Email

Market Mayhem: Tariffs, Trade Wars, and Treasury Teasers! Weekly Cheat Sheet)

| From | Irving Wilkinson <[email protected]> |

| Subject | Market Mayhem: Tariffs, Trade Wars, and Treasury Teasers! Weekly Cheat Sheet) |

| Date | February 11, 2025 4:04 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

View image: ([link removed])

Follow image link: ([link removed])

Caption:

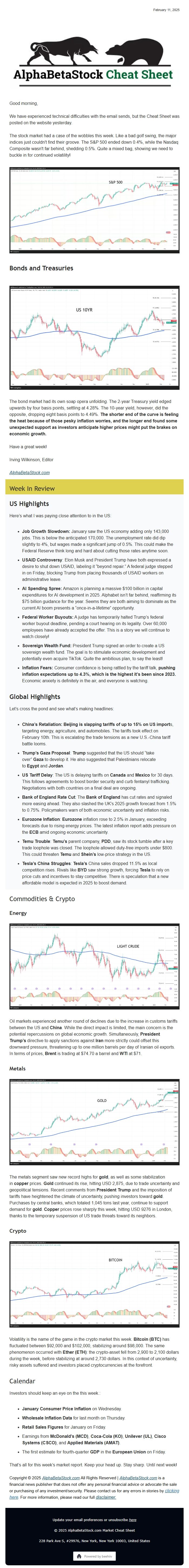

Good morning,

We have experienced technical difficulties with the email sends, but the Cheat Sheet was posted on the website yesterday.

The stock market had a case of the wobbles this week. Like a bad golf swing, the major indices just couldn't find their groove. The S&P 500 ended down 0.4%, while the Nasdaq Composite wasn't far behind, shedding 0.5%. Quite a mixed bag, showing we need to buckle in for continued volatility!

View image: ([link removed])

Caption:

## **Bonds and Treasuries**

View image: ([link removed])

Caption:

The bond market had its own soap opera unfolding. The 2-year Treasury yield edged upwards by four basis points, settling at 4.28%. The 10-year yield, however, did the opposite, dropping eight basis points to 4.49%. **The shorter end of the curve is feeling the heat because of those pesky inflation worries, and the longer end found some unexpected support as investors anticipate higher prices might put the brakes on economic growth.**

Have a great week!

Irving Wilkinson, Editor

[AlphaBetaStock.com]([link removed])

----------

## Week In Review

--------------------

## **US Highlights**

Here’s what I was paying close attention to in the US:

* **Job Growth Slowdown:** January saw the US economy adding only 143,000 jobs. This is below the anticipated 170,000. The unemployment rate did dip slightly to 4%, but wages made a significant jump of 0.5%. This could make the Federal Reserve think long and hard about cutting those rates anytime soon.

* **USAID Controversy**: Elon Musk and President Trump have both expressed a desire to shut down USAID, labeling it “beyond repair.” A federal judge stepped in on Friday, blocking Trump from placing thousands of USAID workers on administrative leave.

* **AI Spending Spree:** Amazon is planning a massive $100 billion in capital expenditures for AI development in 2025. Alphabet isn’t far behind, reaffirming its $75 billion guidance for the year. Seems they are both aiming to dominate as the current AI boom presents a “once-in-a-lifetime” opportunity.

* **Federal Worker Buyouts:** A judge has temporarily halted Trump’s federal worker buyout deadline, pending a court hearing on its legality. Over 60,000 employees have already accepted the offer. This is a story we will continue to watch closely!

* **Sovereign Wealth Fund:** President Trump signed an order to create a US sovereign wealth fund. The goal is to stimulate economic development and potentially even acquire TikTok. Quite the ambitious plan, to say the least!

* **Inflation Fears:** Consumer confidence is being rattled by the tariff talk,** pushing inflation expectations up to 4.3%, which is the highest it’s been since 2023.** Economic anxiety is definitely in the air, and everyone is watching.

## **Global Highlights**

Let’s cross the pond and see what’s making headlines:

* **China’s Retaliation: Beijing is slapping tariffs of up to 15% on US import**s, targeting energy, agriculture, and automobiles. The tariffs took effect on February 10th. This is escalating the trade tensions as a new U.S.-China tariff battle looms.

* **Trump’s Gaza Proposal**: **Trump** suggested that the US should “take over” **Gaza** to develop it. He also suggested that Palestinians relocate to **Egypt** and **Jordan**.

* **US Tariff Delay**: The US is delaying tariffs on **Canada** and **Mexico** for 30 days. This follows agreements to boost border security and curb fentanyl trafficking. Negotiations with both countries on a final deal are ongoing.

* **Bank of England Rate Cut**: The **Bank of England** has cut rates and signaled more easing ahead. They also slashed the UK’s 2025 growth forecast from 1.5% to 0.75%. Policymakers warn of both economic uncertainty and inflation risks.

* **Eurozone Inflation**: **Eurozone** inflation rose to 2.5% in January, exceeding forecasts due to rising energy prices. The latest inflation report adds pressure on the **ECB** amid ongoing economic uncertainty.

* **Temu Trouble**: **Temu’s** parent company, **PDD**, saw its stock tumble after a key trade loophole was closed. The loophole allowed duty-free imports under $800. This could threaten **Temu** and **Shein’s** low-price strategy in the US.

* **Tesla’s China Struggles**: **Tesla’s** China sales dropped 11.5% as local competition rises. Rivals like **BYD** saw strong growth, forcing **Tesla** to rely on price cuts and incentives to stay competitive. There is speculation that a new affordable model is expected in 2025 to boost demand.

----------## Commodities & Crypto

### **Energy**

View image: ([link removed])

Caption:

Oil markets experienced another round of declines due to the increase in customs tariffs between the US and **China**. While the direct impact is limited, the main concern is the potential repercussions on global economic growth. Simultaneously, **President Trump’s** directive to apply sanctions against **Iran** more strictly could offset this downward pressure, threatening up to one million barrels per day of Iranian oil exports. In terms of prices, **Brent** is trading at $74.70 a barrel and **WTI** at $71.

### **Metals**

View image: ([link removed])

Caption:

The metals segment saw new record highs for **gold**, as well as some stabilization in **copper** prices. **Gold** continued its rise, hitting USD 2,875, due to trade uncertainty and geopolitical tensions. Recent comments from **President Trump** and the imposition of tariffs have heightened the climate of uncertainty, pushing investors toward **gold**. Purchases by central banks, which totaled 1,045 tons last year, continue to support demand for **gold**. **Copper** prices rose sharply this week, hitting USD 9276 in London, thanks to the temporary suspension of US trade threats toward its neighbors.

### **Crypto**

View image: ([link removed])

Caption:

Volatility is the name of the game in the crypto market this week. **Bitcoin (BTC)** has fluctuated between $92,000 and $102,000, stabilizing around $98,000. The same phenomenon occurred with **Ether (ETH)**: the crypto-asset fell from 2,900 to 2,100 dollars during the week, before stabilizing at around 2,730 dollars. In this context of uncertainty, risky assets suffered and investors placed cryptocurrencies at the forefront.

## Calendar

Investors should keep an eye on the this week.:

* **January Consumer Price Inflation** on Wednesday.

* **Wholesale Inflation Data** for last month on Thursday.

* **Retail Sales Figures** for January on Friday.

* Earnings from **McDonald’s (MCD)**, **Coca-Cola (KO)**, **Unilever (UL)**, **Cisco Systems (CSCO)**, and **Applied Materials (AMAT)**.

* The first estimate for fourth-quarter **GDP** in the **European Union** on Friday.

That’s all for this week’s market report. Keep your head up. Stay sharp. Until next week!

Copyright © 2025 [AlphaBetaStock.com]([link removed]) All Rights Reserved | [AlphaBetaStock.com]([link removed]) is a financial news publisher that does not offer any personal financial advice or advocate the sale or purchasing of any investment/security. Please contact us for any errors in stories by [clicking here]([link removed]). For more information, please read our full [disclaimer.]([link removed])

———

You are reading a plain text version of this post. For the best experience, copy and paste this link in your browser to view the post online:

[link removed]

Follow image link: ([link removed])

Caption:

Good morning,

We have experienced technical difficulties with the email sends, but the Cheat Sheet was posted on the website yesterday.

The stock market had a case of the wobbles this week. Like a bad golf swing, the major indices just couldn't find their groove. The S&P 500 ended down 0.4%, while the Nasdaq Composite wasn't far behind, shedding 0.5%. Quite a mixed bag, showing we need to buckle in for continued volatility!

View image: ([link removed])

Caption:

## **Bonds and Treasuries**

View image: ([link removed])

Caption:

The bond market had its own soap opera unfolding. The 2-year Treasury yield edged upwards by four basis points, settling at 4.28%. The 10-year yield, however, did the opposite, dropping eight basis points to 4.49%. **The shorter end of the curve is feeling the heat because of those pesky inflation worries, and the longer end found some unexpected support as investors anticipate higher prices might put the brakes on economic growth.**

Have a great week!

Irving Wilkinson, Editor

[AlphaBetaStock.com]([link removed])

----------

## Week In Review

--------------------

## **US Highlights**

Here’s what I was paying close attention to in the US:

* **Job Growth Slowdown:** January saw the US economy adding only 143,000 jobs. This is below the anticipated 170,000. The unemployment rate did dip slightly to 4%, but wages made a significant jump of 0.5%. This could make the Federal Reserve think long and hard about cutting those rates anytime soon.

* **USAID Controversy**: Elon Musk and President Trump have both expressed a desire to shut down USAID, labeling it “beyond repair.” A federal judge stepped in on Friday, blocking Trump from placing thousands of USAID workers on administrative leave.

* **AI Spending Spree:** Amazon is planning a massive $100 billion in capital expenditures for AI development in 2025. Alphabet isn’t far behind, reaffirming its $75 billion guidance for the year. Seems they are both aiming to dominate as the current AI boom presents a “once-in-a-lifetime” opportunity.

* **Federal Worker Buyouts:** A judge has temporarily halted Trump’s federal worker buyout deadline, pending a court hearing on its legality. Over 60,000 employees have already accepted the offer. This is a story we will continue to watch closely!

* **Sovereign Wealth Fund:** President Trump signed an order to create a US sovereign wealth fund. The goal is to stimulate economic development and potentially even acquire TikTok. Quite the ambitious plan, to say the least!

* **Inflation Fears:** Consumer confidence is being rattled by the tariff talk,** pushing inflation expectations up to 4.3%, which is the highest it’s been since 2023.** Economic anxiety is definitely in the air, and everyone is watching.

## **Global Highlights**

Let’s cross the pond and see what’s making headlines:

* **China’s Retaliation: Beijing is slapping tariffs of up to 15% on US import**s, targeting energy, agriculture, and automobiles. The tariffs took effect on February 10th. This is escalating the trade tensions as a new U.S.-China tariff battle looms.

* **Trump’s Gaza Proposal**: **Trump** suggested that the US should “take over” **Gaza** to develop it. He also suggested that Palestinians relocate to **Egypt** and **Jordan**.

* **US Tariff Delay**: The US is delaying tariffs on **Canada** and **Mexico** for 30 days. This follows agreements to boost border security and curb fentanyl trafficking. Negotiations with both countries on a final deal are ongoing.

* **Bank of England Rate Cut**: The **Bank of England** has cut rates and signaled more easing ahead. They also slashed the UK’s 2025 growth forecast from 1.5% to 0.75%. Policymakers warn of both economic uncertainty and inflation risks.

* **Eurozone Inflation**: **Eurozone** inflation rose to 2.5% in January, exceeding forecasts due to rising energy prices. The latest inflation report adds pressure on the **ECB** amid ongoing economic uncertainty.

* **Temu Trouble**: **Temu’s** parent company, **PDD**, saw its stock tumble after a key trade loophole was closed. The loophole allowed duty-free imports under $800. This could threaten **Temu** and **Shein’s** low-price strategy in the US.

* **Tesla’s China Struggles**: **Tesla’s** China sales dropped 11.5% as local competition rises. Rivals like **BYD** saw strong growth, forcing **Tesla** to rely on price cuts and incentives to stay competitive. There is speculation that a new affordable model is expected in 2025 to boost demand.

----------## Commodities & Crypto

### **Energy**

View image: ([link removed])

Caption:

Oil markets experienced another round of declines due to the increase in customs tariffs between the US and **China**. While the direct impact is limited, the main concern is the potential repercussions on global economic growth. Simultaneously, **President Trump’s** directive to apply sanctions against **Iran** more strictly could offset this downward pressure, threatening up to one million barrels per day of Iranian oil exports. In terms of prices, **Brent** is trading at $74.70 a barrel and **WTI** at $71.

### **Metals**

View image: ([link removed])

Caption:

The metals segment saw new record highs for **gold**, as well as some stabilization in **copper** prices. **Gold** continued its rise, hitting USD 2,875, due to trade uncertainty and geopolitical tensions. Recent comments from **President Trump** and the imposition of tariffs have heightened the climate of uncertainty, pushing investors toward **gold**. Purchases by central banks, which totaled 1,045 tons last year, continue to support demand for **gold**. **Copper** prices rose sharply this week, hitting USD 9276 in London, thanks to the temporary suspension of US trade threats toward its neighbors.

### **Crypto**

View image: ([link removed])

Caption:

Volatility is the name of the game in the crypto market this week. **Bitcoin (BTC)** has fluctuated between $92,000 and $102,000, stabilizing around $98,000. The same phenomenon occurred with **Ether (ETH)**: the crypto-asset fell from 2,900 to 2,100 dollars during the week, before stabilizing at around 2,730 dollars. In this context of uncertainty, risky assets suffered and investors placed cryptocurrencies at the forefront.

## Calendar

Investors should keep an eye on the this week.:

* **January Consumer Price Inflation** on Wednesday.

* **Wholesale Inflation Data** for last month on Thursday.

* **Retail Sales Figures** for January on Friday.

* Earnings from **McDonald’s (MCD)**, **Coca-Cola (KO)**, **Unilever (UL)**, **Cisco Systems (CSCO)**, and **Applied Materials (AMAT)**.

* The first estimate for fourth-quarter **GDP** in the **European Union** on Friday.

That’s all for this week’s market report. Keep your head up. Stay sharp. Until next week!

Copyright © 2025 [AlphaBetaStock.com]([link removed]) All Rights Reserved | [AlphaBetaStock.com]([link removed]) is a financial news publisher that does not offer any personal financial advice or advocate the sale or purchasing of any investment/security. Please contact us for any errors in stories by [clicking here]([link removed]). For more information, please read our full [disclaimer.]([link removed])

———

You are reading a plain text version of this post. For the best experience, copy and paste this link in your browser to view the post online:

[link removed]

Message Analysis

- Sender: n/a

- Political Party: n/a

- Country: n/a

- State/Locality: n/a

- Office: n/a