March 7, 2025

Permission to republish original opeds and cartoons granted.

Trump Is Right. Now Is The Best Time For Tariffs And Tax Cuts After Economy Overheated From Inflation.

|

|

|

Unemployment increased in the U.S. by 203,000 in February as 588,000 fewer people reported having jobs, according to the latest data by the U.S. Bureau of Labor Statistics’ (BLS) household survey. That means the economy is slowing down, as has been expected after overheating from high inflation for four years as a result of global production slowing down after Covid and printing trillions of dollars. In the process, American households maxed out their credit cards. The American people felt the pain big time, and it played a critical factor in knocking former President Joe Biden and former Vice President Kamala Harris out of power in 2024. To be certain, total consumer credit was increasing at a 10 percent annual rate in April 2022, which has slowed down to 2.4 percent annual growth in Dec. 2024. And overall unemployment has actually risen by 1.3 million since Jan. 2023 to 7.05 million. So, what we’re seeing right now is actually a continuation of the trend seen during the Biden years. In every single recession — twelve out of the last twelve — as unemployment increased or when it increased or right after it increased (sometimes the timing varies), inflation slowed down. Every single time. Meaning, it could be a favorable time to do two things now being implemented and proposed by President Donald Trump: Increase tariffs to reorient production to the U.S. and cut taxes for American households and companies to help speed up the recovery. When things are slowing down, that’s usually when governments are looking at some sort of stimulus and are less worried about inflation. Trump is ahead of the curve. |

In Narrow Decision Supreme Court Upholds A Lower Court Demand Ordering Trump To Pay Out $2 Billion in Foreign Aid

|

|

|

President Donald Trump is locked in a lengthy battle with a slate of foreign-aid recipients dead-set on unlocking billions of dollars in U.S. taxpayer money, after his executive order last month temporarily froze the foreign-aid spigot until his administration could vet the process. Trump issued his executive order freezing foreign aid until his administration – with the help of the White House Department of Government Efficiency (DOGE) – could verify that recipients of the money were aligned with an America First approach to foreign-policy. However, non-profits determined to get the spigot of U.S.-dollars flowing again sued the Trump Administration, asking a judge to force the Trump administration to unfreeze and disperse close to $2 billion dollars to foreign organizations for what they say are services already rendered. On Monday of last week, U.S. District Judge Amir Ali ordered the Trump Administration to pay roughly $1.5 billion dollars to USAID-affiliated non-profits, plus an additional $400 million to the State Department by a Wednesday night deadline. In a 5-4 decision, the Supreme Court left District Judge Ali’s order in place, effectively forcing the Trump Administration to release the nearly $2 billion in foreign aid and directing Ali to “clarify what obligations the government must fulfill” to disburse the funds. Justices Clarence Thomas, Neil Gorsuch and Brett Kavanaugh joined Alito in grave concern over the lower court ruling forcing the government to pay out the $2 billion dollars being left to stand. As for what happens now, as Alito wrote in his dissent, “the government must apparently pay the $2 billion posthaste – not because the law requires it, but simply because a district judge so ordered.” |

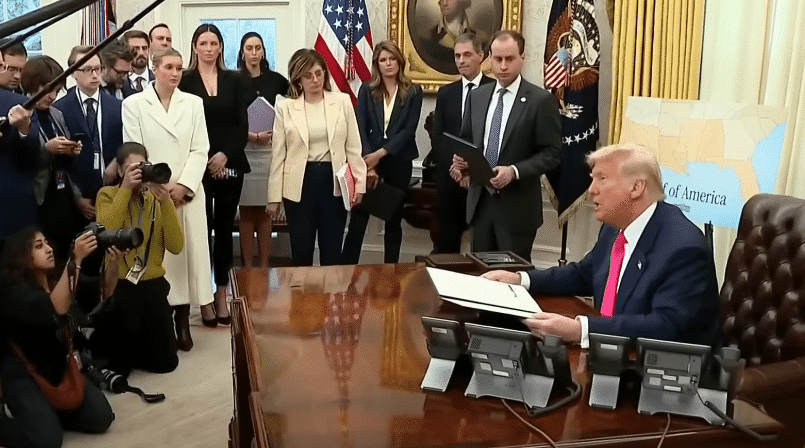

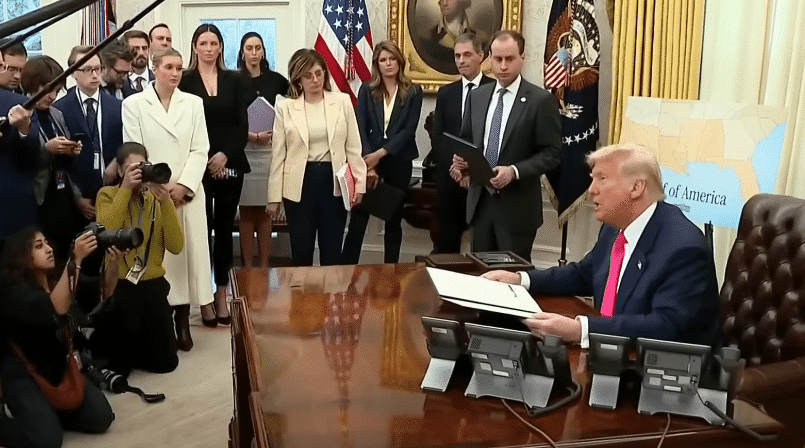

Trump Is Right. Now Is The Best Time For Tariffs And Tax Cuts After Economy Overheated From Inflation.

By Robert Romano

Bad news. Unemployment increased in the U.S. by 203,000 in February as 588,000 fewer people reported having jobs, according to the latest data by the U.S. Bureau of Labor Statistics’ (BLS) household survey.

That means the economy is slowing down, as has been expected after overheating from high inflation for four years as a result of global production slowing down after Covid and printing trillions of dollars. In the process, American households maxed out their credit cards. The American people felt the pain big time, and it played a critical factor in knocking former President Joe Biden and former Vice President Kamala Harris out of power in 2024.

To be certain, total consumer credit was increasing at a 10 percent annual rate in April 2022, which has slowed down to 2.4 percent annual growth in Dec. 2024. And overall unemployment has actually risen by 1.3 million since Jan. 2023 to 7.05 million.

So, what we’re seeing right now is actually a continuation of the trend seen during the Biden years. It is unsurprising.

A combination of labor markets and consumer credit slowing down usually means prices are coming down as demand softens, thanks to the inverse relationship between inflation and unemployment.

Generally, as prices get too high and outpaced incomes, as they have been for the past several years, consumers slow down purchases, the economy slows and then eventually, layoffs occur, prices cool and you get a slowdown or a recession. It’s like clockwork.

In fact, in every single recession — twelve out of the last twelve — as unemployment increased or when it increased or right after it increased (sometimes the timing varies), inflation slowed down. Every single time. In three cases, 1949, 1955 and 2009, prices actually decreased, a process called deflation, which was also very present during the Great Depression of the 1930s.

Well, as we have come off peak inflation of 9.1 percent in June 2022, unemployment has increased from its April 2023 low of 3.4 percent to 4.1 percent now. The inverse relationship remains intact.

Meaning, it could be a favorable time to do two things now being implemented and proposed by President Donald Trump: Increase tariffs to reorient production to the U.S. and cut taxes for American households and companies to help speed up the recovery.

Trump has recently enacted 25 percent tariffs on Canada and Mexico in a bid to incentivize both countries help defeat the drug cartels and crush the fentanyl trade.

And that’s just the beginning. In April, Trump is looking to enact reciprocal tariffs against countries around the world that have tariffs and other trade barriers against the U.S.

In response, many countries might choose to weaken their currencies to boost exports, which could have the relative impact of strengthening the dollar, which would put downward pressure on prices, not upward.

While taxes including sales taxes are technically included in the Consumer Price Index, if you know unemployment is increasing, demand is softening and prices increases will slow down, then the inflationary risk of tariffs or tax cuts is much lower than it might otherwise be. It’s all about the timing.

For example, in just the past month, despite all of the talk about tariffs, the price of light sweet crude oil has dropped from a high of $76 per barrel down to $67 as global demand has dropped, about a 13.5 percent drop. In June 2022 it was more than $120 a barrel. That’s almost a 50 percent drop. Most of the inflation is already in the rear-view mirror.

And in terms of jobs, one sector that got hit in February was food services, which was down 27,500 jobs. Does anyone think local restaurants lay off waiters and waitresses because of tariffs on Mexico, Canada and China? Or is that just something that tends to happen in garden variety economic slowdowns and recessions?

In any event, local tax rates are unlikely to impact the global economy and prices in this manner. When the economy’s running hot, prices will be high, and when it’s cooling, prices will come down. And when things are slowing down, that’s usually when governments are looking at some sort of stimulus and are less worried about inflation.

For example, if prices actually stabilize or go down, that’s usually when the Federal Reserve tends to start cutting interest rates at the end of an economic cycle as unemployment increases. So overall interest rates would come down, too. Meaning, Trump’s critics will just have been wrong. The inflation already overheated the economy and the thing to have worried about was how to deal with the inevitable downturn to follow. Trump is ahead of the curve.

Robert Romano is the Vice President of Public Policy at Americans for Limited Government Foundation.

To view online: https://dailytorch.com/2025/03/in-narrow-decision-supreme-court-upholds-a-lower-court-demand-ordering-trump-to-pay-out-2-billion-in-foreign-aid/

In Narrow Decision Supreme Court Upholds A Lower Court Demand Ordering Trump To Pay Out $2 Billion in Foreign Aid

By Manzanita Miller

President Donald Trump is locked in a lengthy battle with a slate of foreign-aid recipients dead-set on unlocking billions of dollars in U.S. taxpayer money, after his executive order last month temporarily froze the foreign-aid spigot until his administration could vet the process.

Trump issued his executive order freezing foreign aid until his administration – with the help of the White House Department of Government Efficiency (DOGE) – could verify that recipients of the money were aligned with an America First approach to foreign-policy.

However, non-profits determined to get the spigot of U.S.-dollars flowing again sued the Trump Administration, asking a judge to force the Trump administration to unfreeze and disperse close to $2 billion dollars to foreign organizations for what they say are services already rendered.

On Monday of last week, U.S. District Judge Amir Ali ordered the Trump Administration to pay roughly $1.5 billion dollars to USAID-affiliated non-profits, plus an additional $400 million to the State Department by a Wednesday night deadline.

By late last Wednesday, the case had reached the Supreme Court, where Chief Justice John Roberts issued a last-minute pause to the court-ordered deadline, giving Trump’s team time to make their case.

This Wednesday, the Supreme Court handed down a decision that did not specifically address the core of the foreign aid issue but denied the Trump Administration’s request to lift the court ordered deadline.

In a 5-4 decision, the Supreme Court left District Judge Ali’s order in place, effectively forcing the Trump Administration to release the nearly $2 billion in foreign aid and directing Ali to “clarify what obligations the government must fulfill” to disburse the funds.

However, four justices – led by Justice Samuel Alito – strongly disagreed with the decision to force the Trump Administration to unlock billions in frozen foreign-aid funds. In a strongly worded dissent, Justice Alito asked:

“Does a single district-court judge who likely lacks jurisdiction have the unchecked power to compel the government of the United States to pay out (and probably lose forever) 2 billion taxpayer dollars? The answer to that question should be an emphatic ‘No.’”

Justices Clarence Thomas, Neil Gorsuch and Brett Kavanaugh joined Alito in grave concern over the lower court ruling forcing the government to pay out the $2 billion dollars being left to stand.

As for what happens now, as Alito wrote in his dissent, “the government must apparently pay the $2 billion posthaste – not because the law requires it, but simply because a district judge so ordered.”

Ali and the district court promptly ordered the Trump Administration and the non-profits demanding funding to come to an agreement over the payment schedule, but this is highly disconcerting.

Apparently, according to the Supreme Court a president has no ability to temporarily pause taxpayer dollars flowing out the door to ensure those dollars are being spent wisely and not falling into the wrong hands.

The Court’s decision also sets a precedent that may encourage other groups who find themselves in the crosshairs of Trump and DOGE’s federal spending audit to try their luck at forcing the administration to turn the money spout of taxpayer dollars back on.

Manzanita Miller is the senior political analyst at Americans for Limited Government Foundation.

To view online: https://dailytorch.com/2025/03/in-narrow-decision-supreme-court-upholds-a-lower-court-demand-ordering-trump-to-pay-out-2-billion-in-foreign-aid/