Rep. Buddy Carter (R-GA) recently introduced the Fair Tax Act, a bill that would repeal the current tax code and replace it with a single national consumption tax, allowing Americans to keep every single cent they earn and eliminating the need for the IRS altogether.

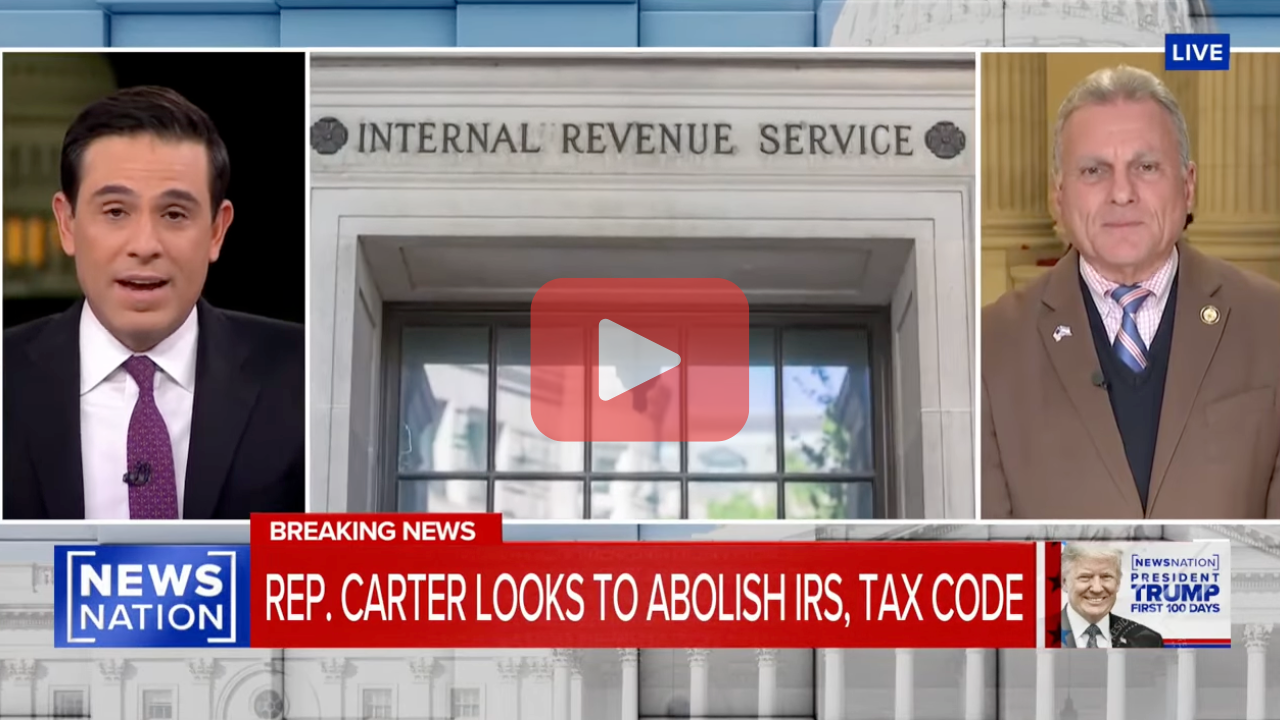

In Case You Missed It, Rep. Carter discussed how the Fair Tax Act will unleash the American economy and put YOU back in charge of your paycheck.

Here are the highlights:

“I’m a big fan of the external revenue service, and I can do one-up on the president in this case because he wants to send 90,000 IRS agents down there and I can send them all down there. If we go with a consumption tax like the Fair Tax, you can send them all down there or you can eliminate them completely, because then people will be in charge of their own taxes.”

“And we need the Fair Tax, its time has come. It is fair, it is simple, and it is a consumption tax, people prefer a consumption tax.”

“We could supplement a lot of our revenues with the tariffs that he is talking about imposing, and don’t tell me it doesn’t work, I mean it’s already proven to work.”

Watch the full interview here.

“77 million people said they wanted Donald Trump to be President again and they want him to shake things up.”

“We understand when the American People speak, and when they speak loudly, and they say we want this done, we want spending cut, we want to stop this outrageous debt that we have. 36 trillion dollars. The interest on our debt, more than what we’re spending on defense. We can’t continue that.”

“The Fair Tax is a consumption tax. You know, right now unelected armed bureaucrats have more control over your paycheck than you do.”

Watch the full interview here.

“Washington D.C. used to be a place about big ideas, I don’t know what happened. The Fair Tax is a big idea, doing away with unelected bureaucrats who have more power over your paycheck than you do. I think that’s a big idea, I think it’s an idea we ought to follow. I mean after all with the Fair Tax, it’s simple, its practical.”

“If you make $40,000 a year, you’ll take home $40,000 a year. If you’re going to buy a boat, you’re going to pay taxes on it. And look, everybody talks about the wealthy, ‘They don’t pay their fair share of taxes.’ Well, the wealthy are going to buy a yacht. And let me tell you… the taxes on a yacht are a lot more than they are on a john boat.”

Watch the full interview here.

“I believe this is the right move because it’s simple and it’s fair... You know people don't like paying taxes. But given the choice between a consumption tax and a property tax or an income tax, they would much prefer a consumption tax, because that way they're in charge.”

“With the IRS, they’re no longer going to be in control. You’re going to be in control.”

“People came out and voted for Donald Trump. People who normally would have voted Democrat, voted for a Republican and voted for President Trump. They know that our economy has got to get started again.”

Watch the full interview here.