Email

The Connection: Economic Fallout from Losing Premium Tax Credits; Explaining the Medical Debt Rule; Barriers to Primary Care; and More

| From | The Commonwealth Fund <[email protected]> |

| Subject | The Connection: Economic Fallout from Losing Premium Tax Credits; Explaining the Medical Debt Rule; Barriers to Primary Care; and More |

| Date | March 10, 2025 6:40 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

The Connection

A roundup of recent Fund publications, charts, multimedia, and other timely content.

Having trouble viewing this email? View online

March 10, 2025

Facebook ([link removed] )

LinkedIn ([link removed] )

Ending Tax Credits Will Cost Jobs, Harm State Economies

If lawmakers don’t take action to renew enhanced premium tax credits for marketplace health plans, the impact will likely include substantial job losses and economic pain in every U.S. state, according to a report from the Commonwealth Fund and the George Washington University. The tax credits, which help people pay premiums for health coverage purchased in the Affordable Care Act’s insurance marketplaces, have made ACA plans more affordable to millions of Americans. But if they’re allowed to expire at the end of this year, analysts estimate that state economies would shrink by $34 billion, 286,000 jobs would be lost nationwide, and state and local tax revenues would decline by $2.1 billion.

READ MORE ([link removed] )

The Federal Rule on Medical Debt

About 15 million Americans have medical bill debt on their credit reports, totaling some $49 billion. Studies have shown, however, that having medical debt isn’t indicative of whether someone is a good or bad credit risk. A Commonwealth Fund explainer discusses a federal rule that would prohibit lenders from considering medical debt when assessing the creditworthiness of borrowers. The rule, which was finalized by the Biden administration in January but is now on pause, applies only to creditors making lending decisions, such as banks considering mortgage applications. But the rule is likely to make a big difference to consumers seeking loans, and it could help boost the credit scores of people with medical debt by an average of 20 points.

READ MORE ([link removed] )

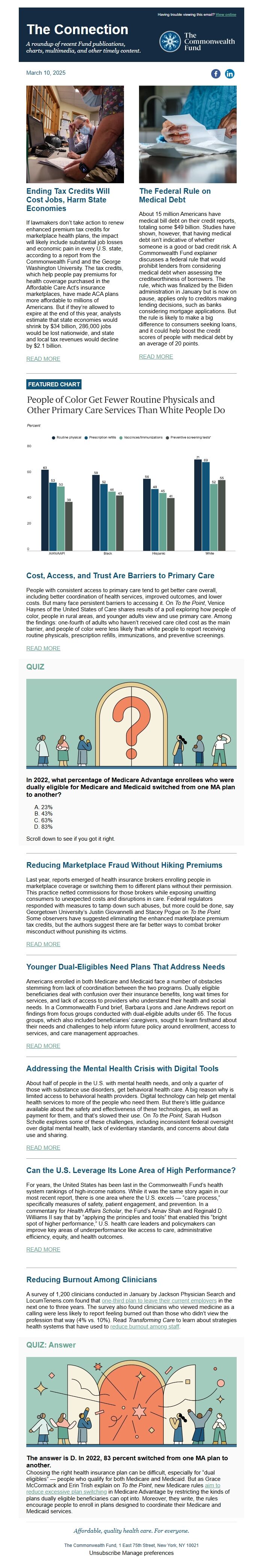

FEATURED CHART

Cost, Access, and Trust Are Barriers to Primary Care

People with consistent access to primary care tend to get better care overall, including better coordination of health services, improved outcomes, and lower costs. But many face persistent barriers to accessing it. On To the Point, Venice Haynes of the United States of Care shares results of a poll exploring how people of color, people in rural areas, and younger adults view and use primary care. Among the findings: one-fourth of adults who haven’t received care cited cost as the main barrier, and people of color were less likely than white people to report receiving routine physicals, prescription refills, immunizations, and preventive screenings.

READ MORE ([link removed] )

QUIZ

In 2022, what percentage of Medicare Advantage enrollees who were dually eligible for Medicare and Medicaid switched from one MA plan to another?

- 23%

- 43%

- 63%

- 83%

Scroll down to see if you got it right.

Reducing Marketplace Fraud Without Hiking Premiums

Last year, reports emerged of health insurance brokers enrolling people in marketplace coverage or switching them to different plans without their permission. This practice netted commissions for those brokers while exposing unwitting consumers to unexpected costs and disruptions in care. Federal regulators responded with measures to tamp down such abuses, but more could be done, say Georgetown University’s Justin Giovannelli and Stacey Pogue on To the Point. Some observers have suggested eliminating the enhanced marketplace premium tax credits, but the authors suggest there are far better ways to combat broker misconduct without punishing its victims.

READ MORE ([link removed] )

Younger Dual-Eligibles Need Plans That Address Needs

Americans enrolled in both Medicare and Medicaid face a number of obstacles stemming from lack of coordination between the two programs. Dually eligible beneficiaries deal with confusion over their insurance benefits, long wait times for services, and lack of access to providers who understand their health and social needs. In a Commonwealth Fund brief, Barbara Lyons and Jane Andrews report on findings from focus groups conducted with dual-eligible adults under 65. The focus groups, which also included beneficiaries’ caregivers, sought to learn firsthand about their needs and challenges to help inform future policy around enrollment, access to services, and care management approaches.

READ MORE ([link removed] )

Addressing the Mental Health Crisis with Digital Tools

About half of people in the U.S. with mental health needs, and only a quarter of those with substance use disorders, get behavioral health care. A big reason why is limited access to behavioral health providers. Digital technology can help get mental health services to more of the people who need them. But there’s little guidance available about the safety and effectiveness of these technologies, as well as payment for them, and that’s slowed their use. On To the Point, Sarah Hudson Scholle explores some of these challenges, including inconsistent federal oversight over digital mental health, lack of evidentiary standards, and concerns about data use and sharing.

READ MORE ([link removed] )

Can the U.S. Leverage Its Lone Area of High Performance?

For years, the United States has been last in the Commonwealth Fund’s health system rankings of high-income nations. While it was the same story again in our most recent report, there is one area where the U.S. excels — “care process,” specifically measures of safety, patient engagement, and prevention. In a commentary for Health Affairs Scholar, the Fund’s Arnav Shah and Reginald D. Williams II say that by “applying the principles and tools” that enabled this “bright spot of higher performance,” U.S. health care leaders and policymakers can improve key areas of underperformance like access to care, administrative efficiency, equity, and health outcomes.

READ MORE ([link removed] )

Reducing Burnout Among Clinicians

A survey of 1,200 clinicians conducted in January by Jackson Physician Search and LocumTenens.com found that one-third plan to leave their current employers ([link removed] ) in the next one to three years. The survey also found clinicians who viewed medicine as a calling were less likely to report feeling burned out than those who didn’t view the profession that way (4% vs. 10%). Read Transforming Care to learn about strategies health systems that have used to reduce burnout among staff ([link removed] ) .

QUIZ: Answer

The answer is D. In 2022, 83 percent switched from one MA plan to another.

Choosing the right health insurance plan can be difficult, especially for “dual eligibles” — people who qualify for both Medicare and Medicaid. But as Grace McCormack and Erin Trish explain on To the Point, new Medicare rules aim to reduce excessive plan switching ([link removed] ) in Medicare Advantage by restricting the kinds of plans dually eligible beneficiaries can opt into. Moreover, they write, the rules encourage people to enroll in plans designed to coordinate their Medicare and Medicaid services.

Affordable, quality health care. For everyone.

The Commonwealth Fund, 1 East 75th Street, New York, NY 10021

Unsubscribe ([link removed] )

Manage preferences ([link removed] )

A roundup of recent Fund publications, charts, multimedia, and other timely content.

Having trouble viewing this email? View online

March 10, 2025

Facebook ([link removed] )

LinkedIn ([link removed] )

Ending Tax Credits Will Cost Jobs, Harm State Economies

If lawmakers don’t take action to renew enhanced premium tax credits for marketplace health plans, the impact will likely include substantial job losses and economic pain in every U.S. state, according to a report from the Commonwealth Fund and the George Washington University. The tax credits, which help people pay premiums for health coverage purchased in the Affordable Care Act’s insurance marketplaces, have made ACA plans more affordable to millions of Americans. But if they’re allowed to expire at the end of this year, analysts estimate that state economies would shrink by $34 billion, 286,000 jobs would be lost nationwide, and state and local tax revenues would decline by $2.1 billion.

READ MORE ([link removed] )

The Federal Rule on Medical Debt

About 15 million Americans have medical bill debt on their credit reports, totaling some $49 billion. Studies have shown, however, that having medical debt isn’t indicative of whether someone is a good or bad credit risk. A Commonwealth Fund explainer discusses a federal rule that would prohibit lenders from considering medical debt when assessing the creditworthiness of borrowers. The rule, which was finalized by the Biden administration in January but is now on pause, applies only to creditors making lending decisions, such as banks considering mortgage applications. But the rule is likely to make a big difference to consumers seeking loans, and it could help boost the credit scores of people with medical debt by an average of 20 points.

READ MORE ([link removed] )

FEATURED CHART

Cost, Access, and Trust Are Barriers to Primary Care

People with consistent access to primary care tend to get better care overall, including better coordination of health services, improved outcomes, and lower costs. But many face persistent barriers to accessing it. On To the Point, Venice Haynes of the United States of Care shares results of a poll exploring how people of color, people in rural areas, and younger adults view and use primary care. Among the findings: one-fourth of adults who haven’t received care cited cost as the main barrier, and people of color were less likely than white people to report receiving routine physicals, prescription refills, immunizations, and preventive screenings.

READ MORE ([link removed] )

QUIZ

In 2022, what percentage of Medicare Advantage enrollees who were dually eligible for Medicare and Medicaid switched from one MA plan to another?

- 23%

- 43%

- 63%

- 83%

Scroll down to see if you got it right.

Reducing Marketplace Fraud Without Hiking Premiums

Last year, reports emerged of health insurance brokers enrolling people in marketplace coverage or switching them to different plans without their permission. This practice netted commissions for those brokers while exposing unwitting consumers to unexpected costs and disruptions in care. Federal regulators responded with measures to tamp down such abuses, but more could be done, say Georgetown University’s Justin Giovannelli and Stacey Pogue on To the Point. Some observers have suggested eliminating the enhanced marketplace premium tax credits, but the authors suggest there are far better ways to combat broker misconduct without punishing its victims.

READ MORE ([link removed] )

Younger Dual-Eligibles Need Plans That Address Needs

Americans enrolled in both Medicare and Medicaid face a number of obstacles stemming from lack of coordination between the two programs. Dually eligible beneficiaries deal with confusion over their insurance benefits, long wait times for services, and lack of access to providers who understand their health and social needs. In a Commonwealth Fund brief, Barbara Lyons and Jane Andrews report on findings from focus groups conducted with dual-eligible adults under 65. The focus groups, which also included beneficiaries’ caregivers, sought to learn firsthand about their needs and challenges to help inform future policy around enrollment, access to services, and care management approaches.

READ MORE ([link removed] )

Addressing the Mental Health Crisis with Digital Tools

About half of people in the U.S. with mental health needs, and only a quarter of those with substance use disorders, get behavioral health care. A big reason why is limited access to behavioral health providers. Digital technology can help get mental health services to more of the people who need them. But there’s little guidance available about the safety and effectiveness of these technologies, as well as payment for them, and that’s slowed their use. On To the Point, Sarah Hudson Scholle explores some of these challenges, including inconsistent federal oversight over digital mental health, lack of evidentiary standards, and concerns about data use and sharing.

READ MORE ([link removed] )

Can the U.S. Leverage Its Lone Area of High Performance?

For years, the United States has been last in the Commonwealth Fund’s health system rankings of high-income nations. While it was the same story again in our most recent report, there is one area where the U.S. excels — “care process,” specifically measures of safety, patient engagement, and prevention. In a commentary for Health Affairs Scholar, the Fund’s Arnav Shah and Reginald D. Williams II say that by “applying the principles and tools” that enabled this “bright spot of higher performance,” U.S. health care leaders and policymakers can improve key areas of underperformance like access to care, administrative efficiency, equity, and health outcomes.

READ MORE ([link removed] )

Reducing Burnout Among Clinicians

A survey of 1,200 clinicians conducted in January by Jackson Physician Search and LocumTenens.com found that one-third plan to leave their current employers ([link removed] ) in the next one to three years. The survey also found clinicians who viewed medicine as a calling were less likely to report feeling burned out than those who didn’t view the profession that way (4% vs. 10%). Read Transforming Care to learn about strategies health systems that have used to reduce burnout among staff ([link removed] ) .

QUIZ: Answer

The answer is D. In 2022, 83 percent switched from one MA plan to another.

Choosing the right health insurance plan can be difficult, especially for “dual eligibles” — people who qualify for both Medicare and Medicaid. But as Grace McCormack and Erin Trish explain on To the Point, new Medicare rules aim to reduce excessive plan switching ([link removed] ) in Medicare Advantage by restricting the kinds of plans dually eligible beneficiaries can opt into. Moreover, they write, the rules encourage people to enroll in plans designed to coordinate their Medicare and Medicaid services.

Affordable, quality health care. For everyone.

The Commonwealth Fund, 1 East 75th Street, New York, NY 10021

Unsubscribe ([link removed] )

Manage preferences ([link removed] )

Message Analysis

- Sender: Commonwealth Fund

- Political Party: n/a

- Country: United States

- State/Locality: n/a

- Office: n/a