Email

Trump's trade war, capital gains, lessons from 1995, and reaction to provincial budgets

| From | Fraser Institute <[email protected]> |

| Subject | Trump's trade war, capital gains, lessons from 1995, and reaction to provincial budgets |

| Date | March 8, 2025 3:00 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

Having trouble viewing? Try the web version [link removed] of this email. Trump's Tariffs Trump’s trade war and what it means for Canada [[link removed]] by Jock Finlayson

Trump’s tariffs–with the possibility of even higher levies and various other trade restrictions still to come–could be the new normal for Canada, at least for the duration of this presidency.

Historic Damage to a Globally Unique Relationship [[link removed]] By: Jason Clemens and Niels Veldhuis

President Trump’s unilateral actions have damaged and potentially jeopardized one of the most unique and longstanding bilateral relationships in the world.

How Trump’s Trade War Threatens US Economic Freedom [[link removed]] (Appeared in The News & Observer) by Matthew D. Mitchell and Meg Tuszynski

President Trump's effort to bolster economic freedom for Americans is under threat. Not from Democrats, but from the president himself because his trade war is likely to undermine all of it.

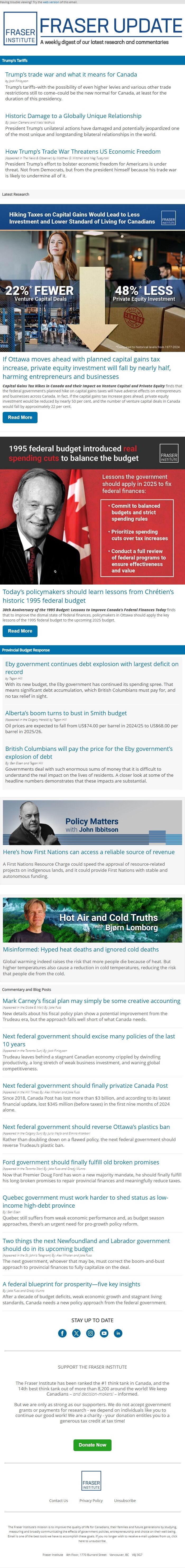

Latest Research If Ottawa moves ahead with planned capital gains tax increase, private equity investment will fall by nearly half, harming entrepreneurs and businesses [[link removed]] Capital Gains Tax Hikes in Canada and their Impact on Venture Capital and Private Equity finds that the federal government’s planned hike on capital gains taxes will have adverse effects on entrepreneurs and businesses across Canada. In fact, if the capital gains tax increase goes ahead, private equity investment would be reduced by nearly 50 per cent, and the number of venture capital deals in Canada would fall by approximately 22 per cent. Read More [[link removed]] Today’s policymakers should learn lessons from Chrétien’s historic 1995 federal budget [[link removed]] 30th Anniversary of the 1995 Budget: Lessons to Improve Canada’s Federal Finances Today finds that to improve the dismal state of federal finances, policymakers in Ottawa should apply the key lessons of the 1995 federal budget to the upcoming 2025 budget. Read More [[link removed]] Provincial Budget Response Eby government continues debt explosion with largest deficit on record [[link removed]] by Tegan Hill

With its new budget, the Eby government has continued its spending spree. That means significant debt accumulation, which British Columbians must pay for, and no tax relief in sight.

Alberta’s boom turns to bust in Smith budget [[link removed]] (Appeared in the Calgary Herald) by Tegan Hill

Oil prices are expected to fall from US$74.00 per barrel in 2024/25 to US$68.00 per barrel in 2025/26.

British Columbians will pay the price for the Eby government’s explosion of debt [[link removed]] By: Ben Eisen and Tegan Hill

Governments deal with such enormous sums of money that it is difficult to understand the real impact on the lives of residents. A closer look at some of the headline numbers demonstrates that these impacts are substantial.

Here’s how First Nations can access a reliable source of revenue [[link removed]]

A First Nations Resource Charge could speed the approval of resource-related projects on indigenous lands, and it could provide First Nations with stable and autonomous funding.

Misinformed: Hyped heat deaths and ignored cold deaths [[link removed]]

Global warming indeed raises the risk that more people die because of heat. But higher temperatures also cause a reduction in cold temperatures, reducing the risk that people die from the cold.

Commentary and Blog Posts Mark Carney’s fiscal plan may simply be some creative accounting [[link removed]] (Appeared in the Globe & Mail) By: Jake Fuss

New details about his fiscal policy plan show a potential improvement from the Trudeau era, but the approach falls well short of what Canada needs.

Next federal government should excise many policies of the last 10 years [[link removed]] (Appeared in the Toronto Sun) By: Jock Finlayson

Trudeau leaves behind a stagnant Canadian economy crippled by dwindling productivity, a long stretch of weak business investment, and waning global competitiveness.

Next federal government should finally privatize Canada Post [[link removed]] (Appeared in the Hill Times) By: Alex Whalen and Jake Fuss

Since 2018, Canada Post has lost more than $3 billion, and according to its latest financial update, lost $345 million (before taxes) in the first nine months of 2024 alone.

Next federal government should reverse Ottawa’s plastics ban [[link removed]] (Appeared in the Calgary Sun) By: Julio Mejía and Elmira Aliakbari

Rather than doubling down on a flawed policy, the next federal government should reverse Trudeau’s plastic ban.

Ford government should finally fulfill old broken promises [[link removed]] (Appeared in the Toronto Star) By: Jake Fuss and Grady Munro

Now that Premier Doug Ford has won a new majority mandate, he should finally fulfill his long-broken promises to repair provincial finances and meaningfully reduce taxes.

Quebec government must work harder to shed status as low-income high-debt province [[link removed]] By: Ben Eisen

Quebec still suffers from weak economic performance and, as budget season approaches, there’s an urgent need for pro-growth policy reform.

Two things the next Newfoundland and Labrador government should do in its upcoming budget [[link removed]] (Appeared in the St. John's Telegram) By: Alex Whalen and Jake Fuss

The next government, whoever that may be, must correct the boom-and-bust approach to provincial finances to fully capitalize on the deal.

A federal blueprint for prosperity—five key insights [[link removed]] By: Jake Fuss and Grady Munro

After a decade of budget deficits, weak economic growth and stagnant living standards, Canada needs a new policy approach from the federal government.

STAY UP TO DATE

SUPPORT THE FRASER INSTITUTE

The Fraser Institute has been ranked the #1 think tank in Canada, and the 14th best think tank out of more than 8,200 around the world! We keep Canadians – and decision-makers! – informed.

But we are only as strong as our supporters. We do not accept government grants or payments for research - we depend on individuals like you to continue our good work! We are a charity - your donation entitles you to a generous tax credit at tax time!

Donate Now [[link removed][campaignid]]

Contact Us [[link removed]] Privacy Policy [[link removed]] Unsubscribe [link removed] The Fraser Institute's mission is to improve the quality of life for Canadians, their families and future generations by studying, measuring and broadly communicating the effects of government policies, entrepreneurship and choice on their well-being. Email is one of the best tools we have to accomplish these goals. If you no longer wish to receive e-mail updates from us, click here to unsubscribe [link removed].

Fraser Institute 4th Floor, 1770 Burrard Street Vancouver, BC V6J 3G7

Trump’s tariffs–with the possibility of even higher levies and various other trade restrictions still to come–could be the new normal for Canada, at least for the duration of this presidency.

Historic Damage to a Globally Unique Relationship [[link removed]] By: Jason Clemens and Niels Veldhuis

President Trump’s unilateral actions have damaged and potentially jeopardized one of the most unique and longstanding bilateral relationships in the world.

How Trump’s Trade War Threatens US Economic Freedom [[link removed]] (Appeared in The News & Observer) by Matthew D. Mitchell and Meg Tuszynski

President Trump's effort to bolster economic freedom for Americans is under threat. Not from Democrats, but from the president himself because his trade war is likely to undermine all of it.

Latest Research If Ottawa moves ahead with planned capital gains tax increase, private equity investment will fall by nearly half, harming entrepreneurs and businesses [[link removed]] Capital Gains Tax Hikes in Canada and their Impact on Venture Capital and Private Equity finds that the federal government’s planned hike on capital gains taxes will have adverse effects on entrepreneurs and businesses across Canada. In fact, if the capital gains tax increase goes ahead, private equity investment would be reduced by nearly 50 per cent, and the number of venture capital deals in Canada would fall by approximately 22 per cent. Read More [[link removed]] Today’s policymakers should learn lessons from Chrétien’s historic 1995 federal budget [[link removed]] 30th Anniversary of the 1995 Budget: Lessons to Improve Canada’s Federal Finances Today finds that to improve the dismal state of federal finances, policymakers in Ottawa should apply the key lessons of the 1995 federal budget to the upcoming 2025 budget. Read More [[link removed]] Provincial Budget Response Eby government continues debt explosion with largest deficit on record [[link removed]] by Tegan Hill

With its new budget, the Eby government has continued its spending spree. That means significant debt accumulation, which British Columbians must pay for, and no tax relief in sight.

Alberta’s boom turns to bust in Smith budget [[link removed]] (Appeared in the Calgary Herald) by Tegan Hill

Oil prices are expected to fall from US$74.00 per barrel in 2024/25 to US$68.00 per barrel in 2025/26.

British Columbians will pay the price for the Eby government’s explosion of debt [[link removed]] By: Ben Eisen and Tegan Hill

Governments deal with such enormous sums of money that it is difficult to understand the real impact on the lives of residents. A closer look at some of the headline numbers demonstrates that these impacts are substantial.

Here’s how First Nations can access a reliable source of revenue [[link removed]]

A First Nations Resource Charge could speed the approval of resource-related projects on indigenous lands, and it could provide First Nations with stable and autonomous funding.

Misinformed: Hyped heat deaths and ignored cold deaths [[link removed]]

Global warming indeed raises the risk that more people die because of heat. But higher temperatures also cause a reduction in cold temperatures, reducing the risk that people die from the cold.

Commentary and Blog Posts Mark Carney’s fiscal plan may simply be some creative accounting [[link removed]] (Appeared in the Globe & Mail) By: Jake Fuss

New details about his fiscal policy plan show a potential improvement from the Trudeau era, but the approach falls well short of what Canada needs.

Next federal government should excise many policies of the last 10 years [[link removed]] (Appeared in the Toronto Sun) By: Jock Finlayson

Trudeau leaves behind a stagnant Canadian economy crippled by dwindling productivity, a long stretch of weak business investment, and waning global competitiveness.

Next federal government should finally privatize Canada Post [[link removed]] (Appeared in the Hill Times) By: Alex Whalen and Jake Fuss

Since 2018, Canada Post has lost more than $3 billion, and according to its latest financial update, lost $345 million (before taxes) in the first nine months of 2024 alone.

Next federal government should reverse Ottawa’s plastics ban [[link removed]] (Appeared in the Calgary Sun) By: Julio Mejía and Elmira Aliakbari

Rather than doubling down on a flawed policy, the next federal government should reverse Trudeau’s plastic ban.

Ford government should finally fulfill old broken promises [[link removed]] (Appeared in the Toronto Star) By: Jake Fuss and Grady Munro

Now that Premier Doug Ford has won a new majority mandate, he should finally fulfill his long-broken promises to repair provincial finances and meaningfully reduce taxes.

Quebec government must work harder to shed status as low-income high-debt province [[link removed]] By: Ben Eisen

Quebec still suffers from weak economic performance and, as budget season approaches, there’s an urgent need for pro-growth policy reform.

Two things the next Newfoundland and Labrador government should do in its upcoming budget [[link removed]] (Appeared in the St. John's Telegram) By: Alex Whalen and Jake Fuss

The next government, whoever that may be, must correct the boom-and-bust approach to provincial finances to fully capitalize on the deal.

A federal blueprint for prosperity—five key insights [[link removed]] By: Jake Fuss and Grady Munro

After a decade of budget deficits, weak economic growth and stagnant living standards, Canada needs a new policy approach from the federal government.

STAY UP TO DATE

SUPPORT THE FRASER INSTITUTE

The Fraser Institute has been ranked the #1 think tank in Canada, and the 14th best think tank out of more than 8,200 around the world! We keep Canadians – and decision-makers! – informed.

But we are only as strong as our supporters. We do not accept government grants or payments for research - we depend on individuals like you to continue our good work! We are a charity - your donation entitles you to a generous tax credit at tax time!

Donate Now [[link removed][campaignid]]

Contact Us [[link removed]] Privacy Policy [[link removed]] Unsubscribe [link removed] The Fraser Institute's mission is to improve the quality of life for Canadians, their families and future generations by studying, measuring and broadly communicating the effects of government policies, entrepreneurship and choice on their well-being. Email is one of the best tools we have to accomplish these goals. If you no longer wish to receive e-mail updates from us, click here to unsubscribe [link removed].

Fraser Institute 4th Floor, 1770 Burrard Street Vancouver, BC V6J 3G7

Message Analysis

- Sender: Fraser Institute

- Political Party: n/a

- Country: Canada

- State/Locality: n/a

- Office: n/a

-

Email Providers:

- Campaign Monitor