Email

Tariffs, Tremors, and a Dash of Chip News (Weekly Cheat Sheet)

| From | Irving Wilkinson <[email protected]> |

| Subject | Tariffs, Tremors, and a Dash of Chip News (Weekly Cheat Sheet) |

| Date | March 10, 2025 1:15 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

View image: ([link removed])

Follow image link: ([link removed])

Caption:

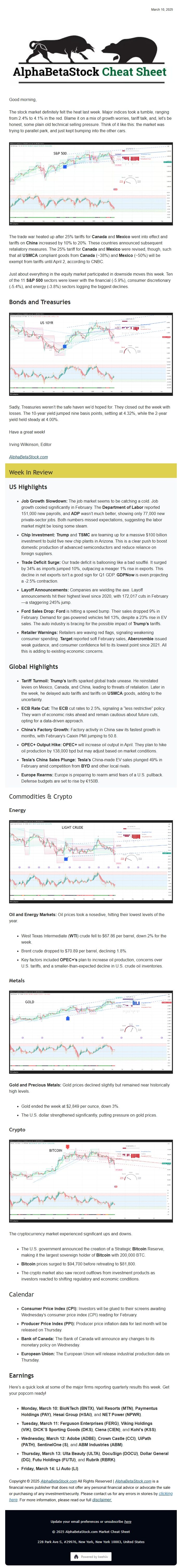

Good morning,

The stock market definitely felt the heat last week. Major indices took a tumble, ranging from 2.4% to 4.1% in the red. Blame it on a mix of growth worries, tariff talk, and, let’s be honest, some plain old technical selling pressure. Think of it like this: the market was trying to parallel park, and just kept bumping into the other cars.

View image: ([link removed])

Caption:

The trade war heated up after 25% tariffs for **Canada** and **Mexico** went into effect and tariffs on **China** increased by 10% to 20%. These countries announced subsequent retaliatory measures. The 25% tariff for **Canada** and **Mexico** were revised, though, such that all **USMCA** compliant goods from **Canada** (~38%) and **Mexico** (~50%) will be exempt from tariffs until April 2, according to CNBC.

Just about everything in the equity market participated in downside moves this week. Ten of the 11 **S&P 500** sectors were lower with the financial (-5.9%), consumer discretionary (-5.4%), and energy (-3.8%) sectors logging the biggest declines.

## **Bonds and Treasuries**

View image: ([link removed])

Caption:

Sadly, Treasuries weren’t the safe haven we’d hoped for. They closed out the week with losses. The 10-year yield jumped nine basis points, settling at 4.32%, while the 2-year yield held steady at 4.00%.

Have a great week!

Irving Wilkinson, Editor

[AlphaBetaStock.com]([link removed])

----------

## Week In Review

--------------------

## **US Highlights**

* **Job Growth Slowdown:** The job market seems to be catching a cold. Job growth cooled significantly in February. The **Department of Labor** reported 151,000 new payrolls, and **ADP** wasn’t much better, showing only 77,000 new private-sector jobs. Both numbers missed expectations, suggesting the labor market might be losing some steam.

* **Chip Investment:** **Trump** and **TSMC** are teaming up for a massive $100 billion investment to build five new chip plants in Arizona. This is a clear push to boost domestic production of advanced semiconductors and reduce reliance on foreign suppliers.

* **Trade Deficit Surge:** Our trade deficit is ballooning like a bad soufflé. It surged by 34% as imports jumped 10%, outpacing a meager 1% rise in exports. This decline in net exports isn’t a good sign for Q1 GDP. **GDPNow** is even projecting a -2.5% contraction.

* **Layoff Announcements:** Companies are wielding the axe. Layoff announcements hit their highest level since 2020, with 172,017 cuts in February—a staggering 245% jump.

* **Ford Sales Drop:** **Ford** is hitting a speed bump. Their sales dropped 9% in February. Demand for gas-powered vehicles fell 13%, despite a 23% rise in EV sales. The auto industry is bracing for the possible impact of **Trump’s** tariffs.

* **Retailer Warnings:** Retailers are waving red flags, signaling weakening consumer spending. **Target** reported soft February sales, **Abercrombie** issued weak guidance, and consumer confidence fell to its lowest point since 2021. All this is adding to existing economic concerns.

## **Global Highlights**

* **Tariff Turmoil:** **Trump’s** tariffs sparked global trade unease. He reinstated levies on Mexico, Canada, and China, leading to threats of retaliation. Later in the week, he delayed auto tariffs and tariffs on **USMCA** goods, adding to the uncertainty.

* **ECB Rate Cut:** The **ECB** cut rates to 2.5%, signaling a “less restrictive” policy. They warn of economic risks ahead and remain cautious about future cuts, opting for a data-driven approach.

* **China’s Factory Growth:** Factory activity in China saw its fastest growth in months, with February’s Caixin PMI jumping to 50.8.

* **OPEC+ Output Hike:** **OPEC+** will increase oil output in April. They plan to hike oil production by 138,000 bpd but may adjust based on market conditions.

* **Tesla’s China Sales Plunge:** **Tesla’s** China-made EV sales plunged 49% in February amid competition from **BYD** and other local rivals.

* **Europe Rearms:** Europe is preparing to rearm amid fears of a U.S. pullback. Defense budgets are set to rise by €150B.

----------## Commodities & Crypto

### **Energy**

View image: ([link removed])

Caption:

**Oil and Energy Markets:** Oil prices took a nosedive, hitting their lowest levels of the year.

* West Texas Intermediate (**WTI**) crude fell to $67.86 per barrel, down 2% for the week.

* Brent crude dropped to $70.89 per barrel, declining 1.8%.

* Key factors included **OPEC+’s** plan to increase oil production, concerns over U.S. tariffs, and a smaller-than-expected decline in U.S. crude oil inventories.

### **Metals**

View image: ([link removed])

Caption:

**Gold and Precious Metals:** Gold prices declined slightly but remained near historically high levels.

* Gold ended the week at $2,849 per ounce, down 3%.

* The U.S. dollar strengthened significantly, putting pressure on gold prices.

### **Crypto**

View image: ([link removed])

Caption:

The cryptocurrency market experienced significant ups and downs.

* The U.S. government announced the creation of a Strategic **Bitcoin** Reserve, making it the largest sovereign holder of **Bitcoin** with 200,000 BTC.

* **Bitcoin** prices surged to $94,700 before retreating to $81,800.

* The crypto market also saw record outflows from investment products as investors reacted to shifting regulatory and economic conditions.

## Calendar

* **Consumer Price Index (CPI):** Investors will be glued to their screens awaiting Wednesday’s consumer price index (CPI) reading for February.

* **Producer Price Index (PPI):** Producer price inflation data for last month will be released on Thursday.

* **Bank of Canada:** The Bank of Canada will announce any changes to its monetary policy on Wednesday.

* **European Union:** The European Union will release industrial production data on Thursday.

## **Earnings**

Here’s a quick look at some of the major firms reporting quarterly results this week. Get your popcorn ready!

* **Monday, March 10:** **BioNTech (BNTX)**, **Vail Resorts (MTN)**, **Paymentus Holdings (PAY)**, **Hesai Group (HSAI)**, and **NET Power (NPWR)**.

* **Tuesday, March 11:** **Ferguson Enterprises (FERG)**, **Viking Holdings (VIK)**, **DICK’S Sporting Goods (DKS)**, **Ciena (CIEN)**, and **Kohl’s (KSS)**.

* **Wednesday, March 12:** **Adobe (ADBE)**, **Crown Castle (CCI)**, **UiPath (PATH)**, **SentinelOne (S)**, and **ABM Industries (ABM)**.

* **Thursday, March 13:** **Ulta Beauty (ULTA)**, **DocuSign (DOCU)**, **Dollar General (DG)**, **Futu Holdings (FUTU)**, and **Rubrik (RBRK)**.

* **Friday, March 14:** **Li Auto (LI)**.

Copyright © 2025 [AlphaBetaStock.com]([link removed]) All Rights Reserved | [AlphaBetaStock.com]([link removed]) is a financial news publisher that does not offer any personal financial advice or advocate the sale or purchasing of any investment/security. Please contact us for any errors in stories by [clicking here]([link removed]). For more information, please read our full [disclaimer.]([link removed])

———

You are reading a plain text version of this post. For the best experience, copy and paste this link in your browser to view the post online:

[link removed]

Follow image link: ([link removed])

Caption:

Good morning,

The stock market definitely felt the heat last week. Major indices took a tumble, ranging from 2.4% to 4.1% in the red. Blame it on a mix of growth worries, tariff talk, and, let’s be honest, some plain old technical selling pressure. Think of it like this: the market was trying to parallel park, and just kept bumping into the other cars.

View image: ([link removed])

Caption:

The trade war heated up after 25% tariffs for **Canada** and **Mexico** went into effect and tariffs on **China** increased by 10% to 20%. These countries announced subsequent retaliatory measures. The 25% tariff for **Canada** and **Mexico** were revised, though, such that all **USMCA** compliant goods from **Canada** (~38%) and **Mexico** (~50%) will be exempt from tariffs until April 2, according to CNBC.

Just about everything in the equity market participated in downside moves this week. Ten of the 11 **S&P 500** sectors were lower with the financial (-5.9%), consumer discretionary (-5.4%), and energy (-3.8%) sectors logging the biggest declines.

## **Bonds and Treasuries**

View image: ([link removed])

Caption:

Sadly, Treasuries weren’t the safe haven we’d hoped for. They closed out the week with losses. The 10-year yield jumped nine basis points, settling at 4.32%, while the 2-year yield held steady at 4.00%.

Have a great week!

Irving Wilkinson, Editor

[AlphaBetaStock.com]([link removed])

----------

## Week In Review

--------------------

## **US Highlights**

* **Job Growth Slowdown:** The job market seems to be catching a cold. Job growth cooled significantly in February. The **Department of Labor** reported 151,000 new payrolls, and **ADP** wasn’t much better, showing only 77,000 new private-sector jobs. Both numbers missed expectations, suggesting the labor market might be losing some steam.

* **Chip Investment:** **Trump** and **TSMC** are teaming up for a massive $100 billion investment to build five new chip plants in Arizona. This is a clear push to boost domestic production of advanced semiconductors and reduce reliance on foreign suppliers.

* **Trade Deficit Surge:** Our trade deficit is ballooning like a bad soufflé. It surged by 34% as imports jumped 10%, outpacing a meager 1% rise in exports. This decline in net exports isn’t a good sign for Q1 GDP. **GDPNow** is even projecting a -2.5% contraction.

* **Layoff Announcements:** Companies are wielding the axe. Layoff announcements hit their highest level since 2020, with 172,017 cuts in February—a staggering 245% jump.

* **Ford Sales Drop:** **Ford** is hitting a speed bump. Their sales dropped 9% in February. Demand for gas-powered vehicles fell 13%, despite a 23% rise in EV sales. The auto industry is bracing for the possible impact of **Trump’s** tariffs.

* **Retailer Warnings:** Retailers are waving red flags, signaling weakening consumer spending. **Target** reported soft February sales, **Abercrombie** issued weak guidance, and consumer confidence fell to its lowest point since 2021. All this is adding to existing economic concerns.

## **Global Highlights**

* **Tariff Turmoil:** **Trump’s** tariffs sparked global trade unease. He reinstated levies on Mexico, Canada, and China, leading to threats of retaliation. Later in the week, he delayed auto tariffs and tariffs on **USMCA** goods, adding to the uncertainty.

* **ECB Rate Cut:** The **ECB** cut rates to 2.5%, signaling a “less restrictive” policy. They warn of economic risks ahead and remain cautious about future cuts, opting for a data-driven approach.

* **China’s Factory Growth:** Factory activity in China saw its fastest growth in months, with February’s Caixin PMI jumping to 50.8.

* **OPEC+ Output Hike:** **OPEC+** will increase oil output in April. They plan to hike oil production by 138,000 bpd but may adjust based on market conditions.

* **Tesla’s China Sales Plunge:** **Tesla’s** China-made EV sales plunged 49% in February amid competition from **BYD** and other local rivals.

* **Europe Rearms:** Europe is preparing to rearm amid fears of a U.S. pullback. Defense budgets are set to rise by €150B.

----------## Commodities & Crypto

### **Energy**

View image: ([link removed])

Caption:

**Oil and Energy Markets:** Oil prices took a nosedive, hitting their lowest levels of the year.

* West Texas Intermediate (**WTI**) crude fell to $67.86 per barrel, down 2% for the week.

* Brent crude dropped to $70.89 per barrel, declining 1.8%.

* Key factors included **OPEC+’s** plan to increase oil production, concerns over U.S. tariffs, and a smaller-than-expected decline in U.S. crude oil inventories.

### **Metals**

View image: ([link removed])

Caption:

**Gold and Precious Metals:** Gold prices declined slightly but remained near historically high levels.

* Gold ended the week at $2,849 per ounce, down 3%.

* The U.S. dollar strengthened significantly, putting pressure on gold prices.

### **Crypto**

View image: ([link removed])

Caption:

The cryptocurrency market experienced significant ups and downs.

* The U.S. government announced the creation of a Strategic **Bitcoin** Reserve, making it the largest sovereign holder of **Bitcoin** with 200,000 BTC.

* **Bitcoin** prices surged to $94,700 before retreating to $81,800.

* The crypto market also saw record outflows from investment products as investors reacted to shifting regulatory and economic conditions.

## Calendar

* **Consumer Price Index (CPI):** Investors will be glued to their screens awaiting Wednesday’s consumer price index (CPI) reading for February.

* **Producer Price Index (PPI):** Producer price inflation data for last month will be released on Thursday.

* **Bank of Canada:** The Bank of Canada will announce any changes to its monetary policy on Wednesday.

* **European Union:** The European Union will release industrial production data on Thursday.

## **Earnings**

Here’s a quick look at some of the major firms reporting quarterly results this week. Get your popcorn ready!

* **Monday, March 10:** **BioNTech (BNTX)**, **Vail Resorts (MTN)**, **Paymentus Holdings (PAY)**, **Hesai Group (HSAI)**, and **NET Power (NPWR)**.

* **Tuesday, March 11:** **Ferguson Enterprises (FERG)**, **Viking Holdings (VIK)**, **DICK’S Sporting Goods (DKS)**, **Ciena (CIEN)**, and **Kohl’s (KSS)**.

* **Wednesday, March 12:** **Adobe (ADBE)**, **Crown Castle (CCI)**, **UiPath (PATH)**, **SentinelOne (S)**, and **ABM Industries (ABM)**.

* **Thursday, March 13:** **Ulta Beauty (ULTA)**, **DocuSign (DOCU)**, **Dollar General (DG)**, **Futu Holdings (FUTU)**, and **Rubrik (RBRK)**.

* **Friday, March 14:** **Li Auto (LI)**.

Copyright © 2025 [AlphaBetaStock.com]([link removed]) All Rights Reserved | [AlphaBetaStock.com]([link removed]) is a financial news publisher that does not offer any personal financial advice or advocate the sale or purchasing of any investment/security. Please contact us for any errors in stories by [clicking here]([link removed]). For more information, please read our full [disclaimer.]([link removed])

———

You are reading a plain text version of this post. For the best experience, copy and paste this link in your browser to view the post online:

[link removed]

Message Analysis

- Sender: n/a

- Political Party: n/a

- Country: n/a

- State/Locality: n/a

- Office: n/a