Email

📉 S&P 500 Correction & 📈 Gold's Historic High: Your Weekly Market Roundup

| From | Irving Wilkinson <[email protected]> |

| Subject | 📉 S&P 500 Correction & 📈 Gold's Historic High: Your Weekly Market Roundup |

| Date | March 17, 2025 7:55 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

View image: ([link removed])

Follow image link: ([link removed])

Caption:

Good afternoon,

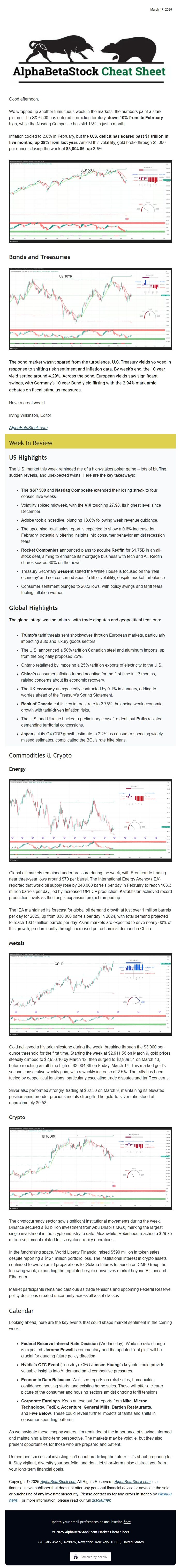

We wrapped up another tumultuous week in the markets, the numbers paint a stark picture. The S&P 500 has entered correction territory,** down 10% from its February** high, while the Nasdaq Composite has slid 13% in just a month.

Inflation cooled to 2.8% in February, but the** U.S. deficit has soared past $1 trillion in five months, up 38% from last year.** Amidst this volatility, gold broke through $3,000 per ounce, closing the week at **$3,004.86, up 2.5%.**

View image: ([link removed])

Caption:

## **Bonds and Treasuries**

View image: ([link removed])

Caption:

The bond market wasn’t spared from the turbulence. U.S. Treasury yields yo-yoed in response to shifting risk sentiment and inflation data. By week’s end, the 10-year yield settled around 4.29%. Across the pond, European yields saw significant swings, with Germany’s 10-year Bund yield flirting with the 2.94% mark amid debates on fiscal stimulus measures.

Have a great week!

Irving Wilkinson, Editor

[AlphaBetaStock.com]([link removed])

----------

## Week In Review

--------------------

## **US Highlights**

The U.S. market this week reminded me of a high-stakes poker game – lots of bluffing, sudden reveals, and unexpected twists. Here are the key takeaways:

* The **S&P 500** and **Nasdaq Composite** extended their losing streak to four consecutive weeks.

* Volatility spiked midweek, with the **VIX** touching 27.98, its highest level since December.

* **Adobe** took a nosedive, plunging 13.8% following weak revenue guidance.

* The upcoming retail sales report is expected to show a 0.6% increase for February, potentially offering insights into consumer behavior amidst recession fears.

* **Rocket Companies** announced plans to acquire **Redfin** for $1.75B in an all-stock deal, aiming to enhance its mortgage business with tech and AI. Redfin shares soared 80% on the news.

* Treasury Secretary **Bessent** stated the White House is focused on the ‘real economy’ and not concerned about ‘a little’ volatility, despite market turbulence.

* Consumer sentiment plunged to 2022 lows, with policy swings and tariff fears fueling inflation worries.

## **Global Highlights**

The global stage was set ablaze with trade disputes and geopolitical tensions:

* **Trump’s** tariff threats sent shockwaves through European markets, particularly impacting auto and luxury goods sectors.

* The U.S. announced a 50% tariff on Canadian steel and aluminum imports, up from the originally proposed 25%.

* Ontario retaliated by imposing a 25% tariff on exports of electricity to the U.S.

* **China’s** consumer inflation turned negative for the first time in 13 months, raising concerns about its economic recovery.

* The **UK economy** unexpectedly contracted by 0.1% in January, adding to worries ahead of the Treasury’s Spring Statement.

* **Bank of Canada** cut its key interest rate to 2.75%, balancing weak economic growth with tariff-driven inflation risks.

* The U.S. and Ukraine backed a preliminary ceasefire deal, but **Putin** resisted, demanding territorial concessions.

* **Japan** cut its Q4 GDP growth estimate to 2.2% as consumer spending widely missed estimates, complicating the BOJ’s rate hike plans.

----------## Commodities & Crypto

### **Energy**

View image: ([link removed])

Caption:

Global oil markets remained under pressure during the week, with Brent crude trading near three-year lows around $70 per barrel. The International Energy Agency (IEA) reported that world oil supply rose by 240,000 barrels per day in February to reach 103.3 million barrels per day, led by increased OPEC+ production. Kazakhstan achieved record production levels as the Tengiz expansion project ramped up.

The IEA maintained its forecast for global oil demand growth at just over 1 million barrels per day for 2025, up from 830,000 barrels per day in 2024, with total demand projected to reach 103.9 million barrels per day. Asian markets are expected to drive nearly 60% of this growth, predominantly through increased petrochemical demand in China.

### **Metals**

View image: ([link removed])

Caption:

Gold achieved a historic milestone during the week, breaking through the $3,000 per ounce threshold for the first time. Starting the week at $2,911.56 on March 9, gold prices steadily climbed to $2,933.16 by March 12, then surged to $2,989.31 on March 13, before reaching an all-time high of $3,004.86 on Friday, March 14. This marked gold’s second consecutive weekly gain, with a weekly increase of 2.5%. The rally has been fueled by geopolitical tensions, particularly escalating trade disputes and tariff concerns.

Silver also performed strongly, trading at $32.50 on March 9, maintaining its elevated position amid broader precious metals strength. The gold-to-silver ratio stood at approximately 89.58.

### **Crypto**

View image: ([link removed])

Caption:

The cryptocurrency sector saw significant institutional movements during the week. Binance secured a $2 billion investment from Abu Dhabi’s MGX, marking the largest single investment in the crypto industry to date. Meanwhile, Robinhood reached a $29.75 million settlement related to its cryptocurrency operations.

In the fundraising space, World Liberty Financial raised $590 million in token sales despite reporting a $124 million portfolio loss. The institutional interest in crypto assets continued to evolve amid preparations for Solana futures to launch on CME Group the following week, expanding the regulated crypto derivatives market beyond Bitcoin and Ethereum.

Market participants remained cautious as trade tensions and upcoming Federal Reserve policy decisions created uncertainty across all asset classes.

## Calendar

Looking ahead, here are the key events that could shape market sentiment in the coming week:

* **Federal Reserve Interest Rate Decision** (Wednesday): While no rate change is expected, **Jerome Powell’s** commentary and the updated “dot plot” will be crucial for gauging future policy direction.

* **Nvidia’s GTC Event** (Tuesday): CEO **Jensen Huang’s** keynote could provide valuable insights into AI demand amid competitive pressures.

* **Economic Data Releases**: We’ll see reports on retail sales, homebuilder confidence, housing starts, and existing home sales. These will offer a clearer picture of the consumer and housing sectors amidst ongoing tariff tensions.

* **Corporate Earnings**: Keep an eye out for reports from **Nike**, **Micron Technology**, **FedEx**, **Accenture**, **General Mills**, **Darden Restaurants**, and **Five Below**. These could reveal further impacts of tariffs and shifts in consumer spending patterns.

As we navigate these choppy waters, I’m reminded of the importance of staying informed and maintaining a long-term perspective. The markets may be volatile, but they also present opportunities for those who are prepared and patient.

Remember, successful investing isn’t about predicting the future – it’s about preparing for it. Stay vigilant, diversify your portfolio, and don’t let short-term noise distract you from your long-term financial goals.

Copyright © 2025 [AlphaBetaStock.com]([link removed]) All Rights Reserved | [AlphaBetaStock.com]([link removed]) is a financial news publisher that does not offer any personal financial advice or advocate the sale or purchasing of any investment/security. Please contact us for any errors in stories by [clicking here]([link removed]). For more information, please read our full [disclaimer.]([link removed])

———

You are reading a plain text version of this post. For the best experience, copy and paste this link in your browser to view the post online:

[link removed]

Follow image link: ([link removed])

Caption:

Good afternoon,

We wrapped up another tumultuous week in the markets, the numbers paint a stark picture. The S&P 500 has entered correction territory,** down 10% from its February** high, while the Nasdaq Composite has slid 13% in just a month.

Inflation cooled to 2.8% in February, but the** U.S. deficit has soared past $1 trillion in five months, up 38% from last year.** Amidst this volatility, gold broke through $3,000 per ounce, closing the week at **$3,004.86, up 2.5%.**

View image: ([link removed])

Caption:

## **Bonds and Treasuries**

View image: ([link removed])

Caption:

The bond market wasn’t spared from the turbulence. U.S. Treasury yields yo-yoed in response to shifting risk sentiment and inflation data. By week’s end, the 10-year yield settled around 4.29%. Across the pond, European yields saw significant swings, with Germany’s 10-year Bund yield flirting with the 2.94% mark amid debates on fiscal stimulus measures.

Have a great week!

Irving Wilkinson, Editor

[AlphaBetaStock.com]([link removed])

----------

## Week In Review

--------------------

## **US Highlights**

The U.S. market this week reminded me of a high-stakes poker game – lots of bluffing, sudden reveals, and unexpected twists. Here are the key takeaways:

* The **S&P 500** and **Nasdaq Composite** extended their losing streak to four consecutive weeks.

* Volatility spiked midweek, with the **VIX** touching 27.98, its highest level since December.

* **Adobe** took a nosedive, plunging 13.8% following weak revenue guidance.

* The upcoming retail sales report is expected to show a 0.6% increase for February, potentially offering insights into consumer behavior amidst recession fears.

* **Rocket Companies** announced plans to acquire **Redfin** for $1.75B in an all-stock deal, aiming to enhance its mortgage business with tech and AI. Redfin shares soared 80% on the news.

* Treasury Secretary **Bessent** stated the White House is focused on the ‘real economy’ and not concerned about ‘a little’ volatility, despite market turbulence.

* Consumer sentiment plunged to 2022 lows, with policy swings and tariff fears fueling inflation worries.

## **Global Highlights**

The global stage was set ablaze with trade disputes and geopolitical tensions:

* **Trump’s** tariff threats sent shockwaves through European markets, particularly impacting auto and luxury goods sectors.

* The U.S. announced a 50% tariff on Canadian steel and aluminum imports, up from the originally proposed 25%.

* Ontario retaliated by imposing a 25% tariff on exports of electricity to the U.S.

* **China’s** consumer inflation turned negative for the first time in 13 months, raising concerns about its economic recovery.

* The **UK economy** unexpectedly contracted by 0.1% in January, adding to worries ahead of the Treasury’s Spring Statement.

* **Bank of Canada** cut its key interest rate to 2.75%, balancing weak economic growth with tariff-driven inflation risks.

* The U.S. and Ukraine backed a preliminary ceasefire deal, but **Putin** resisted, demanding territorial concessions.

* **Japan** cut its Q4 GDP growth estimate to 2.2% as consumer spending widely missed estimates, complicating the BOJ’s rate hike plans.

----------## Commodities & Crypto

### **Energy**

View image: ([link removed])

Caption:

Global oil markets remained under pressure during the week, with Brent crude trading near three-year lows around $70 per barrel. The International Energy Agency (IEA) reported that world oil supply rose by 240,000 barrels per day in February to reach 103.3 million barrels per day, led by increased OPEC+ production. Kazakhstan achieved record production levels as the Tengiz expansion project ramped up.

The IEA maintained its forecast for global oil demand growth at just over 1 million barrels per day for 2025, up from 830,000 barrels per day in 2024, with total demand projected to reach 103.9 million barrels per day. Asian markets are expected to drive nearly 60% of this growth, predominantly through increased petrochemical demand in China.

### **Metals**

View image: ([link removed])

Caption:

Gold achieved a historic milestone during the week, breaking through the $3,000 per ounce threshold for the first time. Starting the week at $2,911.56 on March 9, gold prices steadily climbed to $2,933.16 by March 12, then surged to $2,989.31 on March 13, before reaching an all-time high of $3,004.86 on Friday, March 14. This marked gold’s second consecutive weekly gain, with a weekly increase of 2.5%. The rally has been fueled by geopolitical tensions, particularly escalating trade disputes and tariff concerns.

Silver also performed strongly, trading at $32.50 on March 9, maintaining its elevated position amid broader precious metals strength. The gold-to-silver ratio stood at approximately 89.58.

### **Crypto**

View image: ([link removed])

Caption:

The cryptocurrency sector saw significant institutional movements during the week. Binance secured a $2 billion investment from Abu Dhabi’s MGX, marking the largest single investment in the crypto industry to date. Meanwhile, Robinhood reached a $29.75 million settlement related to its cryptocurrency operations.

In the fundraising space, World Liberty Financial raised $590 million in token sales despite reporting a $124 million portfolio loss. The institutional interest in crypto assets continued to evolve amid preparations for Solana futures to launch on CME Group the following week, expanding the regulated crypto derivatives market beyond Bitcoin and Ethereum.

Market participants remained cautious as trade tensions and upcoming Federal Reserve policy decisions created uncertainty across all asset classes.

## Calendar

Looking ahead, here are the key events that could shape market sentiment in the coming week:

* **Federal Reserve Interest Rate Decision** (Wednesday): While no rate change is expected, **Jerome Powell’s** commentary and the updated “dot plot” will be crucial for gauging future policy direction.

* **Nvidia’s GTC Event** (Tuesday): CEO **Jensen Huang’s** keynote could provide valuable insights into AI demand amid competitive pressures.

* **Economic Data Releases**: We’ll see reports on retail sales, homebuilder confidence, housing starts, and existing home sales. These will offer a clearer picture of the consumer and housing sectors amidst ongoing tariff tensions.

* **Corporate Earnings**: Keep an eye out for reports from **Nike**, **Micron Technology**, **FedEx**, **Accenture**, **General Mills**, **Darden Restaurants**, and **Five Below**. These could reveal further impacts of tariffs and shifts in consumer spending patterns.

As we navigate these choppy waters, I’m reminded of the importance of staying informed and maintaining a long-term perspective. The markets may be volatile, but they also present opportunities for those who are prepared and patient.

Remember, successful investing isn’t about predicting the future – it’s about preparing for it. Stay vigilant, diversify your portfolio, and don’t let short-term noise distract you from your long-term financial goals.

Copyright © 2025 [AlphaBetaStock.com]([link removed]) All Rights Reserved | [AlphaBetaStock.com]([link removed]) is a financial news publisher that does not offer any personal financial advice or advocate the sale or purchasing of any investment/security. Please contact us for any errors in stories by [clicking here]([link removed]). For more information, please read our full [disclaimer.]([link removed])

———

You are reading a plain text version of this post. For the best experience, copy and paste this link in your browser to view the post online:

[link removed]

Message Analysis

- Sender: n/a

- Political Party: n/a

- Country: n/a

- State/Locality: n/a

- Office: n/a