February 14, 2025

Permission to republish original opeds and cartoons granted.

Trump Is Right. Prices Can Definitely Go Down In Response To Tariffs.

|

|

|

“It's going to mean tremendous amounts of jobs and ultimately prices will stay the same, go down but we're going to have a very dynamic country.” That was President Donald Trump in the Oval Office on Feb. 13 taking questions from reporters, outlining his belief that one of the outcomes of imposing reciprocal tariffs on trading partners, including steel and aluminum tariffs set for March 12, is that ultimately consumer prices can come down. Although in the short term, there could be some volatility, Trump explained, stating, “I think what's going to go up is jobs are going to go up and prices could go up somewhat short term, but prices will also go down.” To be certain, when the Consumer Price Index is calculated by the Bureau of Labor Statistics, it does indeed include sales and excise taxes, and so certainly, in the short term, any immediate increases in taxes charged whether at the wholesale or consumer level, could in the short term feed back into the recorded consumer prices. But that’s not where the story ends. Often times, in response to trade adjustments like tariffs (and others like subsidies), trading countries can depreciate their currencies in order to still make exports cheaper. This can have the impact of making the trading partner’s currency weaker relative to the importing country’s which becomes stronger. For example, since the Feb. 1 increase of tariffs on Chinese goods by President Trump by another 10 percent, coming atop 25 percent on $250 billion of goods and 17.5 percent on the remaining $300 billion of goods that were established by Trump in 2019 that President Joe Biden never rescinded, China has in fact devalued its currency against the dollar, dropping from .1391 yuan per dollar to .1372 as of this writing, a 1.36 percent decrease. Meaning, Trump is right. Tariffs can be increased by the U.S., and if the trading partner responds with devaluation, as China already has, it can partly or in full offset the adjustment, meaning the U.S. still collects the revenue but as Trump suggested prices could “stay the same, go down…” |

Federal Judges Selling Out the People are Moving to Block President Trump’s America First Priorities

|

|

|

In a flurry of legal backlash, a number of federal Judges are moving to block key aspects of President Donald Trump’s America First agenda including exposing the abuse of taxpayer dollars in the federal budget and ending birthright citizenship for illegals. As of this writing, at least four judges have attempted to block President Trump’s executive order ending amnesty for the children of illegal immigrants, and one has attempted to block the processing of three illegal Venezuelan nationals. On Thursday, U.S. District Judge Leo Sorokin blocked President Trump's executive order ending citizenship for the children of illegal immigrants, joining three other judges who are refusing to accept Trump’s executive order. U.S. District Judge Joseph N. Laplante of New Hampshire blocked President Trump's executive order ending birthright citizenship on Monday, and last week, U.S. District Judge Deborah Boardman of Maryland issued a nationwide preliminary injunction against Trump's executive order ending birthright citizenship. U.S. District Court Judge John Coughenour also issued a nationwide preliminary injunction to block Trump’s executive order on birthright citizenship after issuing a temporary restraining order to pause the executive order two weeks ago. On Sunday, Judge Kenneth Gonzales of the Federal District Court for New Mexico granted a preemptive restraining order blocking the U.S. government from sending three Venezuelan men detailed in the state to a military base designed to hold migrants in Guantanamo Bay, Cuba. These justices are shamelessly defying President Trump’s executive orders on immigration enforcement, which the people elected him to implement, and revealing the lengths they will go to protect illegals over the American people. |

Congress Should Suspend Impoundment Control Act Through Dec. 2026 and Authorize DOGE Cuts

|

|

|

Americans for Limited Government President Rick Manning: “The Impoundment Control Act negated about 170 years of precedent wherein presidents had the absolute Article II executive authority to not spend funds authorized by Congress when they deemed such spending unnecessary, starting with Thomas Jefferson all the way through Richard Nixon. Besides recessions and wars, the result was relatively sound fiscal policy. The stunning findings of the White House Department of Government Efficiency of waste and theft of taxpayer resources requires that President Trump do what is necessary to end that waste and theft. Congress cannot be expected to guess how much and where the waste and theft is occurring. Only the President has that ability in administering the laws. Suspending the unconstitutional Impoundment Control Act until Dec. 31, 2026 could reduce the deficit by as much as $1 trillion. Importantly, this would alter the current projected spending baselines by incorporating the savings now being touted by the White House. While President Trump is likely to challenge the Impoundment Control Act in a multi-year court battle, Congress can settle the issue right now in the budget bill for the next two years, allowing the experiment in actually cutting spending to occur and the DOGE savings to be realized. Additionally, Congress should authorize the President’s DOGE cuts already undertaken to clear away any legal ambiguities. The government fraud and waste crisis uncovered by DOGE demands that Congress take this simple action to ensure it is ended once and for all.” |

Trump Is Right. Prices Can Definitely Go Down In Response To Tariffs.

</p

</p

By Robert Romano

“It's going to mean tremendous amounts of jobs and ultimately prices will stay the same, go down but we're going to have a very dynamic country.”

That was President Donald Trump in the Oval Office on Feb. 13 taking questions from reporters, outlining his belief that one of the outcomes of imposing reciprocal tariffs on trading partners, including steel and aluminum tariffs set for March 12, is that ultimately consumer prices can come down.

Although in the short term, there could be some volatility, Trump explained, stating, “I think what's going to go up is jobs are going to go up and prices could go up somewhat short term, but prices will also go down.”

To be certain, when the Consumer Price Index is calculated by the Bureau of Labor Statistics, it does indeed include sales and excise taxes, and so certainly, in the short term, any immediate increases in taxes charged whether at the wholesale or consumer level, could in the short term feed back into the recorded consumer prices. But that’s not where the story ends.

Often times, in response to trade adjustments like tariffs (and others like subsidies), trading countries can depreciate their currencies in order to still make exports cheaper. This can have the impact of making the trading partner’s currency weaker relative to the importing country’s which becomes stronger.

If that happens, that might mean the dollar becomes stronger as trading partners respond overseas with devaluations, which would ultimately put downward pressure on consumer prices. Especially with the dollar remaining the world’s reserve currency, these adjustments can be even more pronounced.

For example, since the Feb. 1 increase of tariffs on Chinese goods by President Trump by another 10 percent, coming atop 25 percent on $250 billion of goods and 17.5 percent on the remaining $300 billion of goods that were established by Trump in 2019 that President Joe Biden never rescinded, China has in fact devalued its currency against the dollar, dropping from .1391 yuan per dollar to .1372 as of this writing, a 1.36 percent decrease.

Meaning, Trump is right. Tariffs can be increased by the U.S., and if the trading partner responds with devaluation, as China already has, it can partly or in full offset the adjustment, meaning the U.S. still collects the revenue but as Trump suggested prices could “stay the same, go down…”

There are other historic examples of this. From the nation’s founding through the 1920s, the U.S. almost exclusively collected revenue from tariffs, becoming the manufacturing center of the world and enriching America to be one of the richest countries in the world. But upsetting that ascent was the Great Depression in the 1930s as countries began competitively devaluing their currencies by leaving the interwar gold standard one by one, led by the United Kingdom in 1931.

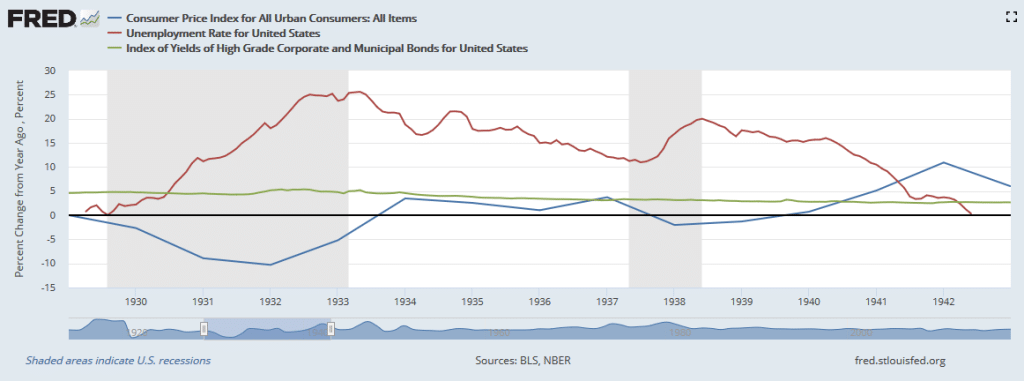

Prior to that, deflation in the U.S. had already begun after the great inflation of World War I and the ensuing credit expansion, had a brief respite in the 1920s before beginning again in 1927. It then slowed in 1929, and then went crazy starting in 1930 as banks began failing en masse. Inflation was marked at -2.7 percent in 1930, -8.9 percent in 1931, -10.3 percent in 1932 and -5.2 percent in 1933.

As that occurred, unemployment skyrocketed, reaching 11.2 percent by the end of 1930, up to 19.2 percent by the end of 1931, up to 25 percent in 1932 and peaked in March 1933 at 25.4 percent.

It was not until Franklin Roosevelt ended the interwar gold standard in 1933, thereby weakening the dollar against that of U.S. trade partners, that some relief was felt as unemployment began collapsing to 11 percent by 1937, before spiking again in the 1937 and 1938 recession as deflation ensued again. The U.S. would not again return to full employment until World War II.

The United Kingdom had a similar experience of deflation following World War I, with unemployment rising dramatically in 1921 to 11 percent before dropping and again rising in 1930 to 11 percent. The UK quickly came off the gold standard in 1931, after which unemployment peaked in 1932 at 15 percent, before slowly coming back down.

In fact, countries that abandoned the gold standard early and engaged in currency devaluation and depreciation to combat the deflation saw the quickest recoveries. The countries that were the last to devalue were the worst off, a 1985 paper, “Exchange Rates and Economic Recovery in the 1930s,” by economists Barry Eichengreen and Jeffrey Sachs found.

What was the impact of the devaluations? Eichengreen and Sachs observe, “In all cases of unilateral devaluation, currency depreciation increases output and employment in the devaluing country. By raising the price of imports relative to domestic goods, depreciation switches expenditure toward domestic goods. The increased pressure of demand will tend to drive up domestic commodity prices, moderating the stimulus to aggregate demand and (by reducing real wages) stimulating aggregate supply, until the domestic commodity market clears. The same effect switches demand, of course, away from foreign goods, exerting deflationary pressure on the foreign economy.”

So, because the UK was one of the first major economies to leave the interwar gold standard in 1931, it boosted exports and restored inflation and then unemployment began dropping.

Note that 1931, as the UK went off the gold standard, was the same year inflation in the U.S. went from -2.7 percent to -8.9 percent and unemployment went from 11.2 percent to 19.2 percent. A good question might be what impact the UK’s devaluation in 1931 and other countries leaving the gold standard had on the U.S., which did not devalue and depreciate until beginning in 1933? In that context, the uneven devaluations of certain countries may have exacerbated the Great Depression in other countries that waited to devalue.

On the issue of tariffs, in 1932, a year after coming off the gold standard, the UK implemented a pretty hefty tariff. In the years that followed, however, unemployment in the UK dropped from 15 percent to 13.9 percent in 1933 and 11.7 percent in 1934. There was no retaliatory reverberation that worsened the UK’s experience. At that point, the U.S. enacted the Reciprocal Trade Act, and was already off the gold standard, and the competitive devaluations and tariffs could begin to get under control as countries sought to stop the trade war.

Obviously the Great Depression is a worst case scenario, wherein disorderly competitive devaluations were so powerful — and mismanaged — that they sent shockwaves throughout the global economy. But not every devaluation has had such impacts. Since Bretton Woods, trade partners like Japan, South Korea, Mexico, etc. have routinely used devaluations to cheapen exports, with the impact simply leading to the U.S. offshoring production and manufacturing jobs.

In any event, the current problem globally since Covid have been production shortfalls and a global supply chain glut, coupled with monetary and fiscal stimulus totaling trillions of dollars — too much money chasing too few goods — so not deflation, but inflation.

One way to potentially deal with that is are items like higher interest rates by central banks, which have already been done, but now President Trump is suggesting that interest rates could start to come down once his tariffs are taken into consideration. Why? Because collecting taxes, wherever the source, takes money out of circulation.

Another mechanism to sop up excess money also performed by central banks is to sell treasuries, which the Federal Reserve has been doing since 2022, decreasing its treasuries holdings from $5.77 trillion in June 2022 to $4.26 trillion on Feb. 12, 2025, a 35 percent decrease and sopping up more than $1.5 trillion out of the money supply.

Similarly, President Trump recently announced his intention to explore creating a sovereign wealth fund in the U.S. One of the likely sources of funding for such an endeavor might include the some $7.3 trillion of intragovernmental holdings of non-marketable U.S. treasuries. Right now those government trust funds are just holding government paper, but there’s really nothing stopping the U.S. from converting them into marketable securities and potentially selling them. This too would take more money out of circulation, which would also strengthen the dollar.

In other words, even as the U.S. increases revenues from tariffs, that is not the only consideration when it comes to measuring inflation. There are offsetting policies that might impact on inflation in the longer term, including policies that impact on the value of the dollar, which is still king, and President Trump knows it.

Robert Romano is the Vice President of Public Policy at Americans for Limited Government Foundation.

To view online: https://dailytorch.com/2025/02/trump-is-right-prices-can-definitely-go-down-in-response-to-tariffs/

Federal Judges Selling Out the People are Moving to Block President Trump’s America First Priorities

By Manzanita Miller

In a flurry of legal backlash, a number of federal Judges are moving to block key aspects of President Donald Trump’s America First agenda including exposing the abuse of taxpayer dollars in the federal budget and ending birthright citizenship for illegals.

As of this writing, at least four judges have attempted to block President Trump’s executive order ending amnesty for the children of illegal immigrants, and one has attempted to block the processing of three illegal Venezuelan nationals.

On Thursday, U.S. District Judge Leo Sorokin blocked President Trump's executive order ending citizenship for the children of illegal immigrants, joining three other judges who are refusing to accept Trump’s executive order.

U.S. District Judge Joseph N. Laplante of New Hampshire blocked President Trump's executive order ending birthright citizenship on Monday, and last week, U.S. District Judge Deborah Boardman of Maryland issued a nationwide preliminary injunction against Trump's executive order ending birthright citizenship.

U.S. District Court Judge John Coughenour also issued a nationwide preliminary injunction to block Trump’s executive order on birthright citizenship after issuing a temporary restraining order to pause the executive order two weeks ago.

On Sunday, Judge Kenneth Gonzales of the Federal District Court for New Mexico granted a preemptive restraining order blocking the U.S. government from sending three Venezuelan men detailed in the state to a military base designed to hold migrants in Guantanamo Bay, Cuba. The base is separate from the prison which houses terrorism suspects, yet Judge Gonzales saw fit to defy Trump’s attempt to deport Venezuelans who are in the country illegally.

These justices are shamelessly defying President Trump’s executive orders on immigration enforcement, which the people elected him to implement, and revealing the lengths they will go to protect illegals over the American people.

If the defenders of the status quo are riled up over Trump’s effort to end birthright citizenship, they are arguably more irate at the Trump Administration’s inspection of the federal budget and it’s web of bureaucratic beneficiaries.

As of Thursday, Feb. 13, fourteen states led by New Mexico Attorney General Raul Torrez filed a federal lawsuit against President Trump and Elon Musk, the head of the Department of Government Efficiency (DOGE) over Musk’s role, referring to Musk as a “designated agent of chaos”. Clearly, powerful individuals do not want Trump’s team combing through the government books.

Earlier this week, U.S. District Judge Jeannette A. Vargas ordered lawyers to confer over an earlier order issued by Judge Paul A. Engelmayer that banned Elon Musk’s team at the Department of Government Efficiency from accessing Treasury Department records.

With DOGE locked out of the Treasury Department’s records, the auditing team is unable to verify that taxpayer dollars are being spent appropriately and legally, something that is understandably in question after DOGE unearthed rampant abuse of taxpayer funds in other areas of government.

Another judge, U.S. District Judge John McConnell Jr. of Rhode Island has attempted to block portions of Trump’s federal funding pause. McConnell recently ordered the Trump Administration to “immediately restore frozen funding” for multiple agencies.

At a press conference Thursday, President Trump asserted that the flurry of legal orders from judges forcing his administration to halt in the auditing process is simply giving fraudsters time to cover their tracks.

“I follow the courts, I have to follow the law, all it means is that we appeal”, Trump told reporters at the Oval Office on Feb. 13. “But that gives people time to cover their tracks, and that’s what they do.”

There is no explanation for this level of negligence other than the conclusion that these judges hold allegiance to the bloated bureaucracy over allegiance to the American people.

Manzanita Miller is the senior political analyst at Americans for Limited Government Foundation.

To view online: https://dailytorch.com/2025/02/federal-judges-selling-out-the-people-are-moving-to-block-president-trumps-america-first-priorities/

Congress Should Suspend Impoundment Control Act Through Dec. 2026 and Authorize DOGE Cuts

Feb. 13, 2025, Fairfax, Va.—Americans for Limited Government President Rick Manning today issued the following statement urging Congress to suspend the Impoundment Control Act and enact President Donald Trump’s White House Department of Government Efficiency’s cuts undertaken to date:

“The Impoundment Control Act negated about 170 years of precedent wherein presidents had the absolute Article II executive authority to not spend funds authorized by Congress when they deemed such spending unnecessary, starting with Thomas Jefferson all the way through Richard Nixon. Besides recessions and wars, the result was relatively sound fiscal policy. The stunning findings of the White House Department of Government Efficiency of waste and theft of taxpayer resources requires that President Trump do what is necessary to end that waste and theft. Congress cannot be expected to guess how much and where the waste and theft is occurring. Only the President has that ability in administering the laws. Suspending the unconstitutional Impoundment Control Act until Dec. 31, 2026 could reduce the deficit by as much as $1 trillion.

“Importantly, this would alter the current projected spending baselines by incorporating the savings now being touted by the White House. While President Trump is likely to challenge the Impoundment Control Act in a multi-year court battle, Congress can settle the issue right now in the budget bill for the next two years, allowing the experiment in actually cutting spending to occur and the DOGE savings to be realized. Additionally, Congress should authorize the President’s DOGE cuts already undertaken to clear away any legal ambiguities. The government fraud and waste crisis uncovered by DOGE demands that Congress take this simple action to ensure it is ended once and for all.”

To view online: https://getliberty.org/2025/02/congress-should-suspend-impoundment-control-act-through-dec-2026-and-authorize-doge-cuts/

Mike Fragoso: Liberal trial judges, not Donald Trump, are inviting a constitutional crisis

By Mike Fragoso

Ever since President Donald Trump returned to office like a whirling dervish, issuing sweeping and potentially transformative orders about the management of the executive branch, elected Democrats have seemed incapable of stopping him. Lucky for Democrats, it seems that federal trial judges are willing to try.

This past week district judges have issued sweeping temporary restraining orders (TROs) against the Trump administration, purporting to stop various agencies and officers from executing the president’s orders. The tactic of judges granting unreviewable relief to manage the internal affairs of the executive branch is a shocking escalation in judicial lawfare.

Unless the sober appellate courts — in particular the Supreme Court — get the district courts in their appropriate constitutional lane, the executive branch will feel it has no choice but escalate in turn to protect the president’s prerogatives.

After Trump issued his orders, state AGs, liberal interest groups, and labor unions got their ducks in a row and sued. In turn judges in Boston, Seattle, Providence, New York, and D.C. have issued TROs against the administration. The cases have involved the “fork in the road” buyout, the recall of foreign service officers, the Treasury Secretary’s access to information, birthright citizenship, the new NIH funding formula, categorical payment freezes, and the aborted OMB funding freeze. Surely more are coming.

The most remarkable thing about this activity is that the judges are issuing TROs. These are the most extraordinary form of relief in the judiciary — sometimes, even here, granted before the defendant has an opportunity to argue his case. Because they are supposed to be temporary and unusual, they also can’t be appealed. If you don’t like a TRO all you can usually do is seek a writ of mandamus, itself an extraordinary form of relief that is rarely granted.

If these were preliminary injunctions, the government could appeal and seek an administrative stay — that is a pause of the order until the appeal has been resolved. In multimember circuit courts the odds of getting an administrative stay are considerable, which would allow the president to carry out his initiatives while the litigation proceeds.

In other words, by issuing TROs and removing an avenue for appeal, these judges aren’t just ruling against Trump, they’re also making sure that he is stuck with the order for as long as the trial judge sees fit.

Even the much-maligned Texas district judges didn’t behave like this under Biden. Would they rule against him and enjoin his initiatives? Sure. But they often went so far as to keep their own opinions from going into effect to give Biden time to appeal and seek a stay. That judicial courtesy is nowhere in sight today.

What makes it worse is how many of these TROs implicate core executive power. Cases like the USAID personnel reforms in D.C., or the fork in the road in Boston, or Treasury access to information in Manhattan, are cases about how the executive branch shall function as a matter of administration and personnel. These aren’t suits challenging rules under the Administrative Procedure Act, where Congress prescribed a justiciable process for some agency actions. Nor are these three cases suits about enforcement policies which implicate the rights of third parties against the government. They’re suits about the inner workings of the executive branch.

Generally questions of bureaucratic management are dealt with ex post and not ex ante. That is, you remedy legal violations in this context after they happen; you don’t prevent them. The legal structures in place allow someone wrongfully terminated to be reinstated or given back pay and they don’t contemplate judges preventing them from being fired. There’s a whole process for adjudicating personnel matters via the Civil Service Reform Act that goes through the Merit Systems Protection Board — not through trial judges. In fact, the D.C. Circuit has held that federal district courts lack jurisdiction over “personnel matters.”

But some of these orders go well beyond interfering with the executive by misapplying civil-service protections and in fact strike at the heart of Article II of the Constitution. Restricting the Senate-confirmed Treasury Secretary from reviewing information within his agency’s control fundamentally frustrates his ability to “take care” that the laws be enforced. It’s a staggering intrusion on presidential power from the judiciary.

Unfortunately we don’t need to look far to see how this will play out. Congress regularly attempts to interfere with core executive functions, principally by trying to compel the contents of privileged deliberations. More often than not, courts stay out of these disputes between Article I and Article II, leaving Congress to attempt to enforce its own demands by holding executive-branch officials in contempt. And then nothing happens. It’s literally a joke: when the House Judiciary Committee voted to hold him in contempt, then-Attorney General Bill Barr saw Nancy Pelosi at event and asked her if she brought her handcuffs.

If courts continue to enjoin core executive activity without the availability of review, the executive branch will start treating these TROs like it treats congressional subpoenas: worthy of some respect but, in the end, not superseding core executive power. And if Secretary Scott Bessent is therefore held in contempt, Attorney General Pam Bondi won’t be sending her Marshals to arrest him any more than Barr sent his Marshals to arrest himself.

The Supreme Court needs to put a stop to this. At some point the Department of Justice will find a way to get these orders in front of the justices, perhaps through disfavored mechanisms like mandamus, and certainly on the emergency or “shadow” docket. When it does, the Court needs to send a strong message to trial judges: the president controls the executive branch, not you. If they don’t, they’re inviting a constitutional crisis — one in which their branch is the aggressor.

To view online: https://washingtonreporter.news/p/op-ed-mike-fragoso-liberal-trial