary policy. In a world of printable money, gold offers a non-printable option.

Unlike Tulipomania or the Dot Com frenzy, people aren’t flocking to gold due to irrational valuations, but rather to flee them. Think of it as a Bizarro market; gold doesn’t inflate because people suddenly value it more; it’s because people value other things less. And if you believe, as I do, that gold price movements are a sign of shifting confidence, then the recent surge in the shiny metal’s price is concerning. Investors are losing faith in the future of traditional currencies. But in the end, if gold prices do form a bubble that bursts, it will not be the result of irrational exuberance, but rather, irrational angst.

VIKRAM MANSHARAMANI is an entrepreneur, consultant, scholar, neighbor, husband, father, volunteer, and professional generalist who thinks in multiple-dimensions and looks beyond the short-term. Self-taught to think around corners and connect original dots, he spends his time speaking with global leaders in business, government, academia, and journalism. He’s currently the Chairman and CEO of Goodwell Foods, a manufacturer of private label frozen pizza. LinkedIn has twice listed him as its #1 Top Voice in Money & Finance, and Worth profiled him as one of the 100 Most Powerful People in Global Finance. Vikram earned a PhD From MIT, has taught at Yale and Harvard, and is the author of three books, The Making of a Generalist: An Independent Thinker Finds Unconventional Success in an Uncertain World [ [link removed] ], Think for Yourself: Restoring Common Sense in an Age of Experts and Artificial Intelligence [ [link removed] ] and Boombustology: Spotting Financial Bubbles Before They Burst [ [link removed] ]. Vikram lives in Lincoln, New Hampshire with his wife and two children, where they can usually be found hiking or skiing.

Unsubscribe [link removed]?

Message Analysis

- Sender: n/a

- Political Party: n/a

- Country: n/a

- State/Locality: n/a

- Office: n/a